gorodenkoff/iStock via Getty Images

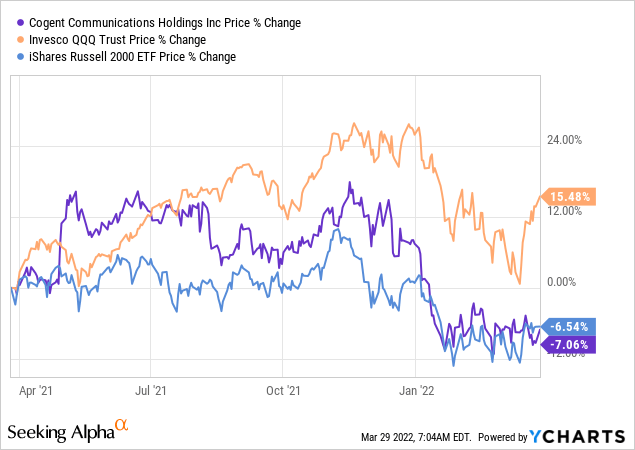

The stock of Cogent Communications Holdings, Inc. (NASDAQ:NASDAQ:CCOI) has followed the same downwards path as the tech-heavy Invesco QQQ Trust ETF (QQQ) since mid-November 2021, once it became clear that the Fed would have to raise interest rates. Subsequently, unlike QQQ which rebounded by around 15% from its mid-March lows, the pains continued for this communications play, whose shares are now available for about $65.

Its shares are now more aligned with the small caps-driven iShares Russell 2000 ETF (IWM). With expectations of heightened financial stress for highly indebted smaller tech plays due to the Federal Reserve hiking rates, it is time to assess Cogent’s prospects in this new market environment, as well as any possible topline impact after the company stopped supplying internet services to its Russian clients.

I start with the financial results.

The revenues

Cogent is a Tier 1 service provider signifying that its network can directly reach anywhere on the global internet, including customers in Russia, without the need to pay fees to other carriers. This is in contrast with Tier 2 providers whose DIA (Direct Internet Access) customers need to deal with other providers, implying delays and additional charges. These are referred to as “net-centric” customers consisting of telecom operators as well as providers of online content located in geographies ranging from North America, South America, Europe, Asia, Australia, and Africa. The company also serves “corporates” which range from small to large multinationals.

About 60.8% of FY 2021’s sales were derived from the U.S. and Canada, where, as a result of work-at-home mandates implemented during the pandemic and subsequently during the Omicron scare, employees did not attend offices where Cogent makes money by leasing fiber internet to their employers.

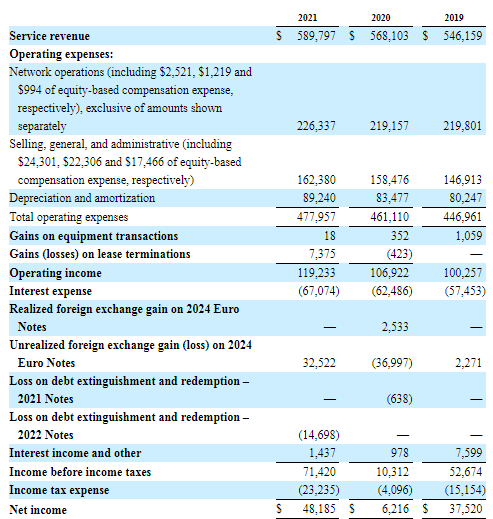

Consequently, service revenues from corporate customers decreased by 6.5% to $358.4 million in 2021. However, sales from net-centric customers actually saw an increase of 25.3% to $231.4 million during the same time period. As a result, overall Service revenues increased to $589.8 million as shown in the extract below.

Revenues from SEC Filings (seekingalpha.com/filing/6250991)

As for operating income, it was helped by a gain on lease termination of $7.4 million following a court settlement with a former provider of optical fiber in Spain. As part of the settlement, Cogent will have to disburse $0.7 million in Q1-2022.

Going forward, the executives see strength in the net-centric business driven by streaming service providers aggressively targeting overseas markets. As for market positioning and ability to support growth, the company established connections to 1,413 data centers including 54 self-owned ones last year. This coverage-broadening strategy aims to both improve the quality of the service as well as expand at a faster rate than other carriers.

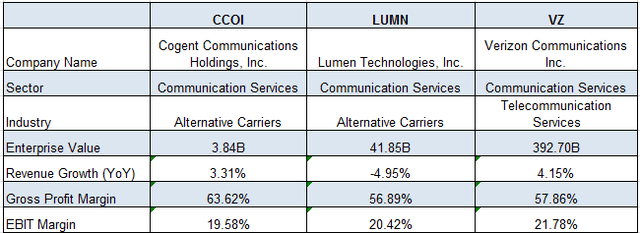

Looking at the competition, depending on the geography, Cogent competes with several other Internet service providers (“ISPs”) as well as large communication providers like Lumen Technologies (LUMN), formerly called CenturyLink. There also is giant Verizon (VZ), which proposes a global MPLS solution of a vast private network carrying internet traffic.

The competition

Despite its much smaller size, Cogent is growing its global internet footprint at a very rapid pace. As per its CEO, Dave Schaeffer, his company is connecting to data centers faster than others in the business. Thus, by the end of last year, the company had established connectivity to 7,560 networks, a 3.1% increase from 2020, with plans to add roughly 100 points of presence (POPs) in carrier-neutral data centers per year to expand its network over the next several years.

Consequently, Cogent should maintain its superior growth compared to Lumen. As for Verizon, which operates as part of the telecom services industry, it also relies on its mobile cellular network to generate sales.

