ArLawKa AungTun

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 4th, 2022.

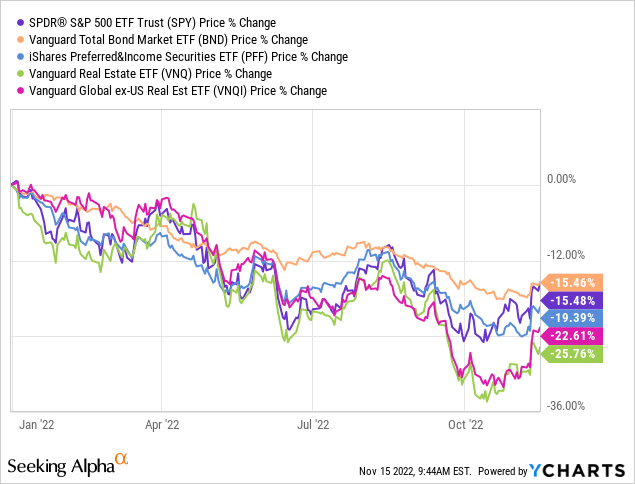

I last covered the Vanguard Global ex-U.S. Real Estate ETF (NASDAQ:VNQI) in late 2021. In that article, I argued that VNQI’s diversification, cheap valuation, and exposure to real assets made the fund a buy. Since then, the fund has moderately underperformed relative to the S&P 500 but matched the performance of U.S. REIT indexes. With the result being below-average returns, but nothing too disastrous.

Although VNQI’s recent losses were a negative to investors in the past, they present somewhat of an opportunity for investors moving forward. VNQI currently trades with an incredibly low share price, significantly below its historical average. Valuations are incredibly low too, with the fund’s underlying holdings trading below book value. As the fund exclusively invests in international REITs, it lacks exposure to the frothy, deflating U.S. real estate market.

In my opinion, VNQI’s diversified holdings and incredibly cheap price and valuation make the fund a buy. On the other hand, the fund’s risky holdings and subpar performance track-record are both important negatives, and perhaps deal-breakers for some investors.

VNQI – Benefits and Investment Thesis

Diversified Holdings

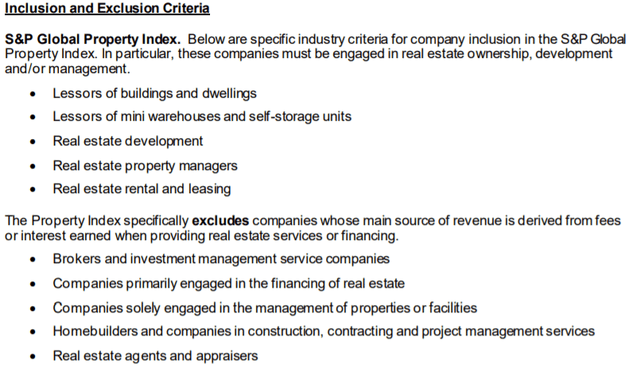

VNQI is an international REIT index ETF, tracking the S&P Global ex-U.S. Property Index. It is a relatively simple index, investing only in companies which focus on real estate ownership, development, and/or management, excluding those focused on financial services, as well as U.S. securities. Index inclusion and exclusion criteria are as follows.

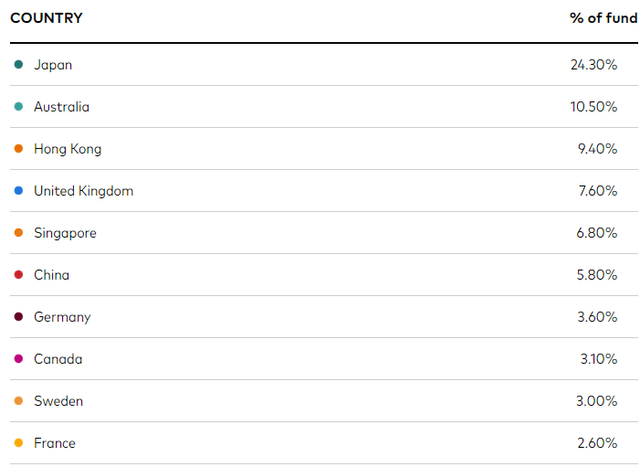

VNQI’s underlying index is quite broad, which results in an incredibly well-diversified fund, with exposure to over 700 securities from dozens of countries and all relevant industry segments. Unlike most international funds, VNQI is significantly overweight Asian securities, with smaller allocations to Europe, Latin America, and other emerging markets.

