SolStock/E+ via Getty Images

Never invest in any scheme that is based on a metaphor, or anything with the word, “next”, in it (e.g., “this kid is the next Elvis Presley”, “this will be the Lake Lucerne of the Southwest”). You will lose your shirt. ― Clifford Cohen

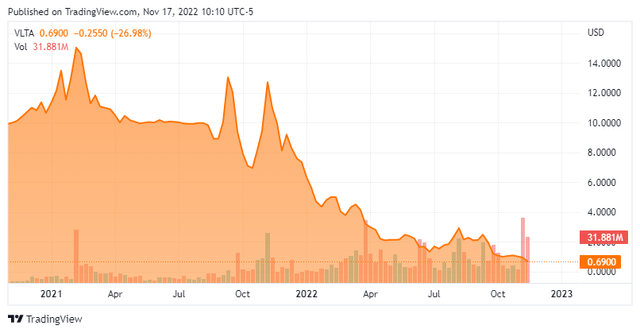

Today, we look at Volta Inc. (NYSE:VLTA) for the first time. This EV related concern came public in early 2021 via a merger to Blank check company Tortoise Acquisition Corp. II. Like so many small cap companies that came public in the SPAC craze of late 2020 and 2021, the equity has been a dumpster fire for initial shareholders. Volta also lost its CFO and General Counsel earlier this year. The company has also radically downsized its workforce in order to conserve cash.

However, the company is seeing stellar sales growth even as cash burn rates are a critical concern. Can the company survive without diluting its shareholders further? Volta, Inc. recently posted its latest quarterly results. An analysis follows below.

Seeking Alpha

Company Overview:

Volta, Inc. in headquartered in San Francisco, CA. The company operates a network of smart media-enabled charging stations for electric vehicles in the United States. The company has just over 3,000 installed charging stalls across the country. A stall is attributed to a station based on the number of vehicles that can charge concurrently from that station, and there are certain configurations of Volta sites where one station is capable of charging more than one vehicle at a time. Importantly, Volta also uses these 55-inch video screens at these charging stations to deliver digital advertising ‘Volta Media™ Network’ for a wide assortment of clients. This is where the company receives the bulk of its overall revenue.

May Company Presentation

The stock currently trades just south of 75 cents a share and sports an approximate market capitalization of $120 million.

May Company Presentation

Third Quarter Results:

On November 14th, Volta posted third quarter numbers. The firm had a GAAP loss of a quarter a share, which slightly beat expectations. Revenues rose nearly 70% on a year-over-year basis to $14.4 million, roughly in line with the consensus.

At the end of the quarter, the company now has 3,093 charging stalls. This is up six percent sequentially from last quarter and 45% above the same period a year ago. The Volta Media™ Network had more than one billion monthly media impressions during the quarter for the first time as well. Media sales were the bulk of overall sales in the quarter. They came in at $12.2 million this quarter, an increase of 9% quarter-over-quarter and 66% year-over-year.

Late in September, announced another 10% reduction in its workforce, withdrew its full year revenue guidance and revised its Q3 revenue forecast amidst challenging market conditions. The company’s full time workforce is now down more than half from where it was a year ago. Volta is also looking to limit the use of outside consultants and consolidate its teams and three offices in San Francisco into one. Thanks to these developments, network development revenue fell to $1.9 million in the quarter compared to $3.6 million in 3Q 2021.

Analyst Commentary & Balance Sheet:

Since quarterly results hit this week, five analyst firms have reissued or downgraded to Hold/Sell ratings. These include Barclays and Goldman Sachs. Price targets range from .50 to $2.00 a share. Only Needham ($2 price target) has maintained its Buy rating on VLTA.

Roughly one out of eight shares outstanding is currently held short. The company ended the third quarter with just under $12 million worth of cash and marketable securities against $12 million of long-term debt. The company burned through just less than $4 million in the third quarter of this year.

Verdict:

The current analyst firm consensus has the company losing just north of a buck a share in FY2022 even as revenues rise some 90% on a year-over-year basis to just over $61 million. Similar losses are expected in FY2023 even as sales are expected to double. It should be noted there is a wide range of earnings projections (from a 68 cent a share loss to a loss of $2.40).

Volta is hardly unique in this niche as far as facing challenges on multiple fronts right now, outside the fact it co-located digital advertising screens with its EV charging stalls. One has to be concerned about the growth outlook for digital advertising and overall marketing spend as the country looks heading towards a recession in 2023.

Outside a buyout by a larger charging concern looking for economies of scale and sales diversification in this rapidly growing but currently unprofitable space, it is hard to see how Volta survives without a significant and most likely quite dilutive capital raise. Therefore, the recommendation is to avoid this stock despite the impressive revenue growth.

The hustler knew that all that people ever wanted in the world was what they could not have, and what they had already lost. ― Stuart Stromin

Be the first to comment