Sundry Photography/iStock Editorial via Getty Images

When it comes to perusing real estate, as with many of you, Zillow Group Inc. (NASDAQ:Z) (NASDAQ:ZG) has long been my preferred portal. Today, just as a decade ago, the interfaces of Realtor.com and Redfin just fall short. Cumbersome to use, inferior sorting and search, and personally I just hate their color schemes. There are good psychological reasons why blues perform better than reds in web design, but that’s a conversation for another time.

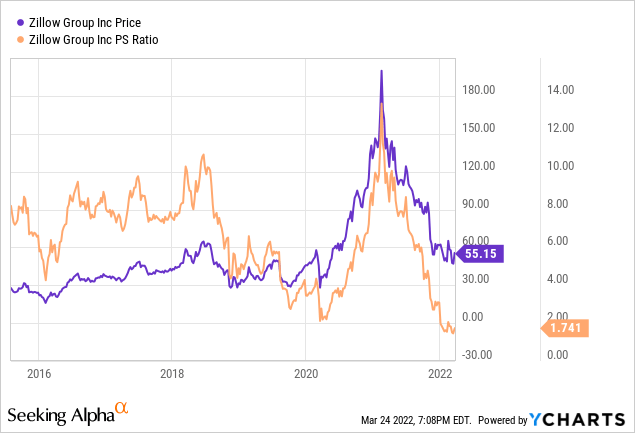

Despite Zillow being best of breed, I have never really been too interested in their stock due to valuation.

That changed in late 2021, when it plunged below $100 and even $50. I love falling knives and of course, I often buy them too early, but in the long run, they generally reward me quite well. After nibbling last year and this January, I doubled down the day before earnings last month.

Good riddance iBuying

If you’re not familiar with the term, iBuying is the business of buying homes almost instantly, based on algorithmic valuations. That corporate buyer will then flip the homes, with hopes of making a few percent profit.

Growth bloodbath aside, the selloff in their stock was initially due to their iBuying debacle. Wall Street hated the flop but I was loving it, because that’s what it took to convince management to abandon iBuying altogether.

Not that I don’t think they could have done it well. Rather, I just don’t want to be in a capital-intensive, levered operation which has a cyclical risk more akin to a homebuilder. Save that risk for the other guys like Opendoor (OPEN). I would prefer just having the CoStar (CSGP) equivalent of residential real estate. Because good economy or bad, the middleman usually does well.

User generated entertainment?

When it comes to apps, I’m quite the minimalist. Unless it’s something I use weekly, I refuse to clutter my phone. Even during the depths of the pandemic, Zoom (ZM) was never on it. When someone proposed a Zoom call, my response was “Nope. I’ll do Facetime or just a regular voice call.”

