Michael Vi/iStock Editorial via Getty Images

Okta (NASDAQ:OKTA) is a leading identity and access management company that helps companies accelerate their digital transformation by securing and connecting business workflows which drives enhanced operating efficiency.

Over the last few years, security and identity management has become a top priority for enterprises and as a leader in the industry, OKTA is well positioned to capitalize on their growing addressable market. OKTA is starting to realize a significant growth in its topline from its aggressive sales and marketing investments and through significant acquisitions. This growth comes at the expense of its operating margin today, however, its long-term goal of over $4 billion revenue and positive 20% FCF margin in 2026 makes this stock extremely undervalued compared to its future potential. Currently, OKTA is trading at 20.80x P/S, cheaper compared to its forward P/S of 16.39x and 29.08x 3 year average, making it a good buy on its next dip.

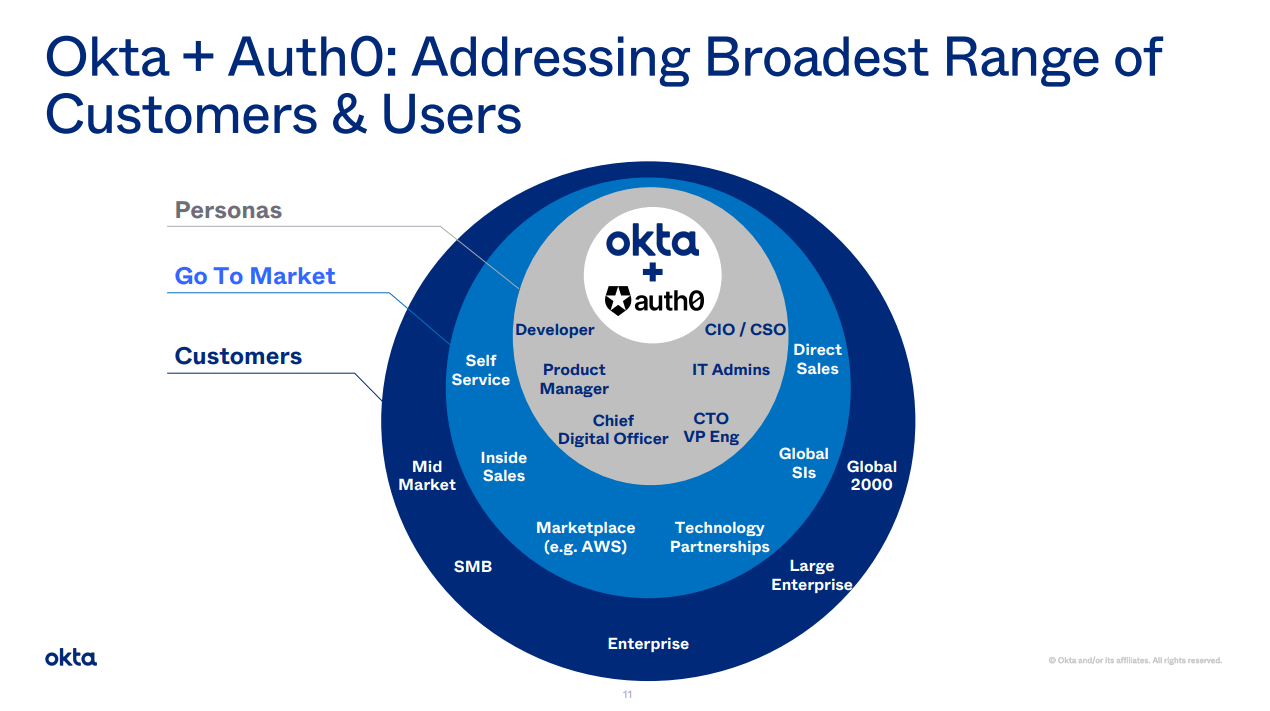

Bigger TAM with Auth0

Addressing Broadest Range of Customers & Users (Q4 2022 Earnings Call Presentation)

OKTA has a very aggressive strategy towards its long-term goal of profitability. With the Auth0 acquisition, they managed to accelerate their addressable market from $55 billion last year to $80 billion this Q4 2022. OKTA is already realizing some fruits from this acquisition, which contributed $140 million to its total revenue of $1,300.2 million, showing an outstanding revenue growth of 56% versus $835.42 million last year. Additionally, OKTA continued to generate strong growth in its subscription revenue which contributed most of its total revenue to $1,249.2 million this year, up 57% from last year.

