Bjoern Wylezich/iStock Editorial via Getty Images

Dear readers/followers,

The time has come for me to update my thesis on Vonovia (OTCPK:VONOY) (OTCPK:VNNVF). As you probably know at this point, I’ve held a very positive view of the company for over a year’s time. Vonovia has seen a fundamental decline in valuation over time, to levels where we were able to see triple-digit upsides fairly easily.

ADR investment isn’t something I recommend here. I would argue that it’s an advantage to look at using an international broker like IBKR to invest in the native German ticker.

There are so many reasons why investing in Vonovia is a great choice here – and why indeed, I’ve been investing in the business for over two years. I really dialed up my investing pace back when the company dropped below €25, and my cost basis is below this almost “holy” level as I consider it.

Given that we’ve recently seen a powerful reversal from the absolutely lowest level, I figure it a good idea to show you how much upside is contained in the stock here.

Vonovia – Plenty of German Real Estate upside.

To understand where we might be going, we must first understand where we come from. Vonovia, not that long ago, was a company that traded above €50/share.

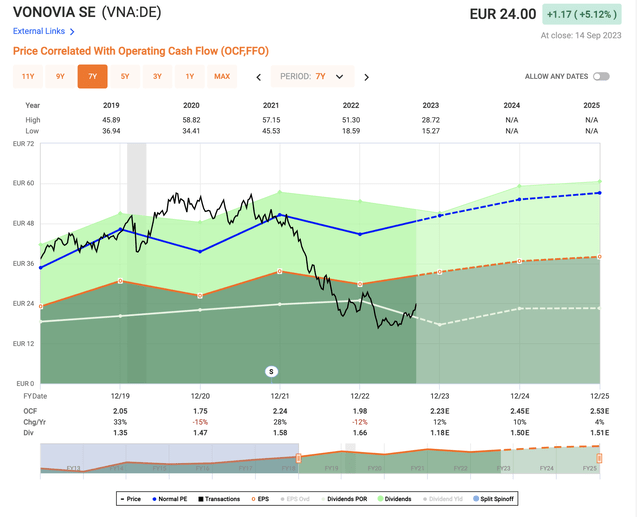

Vonovia upside (F.A.S.T graphs)

As you can see, a multitude of factors having very little to do with actual operating results, because those are mostly fine, then ensured that the company fell more than 50% in a relatively short amount of time. Those impacts came in part from political factors, with the German rental market being in the state it’s in, but also from interest rates rising for the first time in almost a decade. This impacted all real estate companies, but Vonovia took the brunt of the beating here.

So, Vonovia.

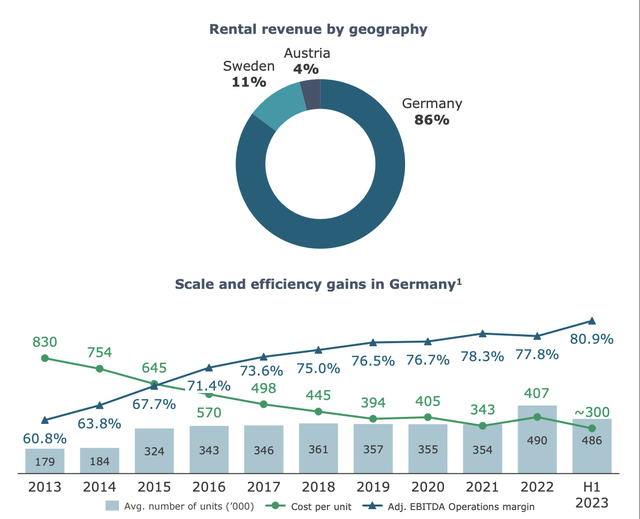

The company is Europe’s leading residential real estate company. This is not an exaggeration. The company manages 548,100 residential units in attractive areas not only in Germany but also in Sweden and Austria, as well as managing over 70,000 apartments. The portfolio, even with re-evaluated NAV, is worth over €88B, and the company offers an attractive mix of development, management, services, and the like. It cut the dividend to remain conservative and currently yields a bit less than 4%, but this comes at the advantage of a BBB+ credit rating, which you might not guess if you look at the company’s recent share price trends.

