JasonDoiy/E+ via Getty Images

Overview

Home security systems companies are poised to perform well during the next decade and could be a great buy to help protect from the impact of inflation. Vivint Smart Home, Inc. (NYSE:VVNT) is an excellent stock to consider if you want to gain exposure to this industry. However, I am taking a wait-and-see approach, mainly because external shocks like inflation and interest rates will impact this company.

Growth Potential

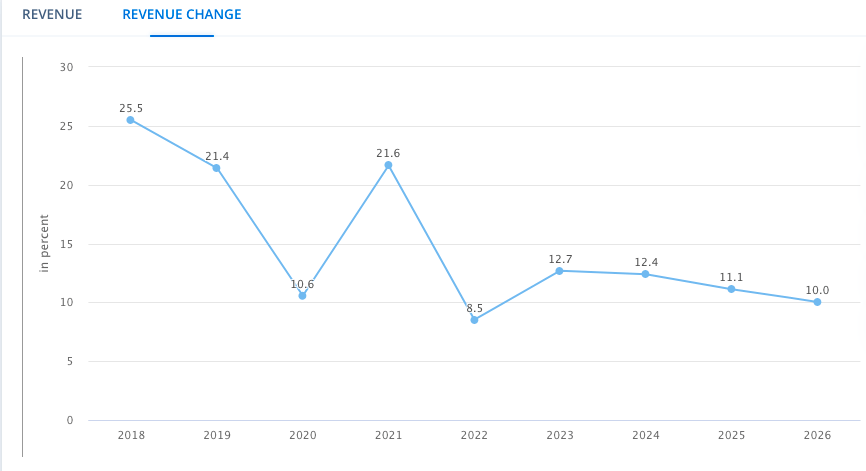

The average revenue growth for home security systems in the United States has been rapid in recent years, and will likely remain above 10%. Around 43% of households in the United States have at least one smart home device and 30% have a security system.

Statista

Technavio projects that the smart camera market will grow by 14% per annum through 2026. I think there is potential for greater adoption of home security systems if companies can follow through with lower costs and higher levels of innovation for price-sensitive consumers, creating a diverse pricing mix for various types of customers. A somewhat relevant analogy is that only 20% of the population owned a smartphone in 2010, and over 70% owned one a decade later. However, I don’t think a 70% saturation rate is reasonable, and the investment thesis behind Vivint is more driven by new product offerings and capturing existing market share.

Growth Despite Decline in Reported Incidents

The burglary rate in the United States has declined from 1,252 incidents per 100,000 people in 1992 to 271.1 per 100,000 in 2021. The growth of home security systems has still been robust despite this crime, largely because purchasing a home security system is an inexpensive way to lower the probability of being targeted. Homes without security systems have a 300% higher chance of being targeted. Furthermore, police solve only 13% of reported cases.

Average Cost

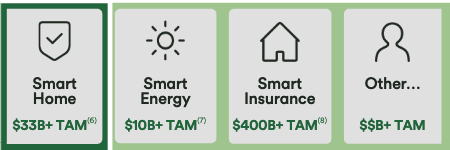

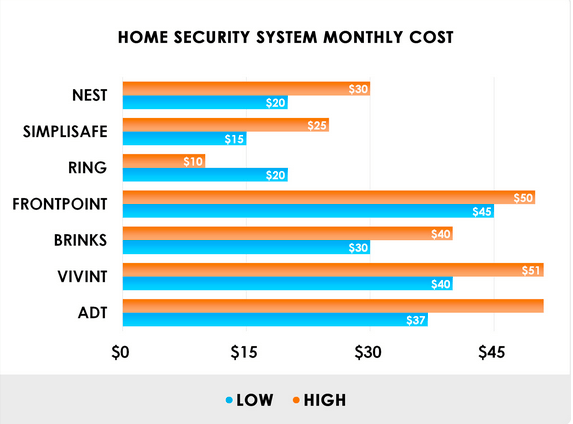

An average home security system costs $300-840 to install ($36.6 billion+ total addressable market (“TAM”) in the United States), and most users pay $25-50/month for home security contacts. The average monthly payment is only 2.2-4.5% of the average $1,100 average monthly mortgage cost in the United States. However, Vivint charges more than most competitors and focuses on providing higher-quality services.

