DakotaSmith

The Vanguard Mid-Cap Value ETF (VOE) has lost less in the past year than its bigger sibling – the Vanguard S&P 500 Index ETF (VOO). The Mid-cap ETF has lost 15.4% compared to the S&P 500 ETF loss of 19.2% over the past year [as of October 14]. I analyzed the top 160 holdings in the Vanguard Mid-cap Value ETF, looking for oversold stocks with long-term potential and a dividend yield above 4% or greater than the U.S. 2-year Treasury Note. The U.S. 2-year Treasury Note yields 4.5% [October 14].

I focused on the success of two retail names and the failure of one industrial company in this ETF in the past year. Dollar Tree, Inc. (DLTR) and AutoZone, Inc. (AZO) are the two successful retailers. Both companies have done well in the past year, posting significant gains. But Dollar Tree is fully valued now, and AutoZone is overvalued.

The failed industrial is Stanley Black & Decker, Inc. (SWK), which has lost over 50% of its value in the past year, but the stock may not yet be a buy. The company’s sales are tied to GDP growth. Currently, the U.S. GDP is going in reverse, given the Fed’s focus on rising interest rates to stamp out inflation. But, given the company’s stellar brands, Stanley Black & Decker would be a great addition to a long-term portfolio once its sales and profits stabilize.

Performance Review of the Vanguard Mid-cap Value ETF

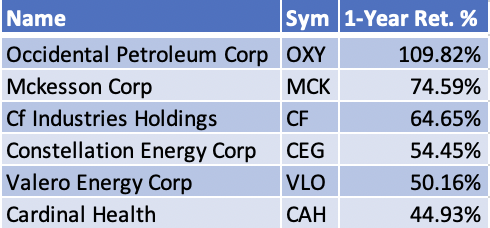

Six companies in the Mid-cap ETF have had stellar performance over the past year with over a 40% return [Exhibit 1]. Occidental Petroleum (OXY) is the best performer on this list, with a one-year return of over 100%.

Exhibit 1: Six Winners in the Vanguard Mid-cap ETF have Gained Over 40% in the Past Year

Six Companies in the Vanguard Mid-cap ETF have Gained Over 40% in One Year (Data Provided by Barchart.com, iexcloud.io, Author Calculations)

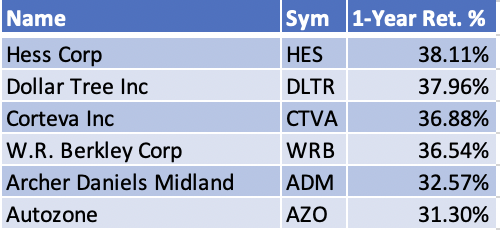

Six companies have gained more than 30% in the past year [Exhibit 2]. Energy and healthcare names dominate these lists. W.R. Berkley Corporation (WRB), with a positive return of 36% in the past year, is a property and casualty insurance company. Corteva operates in the agriculture industry and provides seed and crop protection products. I am surprised to see Dollar Tree, a discount retail store operator, do well during these inflationary times and has returned 37% in the past year.

Exhibit 2: Six Companies in the Vanguard Mid-cap Value ETF have Gained Over 30% in the Past Year

Six Companies in the Vanguard Mid-cap Value ETF have Gained Over 30% in the Past Year (Data Provided by Barchart.com, iexcloud.io, Author Calculations)

