Justin Sullivan/Getty Images News

Investment Thesis

Visa Inc. (V) operates as a payments technology company that facilitates digital payments and processes transactions. Market trends towards cash digitization and new payment methods should ultimately favor Visa and drive future growth. Overall, I expect market performance for Visa:

- Visa reported substantial 24% YoY growth in revenue and maintains high operating margins around 70%, giving enviable profitability.

- Strong growth is expected, as Visa expands into emerging markets, benefits from new payment methods, and enjoys tailwinds from increasing cash digitization.

- Valuation has dropped from pandemic-level highs, making it more attractive to investors.

New Payment Approaches Offer Growth Opportunities

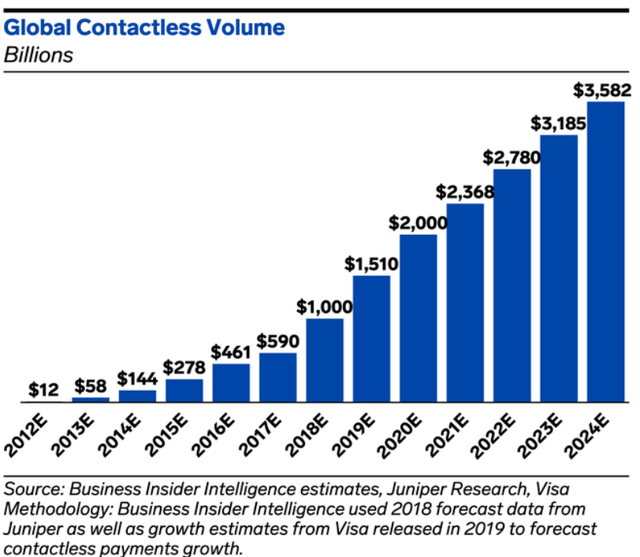

The past several years has brought widespread shifts in how people shop and pay for goods. For example, COVID accelerated the use of cash digitization through e-commerce and tap-to-pay or contactless payments for face-to-face transactions. Younger, tech-savvy customers are interested in digital wallet payments. There is tremendous recent growth in less traditional payment approaches, such as person-to-person transactions and Buy Now, Pay Later installment plans. Visa is well positioned to take advantage of these trends by offering a payment network with scale, security, and reputation.

Comfort with technology and digital payments is increasing. Younger tech-savvy purchasers are interested in mobile, digital wallet payments. Mobile point-of-sale (mPOS) payments are expected to increase 23.9% CAGR by 2024. Visa has partnered with a number of companies, offering Apple Pay, Google Pay, and Samsung Pay. Contactless and tap-to-pay is reaching 20% penetration within the US. These offerings may also ultimately help to accelerate cash digitization. Merchants do not need to invest in significant infrastructure, making these appealing and cost-effective solutions for smaller merchants or merchants in emerging markets. This also gives Visa an edge over other approaches, such as Block, that requires hardware. Visa reported growth across many regions, ranging from emerging markets such as Latin America and Africa, regions that are just starting to adopt more technological approaches such as India, and technological markets interested in digital wallets such as Japan.

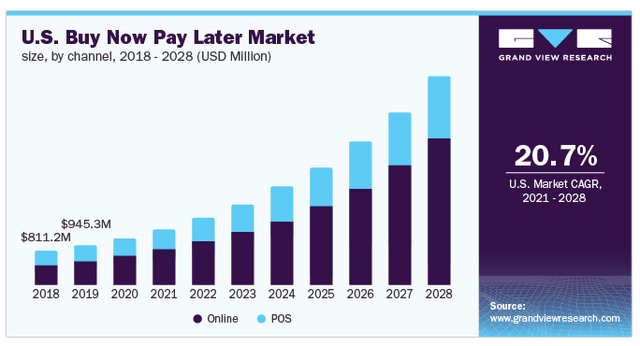

Visa is also taking advantage of the surging popularity of Buy Now, Pay Later (BNPL) options. Visa Installments allows financial institution clients to add BNPL on already approved credit lines. Visa also supports BNPL fintechs by offering virtual cards. They currently have partnerships with Afterpay, ChargeAfter, Klarna, Paidy, Sezzle, Splitit, and Zip. In their most recent earnings call, management reported triple digit volume growth in these payments. Rather than being displacing, Visa appears to be expanding into the sector to capture growth from a new type of lending. BNPL transactions are expected to expand by at least 20% annually through 2028.

Meanwhile, people are also increasingly using technology for personal payments and cross-border transactions. The person-to-person (P2P) market is expected to grow at least 12.1% CAGR to 2030. Visa offers Visa Direct in P2P, which saw 35% quarterly growth, and is actively looking to expand to other geographies and across borders. In December, Visa closed on their Currencycloud acquisition, which offers a real-time foreign exchange and a cross-border platform to transfer and manage multi-currency payments.

Excellent Profitability

Visa saw spectacular growth last quarter, with revenue increasing 24% YoY. Even more impressive, payment volume increased 26% relative to two years ago, and new cards increased 10% YoY in Q4 2021. Over the past 5 years, revenue has grown at a significant pace of 9.4% annually. Analysts expect strong continued growth in the range of 15% annually. Management is also optimistic about near-term prospects, due to increasing cross-border volume as borders reopen, as well as synergies with cash digitization and new payment methods.