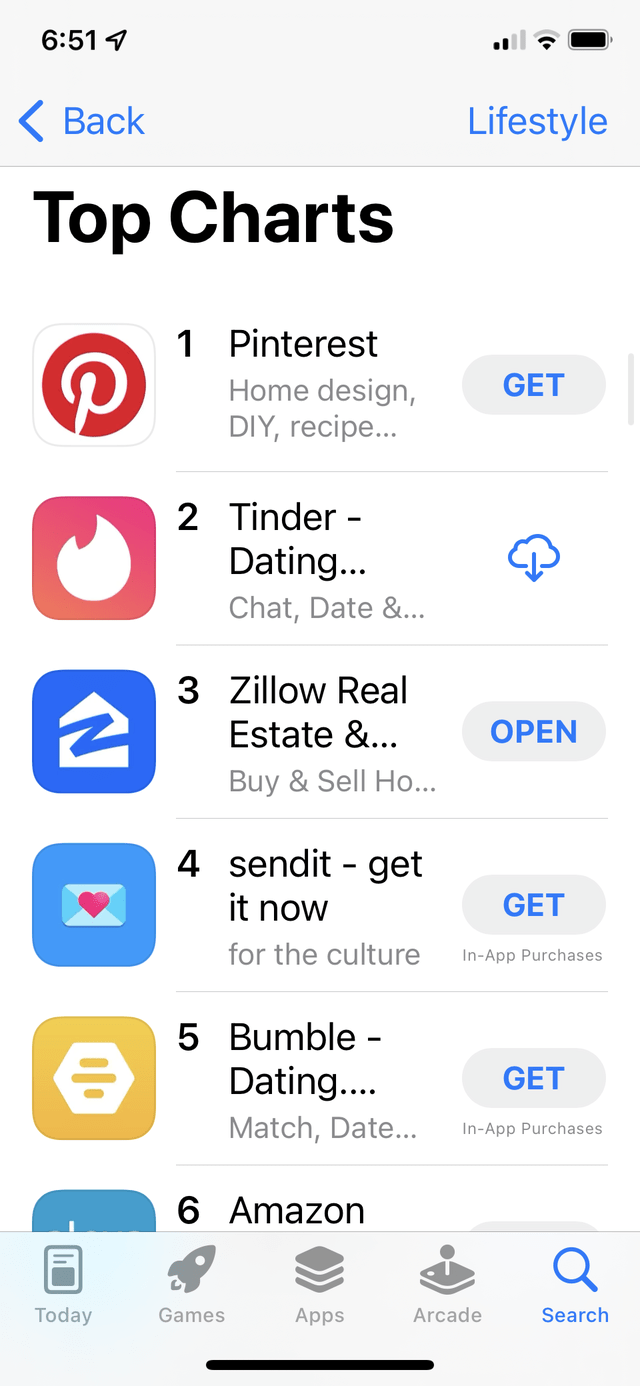

One app which has been on my phone continuously since around 2010 is Zillow. It’s considered essential for many. It’s #3 in The App Store for the Lifestyle category, right after Pinterest (PINS) and Tinder (MTCH).

Is it #3 because all of us are shopping for a new house? No. The reason is that it’s entertainment for many of us, myself included. Some people like to kill their time with TikTok and political partisan talk masquerading as news. Others prefer more substantive things, like Seeking Alpha and analyzing economics from monitoring housing trends.

Okay, maybe the economics angle of Zillow data is a stretch. Most people I know seem to be on there to daydream about homes or spy on the home data of their neighbors/friends/family.

There are many theories as to the psychology behind this so-called Zillow surfing. It has been proposed that millennials love it because they’re too broke to afford a home and it’s a “digital fantasyland.” Gen Z are known for touring houses, via archived photos from a prior sale, before going to the house of a friend/crush for the first time. A recent CivicScience study reported 35% of users are on Zillow just for fun, but I’d argue a good chunk of that other 65% are deluding themselves. They’re on it for fun too, as I recently experienced when selling my house.

Everyone knew my house, yet none were viable buyers

I’ve never been one to post on social media. That includes my house. I’ve also shunned industry periodicals wanting to feature it. Nor would I allow the hired trades to publish photos. Over the years I have caught Instastars, musicians, and even an Olympic silver medalist posing on my property, in front of my all-black house with mirrored glass, for photoshoots. All without permission. Aside from that stuff, nothing had been previously published.

In short, when it hit the MLS, that was the first opportunity for people to know what the inside of my house looked like. During the couple weeks it was for sale I never had a for sale sign up, nor would I allow an open house. A person would have to be proactively perusing my zip code to even know about this listing.

Despite the secrecy, seemingly everyone knew it inside and out, even those who I know for a fact were not looking to move.

Sure, I knew it would draw lots of lookie-loos. That was to be expected given it’s a nearly new 5-story oceanfront house in what is LA’s most expensive zip code, on a PPSF basis. Higher than 90210. However, what I wasn’t expecting was the fact that countless neighbors in my same zip code, as well as people I know elsewhere, were going to text me in the coming days about my house. Before listing it, none of these people even knew I was selling, so it’s not like they were waiting for it.

One neighbor had recently bought a lot a half-mile away and was in the process of a new build. Definitely not a potential buyer. Ditto for another neighbor renting a small apartment nearby. Situations like this were applicable to literally every single person who contacted me.

Amazon realized their advertising potential, will Zillow?

I know from realtors that Zillow charges them a pretty penny for premium listings and what not. But I also know that as a regular user, I could browse the app all day and never be hit with an ad, other than those featured placements which you may or may not encounter.

