Adam Smigielski/E+ via Getty Images

Recommendation

I recommend buying Vita Coco (NASDAQ:COCO). This is the first U.S. company to market bottled coconut water under its own name and has established an asset-lite global supply chain for coconut beverages. Health-related drinks are becoming more popular, particularly as the pandemic has prompted the public to focus on the importance of having a balanced diet. With its hybrid GTM strategy and opportunities for further penetration, COCO is able to expand its market reach across the Americas while leveraging its win-win partnerships with other countries such as the Philippines, Indonesia, and Brazil.

Business

COCO is a brand family that focuses on the production and sale of healthy and nutritious beverages. Key brands include Vita Coco, Runa, and Ever & Ever.

Large and growing market

COCO is a part of the rapidly growing non-alcoholic beverage industry, which is projected to grow to $1.6 trillion worldwide in on-and-off retail sales by 2025.

To the extent that people start paying more attention to their health, I expect that health drinks will be one of the fastest-growing categories of beverages. Drinks made from plants have become increasingly popular among consumers as a means of replenishing fluids lost during and after physical activity, bolstering the nutritional value of their diets, and improving their overall health and well-being. I believe this trend will continue as consumers become increasingly interested in and motivated to try natural and plant-based alternatives wherever possible, particularly as the pandemic has prompted a general uptick in the public’s focus on the importance of eating a balanced diet.

Asset-light global supply chain is a key competitive advantage that is hard to replicate

COCO, the first U.S. company to market bottled coconut water under its own name, began importing its first batch of coconuts from Brazil in the early 2000s. This capacity has been exported to other regions, and the company has begun to actively invest in the neighborhoods where its offices are located.

COCO’s core competitive advantage, I believe, is the ability to source coconut water from the tropics, oversee its packaging, and ship its branded, high-quality product worldwide. The reason they can do this is simple: COCO has direct connections to coconut producers and processors in Brazil, Indonesia, and the Philippines, which are extremely tough to replicate.

It has meticulously established a scalable infrastructure for the distribution of coconut water, allowing manufacturers of coconut products to profit from the by-product. In my opinion, this is a critical factor since COCO enhances the value chain by creating a win-win situation for its suppliers. Before COCO became involved, many factories just made dried coconut and coconut cream and threw away the coconut water because they thought it was unnecessary. So, COCO realized there was a market for reusing coconut water.

Because of its unique properties, coconut water cannot be mass-produced or co-packed with other beverages. Instead, it must go straight from the fruit into packaging after it is picked. To give an idea of how complex this is, COCO’s factories had to be situated as close as possible to the coconut groves in order to preserve the highest quality. In my opinion, COCO and its manufacturing partners are pioneering the field of coconut water processing, which is a key competitive advantage that sub-scale players do not have. In order to help local farmers grow and process coconuts in an ethical and economical way, COCO has set up “model farms” in the areas it sources from and works closely with its manufacturing partners to do so.

In exchange for providing the technical resources and expert knowledge that it has built over decades, COCO typically receives long-term contracts, generally with exclusivity conditions. This is a virtuous cycle as COCO’s long-term manufacturing ties continue to strengthen as they work together with partners, which gives COCO more capacity to scale and continue expanding.

The business model of COCO operates on an asset-light approach, meaning that it does not own any of the coconut water factories it utilizes and instead relies on co-packers to handle local manufacturing as necessary in its largest markets. I believe COCO benefits greatly from this adaptability because production may be swiftly relocated to a new plant or country. This model allows them to immediately modify their sourcing and production globally, which decreases the company’s exposure to external macroeconomic risks and ensures a continuous, stable, and high-quality supply of coconut water while optimizing operational flexibility and capitalization.

Strong hybrid GTM strategy

All aspects of COCO’s supply chain, from sourcing its coconut water to delivering its goods to retailers and consumers, are optimized for efficiency, reliability, flexibility, and profitability. It has spent the last 20 years getting its distribution model just right, which, I believe, has helped it make and sell products that meet the needs of a wide range of consumers.