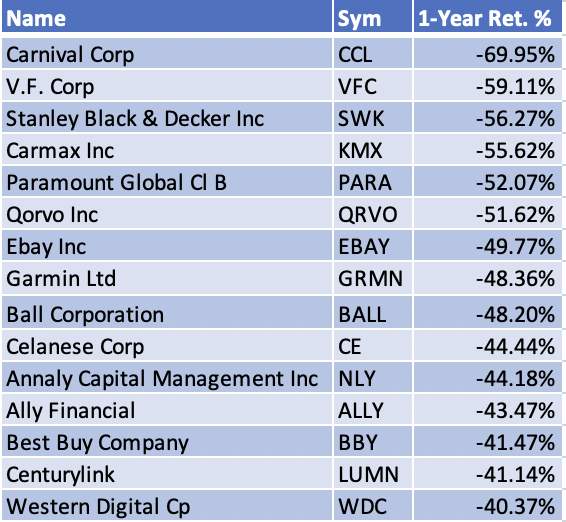

Fifteen Vanguard Mid-cap Value ETF companies have lost over 40% of their value in the past year [Exhibit 3]. A couple of companies with iconic brands, such as V.F. Corp (VFC) and Stanley Black & Decker, are on this list. Both these companies are very much tied to America’s economic strength. As the U.S. GDP lost ground, these two companies suffered.

Exhibit 3: Fifteen Companies in the Vanguard Mid-cap Value ETF have Lost Over 40% in the Past Year

Fifteen Companies in the Vanguard Mid-cap Value ETF have Lost Over 40% (Data Provided by barchart.com, iexcloud.io, author calculations)

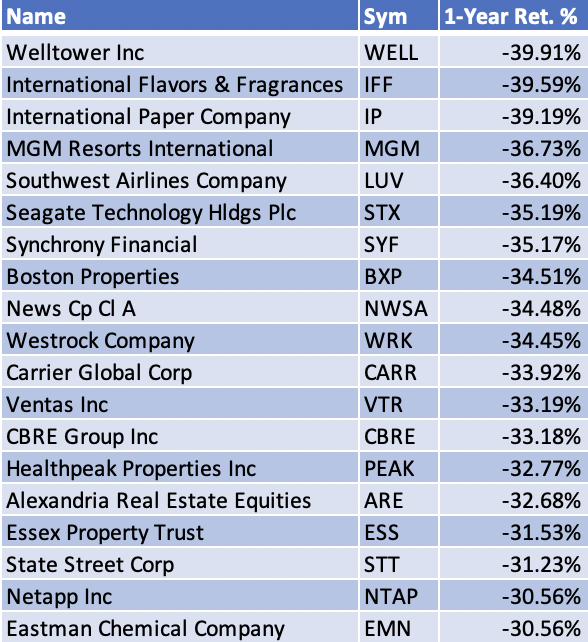

There are nineteen other companies in the ETF which have lost over 30% of their value in the past year [Exhibit 4]. About 115 of the 160 holdings are in negative territory as of the close of trading on Friday, October 14.

Exhibit 4: Nineteen Companies in the Vanguard Mid-cap Value ETF have Lost over 30% in the Past Year

Nineteen Companies in the Vanguard Mid-cap Value ETF have Lost over 30% in the Past Year (Data Provided by Barchart.com, iexcloud.io, author calculations)

Stellar Performance of Two Retail Names – Dollar Tree and AutoZone

Dollar Tree has gained over 37% in the past year. Dollar Tree reported a 6.7% increase in net sales to $6.77 billion in the second quarter compared to $6.34 billion in the second quarter of 2021. The company reported stellar increases in profitability. For example, the company saw a rise of 14.2% in gross profits, 25.7% in operating profits, and 30.1% in earnings per share [EPS]. The company saw its gross profit margin improve by 200 basis points to 31.4%.

Dollar Tree management credits this improved profit margins on price increases and operating leverage on distribution and operating costs. Inflation impacted the company through higher freight costs and unfavorable product mix due to consumers shifting to lower-margin consumable products and markdowns. The company’s growth in EPS was aided by its buyback of 1.664 million shares during the second quarter at an average price of $141.67. The company repurchased 1.754 million shares for $250 million in the first six months of 2022.

Dollar Tree may be fully valued at this time. It is trading at 18.6x forward P/E, the same as its five-year average. It is trading at a forward E.V. to EBITDA multiple of 13x compared to its five-year average of 12.5x. Dollar Tree can continue to do well in this inflationary environment as low-income consumers look for bargains and price breaks.