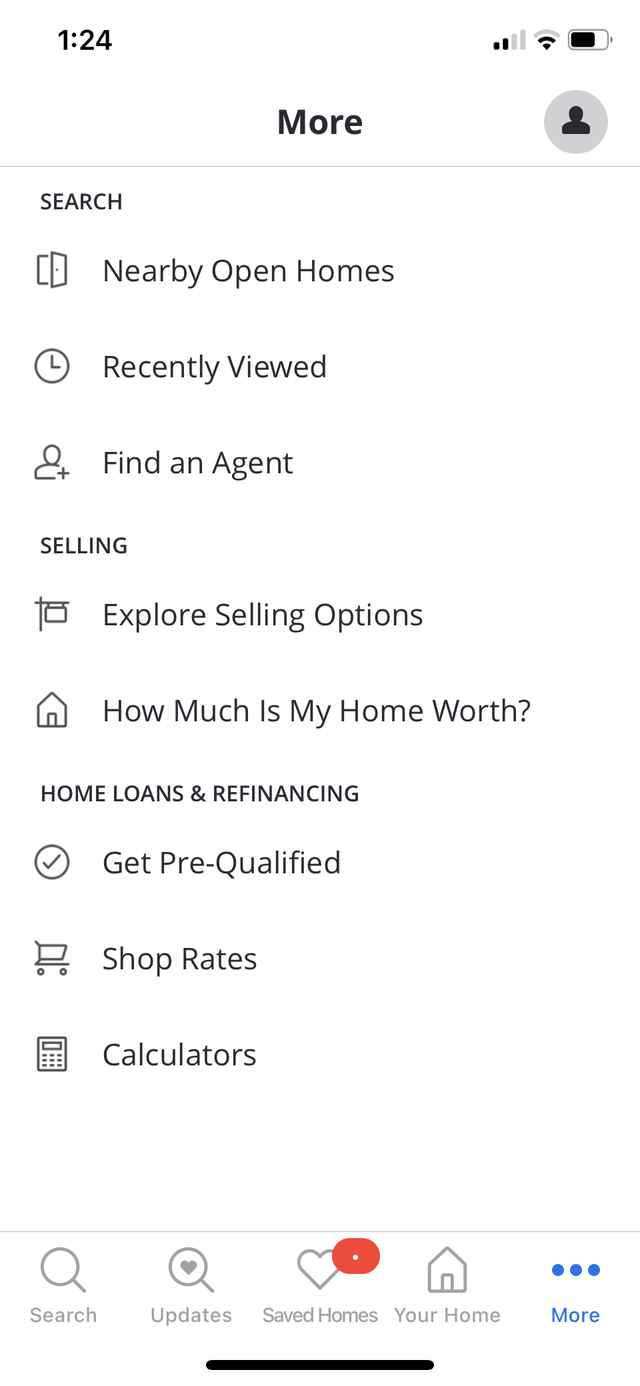

Recently I penned a piece on here about buy now pay later. If you had read it, you will know I have extensive experience in lead generation for financial products and services. More specifically, related to organic traffic and user-generated content. This is immensely under-utilized by Zillow. On the app you have to click “More” to even get to an area where you will be peddled for mortgages. They’re only slightly more overt on the desktop website.

However, these aren’t the types of advertising I have in mind. That’s one-dimensional thinking. Remember, a lot of people on here are not buying a house and therefore, do not need a mortgage or refi. What advertising is being directed at those users?

Nothing. Absolutely nothing!

In other words, there is a large segment of users whom are freeloaders. They’re using the Zillow servers, but not providing any revenue in return.

Yes, one may argue they are indirectly providing revenue, by adding to the visitor count, which in turn is used to drive up the prices which realtors pay for featured placements (more eyeballs). That’s true. However, that’s a weak, underutilized model. There’s no reason why Zillow can’t employ ads in manners similar to Amazon (AMZN), Facebook (FB), Instagram, TikTok, or Pinterest.

Zillow + Pinterest?

Forget PayPal (PYPL) + Pinterest. I’ve always thought a better marriage would have been Zillow and Pinterest. If not an actual combo, then at least Zillow ripping off some of their social elements.

Now more than ever, pride of homeownership is prevalent. Rather than feature photos of decorating and DIY projects on Pinterest – as homeowners currently do – how many would like to feature the same on Zillow, via a profile for their house? I bet a lot would, even when they’re not selling.