Takeaway

There still appears to be room for moderate growth in home security systems, although the market is somewhat saturated. However, growth will likely not be as strong as in the 2010s. Increased digital literacy in the United States may result in a higher adoption rate. Most importantly, it will allow companies to add other bundled services to increase revenue per user. Home security systems companies can serve as an inflation hedge, although F&B, tobacco, and other consumer stocks may still be superior options.

Vivint Smart Home Overview

Vivint Home Security Systems is a decent way to gain exposure to this industry, especially since some competitors are not publicly listed companies. The company’s growth rate has been in line with the industry average, and it may be able to outperform through new product launches. Vivint offers higher-end products that require professional installation, which makes it harder for the company to attract price-sensitive customers that may prefer lower-cost, self-installed models. Nevertheless, growth at Vivint has been consistent and stellar, as it nearly doubled its revenue in 2021 relative to 2016.

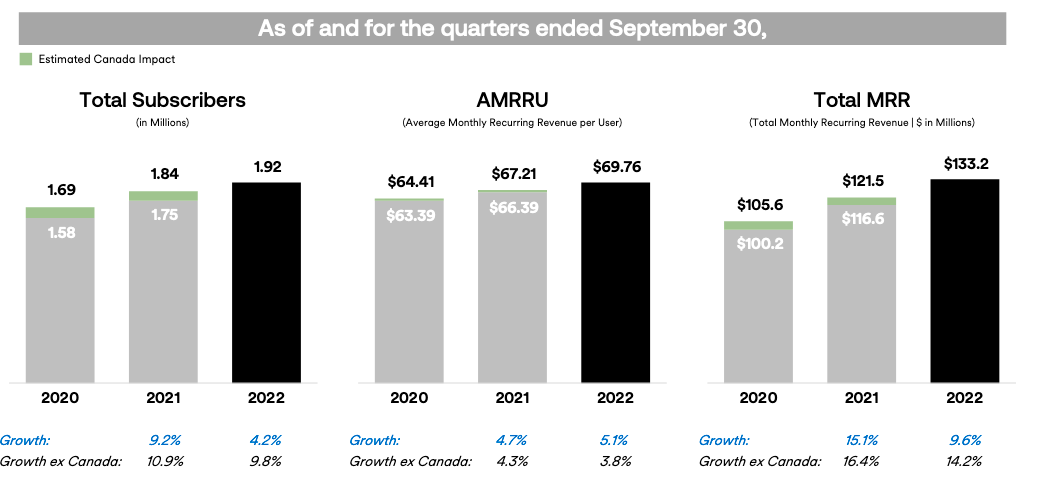

Vivint had 1.92 million subscribers in the United States and Canada and has been experiencing double-digit growth in new customers. Furthermore, the company’s attrition rate fell from 12.8% in Q3 2020 to 11% in Q3 2022. Consumers who pay to install the device are committed and likely to stay with the company. Vivint has bundled options for consumers so they can custom tailor their home security experience.

Vivint ( TAM according to company calculations)

One interesting fact about Vivint is that it has the ability to offer other products such as smart energy and smart insurance to its current user base of nearly 2 million customers. At the moment, smart energy subscribers only accounted for 4.4% of new subscribers. Vivint also recently launched a water sensor detector, which can help reduce the cost of water damage that occurs.

The company has also invested heavily in improving its technologies, notably with an improved computer vision chip in 2022 and a doorbell camera feature. The company’s annual Capex is on track to double from the 2020 levels, as 9M2022 CAPEX was $15.3 million relative to $8.6 million during the same period in 2020. Consistent investments and customer acquisitions allowed the company to have a positive operating cash flow beginning in 2020.

Recent Performance

Vivint had a stellar quarter in Q3 2022, growing its U.S. customer base by 9.8%, increasing revenue by 13.6% YoY, and reducing its attrition rate by 40bps (11%). Extrapolating the company’s Q3 revenue would result in annual revenue of $1.76 billion on a current market cap of $1.94 billion.

