(This article was co-produced with Hoya Capital Real Estate)

Stefan Tomic

In my most recent article here on Seeking Alpha, I reviewed Vanguard Total International Bond ETF (BNDX). I suggested that investors think twice before dismissing international bonds.

In the comments section, multiple readers responded to the effect that, while they appreciated the article and the fact that I brought this particular asset class to their attention, the paltry yield offered by BNDX, combined with the perceived level of uncertainty when other, safer, options are available left them in a quandary.

Interestingly, in the midst of these comments, one reader suggested I “take a look at VWOB.”

I responded to the effect that I intended to along with observing that I currently hold this ETF in my personal portfolio. With this article, I will keep to my word, and review Vanguard Emerging Markets Government Bond ETF (NASDAQ:VWOB).

A Brutally Honest Look At Emerging Markets Sovereign Debt

In this section, I will synthesize some recent research from both Charles Schwab and Vanguard and attempt to put to all together to give readers a strong sense of the risk/reward of emerging markets sovereign debt at this particular point in time.

Let’s get the bad news out of the way first. This is the third time I have reviewed this particular ETF. The first was back on November 17, 2021, and the price stood at $77.42 per share. I returned for a second round of punishment on March 8, 2022, when I suggested that emerging market bonds may be too cheap to ignore. At that point, the price stood at $69.45. In the intervening time, that price dropped all the way below $60 at one point and, as I write this, has recovered to roughly $64.50.

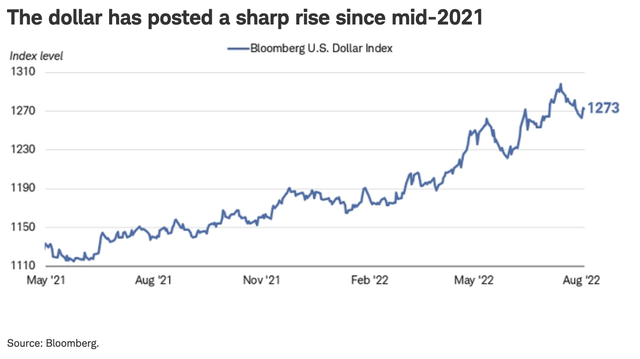

Why has all of this happened? Take a look at the next two graphics from Schwab Research, based on data from Bloomberg.

Dollar Strength Since Mid-2021 (Schwab/Bloomberg)

As can easily be seen, following a period of extreme weakness, the dollar has steadily risen in value against a basket of foreign currencies.

This is due to what Schwab refers to as a “trifecta of factors.” Specifically: 1) The relatively strong performance of the U.S. economy, 2) Tightening monetary policy by the Federal Reserve, and 3) Safe-haven buying.

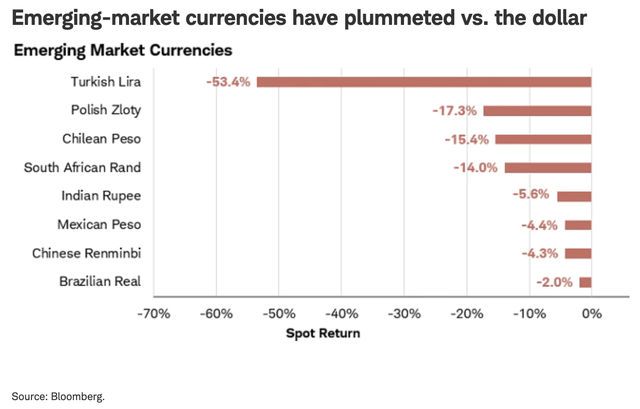

Unsurprisingly, this combination of factors bodes particularly badly for emerging market currencies, a sample of which are displayed in this next graphic.

Emerging Market Currencies vs. The Dollar (Schwab/Bloomberg)

All of this, in turn, leads to challenges for emerging market debt, including sovereign debt. Why? Because this debt is denominated in U.S. dollars. As such foreign currencies lose value compared to the dollar, such debt becomes more difficult to repay.

Is it any surprise, then, that VWOB has performed the way it has over the past few months?

Let’s stick with the negative side of the story for just a little bit longer. If you look at the first graphic offered above, you will see that the tide has recently turned just a little bit. As the bond market appears to anticipate a recession in our future, longer-term rates have declined. Slowing U.S. economic growth could lead to slower appreciation in the value of the dollar against other currencies.

At the same time, the other two factors in that trifecta, in particular the fact that the dollar remains a safe haven, would appear to imply that dollar strength will not completely disappear anytime soon.

Given all of that, what might be the bull case for emerging markets sovereign debt?