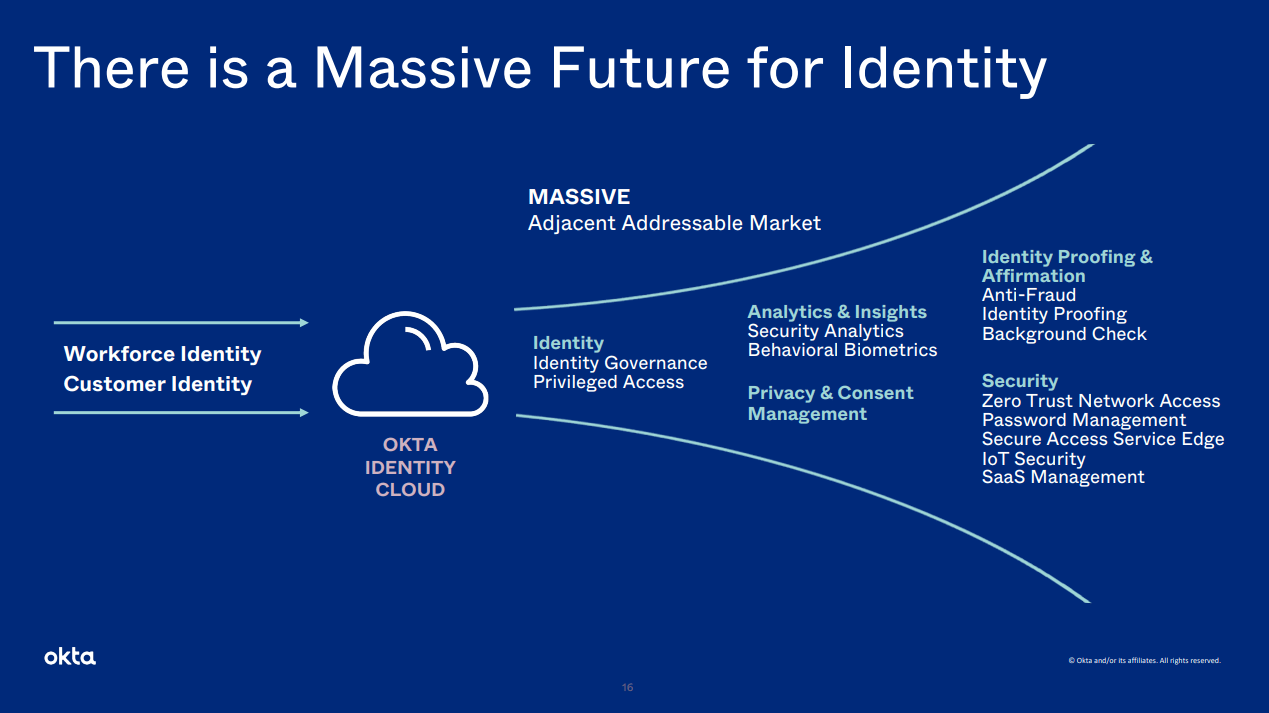

Massive Future for Identity (Q4 2022 Earnings Call Presentation)