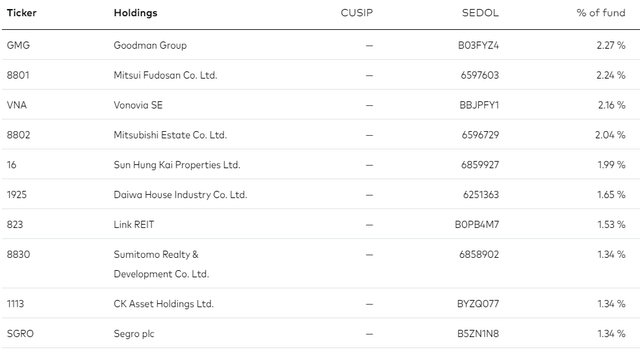

VNQI’s concentration is somewhat below average for an equity/REIT fund, with its top ten holdings accounting for 18% of its value.

VNQI’s diversified holdings benefit investors in two key ways.

First, is the simple fact that diversified portfolios or funds are less risky than more concentrated ones. With investments in over 700 securities, the fund does not have significant exposure to any specific security, so should see limited losses from bankruptcy or underperformance from any specific security. The same can be said for industries and countries.

Second, is the fact that the fund provides investors with exposure to international REITs, which can serve to diversify an investor’s portfolio. Most U.S. investors are significantly overweight U.S. securities, for obvious reasons. Although there is nothing inherently wrong with U.S. securities, far from it, the country does sometimes underperform relative to international equities. It happened in the aftermath of the dot-com bubble, for instance. U.S. real estate markets and securities also performed terribly during the financial crisis of 2008-2009, but the said crisis was international in nature, and also impacted several European countries. In any case, VNQI’s international holdings can serve to diversify an investor’s portfolio, reducing risk, volatility, and reducing exposure to U.S. equities.

The diversification provided by investing in VNQI is an important benefit for the fund and its shareholders.

Cheap Price and Valuation

Skyrocketing inflation has led to significantly increased interest rates, which have, in turn, led to worsening investor sentiment, and lower asset prices and valuations. Equities are down, as are bonds, preferred shares, real estate, and most other asset classes. REITs are down as well, and by quite a bit more than average, in both the U.S. and foreign markets.

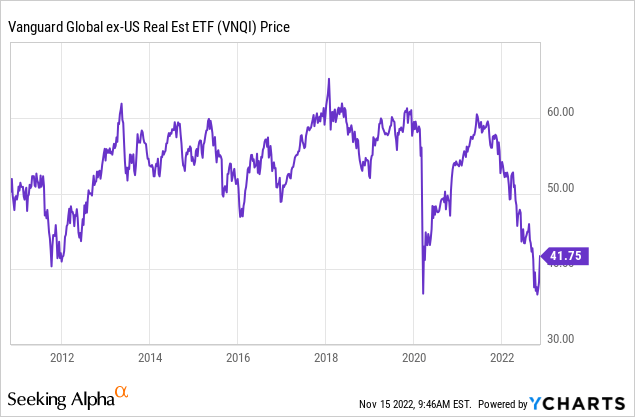

As can be seen above, VNQI’s share price has plummeted by over 20% YTD, significantly underperforming relative to bonds and equities, but only marginally relatively to U.S. REITs. Losses have been staggering, with the fund trading at some of its lowest levels in history. VNQI has only traded lower for a couple of days in March 2020, during the depths of the pandemic, and for a couple of days earlier in the month.

VNQI’s share price has decreased for the same reason asset prices have decreased across the board: higher interest rates and worsening investor sentiment. VNQI’s share price has decreased by more than average, as the real estate industry is very dependent on loans (mortgages) to grow and operate, and so it performs particularly badly when rates rise. As an example, Canada’s residential construction sector has seen new orders plummet by over 65% these past twelve months, due to higher mortgage rates. Plummeting demand for real estate impacts real estate prices and rents, negatively impacting REITs, and hence VNQI.

VNQI’s plummeting share price has led to a much lower valuation as well, with the fund currently trading with a 7.5x PE ratio, and a 0.7x PB ratio. Both are incredibly low figures on an absolute basis, especially the PB ratio. The fund’s underlying holdings trade below book value, meaning below the value of their real estate assets. These are, well, real assets, with real, physical, tangible value, and you can buy said assets at a very hefty 30% discount through investing in VNQI.

Importantly, accounting book value almost certainly discounts the actual market value of said assets. Book value is generally calculated as the original cost of the asset minus depreciation, without considering the resale value and without considering peer prices. Real estate tends to appreciate in price, book value rarely accounts for said appreciation, so book value tends to discount the actual market value of real estate. As such, investing in VNQI means buying real estate assets at a +30% discount, a very low price.

VNQI’s low share price and cheap valuation could lead to significant capital gains and market-beating returns, important benefits for the fund and its shareholders.

VNQI – Risks and Drawbacks

Above-Average Risk

VNQI is a relatively risky investment, for two key reasons.

