Darren415

The index fund is the most sensible equity investment for the great majority of investors. – Bogle

The Vanguard International High Dividend Yield ETF (NASDAQ:VYMI) is an excellent option for investors looking for an exchange-traded fund (ETF) focusing on giving exposure to international markets as well as high dividend yields. The fund tracks the performance of the FTSE Global All Cap US High Dividend Yield Index. This index is composed of stocks from both developed and emerging markets outside of the United States that also offer high dividend yields. The fund has a low expense ratio of 0.22%, which is important when trying to improve overall returns.

The overall dividend yield of 5.13% is very attractive in this market, soundly beating the dividend yield of the S&P 500 at 1.5%. Dividends are paid quarterly. So, if you need monthly cash flow for your financial plans, budget accordingly.

VYMI has been a popular fund since its inception and has grown assets to over $5B. Many large pensions and endowments choose companies like Vanguard to offer stable and consistent investment options and invest in ETFs like this one. It provides investors with exposure to global markets, while at the same time offering the potential for increased income. The fund’s portfolio is composed of over 1,300 equities from a variety of sectors including energy, financials, technology, and healthcare. The fund is well diversified with exposure to international markets including countries such as Japan, Hong Kong, and China.

The broad diversification of this ETF is a winning strategy. As Jack Bogle once said, “In investing, the winning technique is to own the whole stock market via an index fund and then do nothing.” Bogle was basically the father of passive index investing, helping many people achieve financial success over the past decades.

This ETF also offers a fairly low valuation when measured by traditional measures like price to earnings, price to book, and earnings growth. The index has achieved earnings growth of 8.1% over the past five years, while only costing investors 8.1x price to earnings and 1.2x price to book value. Those are very attractive valuations that would make U.S. equity investors swoon.

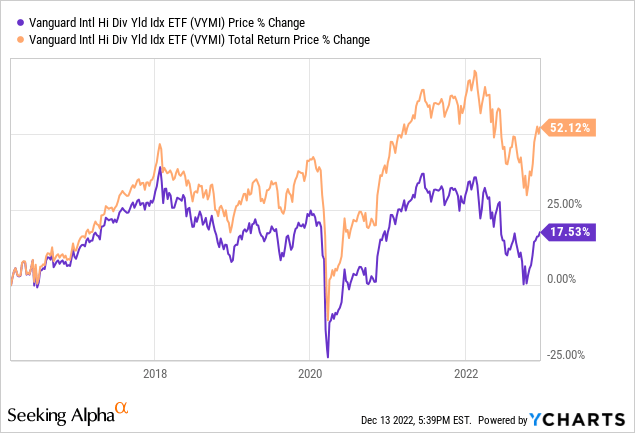

While the long-term stock returns from this investment don’t look spectacular, the total returns tell a different story. Dividends have significantly added to the overall return for holders of this index ETF.

Total Return (Ycharts)

International Exposure

Investors who are looking to diversify their portfolio and buy potentially lucrative investment options should consider international equities and emerging markets. By diversifying a portfolio to include both of these equity classes, investors can benefit in a variety of ways.

The first advantage is variety. International equities offer investors access to a much wider geopolitical and geographic range of companies than those available in domestic markets. This means that investors can access companies operating in different countries, regions and sectors, increasing the potential for higher returns when domestic markets may be stumbling.

The international equities are often less correlated to domestic markets, as well, meaning that they are less likely to suffer downside risks at the same time as domestic markets, sometimes recovering before U.S. equities. This can help to reduce overall risk in the long term, sometimes allowing investors to benefit from the higher returns of foreign markets when domestic markets are struggling.

Another possible advantage of investing in international stocks is the ability to benefit from macroeconomic trends that may not be happening in domestic markets. As an example, investors can benefit from the rapid growth of emerging markets, such as those in China and India, which often have higher growth rates and more potentially attractive investment options.

Finally, as the case with this index ETF, investing in international equities and emerging markets can also provide investors with access to higher-yielding dividend investments than those available in domestic U.S. equity markets. This means that investors can benefit from higher overall returns than they would otherwise be able to obtain in domestic equity markets.

Overall, investing in international equities and emerging markets can provide investors with a wide range of benefits, including access to higher dividend returns, broad diversification of their investment portfolios and the ability to benefit from different macroeconomic trends. As such, investors should seriously consider including these international and emerging market asset classes in their portfolios.

Dollar-Cost Averaging

If you are looking to get started buying an investment like this, you might consider dollar-cost averaging. Dollar-cost averaging is a strategy that involves buying fixed dollar amounts at regular time intervals over a long period. By doing this, investors can spread out the up and down price risk associated with investing in the stock market, since stock prices fluctuate over time. The general idea behind dollar-cost averaging is to buy a little more shares when prices are low and fewer shares when prices are high, thus reducing the average cost per share.

A very popular way to implement dollar-cost averaging is by investing in passive exchange-traded index funds like the Vanguard International High Dividend Yield ETF. When investing in index ETFs, investors can use dollar-cost averaging to spread out their investment purchases over time. This helps to reduce the overall risk associated with investing, since stock prices can be volatile.

When using dollar-cost averaging with index ETFs, investors should decide on a dollar purchase amount to invest each month (or even week or day), and then purchase the appropriate number of shares based on the amount they have decided to invest. Over time, as the stock market fluctuates, the average cost per share will be reduced.

For example, let’s say that an investor has decided to invest $1000 each month into the Vanguard International High Dividend Yield ETF. This month, the price of the index drops to $55. The investor is able to buy 18.18 shares. The next month the price rises to $65. The investor is able to buy 15.38 shares. In total, they have spent $2000 and purchased 33.56 shares. One might expect that their cost basis is around $60 per share, the average between the two months. However, in reality, their basis is $59.59, an amount lower than the overall average.

Dollar-cost averaging is a powerful tool. If the stock market is up one month, the investor will purchase fewer shares of the index, since the price per share is higher. However, if the stock market is down the next month, the investor will purchase more shares of the index, since the price per share is lower.

By dollar-cost averaging with index ETFs, investors can help to reduce their overall risk and also reduce their average cost per share over time. Additionally, since index ETFs are passively managed, investors do not need to actively manage their investments and can let market forces do the work for them. This makes investing in index ETFs an attractive option for those looking to invest in the stock market without having to manage their investments themselves.

Summary

Overall, Vanguard International High Dividend Yield ETF is an index ETF that provides investors with exposure to international markets and the potential for increased income through earnings growth and dividend appreciation. The fund has historically generated strong returns and has delivered relatively low volatility, making it a smart option for investors looking for global diversification and dividend income.

Be the first to comment