Travel_Motion/E+ via Getty Images

Investment thesis

People’s United Financial, Inc. (PBCT) is a great choice for income investors. The 3.58% dividend yield is not only attractive but the management has a great history and sustainable dividend policy. The company is facing higher expenses due to the merger with M&T Bank (MTB) but when the merger finishes, the joint venture’s efficiency will rise and the company will have a leading market share in the Northeast region. I strongly believe that this shareholder-friendly dividend policy will not change in the future despite the merger because M&T’s management shares the same attitude.

Business model

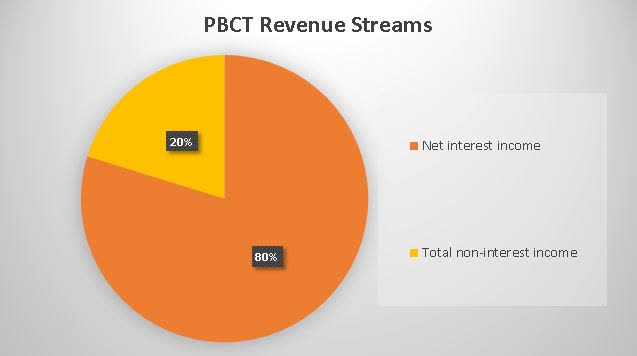

People’s United Financial operates as the bank holding company for People’s United Bank, National Association that provides commercial banking, retail banking, and wealth management services to individual, corporate, and municipal customers. People’s United earns interest on loans and to a much lesser extent on securities and short-term investments. The company recognizes revenue from 2 streams: interest income and non-interest income.

The lion’s share of People’s United’s revenue comes from interest income which is no surprise as the company is a bank. Their current net interest rate margin is 2.69% which is a slight decline from 2020. Non-interest income revenues include realized gains and losses on security transactions, sale-leaseback transactions, and derivatives transactions.

PBCT Revenue Streams The chart is created by the author. All the figures are from the company’s financial statement of Q3 2021.

Financials and earnings

Q3 results

The company reported better than expected results but still had decreases in many segments. Net income totaled $139.7 million, or $0.32 per common share. Net interest income totaled $370.3 million in 3Q21 compared to $380.9 million in 2Q21. This figure also includes all the PPP loans which were $23.1 million. Commercial loans totaled $30.5 billion on September 30, 2021, a $1.4 billion decrease from June 30, 2021.

The mortgage warehouse portfolio decreased $200 million, the New York multifamily portfolio decreased $46 million and the equipment financing portfolio increased $49 million. Residential mortgage loans totaled $7.3 billion on September 30, 2021, a $356 million decrease from June 30, 2021. Retail deposits totaled $27.0 billion on September 30, 2021, compared to $27.7 billion on June 30, 2021.

On January 21, 2021, the Bank announced its decision not to renew its agreements with Stop & Shop to operate 140 in-store branches in Connecticut and New York upon their expiration in 2022. In Q3 2021 the company reached a new agreement with Stop & Shop to retain 27 strategic in-store branch locations in Connecticut. PBCT’s main focus is still the merger with M&T Bank Corporation which is emphasized by the CEO as well: “Our focus remains on completing the merger with M&T, which will bring together two high-performing and well-respected institutions.

As we have worked closely with our M&T partners on integration, we have developed an even greater appreciation for the similarity of the cultures and philosophies between the two banks. As such, a seamless transition is expected for our clients and colleagues once the transaction is closed.”

Valuation

The new company PBCT and MTB together will be approximately a $30 billion market cap bank. This will qualify them somewhere between the top 70-80 banks in the U.S. Expense ratios can also be a good indicator of how well a bank is run. PBCT’s expense ratio has declined in 2021 Q3 YTD 56.9% compared to 2020 Q3 YTD of 53.8%. I expect a further decline in 2022 due to the higher merger-related expenses. However, in the long term the bigger a bank is the better efficiency ratios it can maintain. That is why I only consider this decline a temporary one and when the merger is fully completed with the larger asset size and larger market cap their efficiency ratio will very likely improve to the mid-fifties or better.