First, is the fact that the fund focuses on international REITs, which tend to be riskier than their U.S. peers. The United States is the largest, strongest, most resilient economy on the planet, and although some developed countries have outstanding economies too, most countries do not.

Some countries have real estate market issues, which are particularly important for VNQI. Japan’s economy has stagnated for decades, as has the country’s real estate market. China’s real estate market is imploding, as the country’s housing bubble is starting to burst. Canada’s real estate market is basically frozen, and its housing bubble could yet burst. VNQI invests in these relatively risky markets, and in many others too, which makes the fund a relatively risky investment.

Second, is the fact that the fund’s real estate holdings are particularly exposed to interest rates, and so could see significant losses if rates increase by more or longer than expected. This is a distinct possibility, as inflation remains excessively elevated across the globe, and central banks remain committed to fighting inflation through rate hikes. If inflation persists for longer than expected, and it has persisted for longer than expected, central banks might hike rates until real estate markets are crushed, with a severely negative impact on REITs and VNQI.

The issues above make VNQI a relatively risky investment, and somewhat riskier than the average equity fund or U.S. REIT fund.

Subpar Performance Track-Record

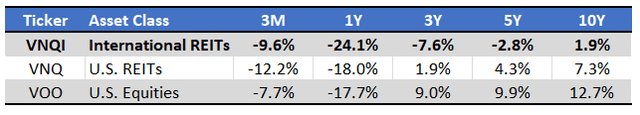

VNQI’s performance track-record is subpar at best, with the fund consistently underperforming relative to U.S. REITs and equities, and by quite a large margin.

VNQI’s underperformance was due to focusing on REITs, which have underperformed as rates rise, and on international securities, which have seen valuations decline vis a vis U.S. securities. VNQI’s subpar performance track-record is a significant negative for the fund and its shareholders, and almost certainly a deal-breaker for some. Still, past performance is no guarantee of future results, and the fund’s very cheap valuation bodes well for its future performance.

VNQI – Dividend Analysis

VNQI’s dividends are, well, a complicated subject.

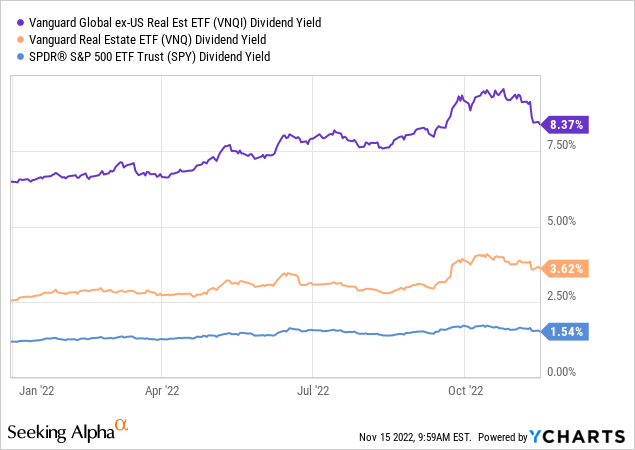

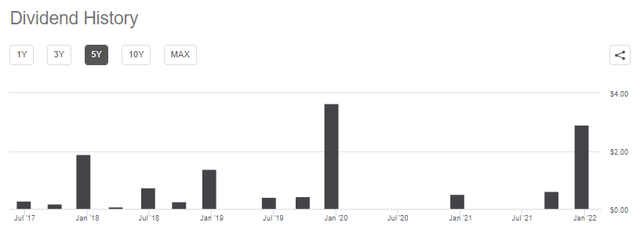

The fund technically sports a dividend yield of 8.4%, an incredibly strong figure, and much higher than that offered by U.S. equities and REITs.

On the other hand, the fund’s yield is not covered by underlying generation of income. For regulatory reasons, international ETFs are sometimes forced to distribute a portion of their capital gains to shareholders as distributions. These distributions are variable, dependent on capital gains, and generally, perhaps always, happen at the end of the year. VNQI’s dividends share these characteristics.

VNQI’s dividend yield is quite high due to a massive special distribution in late 2021, which was the result of the significant capital gains which occurred during said year. Capital gains are variable, so investors should not expect yields in the 8.4% range moving forward. From looking at fund documentation, and by my own calculations, VNQI’s yield should settle in the 3.0%-4.0% in the coming months. These are very rough figures, and ultimately dependent on asset price movements/capital gains moving forward, amongst other factors.

VNQI’s volatile dividends are something of a negative for shareholders and might be a deal-breaker for some income investors. I still think the fund makes for a strong investment opportunity, on price and valuation grounds.

Conclusion

VNQI’s diversified holdings and incredibly cheap price and valuation make the fund a buy.

Be the first to comment