akinbostanci

Introduction

W. R. Berkley (NYSE:WRB) was founded in 1967 by William R. Berkley, who is currently the executive chairman. He started investing in the stock market since he was 12 years old and had the ability to identify undervalued stocks from an early age. While attending Harvard Business School, he managed a $2 million mutual fund, which rose to $10 million when he finished college. Berkley decided to buy an insurance company and in 1973 listed the company as W. R. Berkley Corp.

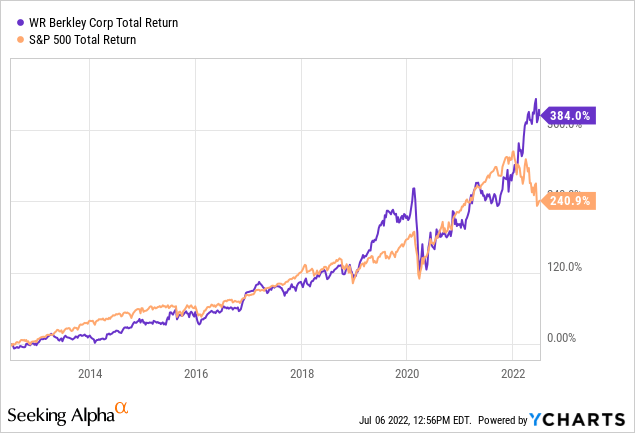

The shares of W. R. Berkley have performed well since the IPO. The total return is 49,520% since the IPO, which translates to 13.5% per annum. The total return for the S&P500 goes back to just 1988, the average annual return is 10.7%. Over the past 10 years, W. R. Berkley outperformed the S&P500, as shown in the following chart.

The shares of W. R. Berkley grew 17.1% year-over-year, compared to 13.1% for the S&P 500 over the past 10 years. Consistent outperformance, growing net premiums written, low combined ratio, high ROE and reasonable stock valuation make the stock interesting to own.

Excellent Financial Growth

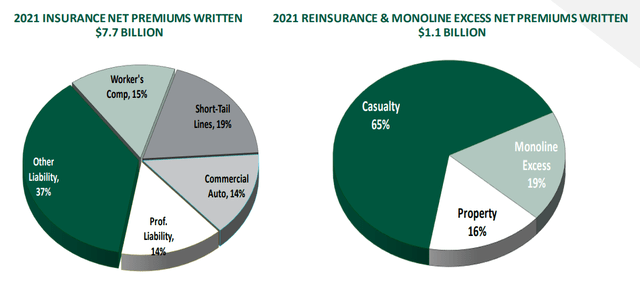

W. R. Berkley Corp. provides commercial casualty insurance and specialty insurance such as Excess & Surplus lines, workers’ compensation insurance, self-insurance consulting, reinsurance, and regional commercial lines for small and midsize businesses. The diversification in different insurance and reinsurance products is good as can be seen in the following figure.

W. R. Berkley Corporation – Investor Primer Year-End 2021

The results of the first quarter of 2022 show an exceptionally strong quarter. Net premiums written grew 17.7% as business expanded, especially in the Excess & Surplus and Special Markets, and operating profit grew 52.1% year-on-year. Net earnings per share grew 158.5% to $2.12 in the quarter. Net income is positively impacted by a net investment gain of $366.3 million from the sale of properties in London.

Net investment income grew by more than 9%, benefiting from higher interest rates. In the near future, investment income will increase further if the Fed raises interest rates to curb inflation. W. R. Berkley is optimistic about the future and its underwriting and investment portfolios are well-positioned for a high inflation environment.

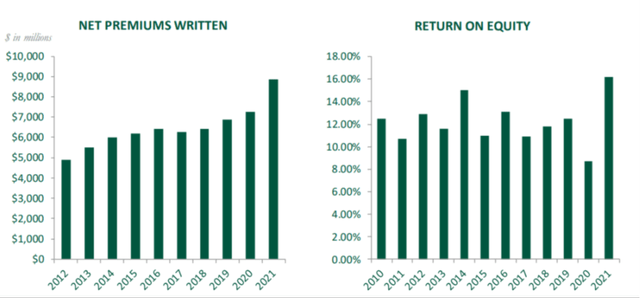

W. R. Berkley Corp. has grown strongly in written premiums in recent years and returns on equity are also excellent.

W. R. Berkley Corporation – Investor Primer Year-End 2021

In recent years, W. R. Berkley showed that it can grow strongly in net premiums written and investment income. Management has an eye for value creation and provides the company with risk-adjusted returns.