It is also a surprise that AutoZone has done well. Its one-year return is an impressive 31%. The company’s excellent performance may be because new cars have been in short supply over the past two years due to the semiconductor shortage and the aging fleet of vehicles. The company has benefitted from its DIY customer base and continues gaining market share in the fragmented commercial segment. The company’s base of low- to middle-income customers may have added to its strength. The company has continued expanding its retail store network in the U.S., Mexico, and Brazil. The company opened 118 new stores in the U.S., 39 stores in Mexico, and 20 in Brazil. The company saw its annual sales grow by 11.1% in 2022 compared to the prior year. The company reported fourth-quarter net sales of $5.3 billion [quarter ending August 27, 2022], an increase of 8.9% from the fourth quarter of fiscal 2021.

The company’s gross margins remained strong in the face of high inflation affecting every segment of the economy over the past year. Its fourth-quarter gross margin was 51.5%, a total decrease of just 73 basis points from the prior year. Most of the decline in gross margins was due to the accelerated growth of its commercial business, while higher freight charges led to a 28 basis point hit. Diluted earnings per share increased by 13.4% to $40.51 from $35.72 in the year-ago quarter. The year’s diluted earnings per share increased by 23.1% to $117.19 from $95.19. The growth in the company’s EPS was partially aided by its $4.4 billion share buybacks for the year. The company repurchased 2.2 million shares at an average cost of $1,964 per share. The company’s return on invested capital [ROIC] was 52.9%.

AutoZone may be overvalued since it is trading at a forward P.E. of 18x and a forward E.V. to EBITDA multiple of 13.6x compared to its five-year average E.V. to EBITDA multiple of 11.9x. A PE of 13x to 15x would be considered undervalued for this company.

It is heartening to see a few companies, such as AutoZone and Dollar Tree, bucking the trend and reporting positive growth in the face of dreary news from around the world surrounding geo-political tensions and conflict, high inflation, and slowing economic growth.

Stanley Black & Decker – A Company Amid a Turnaround

Stanley Black and Decker’s stock has had a terrible year, losing 57% of its value in the past year. The market is right to punish the company, given the poor performance of this company. The company reported sales of $4.4 billion for the second quarter, up 16% from the same quarter in the prior year. But, this sales increase was driven by the company’s acquisition of MTD. Lower sales volumes were a drag on sales, with a negative 13%. The softening demand for the company’s products is a significant concern weighing the stock price.

Another concern is the massive drop in gross margins. Gross profit margin plunged by 800 basis points to 27.5% for the second quarter of 2022. Inflation took a bite out of the margins, and the company pricing could not keep up with it. The company’s management had to revise its GAAP EPS outlook for 2022 to between $0.80 and $2.05, a decrease from its original guidance of $7.20 to $8.30.

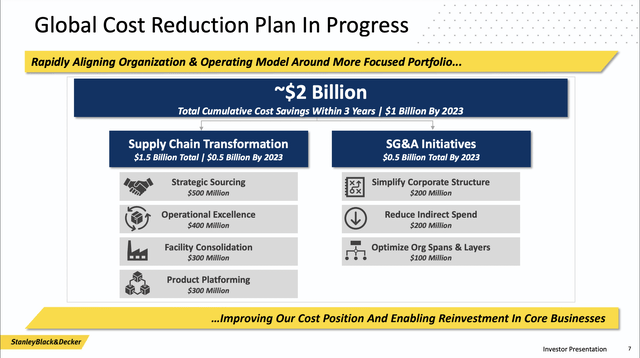

The company has sold assets to reduce its debt and buy back shares. It is embarking on reorganizing its operations targeting cost savings of approximately $2 billion within three years [Exhibit 5]. These cost savings should help it achieve an adjusted gross margin of 35%. The company hopes to reach $1 billion in cost savings in 2023.

