AsiaVision/E+ via Getty Images

Investment Thesis

The rate of growth StoneCo (NASDAQ:STNE) has achieved is not reflective of the valuation we see. After a major sell-off in Q3/4 of 2021, StoneCo now trades below its fair value. Management is clearly incredibly talented, focusing on growing multiple facets of the business, which all complement each other and support the concept of a one-stop-shop for financial services in Brazil. The financials reflect this, as StoneCo has been able to grow at an astonishing rate for a considerable period of time. Our thesis is simple: we believe StoneCo can continue to grow in the mid-double digits. Should this happen, the share price must catch up.

Background

StoneCo is a financial technology solutions business targeting micro, small and medium sized businesses (MSMBs) in Brazil. StoneCo primarily offers payment solutions, but also traditional banking and insurance services. Additionally, StoneCo acquired Linx in 2020, which provides affordable and integrated software solutions on a SaaS model. Finally, in late 2021 StoneCo took a position in Banco Inter (OTCPK:BNCOY), a challenger bank in Brazil.

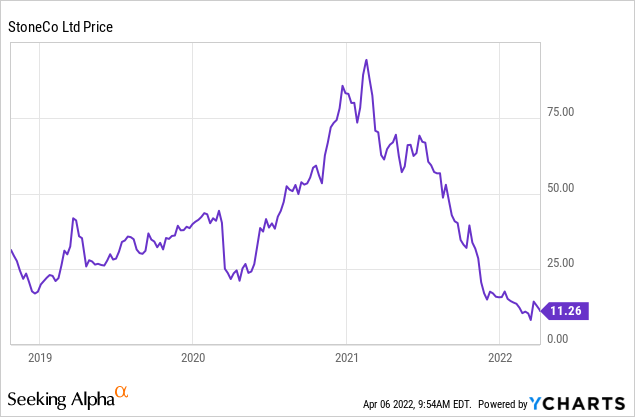

StoneCo was heavily sold in late 2021, alongside many ‘fintech’ businesses, on the back of poor performance due to heavy defaults in their loan book. We believe the fundamentals of the business are strong and the growth going forward will be fantastic. The current share price does not reflect the fair value of the business going forward.

An attractive industry filled with dinosaurs

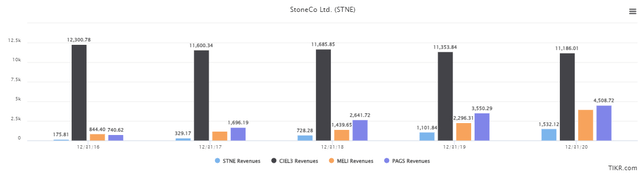

StoneCo has found success utilizing technology to challenge the status quo in a country where financial services are known for structural inefficiencies, due to a lack of modernization. This has allowed fintech businesses to compete on both fees and services, stealing market share from traditional banks. If we look at the graph below it shows a clear trend.

StoneCo’s growth compared to its peers (Tikr Terminal)

StoneCo estimates a market size of 28m MSMBs, 1.3m of which are partnered with StoneCo. This suggests scope for substantial growth through stealing market share from competitors, as well as general growth in the number of MSMBs as Brazil grows.

Therefore, the growth potential within the industry is high and StoneCo so far has shown an ability to take market share.

Brazil is the country of the future and always will be

Brazil is the country of the future and always will be – Charles De Gaulle

StoneCo’s success is dependent on consumer spending, income growth and business expansion. Therefore, the economic landscape in Brazil is paramount to the success of StoneCo.

As in the rest of the world, Brazil has seen interest rates hiked to combat rampant inflation. It currently stands at 11.75%, up from 6.25% in October. This is problematic for StoneCo for two reasons. First, as per the quantity theory of money, as interest rates rise there follows a reduction in transactions. Second, StoneCo has taken the decision to pass on cost increases to their customers slowly, in order to maintain growth, which has depressed margins. As traders expect further rate rises, this is likely to continue in the medium term.

Furthermore, Brazil’s economy can be quite erratic due to ever-present corruption and social issues. With elections this year, there is the continued risk of potentially disrupted economic growth, which is expected to be 1.4% in 2022. Additionally, unemployment stands at 11.2%, which is high and could act as a drag on spending. The improvement of the Brazilian economy is imperative to StoneCo’s ability to generate greater revenues.

Additionally, online sales represent only 3.2% of transactions in Brazil, with only a third of Brazilians having bank accounts. As a result, there is incredible latent growth in the payment industry. So, if StoneCo can remain competitive, the top-line growth will continue to be substantial.

