Cristian Martin/iStock via Getty Images

After the largest drawdown of the US Strategic Oil Reserve in history, the Biden administration recently sold its final batch of oil products. The administration may pursue more sales if deemed necessary, but with the reserve at its lowest level in around fifty years, it is unlikely significant releases will continue. With this in mind, a sizeable portion of the US crude oil supply will now be off the market. Given that US and global oil production remains depressed, the commercial oil supply will likely return to a deficit.

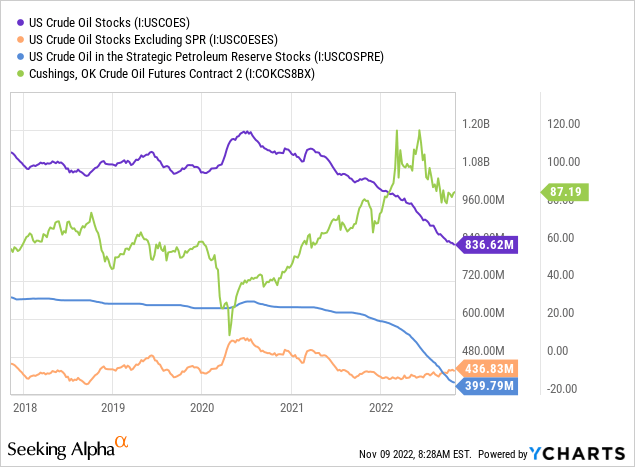

The price of crude oil is closely correlated to commercial inventory levels, measured as US oil stocks excluding SPR. Commercial inventories were extremely low during the beginning of 2022, but have risen slightly over the last seven months amid the substantial declines in SPR reserves. While the commercial market has been in a small glut, overall US oil reserves (both commercial and SPR) have declined steadily since 2021. See below:

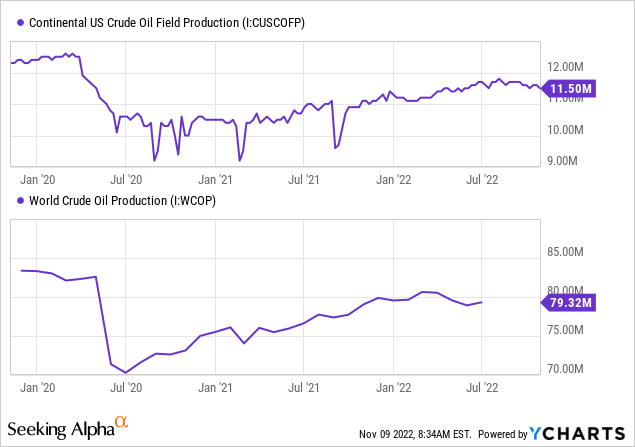

Over the coming weeks and months, I expect a sharp decline in commercial crude oil inventories as the SPR no longer acts as an artificial supply source. US continental oil production peaked in July and has shown some signs of decreasing as shale drilling activity hits a wall. Global oil production levels update much slower, but remain well below pre-2020 levels and may also stagnate or decline amidst OPEC+ cuts and global labor woes. See below:

Oil producers must maintain high drilling activity rates to maintain output levels as new oil wells experience a significant decline in production during their first two years after drilling. The US, in particular, has a large supply of “young” wells today, meaning significant new drilling is necessary to maintain a flat production level. The stagnation in the US rig count implies that it is unlikely. Given the immense decline in drilled-but-uncompleted wells, it seems improbable oil production will rise and possible it may continue to slip (despite being depressed).

President Biden recently stated his opposition to drilling, though his view wavers. Oil market data from recent weeks and months has indicated a potential decline in oil output just as the SPR release ends. Since oil demand remains relatively high, this situation may cause crude oil to enter another decisive phase higher. Many US oil producers are attractive stocks today. Still, given regulatory concerns and the strength of the US dollar, foreign oil producers, such as Mexico-based Vista Energy (NYSE:VIST), may be better bets.

Discount Opportunity in Vista Energy

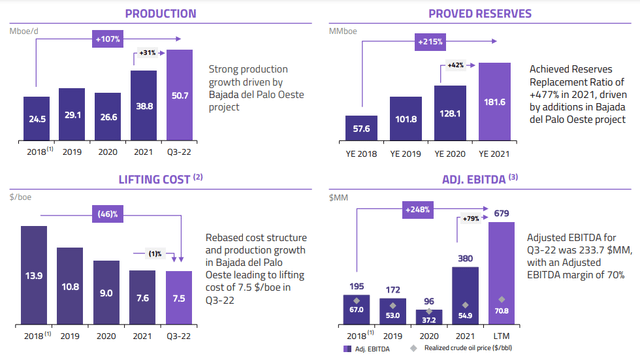

Vista Energy is one of Mexico’s largest independent oil and gas companies, not including the massive state-owned Pemex. Mexico is also a more prominent global oil producer and a net exporter. Of course, most of the company’s production is located in Argentina. In today’s precarious global oil market, Latin America’s status as a large producing region that is relatively free from US regulatory burdens and relatively neutral geopolitical stances make it a possible “haven” within the global energy market. Unlike most US oil companies, Vista has expanded production and reserves while decreasing per-unit costs over the past two years. See below:

Vista Energy Investor Presentation 2022 (Vista Energy Investor Relations)

Most US oil companies are currently experiencing some tightness as output growth stagnates and production costs soar with inflation. Vista’s position is far superior, continuing its growth and efficiency trajectory at a considerable pace.

