Wachiwit

Investment thesis

I cover Sea Limited (NYSE:SE) extensively, with many articles on the company’s fundamentals and valuations, which can be found here. I continue to like the company as the investment case continues to look compelling:

- As highlighted before, I thought that the problems that Garena and Free Fire are facing are short-term ones. As evident from the recent Free Fire trends, we can see that the business is stabilising in its key markets. I continue to take the view that Garena will continue to operate as a market leader and play a key and pivotal role in the development of the other segments of Sea as it continues to generate strong cash flows for the business. As we start to see stabilisation in the business, I think we will see re-acceleration in revenues in the near-term as management remains focused on both Free Fire and on generating a pipeline of new games for the future.

- Shopee continues to dominate in its core markets of ASEAN and Taiwan, where it continues to remain market leader in e-commerce. Management’s shift in focus from growth to profitability will benefit Shopee in the long-term as it communicates to investors that management is looking to grow in a sustainable manner for the long-term. I think that the exits in markets in which it has low confidence in will help further cement its position in its core markets as these markets continue to have strong structural tailwinds due to the low e-commerce penetration.

- Shopee remains focused on Brazil as a core market in Latin America while doing cross border operations in three other markets. With the Latin America e-commerce market being under-penetrated and growing very rapidly, this will further drive growth for Shopee in the long run.

- As an emerging fintech business of Sea, SeaMoney looks set to be the next growth driver as digital payments continue to have strong tailwinds and Sea can benefit from the synergies between SeaMoney and Shopee to compete with peers.

Free Fire continues to stabilise

In my previous article, I stated that we were starting to see some signs of stabilisation for Free Fire in 2Q22. I think that we are also seeing similar signs for such stabilisation for the gaming segment for 3Q22, which brings a nice upside to the 3Q22 results.

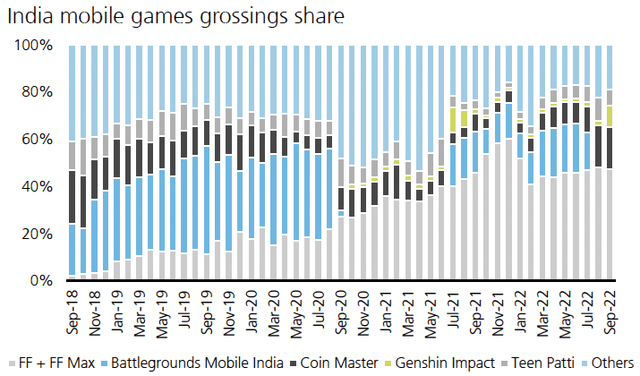

In India, we see that the stabilisation trends since March 2022 have continued for Free Fire and there has been some trending up sequentially in 3Q22 (July to September) compared to 2Q22 (April to June). Recall that Indian authorities banned Free Fire in the country, which resulted in the decline in the game’s grossing share in India.

India mobile games grossings share (Sensor Tower)

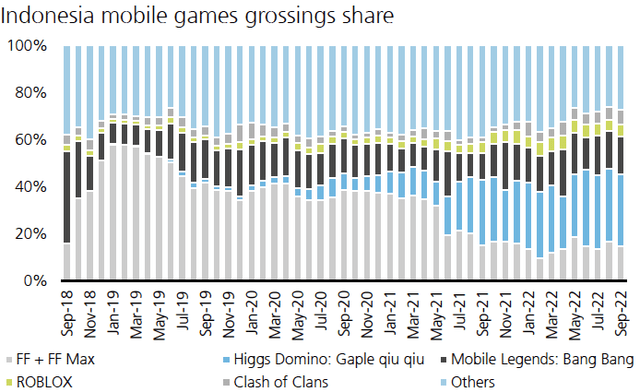

Also, in Indonesia, we see that there are also some stabilisation trends since earlier in the year for Free Fire as the game sees normalisation after growth that was fuelled by the pandemic.

