Pgiam/E+ via Getty Images

Investment Thesis

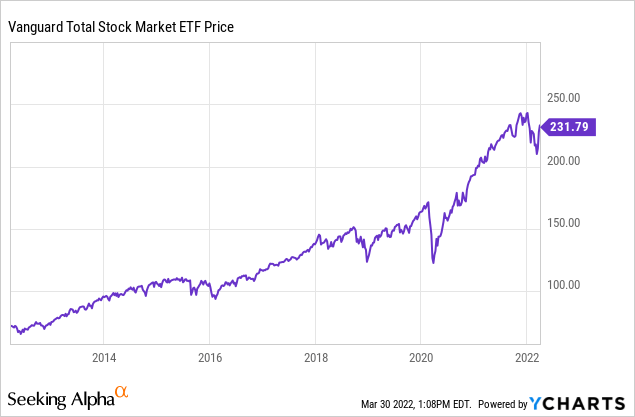

If you are an investor who engages in any form of tactical asset allocation or is not a purely passive buy-and-hold investor, you should consider trimming some of your equity indices positions such as in the Vanguard Total Stock Market Index Fund ETF (NYSEARCA:VTI).

To begin with, the major weightings within the index are heavily overpriced. Secondly, the entire index is overvalued when looking at the Buffett Indicator. Lastly, multiple market indicators are signaling for a recession to occur in late 2022 or early 2023. Although investors have seen some good returns buying and holding the U.S total stock market for the last decade, the previous 10 years do not dictate the next 1-2 years. Therefore, my view is that total stock market ETFs such as VTI should be avoided for the next 9-15 months.

The Yield Curve, Oil Prices, And Consumer Cyclical Stocks Are All Telling Us A Recession Is Approaching

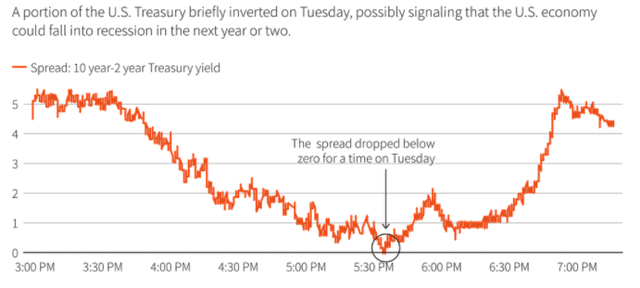

If you follow financial media, I am sure you have heard that the 2/10 part of the yield curve went inverted on March 29th. This, of course, is an indicator that a potential recession could be around the corner as an inverted yield curve is often a precursor for declining economic activity. The yield curve has been relatively accurate in predicting recessions, and the two-year treasury bond yield rising above the ten-year treasury bond yield should be a concern to equity investors in the U.S.

That being said, the yield curve isn’t the only market indicator that investors need to be worried about. The oil market is also hinting that a potential recession could be around the corner. Every oil rally greater than 50% over the last 50 years has been followed by a recession. Currently, crude oil futures are up over 80% over the last 52 weeks. This has also assisted with driving inflation higher which is also said to be a precursor for recessions.

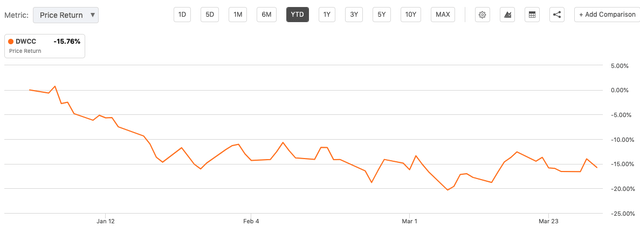

Furthermore, another less common indicator that has been successful in predicting recessions is the return on consumer cyclical stocks. Cyclical sub-sector stock returns have become a good dataset to watch as bear markets within those sub-sectors have preceded the recessions in the years 2001, 2008, and 2020.

The reason I am fond of this indicator is because it would be common sense to associate the performance of consumer cyclical company earnings and stock returns with the broader economy, considering that cyclical companies depend on a roaring economy for their prosperity. In the case for this analysis, I will be using the Dorsey Wright Technical Leaders Consumer Cyclicals Index as a general consensus for how consumer cyclicals have been performing this year.

Currently, the index is down approximately 15.76% YTD and down roughly 25% from its highs, which points towards economic vulnerability. Overall, there are plenty of meaningful indicators within the financial markets hinting that a recession is going to hit the United States soon. In terms of portfolio positioning, VTI is not a place where I’d want a lot of exposure if that happens.