Costs Are Under Control

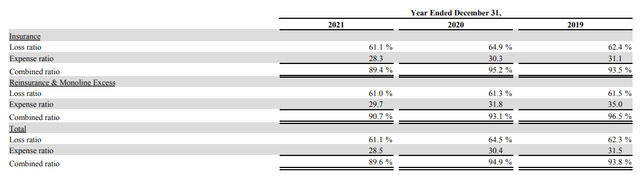

W. R. Berkley has the costs well under control. In the past quarter, the combined ratio was 87.8%. The combined ratio is the sum of the loss ratio and the expense ratio. The combined ratio of recent years has also been excellent, as can be seen in the table below.

W. R. Berkley Corporation – 2021 Annual Report

Dividends And Share Buybacks

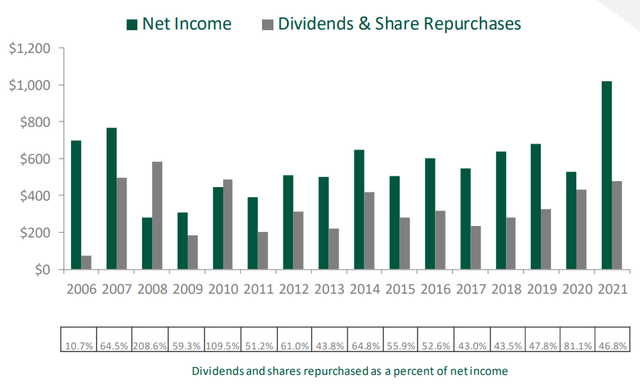

W. R. Berkley is shareholder-friendly by distributing an average of 66% of net income to shareholders since 2006. In 2021, 1.8 million shares were repurchased for a total of $122 million. On December 31, 2021, 10 million shares remained under the authorization to repurchase common stock. With 279 million shares currently outstanding, the repurchase authorization relates to a buyback yield of 3.6%.

W. R. Berkley Corporation – Investor Primer Year-End 2021

Growth Expectations And Valuation

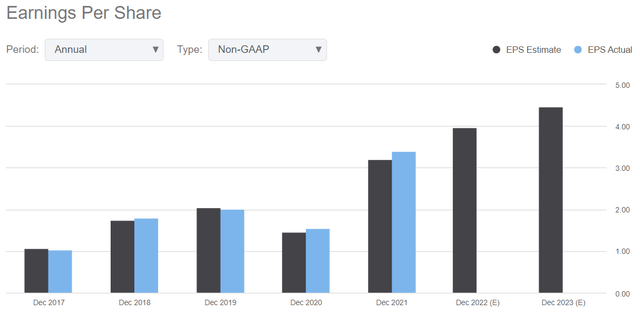

Twelve analysts have revised their expectations for revenue and earnings per share positively. Analysts expect earnings per share of $3.96 (+16.53% year-over-year growth) for 2022 and earnings per share of $4.47 (+12.88% year-over-year growth) for 2023. W. R. Berkley benefits from rising interest rates because its fixed-term income grows at higher interest rates.

Seeking Alpha – NYSE:WRB

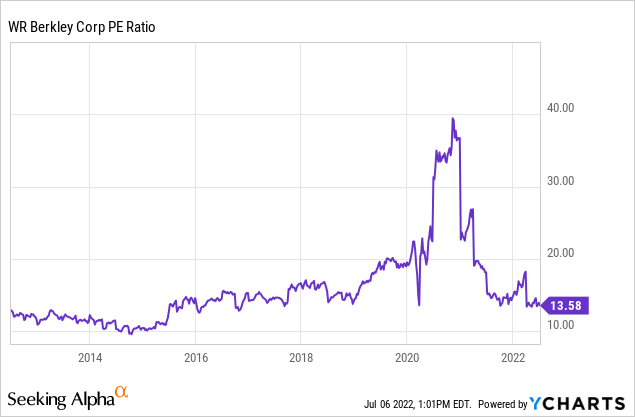

The P/E ratio of 13.6 is slightly lower than the 13-year average of 14.2. I have to admit the stock is trading on the expensive side, but given its strong financial position and growth, share buyback program and strong outlook, the stock is worth buying.

Risks

The share is mainly owned by institutional investors and individuals; less than 4% of the shares are held by the public. That makes the stock risky. Institutional investors have a lot of wealth; if they decide to sell the stock en masse, the stock will fall quickly. However, the chance is small. In such an extreme case, for example, there must be legal problems and that is not the case here.

Conclusion

W. R. Berkley has performed strongly as an insurer and reinsurer for many years. The stock has risen sharply in recent years and even surpasses the S&P 500. Net premiums written are growing steadily, the combined ratio is below 100% and investment income is growing due to higher interest rates. The stock’s P/E ratio is equal to the 12-year average, making its valuation reasonable. The strong outlook for sales and EPS growth makes the stock worth buying.

Be the first to comment