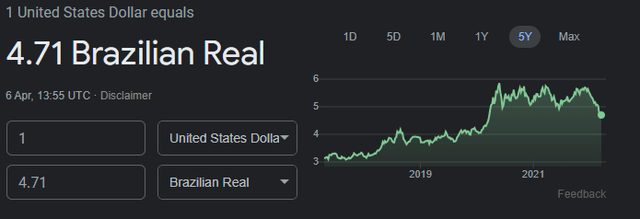

Finally, StoneCo reports in USD but generates all their income in BRL and so its financial performance can be materially impacted by movements in the FX rate. Generally, the BRL has depreciated against the USD, thus reducing the value of StoneCo’s income.

USD:BRL 5Y chart (Google Finance)

Despite this, the BRL is strongly linked to the price of oil which is at record levels compared to recent years and explains the reversion in recent months.

Financial Analysis and Forecasts

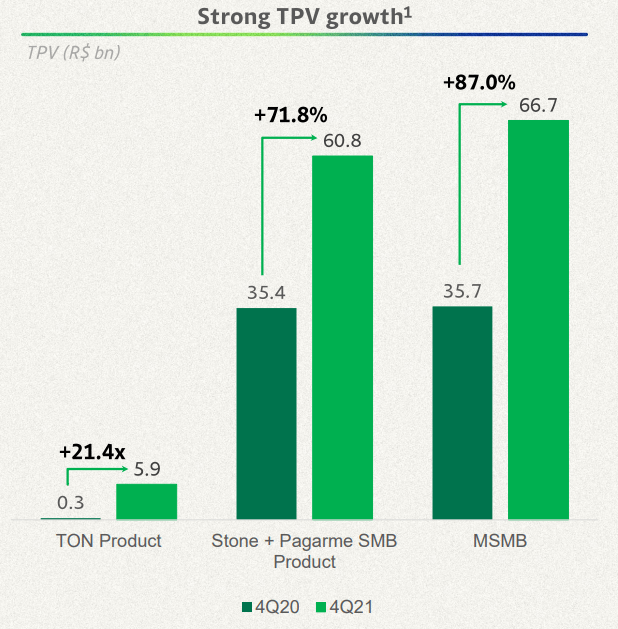

StoneCo’s financial performance has been nothing short of exceptional since trading commenced. Revenue has grown at a CAGR of 61% over the last five years. Active customers have increased 2.3x y-o-y and payment volume is up 54.5%. This reflects StoneCo’s disruptive nature and its ability to offer a unique proposition to businesses.

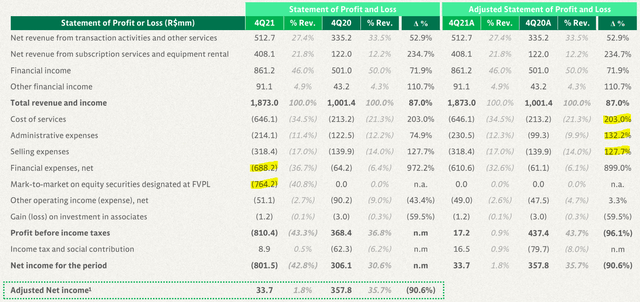

On the other hand, the business has performed poorly in the last 12 months.

StoneCo 2021 Income Statement (StoneCo)

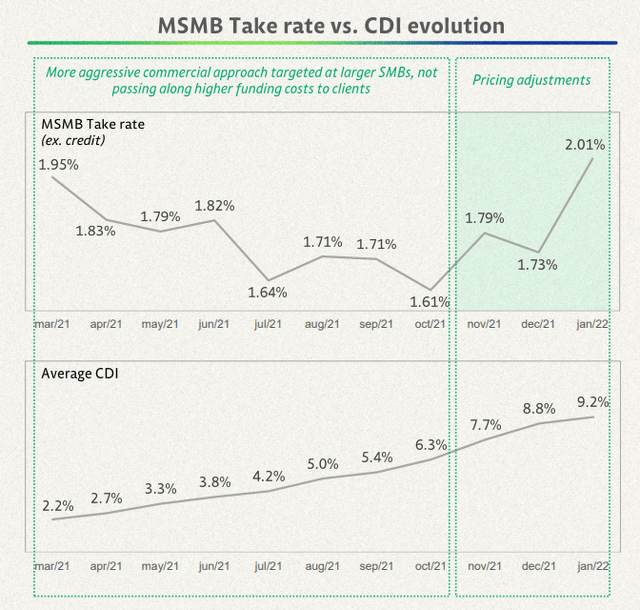

Expenses have ballooned and revenue has been unable to keep up. The reasons for this are multi-layered. First, StoneCo has been slow to pass on funding costs to customers in order to maintain growth. Although, management is now increasing the rates, as the following graph shows. Early signs suggest businesses are willing to accept this.