Cash flow and debt issues.

None worth mentioning. The company’s 2023 and 2024 financial maturities are 98% covered, over 1 year in advance. The company has refinanced loans and ensured new loans, most of them unsecured.

The latest results we have are the half-year ones out of 2023. The company saw significant rental EBITDA growth of 7.8%. Occupancy is sky-high, and collection is nearly flawless with very little delinquency. That’s why you invest in resi real estate. People pay their rent before most other things.

Actual issues?

Cost of capital. The company’s overall group results are actually still down a bit – 4.8% in terms of adjusted EBITDA – due to financing costs and limited transaction volume in an unattractive market (for the most part).

Over 90% of the company’s business is rental. The company does have operations in value add, development, and even a bit of nursing, but this comes in at sub-€50M EBITDA levels – so rental is generally what we want to focus on here. And trends here are very good.

Efficiency continues to climb, and there’s a significant organic rent growth above what I would have expected given the current inflation numbers and how the market works in Germany. Vacancies are also very conservative – 2.2%, while collections are at 99.9% – so no real issue. The company’s expenses and maintenance are also down significantly since 2022, starting to see some of the gains from earlier investments.

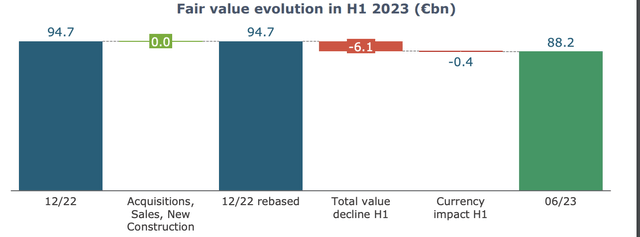

Valuation has been a big question for many investors. Just how much is the portfolio worth? We have the results for that question, with an update in June of this year.

Will there be further valuation declines? Maybe a little – though I argue that most of the re-evaluations are done here, and Vonovia itself says that 2H23 is showing signs of stabilization in the market. The debt structure is somewhat lumpier than some of its American counterparts. There’s quite a few maturities between 2025-2030, but the company’s asset base gives plenty of possibilities for financing. Credit ratings are very strong – BBB+ or Baa1 from Moody’s and S&P, with A- from Scope. The company’s fixed & hedged debt is at 9.6%, and the cost of debt on average is 1.6% here with an average maturity of 6.9 years.

So Vonovia made sure, when they saw the trends in terms of interest, to lock in as many attractive loans and rates as possible, resulting in a current LTV of 46%, meaning only a few conservative European companies have better leverage.

Vonovia has been through multiple theoretical stress tests, including how the company would fare in a 20% value decrease, which is more than double what we’ve seen until now. The company’s covenants are extremely conservative – and Vonovia has looked at things like the FV headroom against an LTV of 60% in terms of bond covenants.

What we’ve seen over the past 12 months is exactly what I’ve expected and previously guided for. Valuation for these sorts of real estate assets does not plummet. Not in Europe. Value changes here are gradual, and the company can slowly adjust where needed, as it has been doing.

In short, to summarize Vonovia’s half-year trends and why I remain as convinced and positive about the company as I did previously:

- The core rental business is solid and continues to show growth and improvement.

- All financial maturities are already covered until late 2024E.

- Multiple efficiency disposals/M&A’s are planned, with another JV transaction planned until 2025E.

- The current Fair-value headroom for Vonovia continues to allow the company to act from a position of strength, without needing to compromise or sell “in panic”. The dividend is already right-sized to a very conservative FFO, almost a P/O of 50%.

All these facts together mean that Vonovia, as I see it, is doing extremely well.

Remember, the nation of Germany is smaller than the US state of Montana but houses 25% of the population of the United States, and is one of the most important western industry nations in the entire world, well ahead of the US in terms of industrial complexity (Source: OECD).

Vonovia’s strategy is not to “buy cheap and refurbish”. Rather, it’s to buy the expensive assets available on the market refurbish further where needed, and then work with rents. This is a segment of the market that requires a great deal of capital, which Vonovia has no shortage of. This makes them a serious player to contend with.