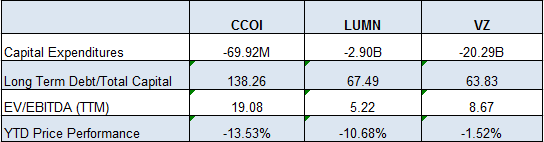

Comparison with peers (seekingalpha.com/comparison/new/MCxjY29pLGx1bW4sdno=)

Thinking strategically, Cogent’s accelerated web-weaving process is aligned with the high demand for more expansive and faster connectivity by service providers whose customers are now consuming more video traffic on their smartphones. This is against the backdrop of mobile network operators upgrading their cellular networks to 5G. By tapping into the mobile data traffic market which is estimated to grow at a CAGR of 28% from 2020 to 2026, Cogent wants to make sure that it monetizes its infrastructure.

Talking profitability, Cogent’s gross margins – which are already the highest (table above) – should benefit from the content provider and access network dynamics. Here, the more a network grows its geographical reach, the more it attracts content distributors like Netflix (NFLX) which essentially serve access network providers like local ISPs and which in turn serve subscribers like you and me. Now, by serving both these two groups, most of the traffic originates and terminates on Cogent’s network itself instead of traveling through other routes. This enables the ISP to control the traffic at a lower expense, ultimately generating more profits.

The risks/rewards ratio

However, to be realistic, in addition to the breadth of service availability, competition is based on other factors, like product pricing, customer support, and brand recognition. In this case, to be more recognized in a world where larger peers have been around for longer and are better known, the company has to spend on sales as part of operational expenses. This is evidenced by Cogent’s relatively lower EBIT margins (above table). Interestingly, sales and marketing together comprised a sizeable 63% of the company’s total workforce in 2021.

Additionally, it has suffered from the “Great Resignation” problem, resulting in many employees not returning to the office after working remotely during the Covid period. As a result, there was a 7% monthly churn rate in the sales/marketing organization. Personnel have since been recruited, but, with high wage inflation, operational expenses should stay on the high side in the first half of 2022.

Moreover, with the nature of jobs becoming hybrid with employees working both from home and in the office after the pandemic, there could be less demand for Cogent’s internet routers and upgrade works than before. Thus, with the reopening, its corporate business is likely to see growth, but, this should not match pre-pandemic levels, at least in the first half of this year. Also, there should be price pressures from lower-end providers of older protocols like circuit-switched voice, ATM, and frame relay. Ultimately, this competition should gradually fade away with the evolution of technology.

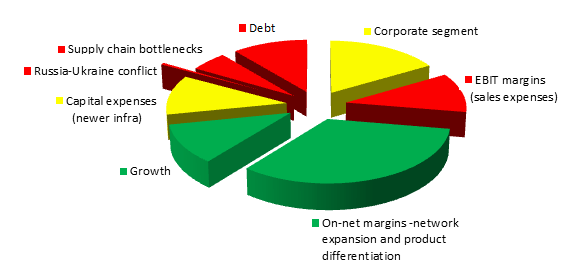

It is because of this uncertainty factor that the corporate segment is shaded in yellow in the risk-reward matrix below, while the EBIT margins I talked about earlier appear in red.

As to risks related to Russia’s invasion of Ukraine, while the company does business with the Russian carriers, these represent a “very small portion of Cogent’s total traffic and net-centric revenues.” The company has no corporate business in the two countries.

Risk Reward matrix built with data from (www.seekingalpha.com)

On the other hand, Cogent’s strategy to differentiate its offer through lower long-term pricing and volume commitments as well as prioritize the more profitable net-centric services, which constituted 75% of total Service revenues in 2021, should yield better margins. This is a plus point and is depicted in green above.

Valuations and key takeaways

Another positive is the management’s aim to double the annual revenue growth rate as shown in green above. Achieving that goal will depend on the timely delivery of network equipment and dark fiber circuits. With recruitment, network expansion, and high inventories, this ambitious growth trajectory is entirely feasible except in the case of a prolonged slowdown in the supply chain (shown in red in the risk-reward matrix).

The company also expects to grow its free cash flow, and increment EBITDA margin by 2% on an annual basis from 2022. This would be more than two times the growth of 0.9% observed from 2020 to 2021. This is also feasible, as, compared to incumbent carriers, Cogent, which started to operate in 1999, has a newer fiber-optic infrastructure, which explains its much lower capital expenses as seen in the table below. This, together with the ability to generate high-margin sales should lead to lower a lower long-term debt to total capital ratio, which is on the high side. In fact, there was some progress on the gross leverage ratio at year-end.

Comparison with peers (seekingalpha.com/comparison/new/MCxjY29pLGx1bW4sdno=)

Thus, Cogent is a buy, but, with an EV/EBITDA multiple of 19x, the company is richly valued and its share price performance will now depend on momentum factors such as revenue and earnings beats, as well as its ability to continue paying dividends. To this end, the company had total cash of $328.6 million as of December 2021, of which $147.4 million was available immediately for paying dividends or effecting share buybacks. Pursuing further, $39.6 million was returned to shareholders in Q4 as dividends and quarterly distributions were raised from $0.83 per share to $0.855 per share. This marks the 38th consecutive increase in quarterly dividends.

Finally, I am also bullish because the risk-reward matrix has more green areas than reds. The stock can climb back to the $75-80 level as it delivers on the topline and bottom line. However, be aware that in a rising rates environment, volatility will be the new normal. That said, the Russian exit should have a negligible impact.

Be the first to comment