Indonesia mobile games grossings share (Sensor Tower)

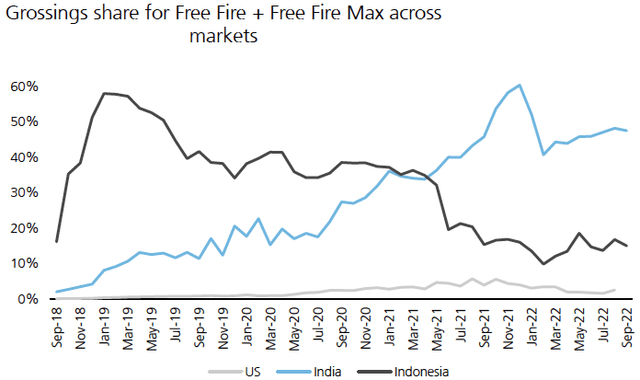

Put together, we see that there are improving trends for India, Indonesia and the United States as I think that we have indeed seen stabilisation in user trends for Free Fire. Given that we are seeing the normalisation of user behaviour post the pandemic, I think that the effects of the pandemic driven growth have already been reflected in the current levels and things look likely to improve from here.

Grossings share for Free Fire across markets (Sensor Tower)

All in all, I think that the stabilisation trends for Free Fire look good for Sea’s 3Q22 results as I think that there is scope for the company to beat the rather low expectations for Free Fire at the moment. I would be looking at the user engagement and monetisation metrics for 3Q22 as these could be further catalysts to an improvement in the fundamentals of Sea’s gaming business.

Continued progress on efficiency gains and on track to meet profitability target

Sea has made the headlines for its efficiency efforts as the company remains focused on its profitability target. Shopee is reducing headcount by 3% in Indonesia, while it is also reducing headcount numbers in Singapore and China as well. These are all part of its efforts to improve operating efficiency as the company looks to become self sufficient across its businesses.

In addition, Sea’s top management also will forego their salaries for the foreseeable future until the company manages to reach its goal of self sufficiency. Management also commented that they do not view this as a passing storm that will go away quickly and expects the tough operating conditions to persist in the medium term. I think that this move by management sets a strong example for employees as management is not just looking at ways to reduce headcount to improve on profitability, but even sacrificing themselves for this cause.

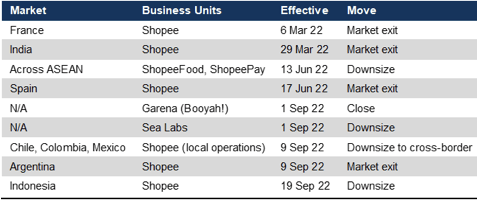

Lastly, we saw that Shopee has exited local operations in most of its Latin America business, except Brazil. As can be seen below, Sea has taken concrete and difficult steps to streamline its business operations. Since leaving the France market in Shopee, the e-commerce segment has exited India, Spain, and in Latin America markets outside of Brazil.

Summary of efficiency measures (Bloomberg, Reuters, CNBC, India Times)

As a result of the streamlining of its business, I think that this points back to the goal of achieving EBITDA breakeven in the ASEAN and Taiwan region by the end of this year for Shopee. The focus of management has been on achieving sustainable business operations for the long-term and the near-term challenges it has to face is what it takes to get there. Given that the Shopee ASEAN and Taiwan EBITDA loss per order has been successfully narrowed to less than one cent in 2Q22 as per my previous article, I think that this achievement of EBITDA breakeven in ASEAN and Taiwan is increasingly achievable given the actions taken in the past few months.

All in all, I would expect that Sea will likely beat on the bottom line numbers for 3Q22 as the company has been very proactive in optimising its cost structure and relentlessly focusing on its core markets.

Exiting other Latin America markets

As Sea’s Shopee announced last month, it will be closing its local operations in Mexico, Colombia and Chile while cross border operations will still remain. In addition, Argentina will be exited completely while Shopee will still remain operating in Brazil. The reason cited was that Shopee needs to focus on its core operations given the macro uncertainty that the company faces today.