And this is only the beginning in terms of upside. As we’re going to see when we look at company valuation, Vonovia has plenty going for it even if we never normalize beyond a P/FFO of 15x.

Vonovia Valuation – Triple-digit upside is still very much possible.

So, triple-digits – how?

Simple – just consider a premium even slightly possible. In the case of a 15x P/FFO upside if you consider any sort of premium invalid, the company’s upside, despite climbing more than 20% since its trough, is 26%+ annually, or 72.6% total RoR until the of fiscal 2025E, implying a share price level of around €38/share.

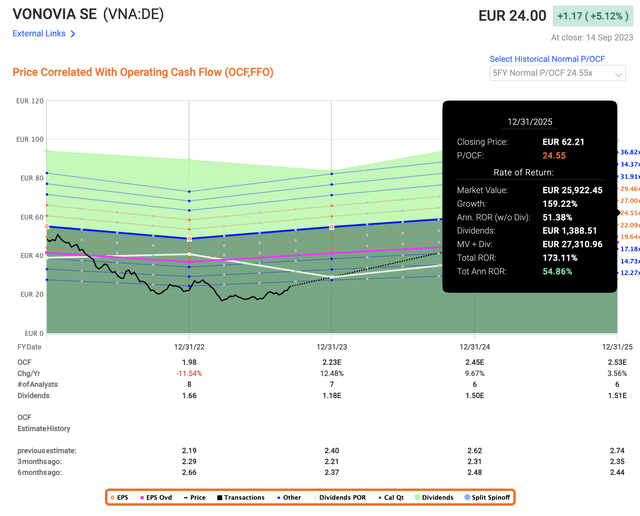

Obviously, I believe Vonovia is worth more/higher multiples given the sheer amount of quality this portfolio does represent. A 5 year average is 24.55x P/FFO. This would imply a reversal potential to levels we saw before 2023 of around 173.11%.

Vonovia Upside (F.A.S.T Graphs)

I say too much exuberance. That would put the company at the sort of valuation we saw when interest rates were close to 0%. That’s too high. But a 17-19x P/FFO, that’s a midpoint I can get onboard with.

At a rough midpoint of 18-18.5x, that gives us an annual upside of around 38%, or a total RoR of 110% in 3 years, and a PT of €47, close enough to my own PT of €48.

That is where I believe the company is going from here. It won’t happen overnight. It won’t even happen quickly or in the next year. Normalizations take time – and this one will take longer.

But I believe it will happen.

I want to emphasize that this company holds over half a million units across Europe. This is a proven business with a concept that works over time, even if we’ve seen a fair bit of impact from both macro and from specifics in the relative markets the company is in. It’s one, however, of the few players with the financial muscles in all of Europe to move on these opportunities – and that’s why I want to push my exposure here. There’s a great deal of safety to be had here. The French REITs I cover on SA don’t have close to the same muscles that Vonovia has.

To those of you asking, “But US REITs seem better”, there’s some point to this sentiment.

That’s why my PT is €48/share.

Traditional US REITs have a definite advantage over Vonovia when comparing them as investments given withholding taxes and some other stability-related variables. However, if you fully include what once was Deutsche Wohnen’s portfolio in the company, then the company’s current NAV, even updated for 2023 comes to 0.6X.

There’s a massive discount on Vonovia 2023E here, and given that I know exactly what sort of properties we’re talking about, I know I want to own them cheaply.

And despite some arguments that could be made in terms of riskiness, Vonovia is a superb real estate company with some very good upside.

Thesis

My view on Vonovia is as follows:

-

The largest, most significant real estate company in all of Europe is at a great discount looking at every single perspective you could possibly consider.

- I’ve been investing in Vonovia for over a year at this point and accelerated my investing as the company saw trough-level valuations.

-

Based on its fundamentals and valuation, I view Vonovia as one of the most appealingly valued real estate companies in all of Europe. Coupled with its credit rating of BBB+, this makes it a “BUY” to me.

-

My target PT is €48/share. I am not changing this PT for now, and I haven’t changed it since I covered this company early in 2023.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment