catalby/iStock via Getty Images

Investment Update

Acadian Timber (OTCPK:ACAZF) has dropped into the price range which I stated in my past article the company would become a strong buy. I’ve determined that due to weakness in FCF, diminishing liquidity and a build-up of inventories in the lumber industry across Canada Acadian Timber will be downgraded to a hold. Some positive is that there are no major debt maturities until March 26, 2025, and liquidity is 19.5 million just 0.3 less than last quarter. Their diversification into carbon credits is also on track and expected to contribute more than expected.

Revenue Breakdown

| New Brunswick | % of Total Revenue |

| Soft Wood | 23.47% |

| Hard Wood | 25.73% |

| Biomass | 4.62% |

| Timber Services and Other | 21.21% |

| Maine | |

| Soft Wood | 16.81% |

| Hard Wood | 7.49% |

| Biomass | 0.02% |

| Timber Services and Other |

0.65% |

Above is Q1 revenue broken down by segment. One can see that besides for small variances revenue by segment has mostly stayed the same. One noticeable difference is an uptick in New Brunswick Timber Services and Other.

| New Brunswick | 7 Year Growth Rates |

| Soft Wood | 9.42% |

| Hard Wood | -22.39% |

| Biomass | 4.04% |

| Timber Services and Other | -9.95% |

| Maine | |

| Soft Wood | 8.13% |

| Hard Wood | 7.47% |

| Biomass | Stable |

| Timber Services and Other | 33.80% |

| Acadian Timber | 8.43% |

*Biomass switched to stable as biomass will continue to be produced.

When looking at growth rates one will see that New Brunswick has slowed slightly and Maine has grown slightly. Overall the trends stayed the same. Year over year sales grew by 5.16%.

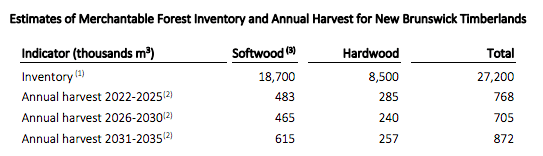

Forest inventory has remained stable

Estimated Forest Inventory (Acadian Timber MD&A 2021)

Earnings

Q1 Earnings came in at 0.25 per share, .10 less than Q1 2021. When Earnings are adjusted for fair value adjustments and a gain on the sale of timberland and other fixed assets earnings per share come in at ~0.26 per share. FCF came in at .30 a share resulting in a payout ratio of 97% for the quarter roughly in line with the management payout target. When annualized at a trailing rate this results in a payout ratio of 114%. The company has retained 19.5 million in liquidity. This can cover the dividend 4.02 quarters or 1.01x on an annual basis and interest coverage by liquidity is currently 6.86x. The dividend remains sustainable when factoring in FCF, but it’ll become increasingly stressed if FCF doesn’t improve. The current yield is roughly 7%

Inventory

A large inventory builds are typically a bearish sign for a cyclical industry. The 5 companies that I keep an eye on all have large builds with an average between the 5 of them being 53.49%. There are many factors behind this such as acquisitions at West Fraser and the large build from Interfor (OTCPK:IFSPF). Inventory has increased in 5 of the last 5 quarters. 3 of these builds are in the top 5 highest inventory builds by percentage since 2015. I see this as a red flag.

Acadian Timber had a small build when compared to its other public peers. I’m looking for a drop of 70-80% in inventory between in Q2 to determine if there is an issue of inventory builds at Acadian Timber. I arrived at this number by looking at the average drop in inventory between Q1 and Q2 going back to 2015.

Acadian had the lowest build at 10% and has noted that demand for hardwood and softwood is rising. There is concern about the large inventories of softwood in the region damaging long term demand.

Debt

Line of credit in CAD for 2 million with a major Canadian bank due on demand for basic corporate purposes currently undrawn. There is also an 80 million USD term loan from MetLife that has a 10 Million revolver as well. As of March 26th, there is zero drawn balance from the credit revolver drawn, and the 80 million was fully drawn. Interest is expected to remain mostly unchanged, but the company has updated that when LIBOR is phased out pricing for the US revolver will be attached to the overnight rate. All debt granted from MetLife is secured via all of Acadian’s assets and is subject to a maximum loan to value ratio. When evaluating Acadian’s debt profile, I gave it a Baa3 rating which has moved upwards but I currently hold a negative view as the Altman-z score continues to tick lower. Upon my last writing, the Altman-z was 1.8526 and as of the writing of this article, it is 1.8267. This is signaling credit distress. The primary factor for the tick-down was the decline in equity prices.