As explained earlier, this strategy is a similar one it took in earlier market exits as it looks to focus on its core markets. As management remains focused on certain core markets like ASEAN and Taiwan as well as Brazil, I think that this action is understandable. In addition, it is also aligned to its goal of first focusing on these core markets and achieving profitability. I do not think that management intends to leave these markets indefinitely, but likely more so only temporarily as it shifts its focus on core markets. Shopee could re-enter these markets when the macro environment improves or after the company manages to achieve a stronger profitability and cash flow profile.

As Shopee continued to maintain cross border operations in three markets in Latin America, I think that by doing this, it ensures that Shopee continues to build relationships with buyers and will continue to work on where it fits in these markets, as well as the different nuances in shopping behaviour in these markets.

Shopee has been very active in considering which markets to exit and which ones to operate as core markets. This razor focus on the markets that it thinks can drive sustainable growth is key to ensuring that the capital markets continue to remain confident in its ability to not just drive growth, but also generate profitability.

Valuation

I have taken into account in my forecasts the stabilisation of the gaming segment and also factored in management guidance of achieving breakeven EBITDA in ASEAN and Taiwan by 2023. As I have previously already made adjustments to the valuation multiples of each business segments which is already in-line with global peers, I maintain my valuation multiples as they remain justified given current macro conditions.

With these assumptions in mind, my 1-year target price for Sea is $139, implying 173% upside from current levels. I think that the risk reward is skewed towards the positive at the moment and there are several catalysts in the 3Q22 results coming up that may drive the share price upward.

Sea Limited SOTP Valuation (Author generated)

Risks

Competition from other e-commerce companies

While Shopee has been successful in its core markets, I think that e-commerce is a rather competitive industry with multiple global market players like Amazon (AMZN) and Alibaba’s (BABA) Lazada. These are e-commerce players that are established and have strong financials that can compete meaningfully with Shopee if they decide to go on a price war to compete in Shopee’s core markets. Also we are seeing the rise of new generation platforms like TikTok that may change the landscape of e-commerce as new generations may prefer using TikTok for things like shopping in the future. The risk of competitive pressures from any of these players may threaten Shopee’s current leadership position in its core ASEAN and Taiwan markets as well as its Brazil market. As such, I will continue to monitor for any changes in the e-commerce landscape and how that could affect Shopee.

Diversifying its gaming segment with new games

Sea’s Garena is on a mission to find the next blockbuster game that could take over Free Fire. That said, creating a new hit game is not easy and even as Garena has spent much time and effort in creating a steady pipeline of new games, there has yet to be a game that looks to be helping fill the gap that we are seeing with the slowing Free Fire growth. I think the risk remains that Free Fire continues to see slowing growth, while Garena may still be unable to release new games that could help it diversify its games segment.

Political and regulatory risks

As a result of the Indian authorities ban of Free Fire, this has created a risk that Sea may face other regulatory or political pressures. While Sea is headquartered in Singapore and not controlled by China, I think that there is a risk that other countries may see Sea in a similar way India did. However, I think that the probability of this is quite small and we could even see India rectifying its position on Sea in the future.

Synergies that can be reaped across segments

As a result of having three business segments like the e-commerce segment, the gaming segment and the fintech segment, Sea has the ability to create a network effect as it continues to see strong user growth on its platforms. Furthermore, the company can also drive scale benefits as it can leverage on its size to improve operating efficiencies. However, if the company does not leverage on its position to reap these synergies, the three segments could act in silos and without demonstrating the true competitive advantage of the platform that Sea has built and the community it has developed over the years.

Conclusion

I think that there is much negative sentiment around the stock and the key to reversing this sentiment is any signs of improvement in fundamentals or achieving of certain targets set by management. First, I highlighted that we are seeing a stabilisation of Garena as Free Fire trends appear to be heading in the right direction. Second, management looks set to achieve their breakeven targets for Shopee in the core markets of ASEAN and Taiwan. Overall, I think that the worst is over for Sea and we could see positive improvements in the business as well as management commentary in the 3Q22 results coming up.

My 1-year target price for Sea is $139, which implies an upside of 173% from current levels. I believe that we could see shares move up towards the target price with the 3Q22 results given that there may be several catalysts materialising. As such, I think that the risk/reward is skewed towards the positive at the moment, and recommend to accumulate at current levels.

Be the first to comment