Warchi/E+ via Getty Images

Author’s Note: All figures listed are in Canadian currency unless otherwise noted.

For my third review in my series of Vanguard Canada funds, I am taking a closer look at Vanguard’s FTSE Canadian Capped REIT Index ETF (TSX:VRE:CA). If you have ever purchased real estate before, you know how important a pre-sale inspection can be. Taking a careful look at what is beneath the surface can help purchasers avoid costly mistakes. There are several REIT ETFs offered in Canada that track different benchmarks and each have slightly different objectives.

VRE’s stated objective is to:

Track, to the extent reasonably possible and before fees and expenses, the performance of a broad Canadian real estate equity index that measures the investment return of publicly traded securities in the Canadian real estate sector. Currently, this Vanguard ETF seeks to track the FTSE Canada All Cap Real Estate Capped 25% Index (or any successor thereto).

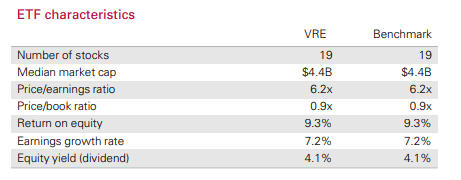

VRE is a passively managed fund that directly holds 19 publicly listed Canadian companies. The fund is coming on up ten years since inception this November. VRE has assets under management of approximately $255M. The fund is thinly traded with average daily volume of 6,800 units.

Fund Profile (Vanguard)

Why own a REIT ETF?

Historically, investing in Real Estate Investment Trusts has produced solid capital gains and consistent distributions of free cash flow. Overtime, REITs have delivered total returns comparable to other broad equity classes, while outpacing fixed income. REITs tend to be less correlated to other asset classes, which can be a useful feature to buffer volatility across a portfolio.

Other attractive qualities about REITs include stable monthly income and ownership of finite tangible assets. Investing in Real Estate is easy for the average investor to understand as REITs payout excess cash to shareholders. Real Estate is an important market segment and REITs are a convenient way to gain that exposure. Just like individual stocks, investors can hold stocks directly, or look to an ETF for the ease of diversification and rebalancing. In Canada, a number of providers offer REIT ETFs including: iShares, BMO Global Asset Management, Vanguard, and CI.

Real Estate Investment Trusts are one of the few remaining publicly traded income trust structures in Canada. REITs were exempted from the conversion of income trusts to corporations in the early 2000’s. The modern REIT structure was created in Canada in 1993 as a tax-efficient vehicle for the listing of public real estate firms. According to the advisory service Grant Thornton:

REITs offer certain tax advantages to encourage this investment. In Canada, a REIT is not taxed on income and gains from its property rental business. Instead, shareholders are taxed on a REIT’s property income when it is distributed, and some investors may be exempt from tax.

Distribution Income

VRE pays a monthly distribution of $0.09434 per unit. At current levels, the fund is projected to pay a total annual distribution of approximately $1.13, for an annual yield of 4%. In 2021, VRE’s total distribution per unit was approximately half income (and foreign income) and half return of capital.

Holdings

VRE has 19 total holdings, with the top ten accounting for 72% of fund’s NAV. This relatively small set of holdings is not sufficient diversification of a portfolio, however, is more diversified than the average investors ability to hold a basket of REITs directly.

Holdings Table (Vanguard)

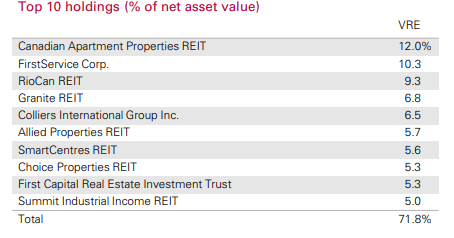

On a sector-weighting basis, VRE is well diversified across subsectors and industries. Retail, unsurprisingly accounts for the largest sector share with RioCan (RIOCF, REI:UN:CA), SmartCentres (SRU.UN:CA, CWYUF) and Choice Properties (CHP.UN:CA, PPRQF) being some of the largest REITs in Canada. VRE’s top holding Canadian Apartment Properties REIT (CAR.UN:CA, CDPYF) is one of Canada’s best run REITs; however, its historically premium valuation has resulted in a lower overall yield. I have covered RioCan, Choice Properties and Canadian Apartment Properties REITs individually should you be interested in a closer look at these holdings.

