Khoa Nguyen/E+ via Getty Images

VanEck Vietnam ETF (BATS:BATS:VNM) is an exchange-traded fund that offers investors direct exposure to Vietnamese stocks. I last covered VNM in my article dated June 20, 2022, suggesting that the fund was undervalued. Unfortunately since then, per Seeking Alpha data, VNM has fallen by -20.72% as compared to the S&P 500 U.S. equity index’s change of 6.16% over the same period.

A recent article from Bloomberg at the start of October 2022 was titled “Investors Take a Long-Term Bet on Vietnam’s Cheap Valuations”. The article explained that risk aversion was due to concerns over higher interest rates (the State Bank of Vietnam’s rate is currently set to 6%, a large increase in October 2022 from 4% during the preceding months of this year). The current central bank rate of 6% also exceeds the U.S. Federal Reserve’s prevailing rate of 3.00-3.25%.

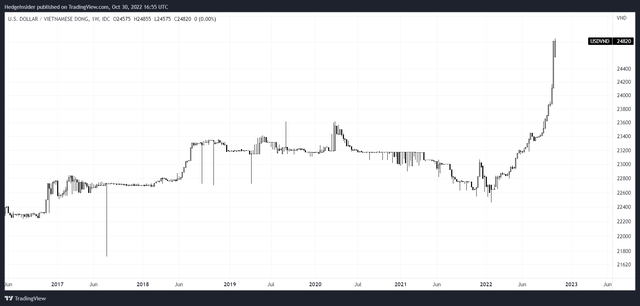

In spite of certain Purchasing Power Parity models suggesting the local currency is significantly undervalued, the Vietnamese dong has fallen materially since my last article owing to fairly strong risk aversion with respect to Vietnam. The USD/VND exchange rate is illustrated below; the U.S. dollar has appreciated by almost 9% against the Vietnamese dong (hereafter abbreviated as VND) since the start of 2022.

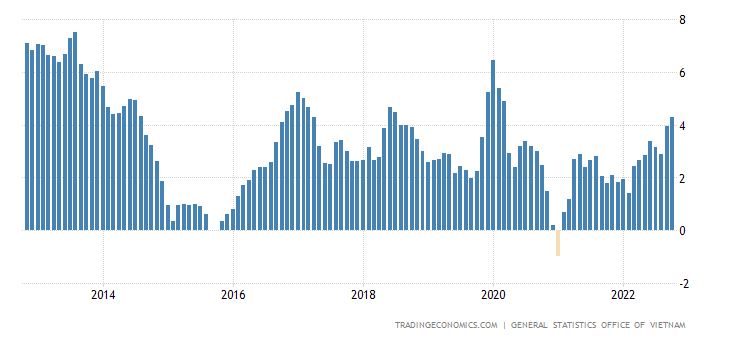

Bear in mind that Vietnamese inflation is actually fairly controlled, in line with historical averages (most recently 4.3% year-over-year).

Trading Economics

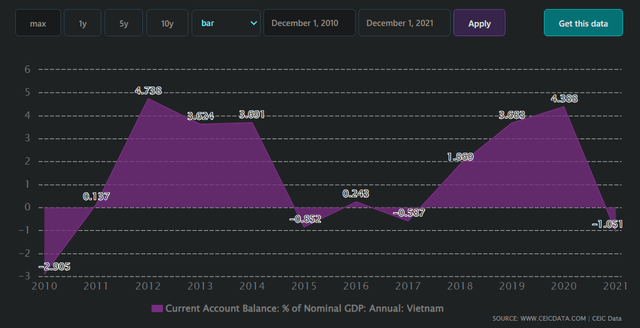

Meanwhile, the local 10-year yield has tightened to 5.19%, indicating not only likely positive real interest rates on a long-term forward basis, but even positive real interest rates by looking only at recent/confirmed short-term inflation rates. This is contractionary monetary policy. Usually stronger real interest rates lend to stronger FX pricing; the recent fall in VND is therefore evidence of fairly harsh risk aversion. It does not help that the Vietnamese current account has fallen into a negative position relative to GDP.

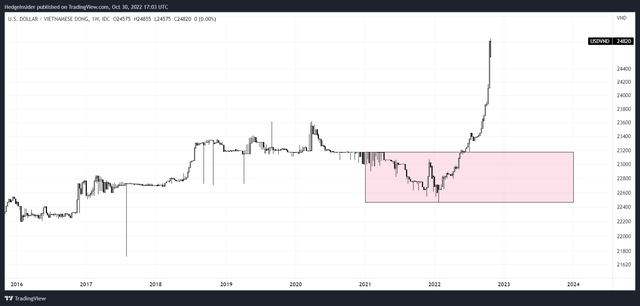

A negative current account in 2021 suggests that VND is probably close to fair value through 2021, while current account surpluses in the preceding years would have indicated under-valuation. VND did actually strengthen during 2021, and given a stronger interest rate spread on offer, I would suggest that VND is most likely undervalued at present. A return to the 2021 range would seem to make sense.