StoneCo’s profitability against funding costs (StoneCo’s annual accounts presentation)

Second, we see the write-off of bad debt. In Q4, an issue in the collateral system in Brazil caused a wave of defaults when interest rates rose. This resulted in a significant deterioration in the loan book. According to Fitch, delinquencies in Brazil are already falling and so we believe this will remain isolated.

Finally, StoneCo posted a mark-to-market loss on their investment in Banco Inter. This acquisition on paper was extremely smart, giving them a strategic partnership with a ‘challenger’ bank whose data can be used to improve their business services, while also providing cross-selling opportunities. Yet months after the investment, markets as a whole began falling.

However, if we manipulate the numbers presented, we see a PBT of $353.8m. We exclude $400m in bad debt, as a one-off write down, and the Banco loss, as a non-trading expense. This suggests that if they can wipe the slate clean, performance could be respectable in struggling market conditions.

Looking forward, management intends to build on their other offerings and look to truly integrate Linx clients (only 0.3% of GMV monetized so far). What we see is StoneCo’s ARPU up in mid-double digits across their various offerings and their customer acquisition costs down 28% y-o-y. This suggests innovation is succeeding and making them more competitive.

StoneCo are forecasting continued strong growth and improved profitability. Although we have not modeled for a margin expansion, it is impressive to see the degree of take rate increase in the final months of the year.

Overall, StoneCo’s financial position is extremely strong. Investors have reacted (and rightly so) to the poor performance post Q2. However, if we look beyond the bottom line numbers, we see the fundamentals improving noticeably.

An unorthodox approach has created an outsized return

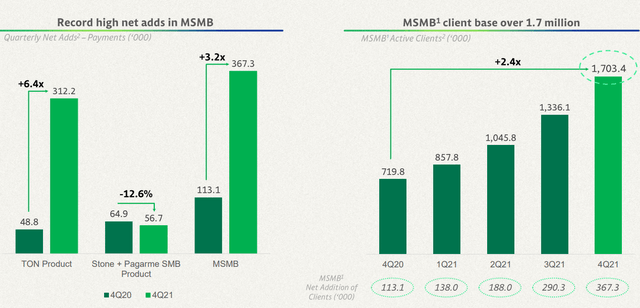

StoneCo offers the market something unique. Its growth in clientele and payment value is unparalleled.

Increase in Clients (StoneCo Annual accounts presentation)

Increase in TPV (StoneCo Annual accounts presentation)

StoneCo’s customer retention is 95%, which stems from the way in which they do business. Although they are a fintech company, they have local ‘shops’ which offer training and in-person support to businesses. This allows for a greater level of customer care and experience. Significantly, StoneCo is looking to cross-sell its other products, so the scope for economies of scale in providing these support hubs is high. The outcome of this strategy is that clients using more than one service have finally crossed 50%, from 14% two years previously.

However, the internal controls around the loan book are concerning. Management, having blind faith in the collateral system, lent aggressively to customers who clearly could not repay. PagSeguro Digital (PAGS) for example were more skeptical and managed to contain NPLs to mid-teens and continue issuing loans. Management has responded extremely well, by reorganizing the business into divisions with dedicated teams. We believe this is the most positive news to come from management recently as StoneCo now offers many services, which will allow for greater focus among teams and delivery of targets.

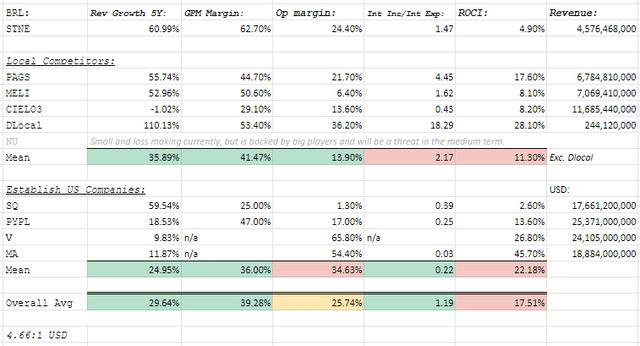

StoneCo leads the pack in performance

StoneCo faces competition from both its fellow challenger businesses, as well as the traditional players.