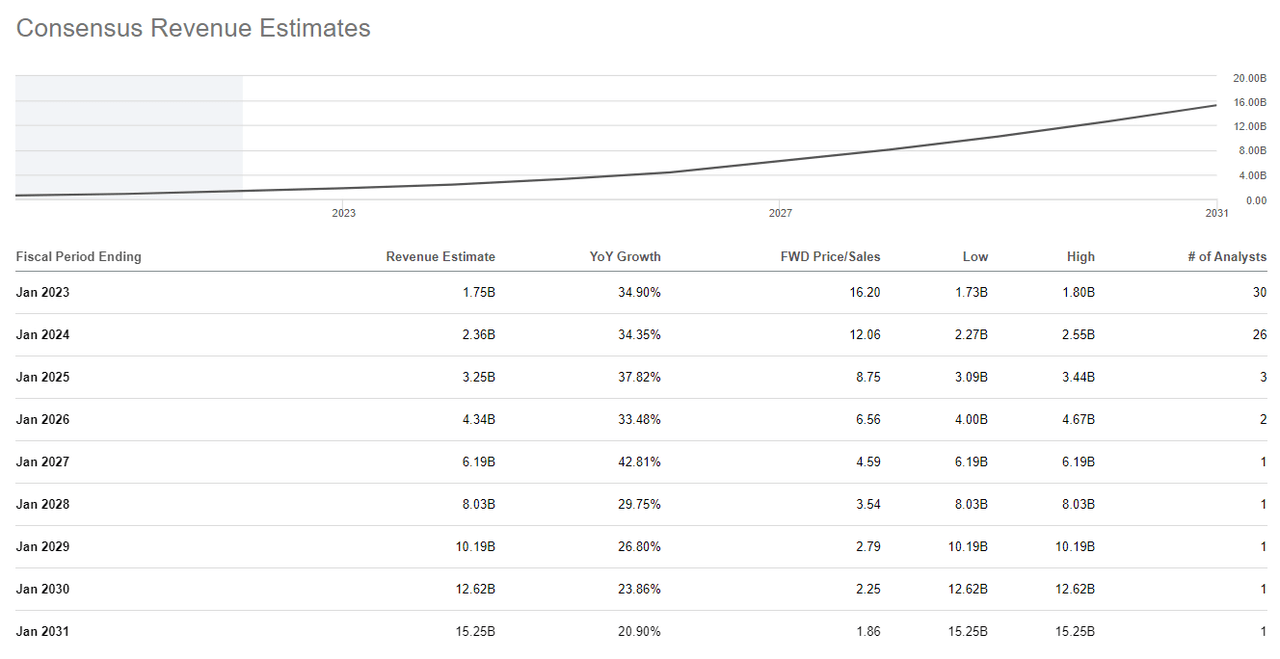

One value-adding catalyst for OKTA is the strong conviction of its management about its long-term outlook for the company with its 20% free cash flow margin and another record breaking $4 billion mark on its revenue for the year 2026. Their aggressive sales and marketing investment today is set to snowball in the future even after its 2026 goal, as shown in the image below.

OKTA: Consensus Revenue Estimates (SeekingAlpha.com)