To further illustrate my point, I believe that access to the whole range of distribution possibilities, without being constrained or compelled to choose only one, maximizes COCO’s execution speed and impact. To put it simply, COCO would be able to outperform smaller competitors with its scalability and worldwide reach thanks to its distinctive product portfolio, intelligent and experienced workforce, and diversified supply chain, while also standing out from larger beverage giants with its nimbler, hybrid platform. COCO’s go-to-market skills make sure that each of the channels it uses and each product at every stage of its life follow a successful and efficient path.

COCO has established itself as a trusted partner to select retailers by meeting their private label requirements, complementing its already formidable sales team and distribution channels. As a result of the success of its private label business, COCO has been able to develop closer ties with coconut water producers worldwide. Additionally, COCO has established its standing with merchants who are committed to their private-label products as a direct result of this success. I have high confidence that its branded product will continue to drive growth in the coconut water market, and its private label product basically guarantees that it will continue to serve both retailers and suppliers.

Opportunities to further increase penetration

There are huge opportunities across channels to get distribution. I believe that COCO can use the connections it already has to go deeper into the market and spread its influence across the Americas.

Increasing shelf space and throughput at already established points of sale are two ways I anticipate this rising demand being translated into distribution gains across channels. I feel that COCO can develop its points of distribution about twofold with the Vita Coco brand alone due to its great velocity across channels. One way I believe COCO could go about it is by expanding the distribution of their staple products in regional chains, as well as introducing multipacks and new product lines. With this, COCO can boost sales at large-format accounts while also demonstrating its dedication to socially and ecologically conscious sourcing.

On the other hand, multipacks of coconut water are especially appealing to the company since their sales volume is increasing faster than that of similarly positioned natural and healthy beverage categories and because they occupy less shelf space than I believe should be allotted to multipacks in their category. Furthermore, there is a huge opportunity to expand Vita Coco’s distribution into new convenience stores. By offering Vita Coco coconut juice in cans, COCO hopes to strengthen its presence in the convenience channel and increase the number of products sold in each location.

Valuation & model

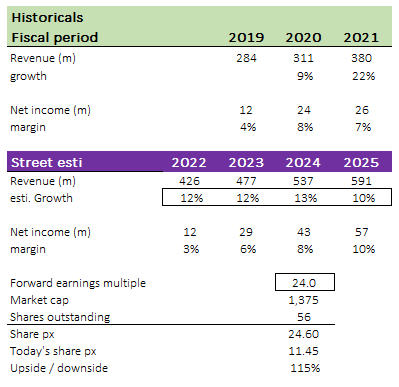

I believe the recent selloff presents investors with an opportunity to gain a lot of upside over the next two years. I expect COCO to continue growing in the low teens as it continues to ride on the secular trend – demand for health drinks – and also has the possibility of capturing share in adjacent verticals. This figure is also in line with management’s expectations for FY22. That said, the TAM is huge, and there are plenty of opportunities to further increase penetration; I would not be surprised if COCO were to grow faster than the low-teens digits.

COCO currently trades at 24x forward EBITDA. I have assumed it would continue to trade at the current multiple. I do note that this multiple seems high on an absolute basis, so investors need to be wary.

Author’s own calculations

Risks

Coconut drinks could be just another trend

Similar to all other trendy products, the consumption of coconut could be a passing trend. If that is the case, COCO could face a severe decline in demand. Given that a large portion of revenues and profits are contributed by sales of coconut water, COCO might not be able to pivot to another product category successfully as well.

Another supply shock would be horrible

COCO does not have its own warehouses and distribution hubs but, instead, contracts with third-party warehouses and fulfillment centers across many countries. While being asset-light is good, it restricts the flexibility of COCO in times of need to adjust supply and distributions. Competitors may take advantage of this gap and capture market share from COCO.

Summary

To conclude, I believe COCO is undervalued. The company has set up an asset-light worldwide supply chain of coconut beverages through its third-party partners, allowing for rapid growth and expansion. Increased public awareness of the necessity of maintaining a healthy diet in the wake of the recent pandemic has contributed to the rise in sales of health-oriented beverages.

Be the first to comment