Exhibit 5: Stanley Black & Decker Focused on Cost Savings

Stanley Black & Decker’s Cost Reduction Goals (Stanley Black & Decker Investor Presentation)

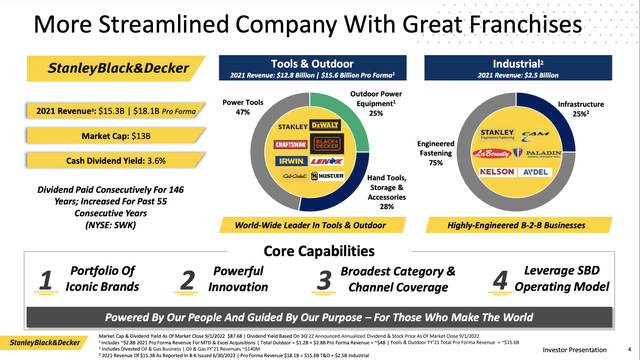

The company’s strength lies in its stellar brands. Brands such as Stanley, DeWalt, Craftsman, and Black & Decker are timeless [Exhibit 6]. I worry about the volume declines more than the margin challenges caused by inflation. Inflation will fade. If the company can stabilize sales volumes over the next year, that would be a positive thing to support the stock. It will be worrisome if volumes continue to decline. The company expects to grow its revenue at 2x to 3x GDP growth over the long term. This level of expected growth may be too optimistic, given where things stand now.

Exhibit 6: Stanley Black & Decker Owns Stellar Brands

Stanley Black & Decker Owns Stellar Brands (Stanley Black & Decker Investor Presentation)

There is no need for investors to rush to buy this stock. I would rate this a hold for long-term investors who own the stock. An investor looking to buy this stock may be better off exercising patience and learning the company’s performance when it releases its third-quarter earnings on October 27, 2022. The U.S. Federal Reserve is expected to increase Interest rates further. These rate increases are causing a decline in consumption across the U.S. economy. The housing market is in a recession, and other sectors of the economy may soon follow. Since the company’s prospects are tied to GDP growth, any further decline in US GDP could negatively impact the company’s sales and profitability.

The company is cheaply valued compared to its historical average. It is trading at a forward P/E of 14x compared to its five-year average of 17x. The company is deeply undervalued based on its forward prices to sales multiple of 0.67x. Given the company’s iconic brands and products, it may not deserve such a low valuation. But, if the economic conditions deteriorate further, this stock can get cheaper and may present a better price to build a long-term position. The company has a forward dividend yield of 4.1% and has paid its dividend for 146 consecutive years. Its payout ratio is currently high at 51%. The company’s dividend had a CAGR of 6% over the past 11 years, which is extraordinary dividend growth. But, I do not expect the company to grow its dividends at this growth rate for the next few years.

The company continued repurchasing shares during the first half of 2022. It is good to be repurchasing shares when the stock price is depressed. But, in Stanley Back & Decker’s case, the stock is depressed due to declining sales and profitability. Any further decline in sales and profitability can cause serious trouble for this company. I would rather have the company shore up its balance sheet and further reduce debt especially given the current levels of uncertainty about the economy. The company carries a very high debt load for current economic conditions. Its debt to EBITDA ratio is a high 4.8x, with a net long-term debt of $6.45 billion [Source: Seeking Alpha/YCharts].

Stanley Black & Decker offers an extraordinary dividend and has the potential to be a long-term winner. But, the company faces a challenging next few quarters. It is best to learn more about the company’s sales and profitability projections for the upcoming quarters when it releases its third-quarter earnings before buying this stock.

Conclusion

There are many treasures hidden inside the Vanguard Mid-cap Value ETF. The Vanguard Mid-cap Value ETF has held up well in a challenging year due to surprising strength in companies such as Dollar Tree and AutoZone. Dollar Tree and AutoZone have run up in 2022 and would be considered a hold in this environment. Other companies, such as Stanley Black & Decker, have lost momentum in the marketplace. If interest rates have peaked, Stanley Black & Decker’s stock may soon find a bottom. With its great brands, this company may have a bright future.

Be the first to comment