The exchange rate matters, as the VNM ETF’s portfolio consists of Vietnamese stocks that are denominated in VND. A stronger VND helps the portfolio, whereas the reverse (as most recently occurred) depresses the price of VNM. While it does not provide too much solace given recent realized downside, VNM’s principal FX exposure should lend to strength rather than further weakness.

In terms of the portfolio itself, it doesn’t help that local interest rates are contractionary. Also, judging by the 2021 debt-to-GDP rate of 39.1% vs. 2020 of 49.9%, the fiscal impulse is negative, which would present as a (negative) headwind against local growth and corporate earnings through 2022. This helps to explain some of the recent downside. Also, credit data available from the Bank for International Settlements suggests that total credit to the private non-financial sector in emerging markets (Vietnam is classed as an emerging market) is negative in both absolute and PPP-adjusted terms.

Further, Vietnam’s top export partners per 2020 data include China (17%) and South Korea (7%). Per Fidelity research, China is in recession, while South Korea is very close to recessionary territory. While other key export partners include the United States (26%), Vietnam’s exposure to other countries in Asia-Pacific means VNM’s portfolio has not been best positioned with respect to the business cycle. While the U.S. is earlier in its business cycle, if/when the country enters recessionary territory, VNM’s portfolio could face further headwinds. You could argue that VNM’s overall position is balanced, but it might be over a year until all its key export partners are all simultaneously buoyed by favorable macroeconomic conditions.

In terms of VNM’s valuation, Morningstar estimate that the fund’s forward price/earnings ratio is 9.92x, with a price/book ratio of 1.69x. That implies a high forward return on equity of 17%. Three- to five-year earnings growth is estimated at 11.16%, which should safely out-pace local inflation. With positive real interest rates and a likely undervalued currency, and with positive real earnings growth, combined with a high local return on equity, would suggest that VNM is likely undervalued.

The forward price/earnings ratio implies a forward earnings yield of 10.08%. VNM has 59 holdings per VanEck, with total net assets of $311 million as of October 28, 2022. It is a concentrated portfolio in a riskier emerging market which naturally has a less sophisticated/developed local equity market (as compared to say the United States). VNM’s five-year beta is circa 1.15x, however this probably under-states the relative risk in relation to the U.S. equity market. Professor Damodaran has previously (January 2022) assigned a country risk premium of over 3.5% to Vietnam; given the falling VND, we should assume the level of market-perceived risk is at least as high as before.

So, if we take a base equity risk premium of say 5%, and add 3.5% as a basic arbitrary risk premium, we arrive at 8.5%. We can then add in circa 5% in light of the country’s local 10-year (risk-free rate); the result is 13.5% as an approximate cost of equity. If we assume long-term inflation falls to 2%, and add up to 1% in “real” earnings growth to perpetuity to accommodate the fact that VNM is exposed to an emerging market with a high-ROE portfolio, the net-of-growth cost of equity comes to circa 10.5-11.5%. Dividing 1 over this range comes to an implied forward price/earnings ratio of 8.70-9.52x. That compares to my 9.92x figure taken from Morningstar earlier.

If earnings do growth as fast as Morningstar’s consensus analyst estimate of over 10% per year, this would help to support the valuation. However, based on my workings, the VNM ETF is probably not currently “cheap”, rather the implied return is simply still strong. Since my last article, earnings have under-whelmed (as judged by a falling return on equity) and valuations have fallen (as judged from a falling forward price/earnings ratio, partly driven no doubt by rising long-term risk-free rates locally).

Given positive real interest rates locally, it is possible that the Vietnamese local 10-year yield could fall back to circa 4% from over 5% presently; this would improve our forward earnings multiple range to 9.52-10.53x. On the upper end, this would generate valuation-driven upside of about 6% alone. However, given the currently contractionary monetary and fiscal policy (on a leading basis), and the recent drop in the VND vs. the U.S. dollar, I would err on the side of caution.

VNM likely still offers a strong cyclical opportunity, but timing will be tricky as ever. However, as we move into 2023, the headwind effects of the contracting local fiscal and credit impulses should begin to ease given base effects. The next few months should also afford some time to see if the USD/VND exchange rate remains stable. As I believe the FX rate fundamentally still supports VND appreciation, a tailwind should take effect over the next 3-12 months. A normalized VND should also help to stem risk aversion, which could help to compress local equity risk premia and thus buoy VNM’s valuation. VNM is not “cheap” in light of country-specific risk, but it is nevertheless priced for returns of over 10% per annum, which I believe are achievable.

Be the first to comment