Feverpitched

Earlier this year, I explained in a separate article why I am staying away from real estate investment trust (“REIT”) exchange-traded funds (“ETFs”) like the Vanguard Real Estate ETF (VNQ).

There are three main reasons:

- Reason #1 – REIT ETFs are typically market cap weighted: This means that most of the capital will be invested in the largest and best-known REITs and little will be invested in the smaller and lesser-known REITs. Since the larger REITs typically trade at a large premium, you end up overpaying for your REIT exposure.

- Reason #2 – REIT ETFs pay a very low yield: I believe that real estate and by extension, REITs, should be an income-driven investment first and foremost. But REIT ETFs only pay a ~3% yield in most cases because they are mainly invested in expensive, large-cap REITs and higher-growth property sectors. A low yield in itself is not a bad thing, but it is not what I am looking for. At High Yield Landlord, we target a 6% dividend yield.

- Reason #3 – REIT ETFs own a lot of poorly managed REITs: A lot of recurrent underperformers can be easily avoided by simply looking at the management structure, incentives, and corporate governance of a REIT. As an example, externally-managed REITs have been persistent underperformers in the long run due to greater fees and conflicts of interest. Yet, REIT ETFs continue to invest in them anyway, and it costs you in performance.

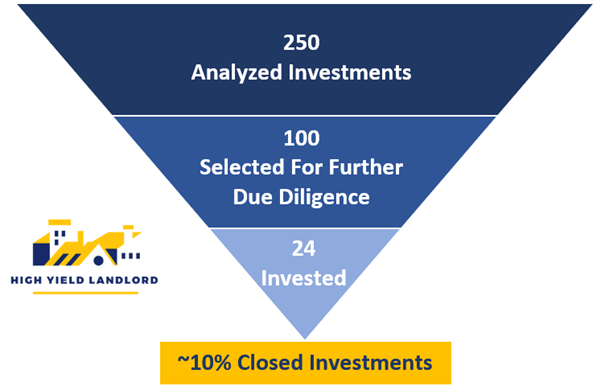

So in short, I feel like I can earn better returns with lower risk by being selective and building my own portfolio of REITs. I typically invest more heavily in smaller and lesser-known REITs that trade at lower valuations and higher yields, and I also avoid poorly managed REITs that suffer significant conflicts of interest. Historically, it has paid off, and I have managed to outperform REIT ETFs by a fairly large margin:

High Yield Landlord

But this does not mean that all REIT ETFs are bad.

In fact, there is a new one called Hoya Capital High Dividend Yield ETF (NYSEARCA:RIET) that I like a lot. If I wasn’t an active investor, it is one in which I would probably invest. Actually, even if you are an active investor, it may make sense to add it to your portfolio to boost its yield and improve its diversification. Below, we provide a review of this new REIT ETF:

Background

Hoya Capital is a member/subscriber of my real estate investment community, High Yield Landlord, and they utilize our platform to research some of the under-covered REITs and generate ideas for new funds and indexes. This is how I have gotten to know Hoya Capital and their new ETF: Hoya Capital High Dividend Yield ETF. It is a good first sign as it shows that this REIT ETF is not just buying every REIT and trying to aggregate capital to collect fees. Instead, it is innovative and looking for ways to improve the risk-to-reward of its ETFs by also listening to third-party experts.

Overview of RIET

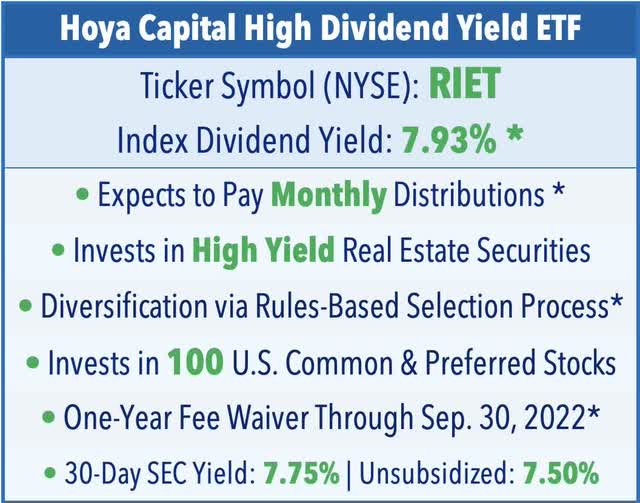

RIET tracks the Hoya Capital High Dividend Yield Index (“RIET Index”), a rules-based index designed to provide diversified exposure to 100 of the highest-dividend-yielding real estate securities in the United States. RIET exclusively targets the income side of the real estate sector:

Hoya Capital

RIET is particularly innovative because unlike some other high-yielding REIT ETFs like (KBWY), it achieves its premium yield not by going all-in on the riskiest segments of the real estate sector, but rather by expanding and redefining the real estate investible universe to incorporate exposure to both common and preferred stock, plus an exposure to real income-producing assets through its holdings in companies across the broader REIT universe – including both equity REITs and mortgage REITs.