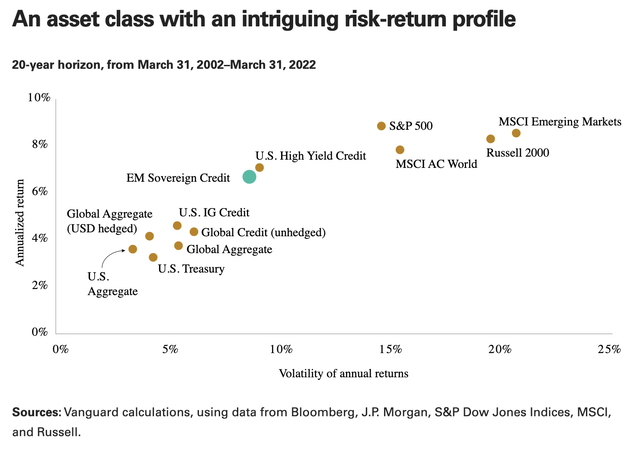

For that, we turn to Vanguard Research. In the graphic below, Vanguard suggests that, over long time spans, this particular asset class has an intriguing risk vs. return profile.

Emerging Markets Sovereign Credit – Risk/Return Profile (Vanguard)

As can be seen, the asset class sits almost on a straight line between U.S. Treasury and the S&P 500. Essentially, even though emerging markets sovereign debt are technically bonds, their risk/return profile is really somewhere between bonds and stocks.

Why might the risk/reward profile be particularly intriguing at this point in time? In short, because of the current price. You see, this particular asset class was one of the first to be hit by changing economic conditions. The emerging markets sell-off began in late-2021 (ironically, right at the time I initially recommended it). As a result, an argument can be made that it is already on the road to recovery, earlier than other asset classes.

Additionally, bear in mind that this is sovereign debt. While it is not without risk, and defaults can and do happen, even in this case recovery rates are higher, since countries do not completely disappear as can companies, and they have powerful incentives to make good on their debt to the extent possible, even in the worst of circumstances.

Vanguard Emerging Markets Government Bond ETF – Digging In

While I won’t rewrite anywhere near the entirety of what I wrote in my previous reviews, I will include a recap of some of the basic details of the ETF here, such that you are not forced to read multiple articles to get these details.

With respect to expenses, this past February 25, Vanguard announced expense ratio changes for 18 funds across multiple ETF and mutual fund share classes, including a wide range of international strategies. One of those changes impacted VWOB, with the expense ratio dropping from .25% to .20%. Another “win” for investors in this ETF!

VWOB seeks to track the performance of a benchmark index that measures the investment return of U.S. dollar-denominated bonds issued by governments and government-related issuers in emerging market countries. The fund employs an indexing investment approach designed to track the performance of the Bloomberg USD Emerging Markets Government RIC Capped Index.

Here, from the fund’s statutory prospectus, is a slightly deeper dive into its exposure:

This Index includes U.S. dollar-denominated bonds that have maturities longer than one year and that were issued by emerging market governments and government-related issuers. The Index is capped, which means that its exposure to any particular bond issuer is limited to a maximum of 20% and its aggregate exposure to issuers that individually constitute 5% or more of the Index is limited to 48%. If the Index, as constituted based on market weights, exceeds the 20% or 48% limits, the excess is reallocated to bonds of other issuers represented in the Index.

With that, let’s get into just a few specifics related to the risk/reward analysis I offered in the previous section. All graphics are courtesy of the Vanguard Investors webpage for VWOB.

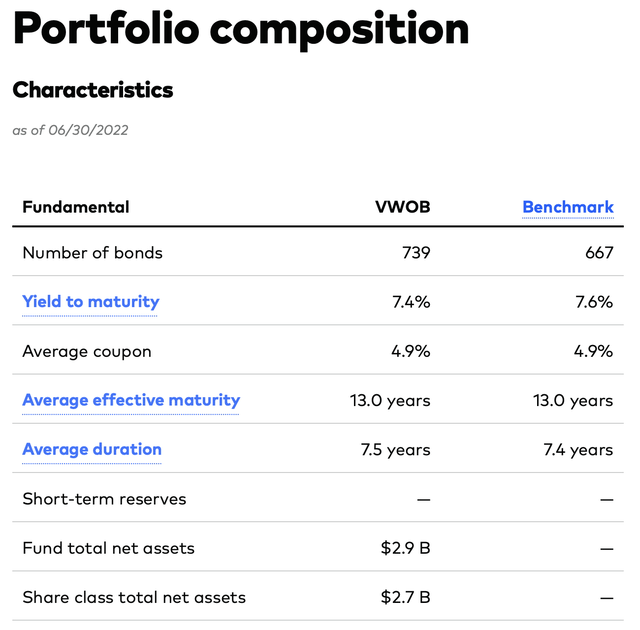

First, a high-level look at overall portfolio composition.

