ErikMandre

Introduction

I like to write about companies that lack coverage on SA and today I’m taking a look at Vision Energy (OTCQB: OTCQB:VIHDD). The company is currently developing a green energy terminal in northwestern Europe and recently announced a cooperation agreement with Linde Engineering, a subsidiary of global chemical group Linde (NYSE: LIN).

I’m concerned that Vision Energy doesn’t have the funds to complete it’s project and I think that the recent share price increase could be driven by strong retail investor interest. Let’s review.

Overview of the business and financials

Vision Energy was established in 2015 and its aim is to develop clean hydrogen production facilities that supply clean hydrogen to manufacturers and gas and power traders. In June 2022, it acquired Dutch firm Evolution Terminals for $11 million in cash and shares. The latter’s main asset is a green energy hub project for the import, storage, processing and distribution of low-carbon and renewable energy products and fuels including hydrogen carriers like ammonia, methanol and liquid organics. According to Vision Energy, Evolution Terminals has a long-lease agreement with European port operator North Sea Port for the exclusive use of 143,132 square meters of sea-front industrial-zoned land at the port of Vlissingen in the Netherlands. The terminal will have a liquid bulk storage capacity of up to 600,000 cubic meters and is designed to be constructed in phases. The project has been in development since the fourth quarter of 2020, but it seems that it was still in an early phase during the acquisition. According to the Q3 2022 financial report of Vision Energy, the capitalized project development costs stood at just $1.55 million at the time of the purchase (see page 13 here). They include financial models, environmental impact assessments, layout drawings, and terminal operation simulations among others.

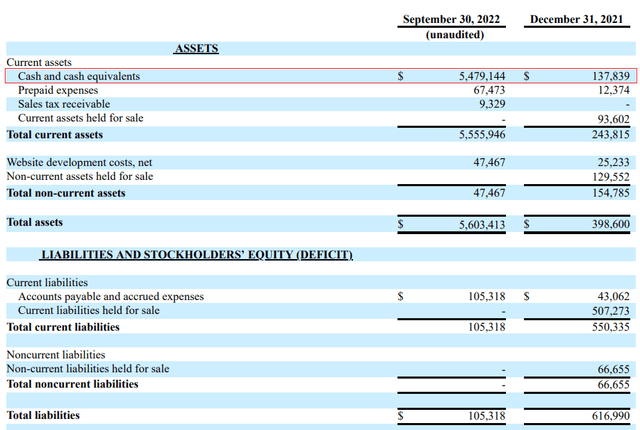

On October 28, Vision Energy announced that phase 1 will cost about €450 million ($466.4 million) and will include 400,000 cubic meters of renewable liquid bulk storage capacity, with 150,000 cubic meters allocated to green ammonia. The issue is that the company doesn’t have anywhere close to that amount on its balance sheet, and I doubt that it would be able to secure a significant amount of funds in a capital increase considering it’s listed on the OTC. As of September 2022, Vision Energy had just $5.5 million in cash and cash equivalents and this amount accounted for almost 98% of its total assets.

Vision Energy

Overall, I think that the company could run out of cash even before reaching a final investment decision which is expected to take place by Q3 2023.

In my view, it’s also concerning that there is a major lack of information about the green energy hub project. You see, North Sea Port operates a network of ports that extend for more than 60 kilometers in Belgium and the Netherlands.

North Sea Port

It’s a major logistics hub that is investing heavily into renewable energy and it just announced that it partnered with tank storage company Vopak to prepare two existing refrigerated LPG storage tanks with a combined capacity of 110,000 cubic meters for ammonia storage. This project is also at Vlissingen but and there is no mention of Evolution Terminals anywhere on the corporate website of North Sea Port. In fact, I couldn’t find a mention of Evolution Terminals on any major news site. In addition, I can’t find news about the Linde Engineering cooperation agreement on any of Linde’s websites or social media accounts. I’m not saying that there is something wrong here, but it seems concerning.

Looking at competing projects, I think that Greenpoint Valley is likely to become the first green ammonia hub in North-West Europe considering it includes refurbishing an existing facility. This will require less permits than Evolution Terminals and considering the facility is located at Vlissingen, I have doubts that constructing another terminal would make sense from a financial point of view.

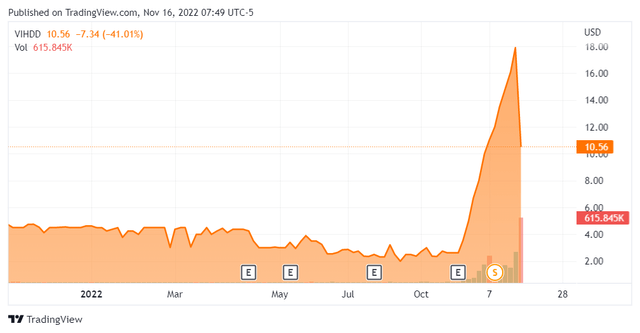

Turning our attention to the share price action, you can see from the graph below that the market valuation of Vision Energy started soaring on October 31. The volume also started rising on that day and it rarely surpassed 1,000 shares in any trading session before that. On November 15 alone, 615,845 shares changed hands and the market capitalization of the company stands at $222.3 million as of the time of writing.

Seeking Alpha

So, why is the share price rising all of a sudden? Well, I think the reason could be high retail investor interest and it seems that the catalyst was the news about the key figures for phase 1 on October 28. Over the past few weeks, there have been a significant number of posts about Vision Energy on websites like StockTwits and twitter, including by stock trading platforms like Trade Ideas. Over at reddit, there are posts about the company on r/OTCpennystocks and r/EV_Trading_Community. Overall, the share prices of microcaps often increase for spurious and unknown reasons, and volatility can be really high when the trading volume suddenly jumps. In my view, the share price is likely to return below $3.00 once retail investor interest fades.

So, how can you play this one? Well, data from Fintel shows that the short borrow fee rate is just 6.05% but there are no shares available as of the time of writing. Even if there were, short selling seems dangerous as there are no call options available to hedge the risk. It could be viable to open a very small position to limit the risk but this isn’t enough sometimes as the market valuations of microcaps on the OTC can increase far beyond what many portfolios can take. For example, Athena Bitcoin Global (OTCPK:ABIT) was valued at $130 billion when I wrote about it in September 2021. Always have a plan for when things go wrong, and use stop losses.

Looking at the risks for the bear case, the major one is that I could be underestimating the chances of Vision Energy to secure funding and successfully develop its green energy hub project. It’s an obscure company that is up against global energy majors and I just don’t think the odds look good. It seems that the market didn’t like the odds either as the market valuation was about $50 million just a few weeks ago.

Investor takeaway

The EU plans to significantly increase its consumption of green ammonia in the coming years and it seems that the North Sea Port is among the prime locations for a hub. Several energy companies already have plans for facilities there and among them is Vision Energy. However, the company had just $5.5 million in cash as of September and its project is at an early stage. I doubt it will be developed before Greenpoint Valley or maybe even at all.

The market valuation of Vision Energy has increased significantly over the past few weeks, and I think the reason for this could be high retail investor interest. In my view, the share price is likely to fall below $3.00 again as enthusiasm wanes. However, there are currently no shares available for short selling. Considering there are no options available, I think risk-averse investors should avoid this stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment