Sjo

The transition toward Electric Vehicles (EVs) is well underway, with sales doubling in 2021 to 6.6 million globally. Volkswagen AG (OTCPK:VWAGY), once the biggest incumbent car manufacturer, has pivoted decisively over the last two years and is now strongly positioned to compete for the growing market share for EVs. I believe Volkswagen will be a structural winner in the EV transition race for the following reasons:

- Volkswagen is equipped with a load of cash that allows the company to fuel its transition to become a global player in the EV space. It has the largest investment spend in EV and software globally, amounting to 100 billion USD over the years, fueled by its stable Combustion-engine vehicle (CEV) business.

- Volkswagen has overtaken Tesla (TSLA) in aggregate sales in Norway, the country with the highest EV adoption. It is beginning to take over market share in China, currently the most critical market, with sales ending at 118,000 BEV in Q2, a total share of 6%.

- Lastly, in its aggressive transition, Volkswagen has achieved profit margins equal to its CEV business almost two years ahead of schedule, allowing the company to scale up its EV business while keeping its profitability levels stable.

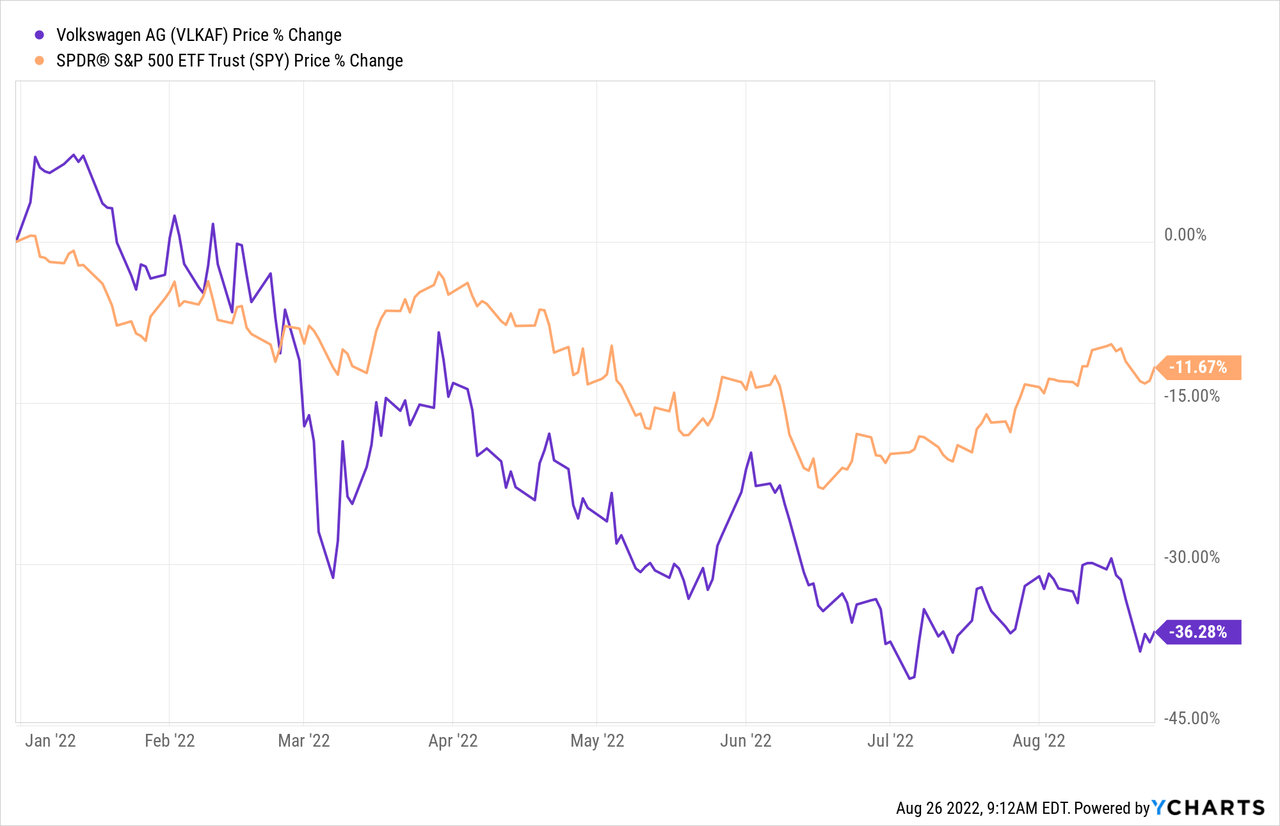

Due to their cheap valuation, trading at a P/E ratio of just 3.91, and my belief that Volkswagen will remain among the top 3 car manufacturers for the foreseeable future, I rate the company with a “buy” rating with a fair valuation of 256.50 USD for the VLKAF shares.

Overview

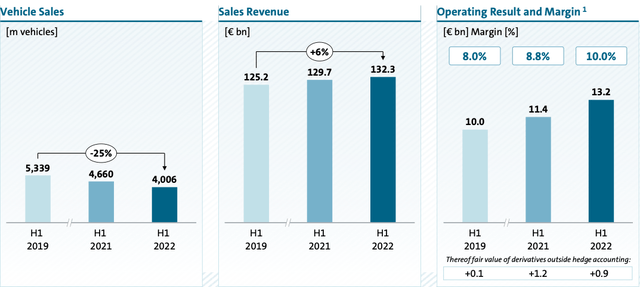

One frequently forgets just about how big Volkswagen is as the brand is a conglomerate consisting of Volkswagen, Audi, Porsche, Skoda, and more, as well as a 90% majority stake in Traton SE (OTCPK:TRATF), a manufacturer of trucks with brands such as MAN, Scania, and Navistar. In 2021 Volkswagen ranked first in revenue among all global car manufacturers. Yet, of the 8.6 million cars they sold in 2021, only 453,000 were electric vehicles, a share of total sales of about 5%. In both their car and truck business, Volkswagen aims to accelerate the shift towards electrification, with Volkswagen having the goal of selling around 700,000 EVs in 2022. The group’s objective is to sell 2.5 million BEVs by 2025, a share of ~25% of total deliveries. While vehicle sales have declined by around 25% from 2019 figures, revenues increased by 6% over the same period. The sales decline can be explained mainly by supply constraints due to the strict lockdown policy in China and, most recently, by the Russia-Ukraine war, severely impacting Volkswagen’s OEMs to deliver necessary components.