VWOB – Portfolio Characteristics (Vanguard)

Needless to say, this ETF makes an intriguing partner for any readers inclined to add a little BNDX to their portfolio after reading my last article.

As opposed to an average coupon of 1.8% and yield to maturity of 3.9% for BNDX, the values here are roughly 2x those amounts. Interestingly, while average effective maturity is quite a bit longer in VWOB, average duration is roughly the same as BNDX.

- NOTE: If you are unclear as to the difference between maturity and duration, I offer quite a nice overview in this article from roughly 4 years ago.

Clearly then, if desirous of including international bonds as an asset class in one’s portfolio, one can start with a foundation of BNDX and then “spice up” the level of dividend income by mixing in whatever level of VWOB one feels comfortable with.

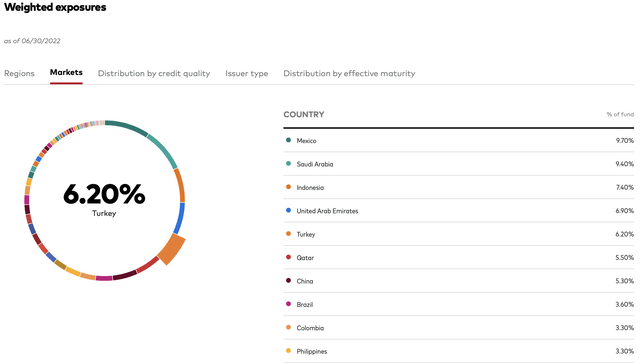

Let’s continue on, with a look at geographical exposure. In the case of VWOB, since all of it is emerging markets sovereign debt, I decided to grab enough of the graphic to list the Top 10 countries. Please be aware that one can easily see the entire list on the Vanguard webpage.

VWOB – Geographic Exposure (Vanguard)

Just a quick note here, courtesy of Vanguard:

Emerging markets debt is significantly more diversified than it has ever been, with numerous new issuers from both sides of the credit spectrum. The category includes low-income countries from sub-Saharan Africa and wealthy oil exporters from the Persian Gulf. A more diversified issuer base translates into less idiosyncratic risk and more active management opportunities.

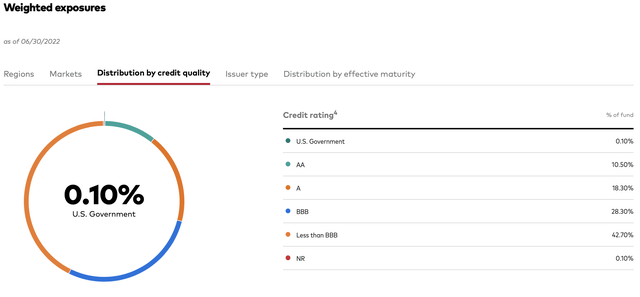

Next, we move to credit quality.

VWOB – Credit Quality Distribution (Vanguard)

Here, to be clear, is where the risk level to obtain that higher dividend yield is ramping up. In BNDX, roughly 20% of the debt is rated BBB or less. In VWOB, that number is roughly 70%.

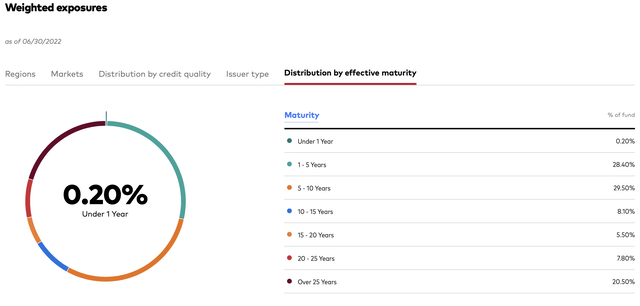

Finally, the effective maturity distribution.

VWOB – Effective Maturity Distribution (Vanguard)

Just one comment on the roughly 28% of bonds in VWOB with a maturity of 20 years or greater. You might view this as somewhat of a double-edged sword. On the one hand, this leads to greater volatility. On the other hand, returns from emerging markets debt can be very significant as these longer maturities can sustain price appreciation as countries strive to improve their credit fundamentals.

Summary & Conclusion

As always, I hope I have given you something to think about.

It may be the case that you may decide an allocation to VWOB is not for you, give the risks I have laid out. At the same time, please ponder that word, allocation. That can be anything you are comfortable with.

Let’s ponder even a conservative portfolio. What if you allocate a total of 3% to international bonds, and split that between 2% of BNDX and 1% of VWOB?

In terms of diversification, you would be expanding your horizons beyond the shores of the U.S., and picking up some dividends as well as moderate potential for long-term gains.

I’d love to hear your comments, questions, and even criticisms in the comments section below.

Be the first to comment