Valuation

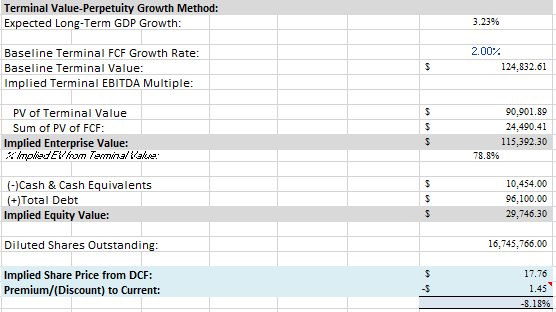

DCF

Risk-Free: 3.23 10-Year Canada bond as of July 4, 2022

Pre-Tax cost of debt of 3.11%

Market Premium of 6.40%

Company Beta: 0.94

Tax Rae of 24.98%

An equity risk premium of 9.25%

This gives a WACC of 6.2280%

A terminal growth rate of 2%

DCF Acadian Timber (Compiled by Author from Acadian Timber Financial Statements)

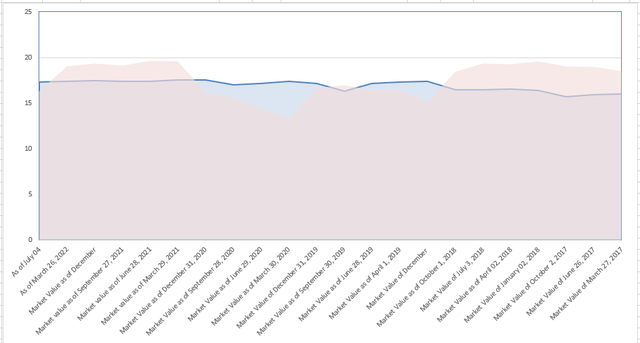

Book Value

Book value has declined marginally from the time of my last article. The market value has declined greatly though with Acadian trading at roughly a 6% discount. These are based on estimates and are currently reflected in the chart below. These may change upon the release of Q2 earnings.

Book Value premium/discount up to Jul4 (Acadian Timber and Author)

Gordon’s Dividend Growth

| Value of next year’s dividend | $1.16 |

| Dividend growth rate 5 year | 1.09% |

| Constant cost of equity capital | 9.25% |

| Implied share price | $14.22 |

| Premium (discount) | 15.23% |

Headwinds

Slowing economy

A slowing economy usually decreases home improvements and new home builds which are the largest usages for lumber. A leading indicator of this is typically inventory builds.

Inventory build

In Q1 2022 the 5 companies that I follow in the Canadian timber space all had significant inventory builds. This is typically an indicator that demand is slowing. We won’t have confirmation until the Q2 results are out. As I noted above, I’m looking for a 70-80% drop at Acadian.

Inflation

Inflation is expected to apply pressure on financial results. The largest increase is the price of fuel. Management has stated that they plan to pass costs onto the customer, but it will not be delayed.

FCF Normalization

FCF normalization has been slower than expected. I was hoping to see FCF between 6,000 and 5,500 in order to bring it closer into line with pre-pandemic first quarters which were typically around 6500. As Q2 is typically the weakest quarter for Acadian, with a weak harvest in Q2 and inflation pressures I’m expecting that FCF from normal operations will be weak.

The company has retained 19.5 million in liquidity enough to cover the dividend 1.01x. Interest coverage by liquidity is currently 6.86x.

Tailwinds

Softwood Prices

Softwood prices have remained elevated in comparison to pre-pandemic levels. Acadian Timber saw the price of softwood logs increase by 9% and softwood pulp increase by 4% on a quarter-to-quarter basis

Carbon Credits

Acadian’s expansion into carbon credits is currently coming along on schedule and is expected to contribute more than originally expected. The diversification of the use of their assets I believe pairs well with how Malcolm Cockwell runs production in Ontario. I also expect to see that cash flows from carbon credits will be mostly uncorrelated to lumber sales leading to a positive diversification. I’m watching for any developments in the Q2 report as details still remain spares.

Conclusion

The company is currently trading at a discount to its DCF and Book Value per share making shares look attractive. Weakness in the broad economy has led to a larger than usual increase in inventory across the industry which may prove to be a leading indicator of further slowing in home improvements and housing starts. With rising inflation adding to costs and delays in transferring these costs to customers with slower than expected FCF normalization Acadian Timber does not appear to be on solid footing. There are highlights as lumber prices remain high and a new carbon credit project is expected to produce more than originally expected. If the economy does slow down, lumber prices can be expected to fall and the carbon credit project should only contribute a small amount of cash flow. For these reasons, I’m downgrading Acadian Timber to a Hold. I’m watching for an increase in YoY FCF, inventory reduction, and continued positive developments in the carbon credit projects in the Q2 release.

Be the first to comment