Revenue and operating margins (Volkswagen Investor Presentation)

Improving supply chains

In their most recent Q2 earnings call, management guided improving unit sales from the lows in Q1 2022, with unit sales recovering in May and a clear upward trend in June with more than 800,000 deliveries worldwide. The trend is fueled by accelerating sales in China, where deliveries were up 27% YoY. Production began to ramp up in the second quarter, and management expects to ramp up production even further, allowing the company to better serve the high demand, especially for its EV products, namely the ID.3, ID.5, and ID.Buzz, with order intake in Western Europe up 40% compared to the year prior. Semiconductor and wiring harness shortages continued to impact the company’s ability to produce. However, supply chain issues have begun to ease over the last month and are expected to improve even further over Q3 and Q4, which should give the company a boost for its H2 2022 sales results. Traton SE has been severely hit by the general supply chain shortage, capping production capabilities at 65%, and is well positioned to expand sales when supply chain shortages continue to ease in the following quarters.

Some of the parts problem

As stated above, the Volkswagen group consists of several notable brands, for which Ryan Daniels laid out a compelling valuation case back in 2019 already. I would argue that little has changed today and that, hypothetically, valuing the Volkswagen brands one by one would result in a higher aggregate valuation. Management has realized the issue, which is why it has started segregating the brands and listing some on their own on the market. Most notable was Traton SE’s formation through a squeeze-out in the fall of 2021 to form a market leader in the heavy-truck segment. In addition, depending on the market segment for the second half of 2022, Volkswagen plans to IPO Porsche as a privately listed company, among other reasons, to resolve the “sum of the parts problem.”

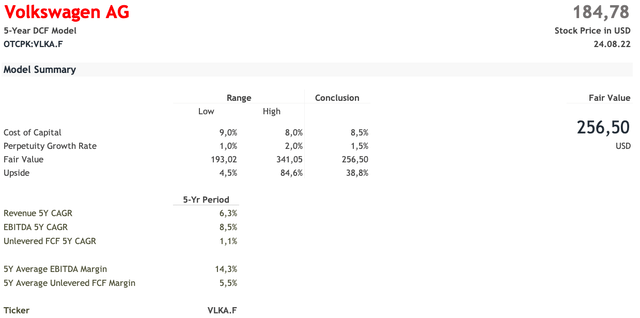

Valuation

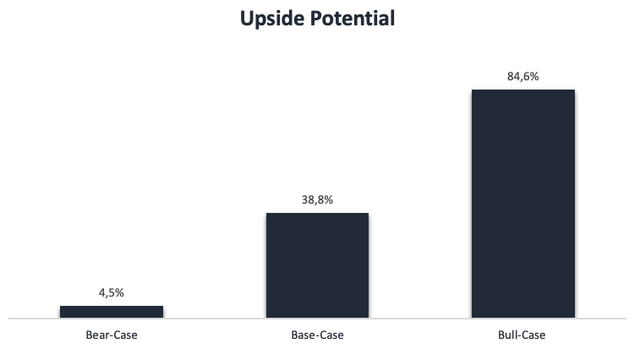

For my analysis, I have conducted a full-blown DCF with variations to consider scenarios that exemplify results below, at-par, and above expectations. To evaluate the different alternatives, I applied a 50-basis point addition/subtraction from both costs of capital and perpetuity growth rate to estimate a range of fair values for the different scenarios. As the base case, I used a cost of capital of 8.5% based on a group of peers consisting of 10 incumbent car manufacturers like BMW (OTCPK:BMWYY), Mercedes (OTCPK:MBGAF), Toyota (TM), BYD (OTCPK:BYDDF) and also consider newer EV companies, I included Tesla and Rivian (RIVN) in the group of peers. The perpetuity growth rate of 1.5% as the base scenario is an approximate weighted average of historical GDP growth based on sales per country. It should be viewed as a conservative base case. Due to high uncertainty regarding future sales, I have revenue growing at a slower rate for the years 2024, 2025, and 2026. For revenue growth, my input projections for 2022 are in the lower range of guidance and accelerating growth for 2023 based on my assumption of improving supply chains. Since Volkswagen has already managed EV profit margins to match those of CEV, I regard a long-term EBITDA margin of 14%, as has been the case historically, as a realistic scenario. Based on the assumption mentioned above, my model estimates a fair value for the stock of 256.50 USD, an upside of 38.8% from where it trades on August 24th.

If supply chain shortages prevail, strategic initiatives fail, or for other reasons, Volkswagen does not accomplish the sales or profitability levels listed above, I estimated the fair value for such a scenario at 193.02 USD or 4.5% upside from current levels. If sales and profitability surpass expectations, particularly if growth in Asia remains strong, the stock could reach a price of 341.05 USD, an upside of 84.6% today.

Conclusion

While Volkswagen does not appeal to investors with the same hype and 50%+ growth prospects for the coming years, in my opinion, it trades well below its fair value. I expect the market to realize this value once the industry consolidates more over the next 2-3 years and when supply chain worries start easing a bit more.

Be the first to comment