NicoElNino/iStock via Getty Images

Vanguard has been releasing AND paying their Q1 dividends on their mutual funds and exchange traded funds (ETFs). That means that my favorite Vanguard ETF has announced and paid their dividend – Vanguard High Dividend Yield ETF (NYSEARCA:VYM).

Vanguard VYM Trailing 12 month dividend

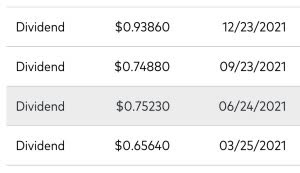

Before this dividend announcement, what exactly was Vanguard’s VYM trailing 12 month dividend? Here is a screen capture of the 4 dividend announcements leading into the March 2022 dividend.

Therefore, from a pure calculation standpoint, Vanguard’s VYM paid out a total of $3.0961. That’s the dividend payout I have been using for the last 3 months to estimate my total forward passive income stream from VYM.

The stock price has fluctuated from as low as $107 to high as $115 essentially. Therefore, the approximate dividend yield for Vanguard in this instance is around 2.79%-2.80%. The dividend yield here is easily 2x the S&P 500, which is around 1.35%-1.45%.

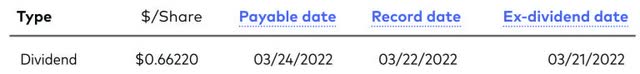

Vanguard’s VYM Q1 2022 Dividend Announcement

Vanguard’s VYM had a $0.66220 dividend announcement for Q1-2022. How I adjust and evaluate ETFs, is I drop the oldest quarterly dividend and slot this one up top. In this case, $0.66220 is ever so slightly higher than $0.65640 by $0.0058 or 0.88%.

I will admit, this was much lower than anticipated, considering VOO (The S&P 500 ETF) had an 8.8% dividend increase Quarter over Quarter.

What does that mean for VYM, then? Well, the forward 12 month dividend now stands at $3.1019. At an average recent price of $111, that’s still a dividend yield of 2.80%. At a close of $113.64, that is a dividend yield of 2.73%. How does this stack up to the S&P 500? Well, this is still almost 2x the total stock market:

Investing plan with VYM

So here I am. I currently own OVER 328 shares of Vanguard’s High Dividend Yield ETF; recently surpassing OVER $1,000 in passive income from this ETF alone, which I showcased in a recent blog post of mine.

First, let’s look at the positives. The dividend was not reduced. The dividend wasn’t technically flat either. The dividend going forward did grow. In addition, the yield is still over 2x the S&P 500.

Second, let’s look at the cons. The dividend growth rate on VOO was stronger this quarter vs. VYM. In addition, inflation is currently at almost 8%. This dividend increase from VYM doesn’t even compare to the rate of inflation.

My goal was to reach $50,000 in total value of VYM and stop investing. Do I continue to invest in Vanguard’s VYM? I would need 100+ more shares to reach $50,000 based on today’s price.

Conclusion

Based on the above, I still believe the pros outweigh the cons for investing with Vanguard and their High Dividend Yield ETF. I am still earning more than 2x the current S&P 500 and the road to financial freedom will be that much “quicker” due to the higher current dividend yield.

However, this recent increase also helps make my decision easier. What decision? After $50,000 in value, I will slow or stop investing with Vanguard in their VYM. Instead, I will more than likely transition to either Vanguard’s S&P 500 ETF (VOO) or their Total Stock Market ETF (VTI).

Why? Due to higher growth and higher dividend growth potential. The goal would be to hopefully reach financial freedom and then transition investments into those assets.

What are your thoughts? Were you upset about Vanguard’s recent dividend announcements in Quarter 1 of 2022? Are you happy or satisfied? Are you still buying Vanguard ETFs? Let me know in the comments!

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment