Cristian Martin/iStock via Getty Images

The currently ongoing energy crisis have shown that reliable energy, such as oil is needed more than ever. At the same time, the Russian invasion in Ukraine and the supply cuts by OPEC+ members have made the situation more difficult. One of the keys for increased supply may be hidden in the Neuquen province of Argentina, where the Vaca Muerta shale formation is located. One of the companies with exposure to that is Vista Energy (NYSE:VIST). The company is on the path of impressive production growth and plans to nearly double its production by 2026. Yet, operating in Argentina comes with a plethora of risks. The country is amongst the least free economies in the world and domestic oil prices are kept artificially low, preventing oil companies to fully reap the benefits of high international prices. Nevertheless, at forward EV/Adj. EBITDA of just 1.8, it looks as an attractive opportunity for those, willing to stomach the political risk.

Oil market outlook

Since the beginning of 2020, oil markets have been on a rollercoaster ride. After the world entered into a lockdown in March-April 2020, oil prices fell sharply and even entered negative territory for a while. However, as it became clear that the world is not going to an end and that fossil fuels are not going away anytime soon, the price started moving upwards. As inflation started to rage and Russia began its invasion in Ukraine, the US government took a historic decision to release 1M barrels of oil each day in order to curtail gas prices. Prior to 2022, there has been only three occasions when reserves from the SPR were released, since it was established in 1975 – in 1991 (due to the Gulf war), in 2005 (Hurricane Katrina) and in 2011 (supply disruptions in Libya).

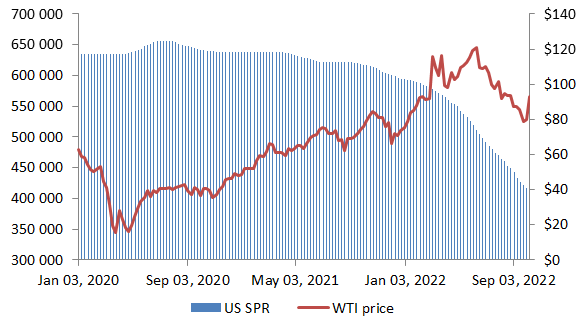

US SPR stocks and WTI price (US EIA)

As a result, US SPR stocks have depleted almost 30% since March to their lowest level in 38 years. And the effects on oil prices were not that great, either. Granted, oil has dipped below the US$120 area towards the US$90s, but the decline probably has more to do with interest rate hikes and the fears that the global economy mas slow down as a result. I’m skeptical regarding the prospects of how high interest rates will be allowed to go to or even the sustainability of the current levels for a considerable amount of time as explained here. Moreover, the last releases from the US’ SPR should be finishing in November and there were signals that the government is looking to refill the reserves at prices around US$80/barrel. OPEC+ has also send a very clear message that the organization is ready to defend current oil prices by announcing a production cut.

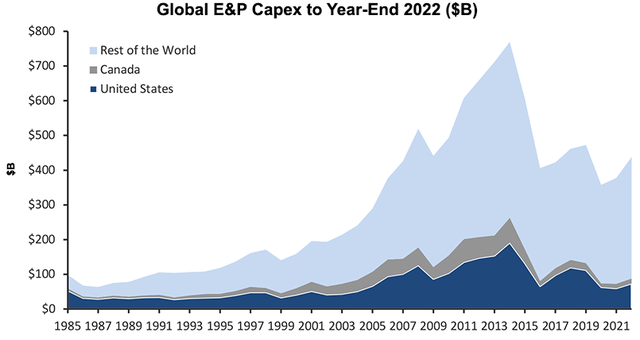

Global E&P CAPEX (Evercore ISI)

Looking at the CAPEX of the industry, it’s well below the peak levels from 2012-2013, as a decade long efforts to vilify fossil fuels have yielded fruit. Since the future before oil companies is uncertain and there’s the risk that they could be regulated out of existence, especially in Europe, a bigger portion of the free cash flow streams are put towards shareholder return programs, instead of investment. That being said, I think that oil prices will remain elevated and will hardly fall significantly below the current levels for a considerable amount of time.