Finally, it also resolves the market-cap weighing issues of VNQ ETF by allocating a large portion of its capital to smaller and lesser-known REITs:

Hoya Capital

The RIET Index isn’t just a random basket of 100 REITs either. Instead, it uses a research-driven process to select 100 common and preferred securities and the selection process incorporates a quality screen to identify REITs with lower leverage and begins by selecting ten “Dividend Champions.”

Securities are then selected based principally on dividend yield, with diversification targets across real estate property sectors.

Hoya Capital

The aim of this process is to maximize the yield of the portfolio, all while keeping an eye on risk, quality, and growth prospects.

In other words, Hoya Capital recognizes that simply going for the highest-yielding opportunities is unlikely to yield the best results. Instead, the best outcome is achieved when you have the right mix of yield, growth, and safety.

RIET’s Dividend Yield

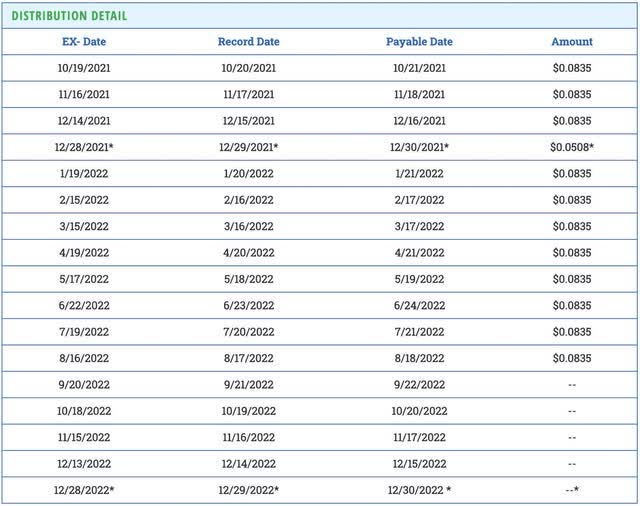

Currently, RIET pays a distribution yield of ~8.5% and has paid a monthly distribution every month since inception – as well as a special distribution in December – at a $0.0835 monthly rate. RIET’s distribution is covered by its index dividend yield and by its 30-Day SEC Yield by a comfortable margin.

Hoya Capital

Portfolio Breakdown

When investing in the higher-yield segments of the market, the need for diversification and additional levels of risk controls becomes exponentially magnified. Risk control can come in multiple forms. The specialty of High Yield Landlord is risk controls through exhaustive due diligence and an active selection process – really diving deep into individual companies and making judgements on their dividend-paying capacity both now and in the future. And the long-term success of the HYL portfolios and service is a testament to the effectiveness of this methodology.

But it is not the only way to achieve such results.

This fund uses a different form of risk control, leaning heavily on the risk-mitigating benefits of diversification through the rules-based process. With 100 components in the tiered equity weight system – with no single component above 2% – you remove a lot of the idiosyncratic risk. Of course, investing in 100 stocks within one’s real estate allocation – including 30 that have just a 0.33% weight and several of which have somewhat limited liquidity – would be extremely challenging and time-consuming at the individual portfolio level, but with the scale of the ETF, the fund is able to do it with a high degree of efficiency.

Hoya Capital

If you look at the top of holdings of the ETF, you will find many of the same names that we own at High Yield Landlord. Just to mention a few examples, we are very bullish on Crown Castle (CCI), Simon Property (SPG), and National Retail (NNN).

Then you layer in the property sector categorization – which limits the exposure to sector-specific risks (retail, office, etc.) – and the market-cap categorization, all of which are factors that we’ve researched extensively specifically within the confines of the REIT universe.

