Ashley-Belle Burns/iStock via Getty Images

When it comes to the boat manufacturing market, there really are only a few players that are publicly traded. One of these that has not fared particularly well recently, from a share price perspective, is a firm called Marine Products (NYSE:MPX). Despite the company reporting attractive sales growth and robust cash flows, investors have pushed the company’s share price down. Part of this problem stems from the fact that the company is trading higher than similar peer firms. But even factoring that into account, shares do look quite affordable at this point in time. So while the business probably does not offer as strong of upside as some of the other players in the space, it should still make for an attractive long-term play for value-minded investors.

Recent performance has been attractive

The last time I wrote about Marine Products was in an article published in September of 2021. At that time, I recognized that the company had resumed growing following a downturn in 2020 that was caused by the COVID-19 pandemic. I also acknowledged that shares of the business were trading at levels that I would consider to be fundamentally attractive. At the end of the day, the factors involved led me to rate the company a ‘buy’, indicating that I felt further upside was warranted moving forward. Unfortunately, the market has since disagreed with me. While the S&P 500 has generated a return of 4.3% from the time of my last article’s publication through today, shares of Marine Products would have resulted in a loss for investors of 2.1%.

Given this performance disparity, it would be right for investors to question what kind of fundamental condition the company has been recently. You see, at the time of my last writing, performance for the company year-over-year had been robust. Revenue in the first half of 2021, the most recent timeframe for which data was available, had come in 45.7% higher than what the company saw one year earlier. Unfortunately, growth did slow down in the second half of the year. But overall revenue still increased for 2021. It ended the year with sales of $298.01 million. That was up 24.3% compared to the $239.8 million generated one year earlier. That implies revenue growth in the second half of the year of 8.9%.

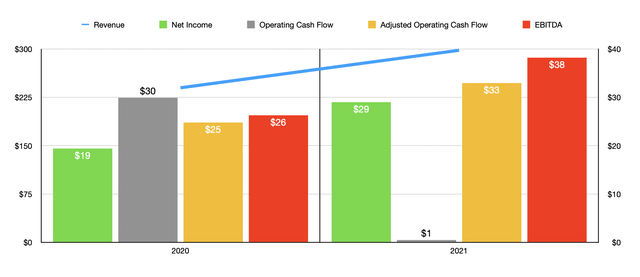

Revenue wasn’t the only area where Marine Products performed well. Net income for the 2021 fiscal year came in at $29 million. That was quite a bit higher than the $19.4 million generated in 2020. Although earnings growth was much stronger in the first half of the year, the second half still saw a year-over-year increase of 11.9%. Of course, investors should also pay attention to other profitability metrics. But for the most part, the company excelled on this front.

As an example, we need only look at operating cash flow. Although total operating cash flow for the year did decline, falling from $29.9 million in 2020 to just $0.46 million in 2021, the troubles with the company experienced on this front came from changes in working capital. Excluding this, cash flow for the year would have been $32.99 million. Another profitability metric that investors should pay attention to is EBITDA. Based on the data provided, this metric came in at $38.2 million during the company’s 2021 fiscal year. That compares favorably to the $26.3 million generated in 2020.

Management has not provided any guidance covering the 2022 fiscal year. But one good thing is that it is unlikely that the improvement the company saw in 2021 is a one-time thing. Back in both 2019 and 2018, sales for the company were at similar levels to what the company experienced in 2021. During this time frame, net profits were just around $28 million in each of those years. Cash flows were a bit mixed, totaling $22.8 million in 2018 and $33.9 million in 2019. And EBITDA for the company was $39.5 million and $38.4 million, respectively, during this timeframe. What this suggests is that Marine Products has returned to normalcy.

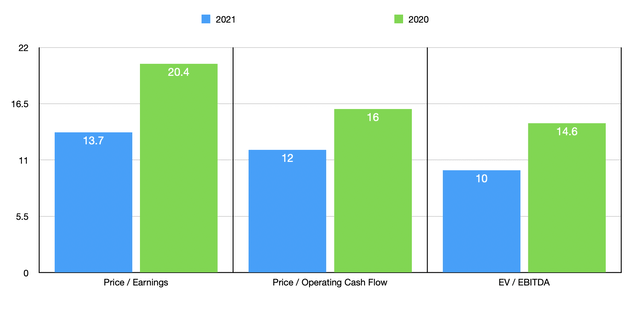

Taking the company’s 2021 results then, we can effectively price the business. On a price-to-earnings basis, the company is trading at a multiple of 13.7. This compares to the 20.4 the company was trading at if we were to rely on 2020 results. The price to adjusted operating cash flow multiple, then, would be 12, down from the 16 experienced one year earlier. And finally, we have the EV to EBITDA multiple, which came in at 10. This stacks up against the 14.6 if we were to rely on 2020 figures.

Although the fundamental condition of Marine Products looks robust, it is worth noting that shares are a bit pricey relative to similar firms. As part of my analysis, I decided to look at three different companies. On a price-to-earnings basis, these firms ranged from a low of 5.3 to a high of 10.2. Our prospect was the most expensive of the group. I then did the same thing using the price to operating cash flow approach, resulting in a range of 1.6 to 9.1. Once again, Marine Products was more expensive than the other three firms. And finally, using the EV to EBITDA approach, the range was from 3.4 to 5.6. And in this case again, our prospect was the most expensive. To be fair, some of this might be warranted. The historical stability of the company is a bonus, as is the fact that the firm has $14.1 million in cash on hand and no debt. So that drastically reduces the firm’s risk profile.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Marine Products | 13.7 | 12.0 | 10.0 |

| MasterCraft Boat Holdings (MCFT) | 7.7 | 9.1 | 5.6 |

| MarineMax (HZO) | 5.3 | 2.3 | 3.4 |

| OneWater Marine (ONEW) | 10.2 | 1.6 | 5.5 |

Takeaway

Based on all the data provided, I can understand why the market decided to punish Marine Products. Financial performance in the second half of the year was weaker and shares are trading at levels that are more expensive than other similar firms. Even so, I would categorize the company’s stock as affordable and I believe the overall risk profile is low enough that it can demand a higher multiple than a company that does have debt. Because of all of this, I would still rate the company a ‘buy’, though I do acknowledge that some of the other players in the space might make for more attractive opportunities.

Be the first to comment