Subsector Table (Vanguard)

While the term “REIT Index ETF” is in VRE’s title, the fund’s holdings are actually broader than just Real Estate Investment Trusts. VRE tracks a real estate index, not an REIT index. While mostly comprised of REITs, the FTSE Canada All Cap Real Estate Capped 25% Index also includes Real Estate Services and Real Estate Holding and Development subsectors. While this may be a subtle distinction, it does materially impact VRE’s constituent parts and portfolio characteristic, including VRE’s distribution yield.

VRE’s lower relative yield is a result of the inclusion of Real Estate Services firms in FirstService Corp. (FSV:CA) and Colliers International Group Inc. (CIGI), which both pay dividends of less than 1%. These are both interesting companies with exposure to real estate through services revenue, however they are different than REITs in that they do not pay out the majority of their cash flow to unitholders. VRE also includes Real Estate Developer Tricon Residential Inc. (TCN:CA, TCN) which has a yield of under 3%.

Comparing VRE to its Peers

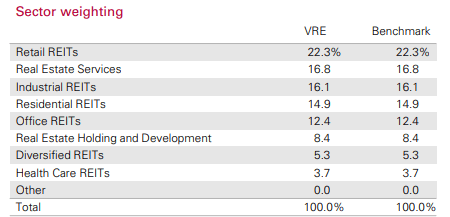

The other large REIT ETFs in Canada are BMO Equal Weight REITs ETF (ZRE:CA), iShares S&P/TSX Capped REIT ETF (XRE:CA) and CI Canadian REIT ETF (RIT:CA). BMO’s ZRE tracks the Solactive Equal Weight Canada REIT Index while both XRE and RIT track the S&P/TSX Capped REIT Index. As RIT tracks the same index as XRE, while charging 20 basis points more in management fees, I will focus comparisons on the BMO and iShares funds instead of CI’s RIT.

Fund Comparisons (Vanguard)

Of the three funds, BMO’s ZRE has the highest yield at 5.22%, while VRE and the iShares XRE are a little above 4%. BMO’s equal weighting formula contributes to ZRE’s higher yield relative to VRE and XRE. The greater representation of smaller market cap REITs with higher yields has an positive impact on the fund’s total yield.

Compared to the other funds in this category, VRE has a smaller market capitalization, with only half of the NAV of ZRE and less than a third of XRE. Where VRE excels, however, is in its fee structure, with a management fee that is 20 basis points lower than its nearest competitor. When this superior MER is factored in, it more than makes up the 15-basis point yield difference between the Vanguard and iShares funds.

Risk Analysis

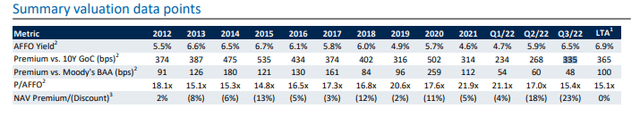

Looking at the Canadian REIT sector’s long-term averages, current prices offer a steep discount to NAV and a P/AFFO that is in line with historical averages. Overall, the REIT sector looks undervalued and still offers an attractive yield premium relative to fixed income.

REIT Sector Valuation Table (RBC Capital)

The key risk for REITs in the near term is rising interest rates. As of Q3 2022, the cost of five-year commercial mortgage debt was 5.2% at end up over 260 basis points from Q4 2021. With central banks still on a tightening trajectory, borrowing costs could continue to rise for REITs even as the rates of fixed income become more attractive.

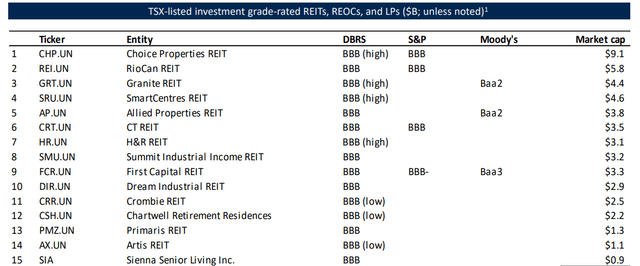

All things considered, the current NAV discount across the REIT sector provides a comfortable margin of safety for the current entry level. While it is difficult to assess the risks of all underlying assets, the diversification of an ETF provides some additional safety here. Of the large REIT holdings represented in VRE, the vast majority are rated BBB or higher.

REIT Sector Credit Ratings (RBC Capital Markets)

Investor takeaways

Vanguard’s FTSE Canadian Capped REIT Index ETF is a good option for a low-cost vehicle to gain exposure to the Canadian real estate market and to generate stable monthly income. VRE’s inclusion of real estate services firms within the fund results in a lower yield than other comparable funds. However, this inclusion provides diversification to other subsectors of the real estate sector. If your objective is overall yield, then there are better funds to consider than VRE.

Be the first to comment