Company overview

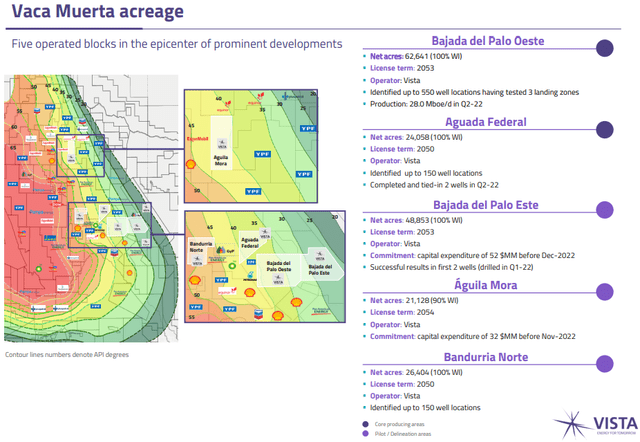

Vista Energy is an independent oil and gas company registered in Mexico, but with the vast majority of its assets located in the famous shale formation Vaca Muerta in Argentina. The company is licensed to operate within 5 blocks with spanning over a total of 183.1k acres.

The Vaca Muerta shale formation is touted as the second largest shale formation in the world and is expected to reach production rate of over 300kBOE/day towards the end of 2022. Besides Vista, significant presence in the area have oil major such as Shell (SHEL), Chevron (CVX), Equinor (EQNR) and YPF Sociedad Anónima (YPF), which is majority owned by the Argentinian government. I see the presence of such large players as a positive, since it somewhat reduces risk.

Capital structure and ownership

As of 30 June 2022, the company has 86.5M shares outstanding, down from 88.6M in the beginning of the year, due to the implementation of a share buyback procedure under which a bit over 2.8M shares were bought. The company has also around 100M warrants outstanding, which are exercisable at 11.50 per share with the surrender of three warrants per share. However, the Warrant Holder’s meeting recently approved an alternative exercise mechanism, allowing for the cashless conversion of 31 warrants to 1 share. While the existing mechanism will still be available, the new one, if preferred by the warrant holders could lead to the issuance of up to 90.32% less shares. The company had US$603M debt on its balance sheet at the end of Q2’22, but it likely fell to US$528M, following some principal repayments as suggested in the Q2 results presentation. According to the 2021 annual report, the biggest shareholder in the company with 17.11% beneficial ownership through 12.5M shares and 10M warrants is Kensington Investments – a wholly owned subsidiary of the Emirate of Abu Dhabi. The CEO of Vista Energy – Miguel Galuccio is reported to have a beneficial ownership of 8.94% as of 31 December 2021, through a combination of shares, warrants and options. This is quite high exposure and implies considerable skin in the game.

Strong performance in Q2’22

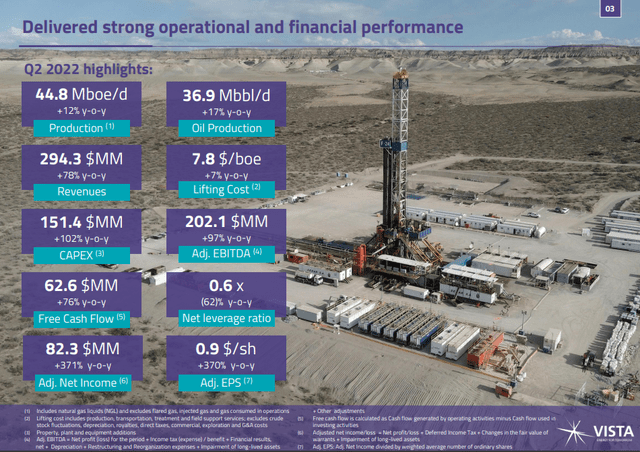

Vista Energy’s Q2’22 results (Vista Energy)

The company’s performance in Q2’22 was nothing short of spectacular, exceeding earnings expectations by 77.4%. Besides the results’ snapshot, it’s important to note the dynamic of the domestic market sales and exports. In Q2’22 the latter amounted to 42%, up from 33% in Q1’22. This had major implications for the average realized price, since domestic prices in Argentina are kept artificially low at around US$60 per barrel, which prevents the companies to take the full benefit of high international prices. As a result, the average realized price in Q2’22 was US$78.4/barrel (+22.3% QoQ). The company doesn’t engage in hedging, but it usually sells around 2 months forward its production with the CEO hinting that one of the three cargoes expected in Q3’22 was sold for US$113/barrel. As a result, I expect another very strong quarter, despite the weakness of international oil prices in September, which will likely be reflected in Q4’22.