Working On Its Present Time

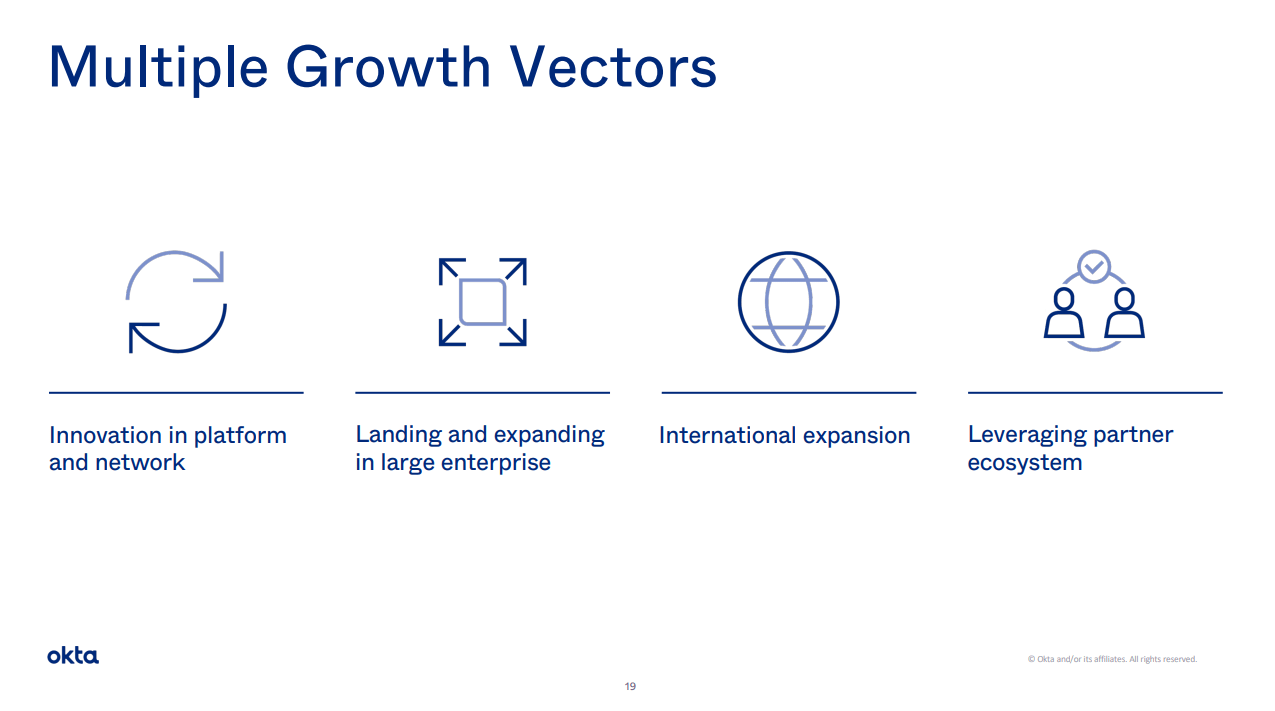

Multiple Growth Vectors (Q4 2022 Earnings Call Presentation)

OKTA unlocks multiple growth vectors in an expensive way, which is not bad in my opinion, as they are securing market share and penetrating their identified $80 billion TAM. The company successfully acquired additional large customers in Q4 2022 and as of today, OKTA added 72 customers with over $1 million ACV, bringing the total to 197 customers, up 58% from 125 customers in 2021. On top of that, OKTA generated a whopping 62% YOY growth in its customers with ACV above $500,000 to 597 this year compared to 369 in 2021.