Peer group performance (Author’s own calculation (Tikr Terminal))

As we see in the table above, StoneCo is outgrowing all its competitors comfortably. Importantly, their GPM and OPM are superior also, and so is not a result of undercutting.

Furthermore, we note the impact of interest rate increases as their interest ratio has fallen to 1.47 compared to PAGS at 4.45. This is disappointing, but our expectation would be for this to improve in the coming months, as they begin passing on costs to clients.

StoneCo’s main competitor would be PagSeguro, both firms have grown alongside each other by taking clients from the traditional providers. We argue StoneCo is better placed in the market due to their ownership of Linx and investment in Banco Inter. This will allow StoneCo to both cross sell and gather data on customers to improve their products.

Although we do not believe it wise to compare StoneCo to its US counterparts, StoneCo’s ROCI does look noticeably problematic. This is due to the unique approach of having local offices which will not grow in line with returns and so our expectation would be for ROCI to increase over time.

On recent performance, StoneCo stands out as best-in-class. Our earlier assessment of the business and environment tells us they could continue performing in a similar vein in the medium term, which has been nothing short of outstanding.

Valuation

What initially drew us to the business was the large sell-off of a seemingly solid, growing business. Our valuation methodology is to consider the discounted cash flows of the business, as well as the level at which current market participants have traded.

DCF

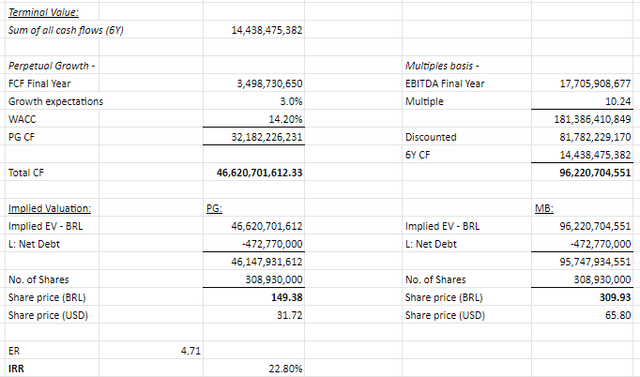

DCF valuation on a PG and multiples basis (Author’s own calculation)

Our key assumption is that revenue will continue to grow at a slightly lower rate than currently. Our assessment above suggests this is plausible given the size of the market.

Although management is attempting to expand margins, we have assumed a slight contraction over time in order to be prudent. Further, we have assumed interest rates will remain elevated into 2023 before tapering off.

This gives the cash flows alone a valuation of $31.72, a MoM of 2.84x. With a delayed exit in five years, the business would be worth $65.8 a share, representing an IRR of 22.8%.

Multiples approach

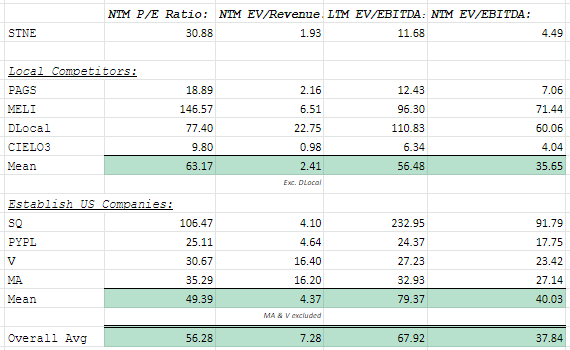

Comp set (Tikr Terminal)

As you can see, lots of green! StoneCo is cheaper than most of its peers. What is most impressive is the 4.49x NTM EV/EBITDA multiple, which implies the markets do not value the growth potential of this business. Yet, we are in the early stages of fintech in Brazil, and we note volatile trading in recent months. Due to this, valuations vary wildly among businesses, making it difficult to find a reliable average.

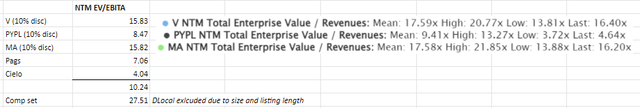

Therefore, in order to value StoneCo, we have taken a cautious approach. Our belief is that StoneCo should trade at a similar level to its US peers, with a discount reflecting the economic differences between Brazil and the US. Currently, Brazilian companies are trading at a 11% discount to their US counterparts’ NTM EV/EBITDA multiple. We have applied this to Visa (V), Mastercard (MA) and PayPal’s (PYPL) historic multiples, alongside PAGS and Cielo (CIOXY).