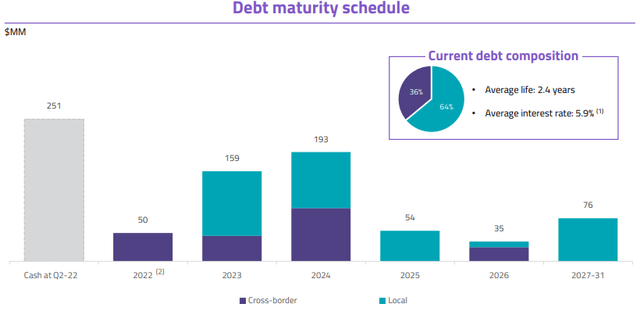

Regarding the balance sheet, the VIST ended the second quarter with about US$251.1M of cash and equivalents, which results in a net debt position of US$351.5M. The net leverage ratio, calculated by dividing net debt by TTM Adj. ABITDA fell to 0.6, compared to 1.7 a year ago.

Ambitious expansion plan

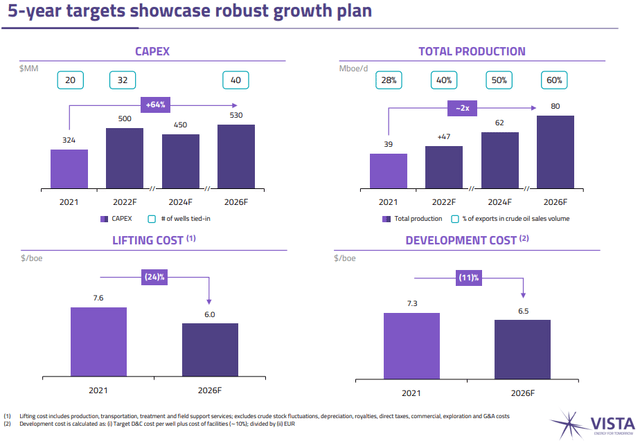

Vista Energy’s growth plan (Vista Energy)

The company is onto a significant growth trajectory with daily production expected to reach 52kBOE, according to the last earnings call. This implies 16.1% increase from Q2’22 and 26.8% YoY. The growth plan envisions extraction of 80kBOE/day in 2026, which is almost double the result from 2021. As production increases, the share of exports is expected to increase as well, as the needs of the domestic market would be fully satisfied and the rest will end up on the international market. This will be another positive for the company, as the average realized price will increase, even if market prices remain unchanged. Note, that the budgeting of the expansion plan is done under assumed average realized price of US$60/barrel, which is a lot lower that the current one. If prices remain elevated and strong cash flow generation continues, the share buyback may be continued in 2023, according to the earnings call.

Regarding the expansion, recently VIST signed an agreement with Trafigura to jointly develop 20 wells in the Vaca Muerta shale formation. The total amount invested will be US$150M with VIST covering 75% of it and subsequently having 75% rights over the production. In addition, 380kBOE of oil per month will be sold to Trafigura in H1’23, which will then be reduced to 345kBOE/month in H2’23. While on one hand this agreement will help with the funding of the expansion plan, the sale to Trafigura is likely going to be on inferior than international market prices.