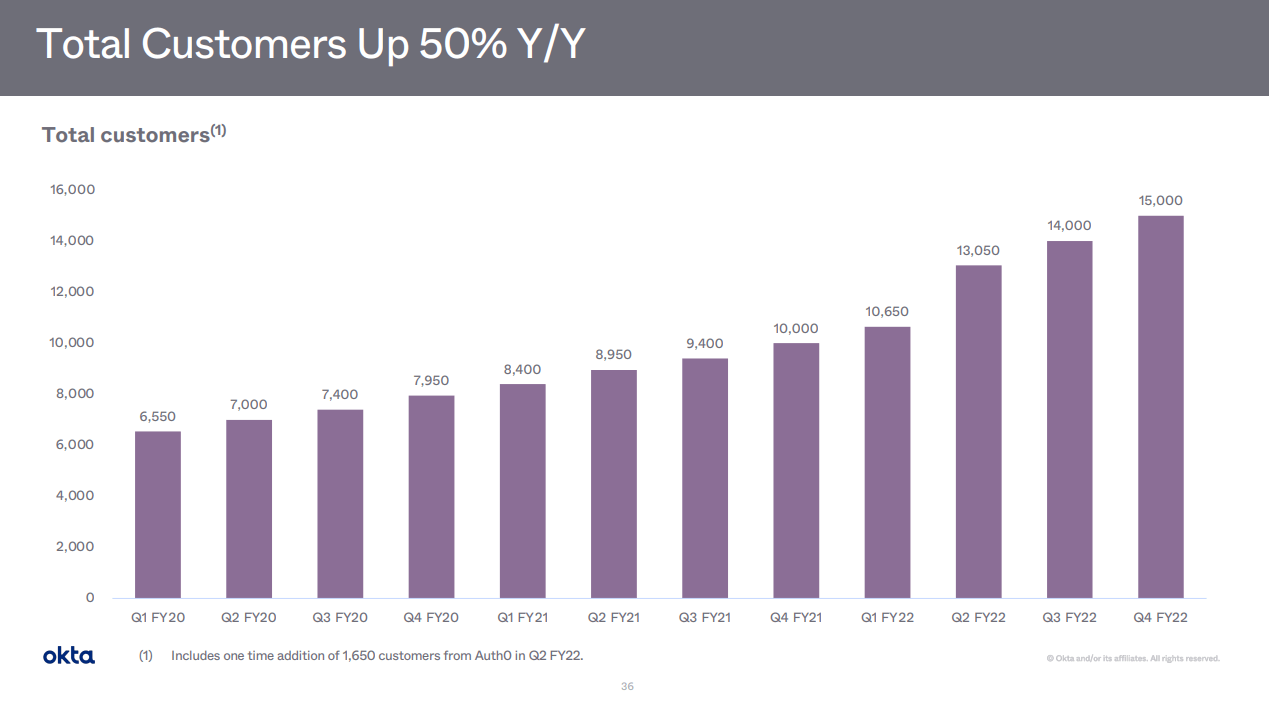

Aside from that, it has grown its total customer count to over 15,000 which is up by 50% compared to over 10,000 last year. On a quarter over quarter basis, we can see a slowdown from its Q2 2022 which generated a 22% QoQ growth and flat 7% in both Q3 and Q4 2022.

Growth in Customer Base (Q4 2022 Earnings Call Presentation)

This might be a red flag to see a slower growth, however, in my opinion the demand for identity management will likely continue to increase at a slower pace than its Q2 2022 as security concerns continue to manifest. This is especially true with the ongoing conflict between Ukraine and Russia where cyber security is one of the highlighted concerns, which may bring more awareness towards a secured and connected workforce.

On the brighter side, OKTA boasted a 59% YoY improvement for its customers with ACV above $100,000 this year to 3,100 customers. OKTA also managed to grow its employee count this year to over 5,030 employees globally, up 79% than last year, helping the company expand outside the US. According to the management, it generated a whopping 119% YoY growth in its international revenue this year. This aggressive hiring ended OKTA’s free cash flow margin of 6.7% this year, down significantly when compared to 13.3% last year. To sum it up, today’s deteriorating free cash flow margin and operating margin is not because of operational inefficiency but rather due to the aggressive expansion which may benefit the company in the long run.

OKTA and Its Peers

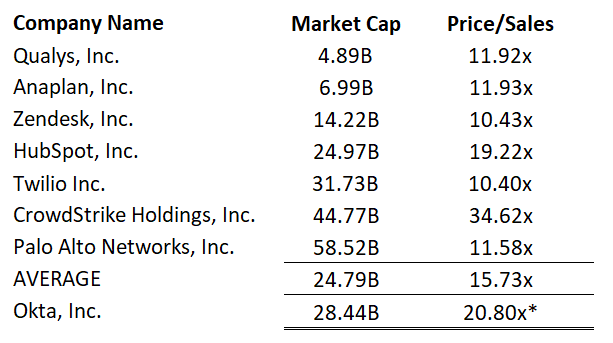

OKTA: Relative Valuation (Data from Seeking Alpha, Prepared by InvestOhTrader, *Estimated Figure)

By looking solely at its trailing P/S of 20.80x compared to its peers’ average of 15.73x, we can easily conclude that OKTA is overvalued. However, taking a closer look at its growing TAM and its historic 3 year P/S average of 29.08x, we can assume that OKTA is comparatively undervalued as of today. At a conservative $4 billion revenue in 2026, and 10% discount rate at an implied 15.73x P/S, we can arrive at a conservative intrinsic value of $237.41. Additionally, OKTA’s trailing P/S is relatively cheap compared to its forward P/S of 16.39x.