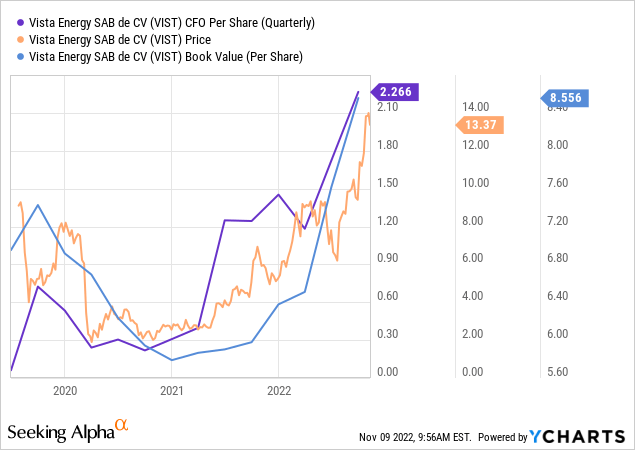

VIST ranks exceptionally well on financial metrics with one of the highest Quant scores in the entire stock market, receiving an A in valuation, momentum, growth, and earnings revisions. Many oil stocks stand out due to their abnormally low valuations and high margins today, but Vista’s objective metrics are generally superior. Even more, its forward “P/E” is a very low 4.6X, half that of the industry median at ~9X. The stock is also among very few oil companies to rise in value since spring despite substantial declines in the price of oil. Both its cash flow and book value per share have also increased materially this year. See below:

Based on objective metrics, Vista appears to be a solid energy company far cheaper than most in the US. Furthermore, while Vista is much younger than most, it is proliferating and will likely continue to do so as its numerous projects are completed. Fundamentally, it is in a counter-cyclical position to the US oil industry, which saw immense growth during the 2010s (leading to glut dynamics and low prices), followed by stagnation today (creating deficits and high prices). In my view, this situation puts Vista in a great position because it is growing during a period when most producers are not, allowing it to capitalize tremendously on higher prices. The stock has risen dramatically this year, but I believe it may eventually double again as its valuation rises toward that of most US peers.

Key Risks Facing Vista

Latin American oil producers generally trade at lower valuations due to perceived “political risks.” Argentina is seen as particularly risky due to its historically anti-foreign business attitude and its out-of-control inflation rate. Argentina’s inflation has worsened to 80% YoY this year and has raised interest rates to be at a similar level to slow it down. Fortunately, because Vista is an oil producer, it is not directly exposed to inflation and may experience some positive consequences due to its negative impact on Argentina’s exchange rate (generally lowering operating costs in US dollar terms). That said, the social ramifications of hyperinflation do pose a risk, as they could result in labor unrest or a shift away from its relatively pro-business government.

Unlike the US, Argentina has also increased its oil production dramatically above pre-2020 levels. The country’s total oil output remains well below its 2000s peak, indicating Vista may have ample opportunities for growth if Argentina continues to allow licenses. While Argentina is historically prone to political risk, its negative economic situation may promote efforts to open the doors to more significant foreign investment and development to mitigate the strain.

In reality, it is unclear if the political risks facing Vista are more significant than those facing US companies. Argentina is looking to increase oil production, while the Biden administration is outwardly opposed to drilling. In light of trends suggesting lower US oil output and the end of SPR withdrawals, the possibility of materially higher oil prices looms. As such, I believe investing in oil companies in countries with fewer anti-oil views is wise. That is not to say reliance on fossil fuels is good, but adequate production is a social necessity as long as that reliance exists. Argentina, despite its past, appears to be attentive to these trends and is looking to boost production accordingly, likely to the benefit of Vista energy.

Of course, Vista faces other risks similar to most oil companies. Oil prices could decline if the global economy continues to slow. I believe a decline in oil demand is possible, but trends suggesting output reduction largely offset this risk. That said, if the US, OPEC, or Russia decide to take measures to increase production, then oil prices could decline. For now, a rise in global output seems unlikely due to OPEC+’s resistance to US oil policy and the US’s falling drilling activity.

Finally, Vista’s balance sheet is roughly as leveraged as most US peers of a similar size, making it slightly more leveraged than many larger producers. The company’s somewhat higher borrowing level stems from its growth over the past three years, which may continue. In my view, this is not a very large risk, given the company’s EBITDA has risen so much this year. Of course, if oil prices experience a seemingly unlikely large decline (akin to that of 2020), then Vista could face difficulties. It is a smaller, more volatile oil company and often rises and falls faster than most stocks, so investors should be mindful of the risk associated with its levered growth positioning.

The Bottom Line

Overall, I am bullish on VIST and believe it will rise in value over the coming months. I believe the stock is around 25-50% undervalued to its peers, given its considerable valuation discount. Some discount is reasonable given its growth positioning and exposure to Argentina, but given US regulatory risks, I do not believe Latin America is much riskier. Indeed, depending on policy attitudes, Latin American oil companies may be less politically exposed than US companies.

VIST has risen steadily in recent months as its earnings outlook has grown. This trend may accelerate if oil prices rise, as I suspect, catalyzed by an end to SPR supply and a potential surprise decline in US production. If oil prices rise, VIST may increase much faster depending on where oil prices reach. Given my bullish outlook on oil stocks, VIST, has a 2-4 year investment horizon and is not too dependent on short-term moves. VIST may be due for a pullback given its recent rally, but its fundamental valuation and the situation in the oil market appear strong enough to justify a continued rally.

Be the first to comment