Our chosen comp set for StoneCo (Tikr Terminal)

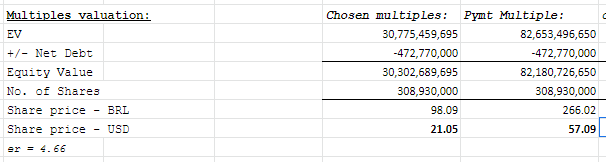

This gives us a valuation of $21.05 per share. Had we taken a comp set from Brazil, this valuation would be as large as $57.09. Our belief is that the valuation likely lies in between these two, closer to the chosen comp set.

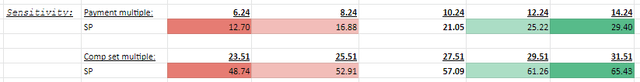

Multiples valuation approach using a chosen set and also market comps (Author’s own calculations)

Although this approach is unusual, we believe it provides us with a wider context in which to attribute a fair value for StoneCo in a market which is extremely young today. To reflect the unorthodox nature of this approach, we attribute only a 25% weighting towards this valuation.

A sensitivity analysis of this valuation suggests a multiple closer to 14.26x aligns with the DCF valuation conducted above.

Sensitivity of multiples valuation (Author’s own calculation)

Please see a summary of our valuation of StoneCo:

Summary of StoneCo’s valuation (Author’s own calculation)

Given our clearly bullish assessment, we would lean towards the best case scenario for StoneCo over the medium to long term. This would be strong growth in cash flows over five years and then to exit at a conservative market multiple. This would result in an IRR of 22.8% which is very respectable. Regardless, at StoneCo’s current share price, our worst case scenario with poor growth would still leave investors with a 74% upside.

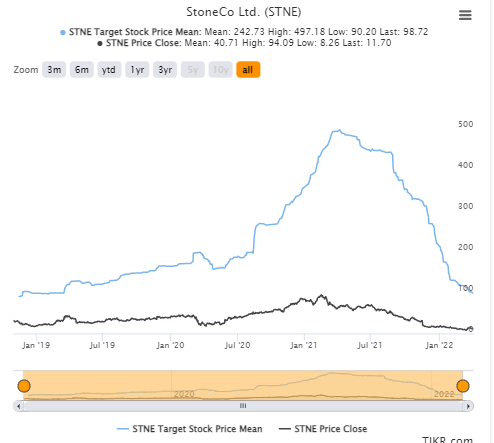

The Street Consensus

We note for the reader that the analyst consensus share price is $98.72, which is over 100% of our price target. As the following will show, analysts can be fairly optimistic when it comes to StoneCo.

Analyst consensus v. share price (Tikr Terminal)

Risks and Impediments

Brazil is the country of the future and always will be. We have already explored the issues of Brazil already but they bear repeating, given 100% of StoneCo’s revenue is generated here.

Enterprising investors should also consider how the new collateral system impacts defaults going forward, with StoneCo looking to begin lending again. The previous system was manipulated by a number of merchants, which created the illusion that collateral was available when it was not. Fitch released their assessment of the new system, stating “the new operational and legal framework provides enhanced operational and legal security for payment arrangement receivable securitizations”. Under the new system, registration companies will control the register, thus ensuring receivables are not pledged more than once.

Finally, although StoneCo has done an exceptional job in differentiating itself in the market, it does not have any tangible moat. At any time, it could find its offering inferior. Although, a five-year track record suggests this is unlikely.

Closing thoughts

StoneCo’s fundamentals are fantastic. The company is growing incredibly quickly with a clear strategy, its financial position is strong, and its offering is well differentiated. Furthermore, the credit business, which historically is cash-flow generative and profitable, will come back online. Management has taken investor comments on board. They are looking to prioritize margins alongside growth and have reorganized themselves to ensure each service offering is adequately nurtured. This should lead to a blow-out year in 2022, driven predominately by cross-selling, we believe. Overall, the robust revenue growth, the expansion of its product offering, and the fact that StoneCo has been oversold and currently trades at below its fair value make the company an irresistible buy.

The business is so undervalued at its current price that should there be lackluster growth in the next few years, it would still yield alpha based on the cash flows alone.

Be the first to comment