jetcityimage/iStock via Getty Images

TMV Momentum

We wrote about Direxion Daily 20+ Year Treasury Bear 3x Shares ETF (NYSEARCA:TMV) in April of this year, when we observed that the leveraged exchange-traded fund (“ETF”) was gaining traction. TMV is essentially a leveraged ETF operating in the long-term U.S. Treasury space, where the aim is to deliver three times the inverse of the standard U.S. Treasury 20+ Year Bond. Shares of the ETF are up roughly 10% since that April piece, but we believe we are nowhere near done here.

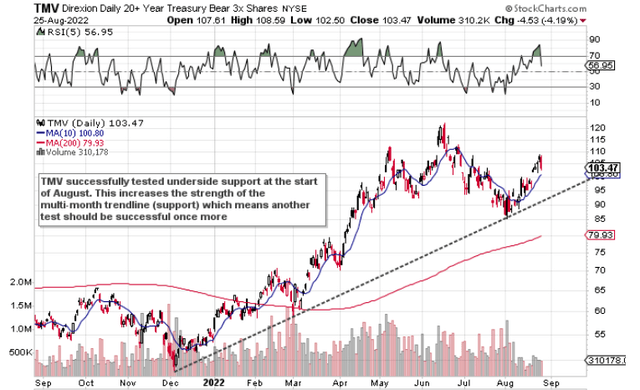

In fact, August has been a terrific month for the ETF thus far, with shares up approximately $17 a share or 20% since registering that bottom on the 1rst of this month at under $87 a share. However, given the volatility of these instruments, we could easily come back down to test the upcycle trend line, which is a good 10% below the prevailing share price of the fund. A successful test of this support level combined with a swing low would be an excellent entry into TMV for the following reasons.

TMV Technical Chart (StockCharts.com)

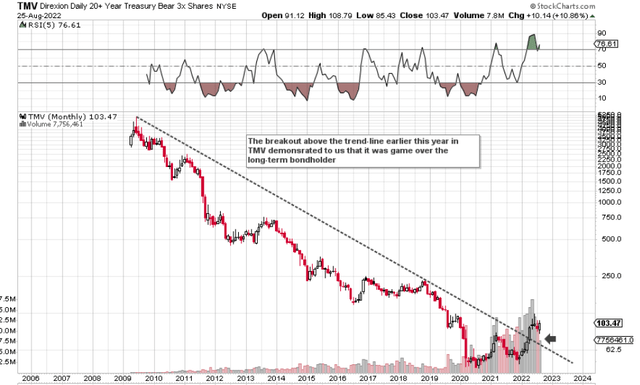

TMV Long-Term Trend Change

Although leveraged ETFs like TMV and their associated risks as discussed previously are a horrible investment in either a sideways or down market, they many times can outperform their targeted returns when one is right on direction. For example, TMV has now returned over 76% over the past 12 months and over 54% over the past six months, both of which are more than -300% higher than what the regular U.S. 20-Year Bond ETF (TLT) has returned over the same periods. Suffice it to say, with relation to TMV and how one plays this instrument going forward, we continue to believe it is all about buying the dips as they take place over time.

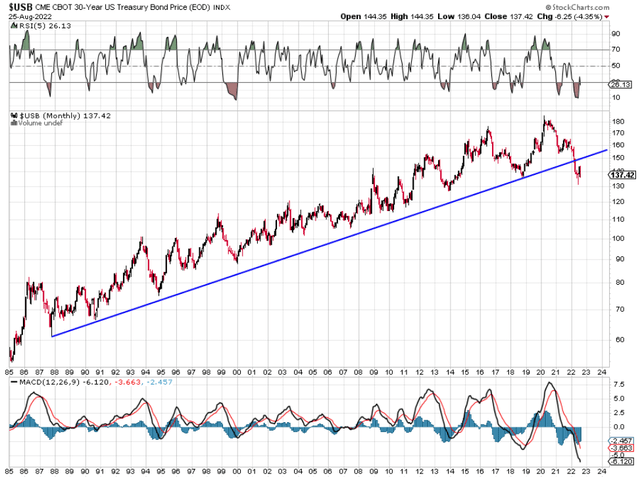

The U.S. long-term bond market definitely has its fair share of both bulls and bears but ever since long-term support failed in this space as we see below and given how high the market actually got to over the past decades, we have only been trading bonds on the short side since we witnessed the sector’s change in nature. What bond bulls need to come to terms with is that the technical chart has digested every possibility that could change this market for the better or worse. This means the “market” is fully aware of current inflation rates and central bank policy with respect to its response to the higher pricing we are seeing right across the board.

TMV – A Change In Direction (StockCharts.com)

30-Year Bond Market – Change In Nature (StockCharts.com)

Talk Is Cheap – Behavior Never Lies

Whether in real life or in the investing world, one thing remains constant: Behavior Never Lies. What do we mean by this? Well, you can bet that bond bulls not long ago (once inflation spiked to the upside) believed the initial narrative that inflation was transitory. That was the first lie. Furthermore, it is reasonable to state that the eternal optimist still believes that the Fed ultimately will get to grips with the problem. In fact, bond bulls once more came out in force to give long-term treasuries a timely boost as a result of Fed Chair Jerome Powell‘s recent hawkish Jackson Hole comments. Powell stated that policy will continue to be tightened sufficiently in order to bring inflation down to target. Once more though, Powell left the door open to a more dovish stance, reminding his audience of the pain of a sustained tightening cycle over time. It was these comments evidently that continue to let Powell off the hook.

So the question I have for the bulls is the following: Do we go on the repeated reassurances Powell gives to the markets or do we judge him by his behavior to date, which is also clearly on view if anyone would like to notice? When it boils down to it, Powell has both raised rates too late and raised them far too slowly to curb inflation. Suffice it to say, if the U.S. undergoes an economic contraction over a sustained period (Which is bound to happen sooner rather than later), what are the possibilities of Powell continuing his tightening cycle if this is all he is doing at present?

Conclusion

This is why we will continue to monitor his behavior and watch how the markets respond as a result. Just remember, in all markets, price moves in trends, and a new trend in motion is much more likely to continue than to reverse. Remaining short bonds. We look forward to continued coverage.

Be the first to comment