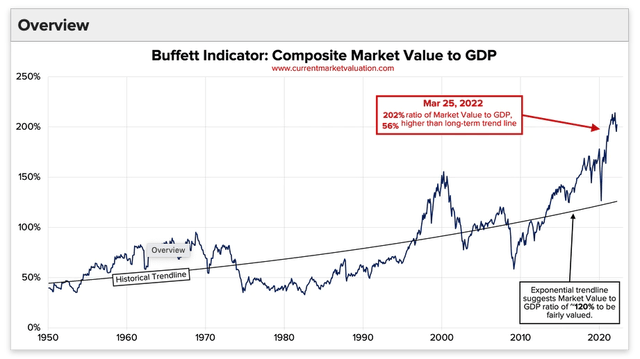

Valuation: The Buffett Indicator

The Buffett indicator is a simple calculation which divides the stock market’s market capitalization by the United States annual GDP. This computation is said to be one of the best indicators of overall market valuations. Currently, the Buffett indicator suggests that the market is significantly overvalued when looking at an exponential trendline.

The consensus is that the current total U.S stock market is priced at an approximate 56% premium when factoring the exponential trendline. In addition to market overvaluation, there are no catalysts in which could explain this market premium. The Atlanta Fed is forecasting Q1 2022 GDP growth to be in the range of -1.7% to 0.5%, compared to growth of 7% in Q4 of 2021. Meaning, the Feds appear to be skeptical about the country’s 2022 economic activity as they forecast a fairly heavy slowdown.

Moreover, as economic growth is expected to slow, Fed Chair Jerome Powell and the FOMC announced a 25 basis point rate hike last week, marking the first rate hike since 2018. The combination of a slowdown in economic growth with 5 more expected rate hikes in 2022 could cause a bad storm for the equity markets and the overall economy.

The Mean Reversion Risks of Major Indices Names Such As Tesla, Apple and Microsoft

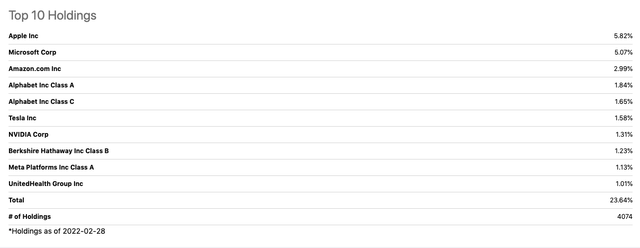

The last factor influencing my sell recommendation for this ETF is the fact that many of the major weights in this portfolio are subject to large mean-reversion risks. The following are the top 10 holdings of VTI encompassing 23% of the total portfolio.

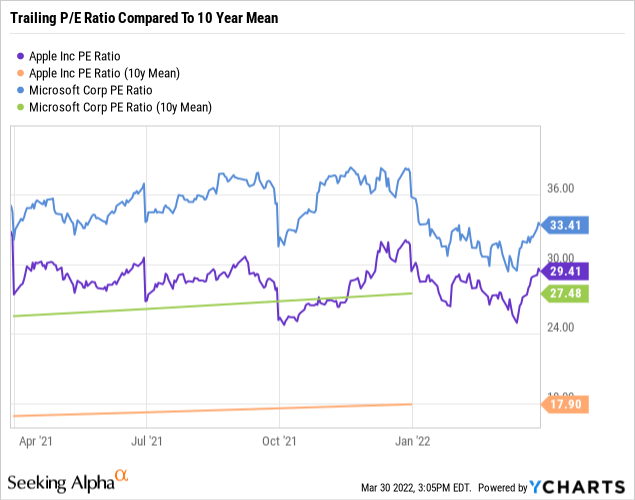

When looking at just the two largest names – Apple (NYSE:AAPL) and Microsoft (MSFT) – you can see that, based on their current P/E multiples compared to their 10-year mean, they face heavy mean-reversion risk.

Apple’s current P/E multiple is currently 70% higher than its 10-year mean, while Microsoft’s P/E multiple is currently 50% higher than its 10-year mean. This leaves the possibility for mean reversion to drive these stocks downward. In addition, that doesn’t even include the more egregiously overpriced names in the top 10 such as Tesla (TSLA) and NVIDIA (NVDA). Major drawbacks in a few of these names could put downward pressure on the index, once again creating another risk factor to consider while holding onto this ETF.

Conclusion

To conclude my bearish thesis, I am not opposed to the “buy-and-hold a total market index” strategy. However, the underlying reality is that the returns of the previous 10 years do not determine the returns for the future. Based on the data and the given catalysts within the current market, there appear to be grey skies upon the horizon. I encourage passive investors to trim a portion of their holdings in VTI and pile into more defensive positions for now.

Be the first to comment