Share price and valuation

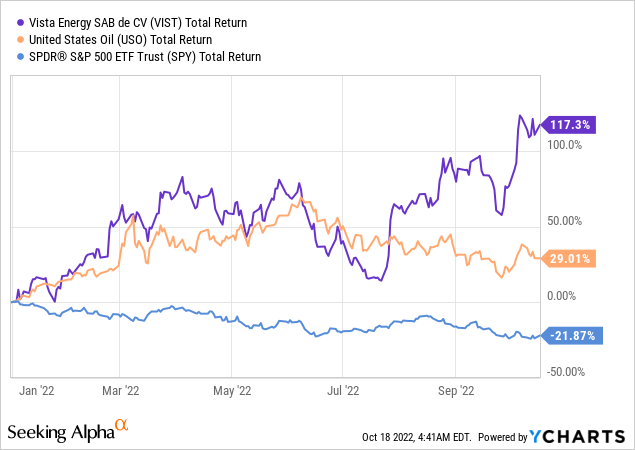

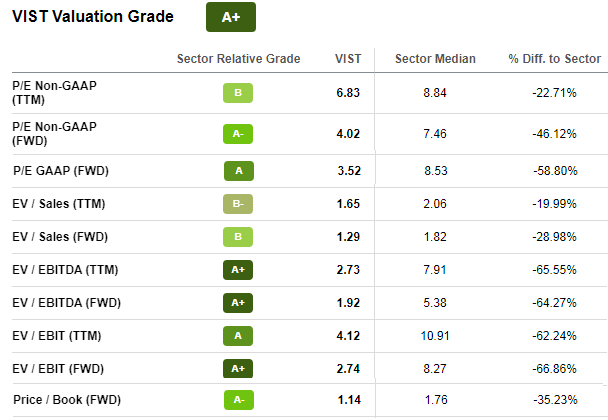

Looking at the share price, the YTD performance is impressive with return of 117.3%, exceeding the broad US market, represented by SPDR S&P 500 Trust ETF (SPY) and even the oil-linked United States Oil ETF (USO). However, looking at the sector comparison, the company still looks relatively cheap in every available metric. Not to mention, that given the expected significant growth in production, all else being equal, the company should trade at a premium.

Vista Energy Vs. sector (Seeking Alpha)

In addition, I estimate Adjusted EBITDA of around US$950M for 2023, assuming average annual production of 55kBOE/day and average realized price around US$70/barrel. This figure is comparable to the current market cap of around US$1B and is around 1.4x EV. Regarding the 2022F EV/Adj. EBITDA, using the guidance figure for the denominator of US$750M, the ratio comes at 1.8, which also looks cheap.

While the Argentinian peer, YPF appears even cheaper with more attractive ratios, it has to be taken into account that the government holds the majority stake in it, which is a major risk, absent from VIST. In addition I see the presence of the Emirate of Abu Dhabi as the largest shareholder as a plus in the case of Vista Energy, since an attack on the company could also have geopolitical implications.

The obvious explanation of the current discount to the sector is the jurisdictional risk. I’ll discuss that further in the Risks section bellow, but I see two potential factors that could drive the share price to the upside, besides higher oil prices. The first one is the share buyback program. If continued, it could fill the demand gap from investors and lead to price increase. The second one is the execution of the growth plan itself. As production grows and the guidance milestones are achieved, even in order for the current valuation multiples to be maintained, the share price should go higher.

Risks

Political risk

In the case of VIST, this is the elephant in the room. In the 2022 Economic Freedom Index ranking of the Heritage Foundation, Argentina takes the 144th place, with only 33 countries ranked below it. The property rights score is just 35.1, with 100 being the best possible mark and 0 the lowest. Regarding the Corruption Perceptions Index, the country is also ranked in the bottom half. That being said, it appears that there’s an understanding within the government about the importance of Vaca Muerta. For example, in 2020, when international oil prices plunged, a price floor of US$45/barrel was introduced in order to shield producers and to allow them to continue development activities in the shale formation. This year, a relaxed FX rules were introduced for energy firms in order to boost the development of Vaca Muerta. Of course, with the historical track record of unpredictability and instability in Argentina, there’s the risk that someday the country may go towards the example of Venezuela, which nationalized its oil fields.

Interest rate risk – While the company has net debt of only US$351.5M, most of it is short term and has to be rolled over in the next few years. In a rising interest rates environment that could increase the burden on the company, but given the strong cash flow generating ability in the current environment, I don’t expect any problems to arise.

Debt maturity schedule (Vista Energy)

Lower oil prices risk

An obvious risk for every oil company, I see this to be slightly less relevant for VIST. The Argentinian government proved in 2020, that it’s ready to support the sector in a Black swan event, that drives prices to very low levels. Besides, as discussed in the Oil market overview section, I don’t think that oil prices will fall much from current levels for a prolonged period of time.

Conclusion

Vista Energy offers a potential for significant production growth, through its Vaca Muerta assets at a discount to peers. As production grows, the share of exports should also increase and yield better average realized prices. However, the risks from operating in a jurisdiction like Argentina are quite high. In that regard, the stock is probably not a good fit for more conservative investors, but looks like a lucrative opportunity for those willing to stomach the political risk.

Be the first to comment