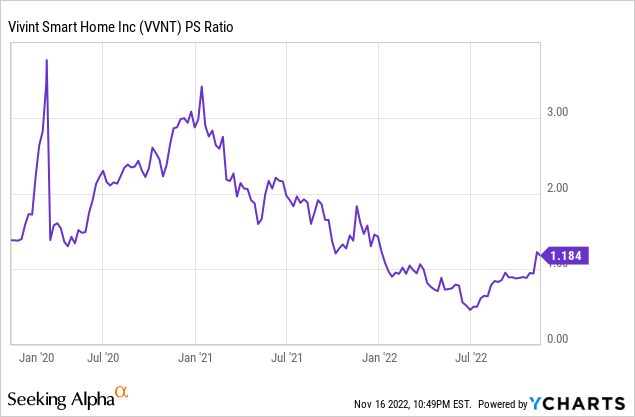

YCharts

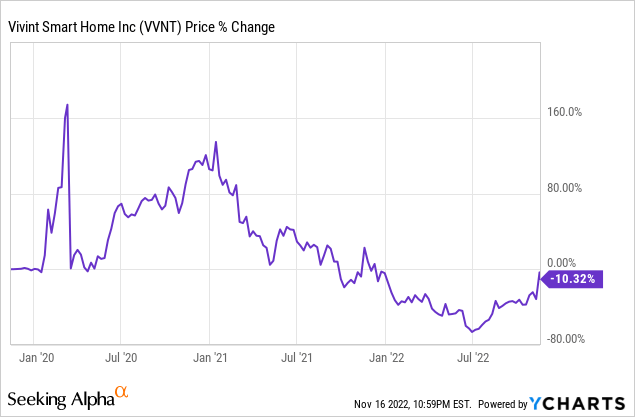

Vivint has the potential to trade at a discount to revenue, which would be an ideal entry point. Vivint has been able to grow by growing its subscriber base and increasing its average monthly revenue by around $5 relative to 2020.

Vivint

Some factors deterring additional growth include the relatively high cost of installing the home security system, which has caused many people to have to turn to finance solutions. Rising rates and higher inflation could make this option less appealing (56% of Americans couldn’t afford a $1,000 emergency according to CNBC). 42% of people who purchase home security systems use self-installed home security systems.

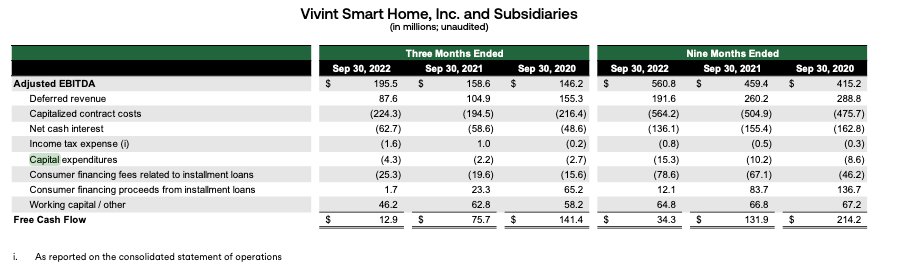

However, there is no indication from current guidance and recent performance that this is a significant risk. Growth will be driven by price increases rather than user growth. Vivint targets a 3.2-3.8% growth in customers this year and 11.5-12.8% revenue growth. The main financial risk for Vivint is the increased interest expense due to rising interest rates, which will result in lower free cash flow. Free cash flow (“FCF”) fell from $131.9mn during 9M 2021 (circa 9% free cash flow yield based on current market cap) to $34.26mn. This decline was not a result of significant CAPEX, as Capex only increased by $5.1 million during this period.

Vivint

Vivint’s lower-end services were higher than that of most competitors, with the exception of Frontpoint, which charged an additional $5/month.

Home Guide

Vivint is still cost-competitive with other major competitors like ADT and is also able to derive other revenue outside of the standard monthly costs.

Takeaway

All of the external risks could serve as an excellent pretext to help investors access shares at a new low. I will be monitoring the company during the next earnings announcement and may consider initiating a position when the P/S ratio is below 1. Some key risks/factors that made me decide to wait to include:

-

Rising interest rates negatively impact the company because of its revolving credit facility ( already negatively impacted 2022 FCF)

-

The share price is extremely volatile and could return to historical lows.

-

Vivint charges more than most of its competitors, and price competitive consumers may choose alternatives.

Ycharts

Vivint Smart Home, Inc. shares experienced a 72% drawdown during the past year. Vivint’s share price is very volatile, and it pays to wait in situations where there is not full short-term clarity.

However, Vivint is thriving with a customer base of around 2 million, largely due to its high level of innovation and product updates. There is still ample room for growth for the company, driven by client acquisition and product launches, and Vivint Smart Home, Inc. has committed to boosting CAPEX during the past three years.

Be the first to comment