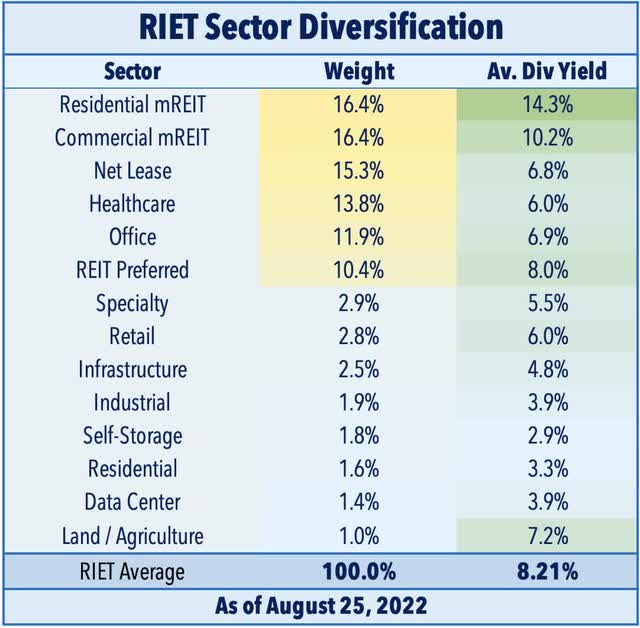

RIET classifies real estate companies into fourteen property sectors. Top four sectors are currently Residential mREITs, Commercial mREITs, Net Lease REITs, and Healthcare REITs.

Hoya Capital

RIET is actually the only REIT ETF that combines Equity REITs, Mortgage REITs, and REIT Preferreds. Equity REITs are supplemented by higher-yielding preferreds and mortgage REITs to achieve the premium yield.

Hoya Capital

Performance

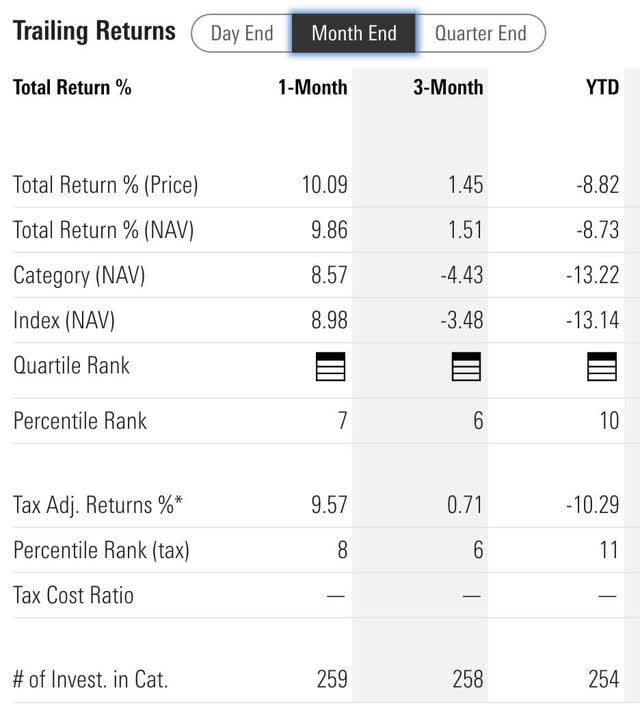

Per Morningstar data, RIET is in the 10th percentile in performance this year in the Real Estate category.

Hoya Capital

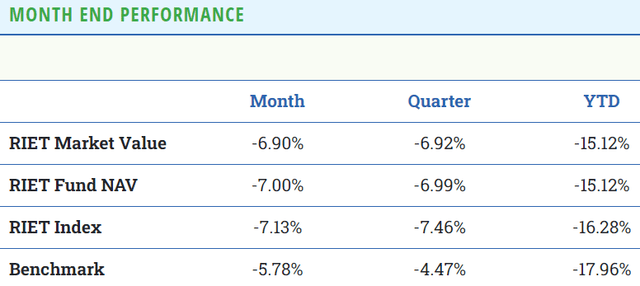

Year to date, RIET has outperformed its benchmark – the Dow Jones US Real Estate Index – by about 200 basis points.

Hoya Capital

Bottom Line

I see RIET as a great compliment to an active REIT strategy to get some instant diversification (100 names + the preferred sleeve) and to “bump up” the yield without straying too far down the risk spectrum. And importantly, I think RIET has delivered on our primary goal of creating a better/cheaper/diversified version of some of the highest-yield REIT ETFs (SRET, REM, MORT, KBWY) that we know have clear shortcomings.

Be the first to comment