Potential Support at Its 200-Day SMA

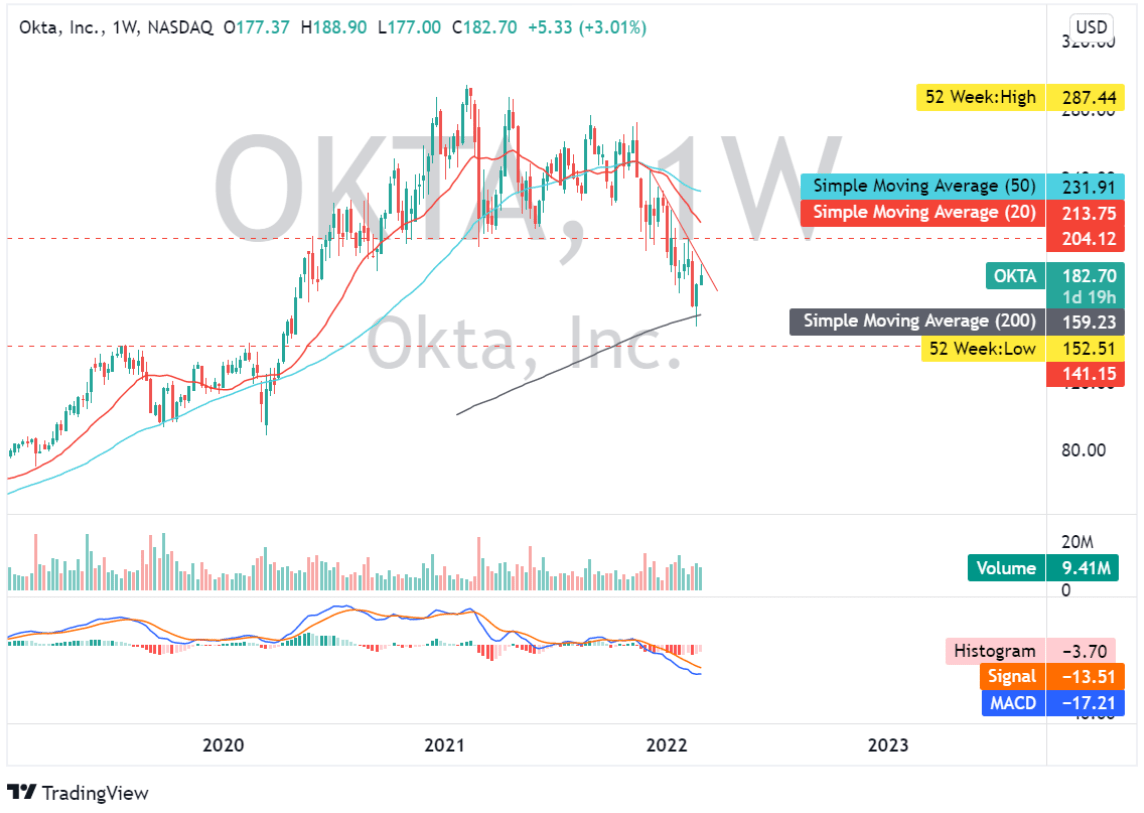

OKTA: Weekly Chart (TradingView.com)

OKTA bounced at its 200 day simple moving average, and is currently being rejected at $188 zone. It is logical that OKTA might experience a short term bearish sentiment, especially with the ongoing Russia-Ukraine war that may negatively affect global IT spending. Additionally, another bearish catalyst is its forecasted negative non-GAAP net loss per share of between $1.27 to $1.24 in 2023. A retest on its 200 day simple moving average and consolidation near its previous breakout point at the $141 zone will provide investors and traders a quality entry set-up. Its MACD indicator is still in a bearish zone, but shows some signs of potential bullish crossover in the next trading weeks.

Final Key Takeaways

OKTA’s outstanding top line growth and growing global footprint makes the company well prepared for its huge revenue forecast in the next few years. Another interesting catalyst about OKTA is its continuous improvement with its product portfolio. According to the management, after a successful beta test on their Okta Identity Governance, they are planning to formally launch it in North America by mid 2022 and globally at the end of the year. Additionally, OKTA remains liquid with $2,501.8 million in its total cash and short term investment, with an improving current ratio of 2.44x than last year of 2.13x and improving its current liabilities amounting to $1,242.8 million, where majority is attributable to growing deferred revenue of $973.28 million. Today’s weakness is temporary and is only due to its aggressive expansion, with a clear growth trajectory on its top line. OKTA is a good candidate for a buy on the dip play.

Thank you for reading and good luck this month everyone!

Be the first to comment