Henrik5000

NIO’s (NYSE:NIO) first-quarter production and delivery performance was greatly impacted by a variety of factors, including Chinese holidays and COVID-related shutdowns that limited factory output levels. In June, however, NIO experienced a surge in deliveries due to factories coming back online and accelerating demand for NIO’s first sedan product, the ET7. While COVID-19 shutdowns remain a significant risk factor going forward, a recovery in delivery volumes could drive an upwards revaluation of NIO’s shares.

Why NIO’s growth will be determined by sedan production going forward

NIO submitted its delivery card for June last week which revealed that the electric vehicle manufacturer delivered 12,961 electric vehicles, showing 60.3% year-over-year growth. On a month-over-month basis, NIO’s deliveries increased a massive 84.5% which was the fastest growth rate when compared against rival companies XPeng (XPEV) and Li Auto (LI). XPeng’s month-over-month delivery growth rate was 51.1% while Li Auto saw 13.3% month-over-month growth.

XPeng, which currently has the fastest year-over-year delivery growth of the Top Three electric vehicle manufacturers delivered the most EVs last month: 15,295, showing 133% growth. Li Auto delivered 13,024 Li ONE sport utility vehicles in June, showing 68.9% year-over-year growth.

|

Deliveries |

April |

April Y/Y Growth |

May |

May Y/Y Growth |

June |

June Y/Y Growth |

|

NIO |

5,074 |

-28.6% |

7,024 |

4.7% |

12,961 |

60.3% |

|

XPEV |

9,002 |

75.0% |

10,125 |

78.0% |

15,295 |

133.0% |

|

LI |

4,167 |

-24.8% |

11,496 |

165.9% |

13,024 |

68.9% |

(Source: Author)

NIO’s delivery card for June contained further evidence that sedan products are going to be NIO’s future. The electric vehicle company delivered 5,100 ES6s, 1,828 EC6s and 1,684 ES8s which are all sport utility vehicles. Additionally, NIO delivered a massive 4,349 ET7s, the firm’s first sedan product that started to sell in China only in March.

NIO’s delivery growth in June has been driven by two models especially: The ET7 which has seen month-over-month delivery growth of a massive 154.8% and the ES6 which saw a delivery increase of 73.7% on a monthly basis. NIO’s ES6 model still has the largest delivery share (currently 39.3%) and NIO produces by far the largest number of SUVs in the ES6 product line. But because of the surge in demand for electric vehicle sedans, going forward, the ET7 is set to replace NIO’s ES6 as the most important vehicle in NIO’s product portfolio. With NIO’s ET5 deliveries expected to start in September, the electric vehicle start-up could generate about half of its deliveries and sales from sedans, not SUVs, by year-end.

The share of ET7 deliveries has consistently increased throughout the second-quarter as well: in April, May and June, the delivery shares of the ET7 were 13.7%, 24.3% and 33.6%. Considering that NIO will add sedan volume through the ET5, especially in the fourth quarter, sedan deliveries are likely going to be the biggest driver for NIO’s delivery growth in the second half of 2022 and beyond.

NIO has long-term potential, but short-term setbacks should be expected

NIO’s valuation today is much cheaper than a year ago. During the pandemic, shares of NIO traded as high as $65. But investors appear to have stopped caring much about NIO’s delivery growth prospects lately which is understandable considering that EV deliveries have slowed down industry-wide in the first quarter. While short-term setbacks have to be expected, especially regarding new COVID-19 outbreaks in China, NIO’s growth prospects are attractive in the long term.

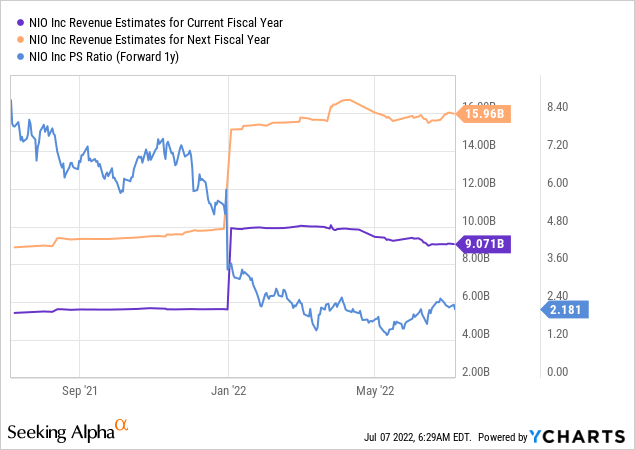

NIO is expected to grow revenues 60% this year to $9.07B, indicating a price-to-sales ratio of 3.8X. The forward P-S ratio, based off of expected sales of $15.96B, implies a P-S ratio of 2.2X and revenue growth of 76%… so the market even expects an acceleration in revenue growth in FY 2023.

Risks with NIO

The biggest risk for NIO, as I see it, is a volatile short-term delivery pattern that makes it hard for the market to predict NIO’s delivery potential with any kind of accuracy. COVID-19 shutdowns are still a threat to electric vehicle manufacturers as well because they could impact manufacturing hubs that produce electric vehicles or dampen demand for NIO’s products. Xi’an, a city of 13M, was partially shut down on Wednesday after a few cases of a new COVID-19 variant have been detected. China’s heavy-handed approach to mitigating the spread of COVID-19 and its variants is a big risk for NIO’s delivery potential as well as the stock in the short term. What would change my mind about NIO is if delivery growth slowed down and the firm’s sedan ramp started to disappoint.

Final thoughts

NIO’s June ramp in production and deliveries was surprisingly good. The surge in ET7 deliveries is the key take-away for investors, because deliveries started only three months ago and sedans now already account for a third of NIO’s delivery volume. Considering that ET5 deliveries are set to start in September, I believe NIO’s long-term delivery potential, especially in the sedan market, is underrated. However, since NIO faces uncertain short-term delivery prospects due to new COVID-19 outbreaks in China, I have a neutral opinion on NIO.

Be the first to comment