Although I’m now retired, monetizing millions of organic visitors is what I specialize in. If I was in charge of executing such monetization at Zillow, I would just salivate given how lucrative I know it would be. I do hope someone there wakes up to this potential and acts on it.

Even without these untapped potentials, the valuation now makes sense

Going into Covid, I had about 37% of my liquid assets in fixed income. I rotated the vast majority of that into equities during the crash, with energy and REITs representing most of my buys. Meanwhile, everyone else seemed to be buying tech high flyers, like Zillow. Not me, the valuation made no sense.

Now I’m seeing the reverse. Right now, it’s a good time to be scaling down your energy exposure. Likewise for most REIT sectors. It’s the best of breed tech darlings you want to be contemplating right now. Zillow is case in point.

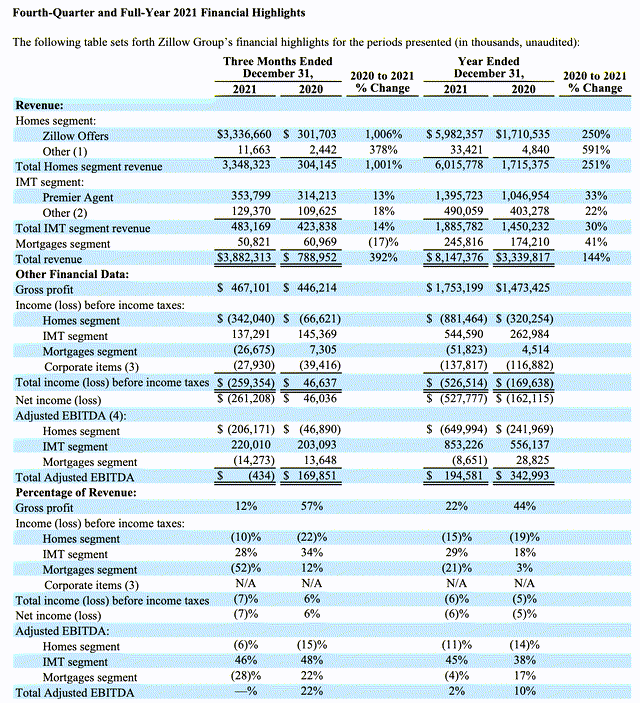

The price/sales is near the cheapest it’s been in 5 years. Granted, the real ratio is not accurately reflected in the above chart, because recent quarters include iBuying (razor thin margin sales, which compresses the ratio). However, even when you back out the iBuying, which they have almost entirely exited, Zillow is cheap.

Ignore the iBuying revenue. Take a look at the IMT segment, which are the fees paid by realtors for leads and featured placements. That, combined with the mortgage revenue (which is only about 12%), gives you a price/sales of around 6.

Buy wait, it gets better. Those numbers we just used are based on 2021. Total IMT revenue grew about 14% over 2020. Not bad considering that 2020 was such a banner year with the pull-forward from Covid location shuffling.

With an adjusted EBITDA margin of 45%, this would imply about $2.25 billion in EBITDA for 2025, if they are able to hit their $5 billion revenue goal.

Considering the current $13-14B market cap, that $2.25B in annual earnings would imply a p/e below 10. Of course, there’s dilution from stock based compensation, which is why I’m being conservative and saying under 10, rather than the 6.2x you would get based on today’s share count. The EV/EBITDA will be even lower, given they have a net cash position of $1.8B.

As far as the here and now, they trade at about a 15x multiple of last year’s IMT segment’s adjusted EBITDA. You just don’t realize that when you glance at the stats, since the numbers are being muddied up with the iBuying wind down.

Don’t forget they also own StreetEasy (New York City), Trulia, and Hotpads. While not as dominant as CoStar is in commercial real estate, Zillow is still the 800-pound gorilla for residential. This ensures they’ll be winning, whatever way the real estate market goes. That’s the beauty of being a middleman.

A downturn in real estate may not harm them as much as you’d think. Now the entry level houses don’t even need to be advertised. Simply being in MLS is enough to get them snapped up. When times are tough, a realtor’s job is more difficult. Rather than leads coming to them, they have to actually work for them. That makes advertising more important, not less.

All in all, perhaps I’ll put a few more bucks into Zillow from my home’s proceeds. A fitting hedge, given that I’m not buying another house for a while.

Be the first to comment