When evaluating PBCT stock’s intrinsic value with DCF, we see a bit undervalued stock. For the calculations, I used Graham’s DCF model. For the last 4 quarters, I used the EPS (TTM) which is 0.69. To the expected growth rate, I added 4%. That is because the company has to focus on the merger which will have several expenses and consolidations and only in the second half of 2022 and only then they can concentrate on better efficiency ratios and focused organic growth. Put all this data together and we can have an intrinsic value for PBCT stock between $22-23.

Company-specific risks

People’s United makes most of its earnings based on the difference between the interest it earns compared to the interest it pays. When interest rates go up, (and they will in 2022) People’s United might have to pay more on some of its interest-bearing liabilities while it continues to receive lower rates on some of its interest-earning assets. The planned phase-out of LIBOR is another risk factor as this could adversely affect PBCT’s results of operations and financial condition failure to effectively manage the transition could have a material adverse effect on the business, results of operations, and financial condition.

Approximately 25%, 20%, and 18% of the company’s loans by outstanding principal amount are to customers located within Connecticut, Massachusetts, and New York, respectively. Loans to people and businesses located in the New England states as a group represented 55% of total loans. How well their business performs depends very much on the health of these regional and local economies. These dependent ratios will decline as the merger finishes and the new company will be the second-largest among the Northeast Banks by branches which will help diversity their loan portfolio.

However, a risk factor will remain which is the location. If the economic environment deteriorates, or negative trends emerge with respect to the financial markets, the New England and southeastern New York economies could suffer more than the national economy. This would be especially likely in Fairfield County, Connecticut (where the company is headquartered at the moment) as well as the suburban communities of New York City and Boston as a result of the significant number of people living in these areas who also work in the financial services industry.

In addition, in the next 2 quarters, non-interest expenses will likely grow due to further merger expenses. Moreover, the management mentioned in press releases that all employees affected by the rightsizing will receive severance benefits, which will temporarily hike expenses.

My take on PBCT’s dividend

Current dividend

The merger made no difference in the company’s dividend in terms of dividend policy. People’s United is a dividend champion with a 29-year consecutive dividend payment history and a 29-year consecutive dividend raise history. This makes the company a primary target for income investors. Especially, because PBCT is yielding 3.58% almost 3 times higher than the S&P 500‘s dividend yield. M&T Bank also has an impressive dividend history with a 22-year consecutive dividend payment history, however not as impressive as PBCT because they are not a dividend champion just yet.

Future sustainability

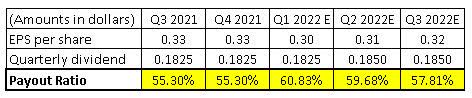

I think the dividend champion title says it all about the management’s intentions towards dividends. There is no question that they intend to grow the dividend. The question is rather the future growth estimates. The management usually announces the increase in Q2 so that is what I expect for 2022 as well. The last 5 years 1.43% average dividend growth is far from impressive but the merger and the new capital can open room for larger dividend increases. Seeking Alpha estimates an average of 3.3% increase in dividends in the next 3 years.

I calculated with more moderate growth for 2022 but when the merger finishes and as we can see the new company’s figures this growth can be higher. I believe (taking into consideration the management’s conservative dividend policy) even if the figures are strong they want to see it continue through the year to announce a larger increase in Q2 2023.

The table is created by the author. All figures are from the company’s financial statements and SA Earnings Estimates.

Summary

For income-seeking investors, PBCT can be a great choice. The company already had a stable and secure position in the northeast region but with the merger, this position will be a market-leading one. In addition, PBCT is a dividend aristocrat with 29 years of consecutive dividend-paying history. This is combined with M&T Bank’s 22-year consecutive dividend payment history can be a guarantee that the new company will continue to execute a highly investor-focused dividend policy. In the next couple of years, not only the dividend policy can be attractive but with the larger asset size, the company will be able to improve its efficiency which can also transform to greater shareholder returns.

Be the first to comment