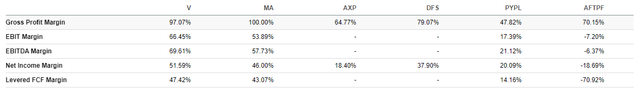

Operating margins are extremely high (69.6%) and well above peers such as Mastercard (NYSE:MA), American Express (NYSE:AXP), and Discover (NYSE:DFS). Metrics are far stronger than for the younger companies PayPal (NASDAQ:PYPL) and Afterpay (OTCPK:AFTPY). Visa generates significant cash, currently $15.9 B. The balance sheet does carry more debt than cash, with a net debt position of positive $5.0 B. However, current ratio (1.40x), quick ratio (1.07x), and covered ratio (33.13x) are higher than peers and indicate plenty of liquidity. Furthermore, their balance sheet gives them resources to add technology and acquire companies as necessary. It will be difficult for a fragmented fintech market to compete with the scale and resources that Visa brings to the table. Overall, Visa is in a good position to capitalize on shifting market trends and mainstream adoption of new payment types.

Profitability Metrics (seekingalpha.com)

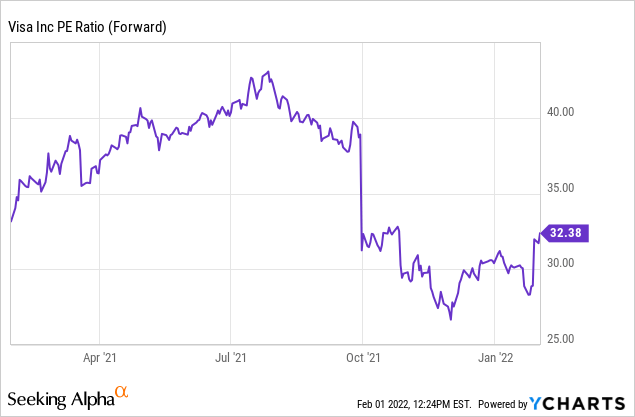

Valuation has Improved Relative to Pandemic Highs

The current valuation looks attractive relative to much of 2021. The positive earnings release last week pushed Forward PE upward somewhat, yet its current level still remains at a reasonable 32.4x. This is certainly lower than Mastercard’s Forward PE of 37.61x.

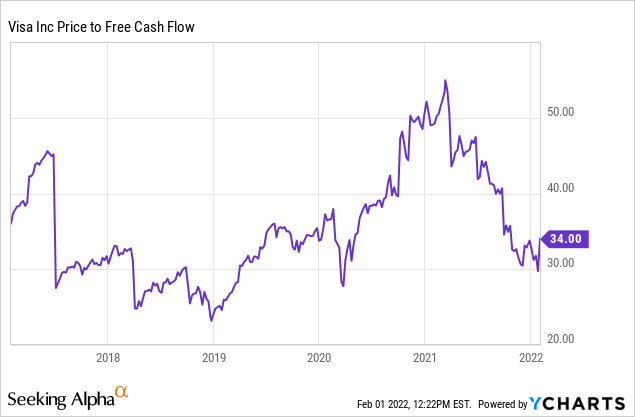

In terms of Price to Free Cash Flow, Visa has come off of its recent highs and is now around its pre-pandemic level. Again, while not necessarily cheap, it is certainly cheaper than it has been in most recent memory.

Intrinsic Value

I used a DCF model to estimate the intrinsic value. For the estimation, I utilized EBITDA ($17.7 B) as a cash flow proxy and current WACC of 7.5% as the discount rate. For the base case, I assumed EBITDA growth of 14.5% (Seeking Alpha estimate) for the next 5 years and zero growth afterwards (zero terminal growth). For the bullish and very bullish case, I assumed EBITDA growth of 19% and 24%, respectively, for the next 5 years and zero growth afterwards.

The estimation revealed that the current stock price commands a premium. Visa has tremendous profitability and strong growth prospects, so some premium certainly seems justified. However, much of this has already been priced into the stock and I expect market performance going forward.

|

Price Target |

Upside |

|

|

Base Case |

$173.80 |

-25% |

|

Bullish Case |

$209.70 |

-9% |

|

Very Bullish Case |

$251.80 |

9% |

The assumptions and data used for the price target estimation are summarized below:

- WACC: 7.5%

- EBITDA Growth Rate: 14% (Base Case), 19% (Bullish Case), 24% (Very Bullish Case)

- Current EBITDA: $17.7 B

- Current Stock Price: $231.21 (02/01/2022)

- Tax rate: 20%

Risks

The rise of new payment methods offers substantial growth prospects but certainly carry some uncertainties. BNPL and cryptocurrencies are likely to come under increasing levels of scrutiny as they evolve, with the regulation framework changing over time and possibly providing headwinds to growth. The Consumer Financial Protection Bureau launched a probe on BNPL in December. In general, while BNPL increases payment flexibility, the option is more prevalent amongst younger and lower income consumers. Roughly a third of payments result in default. These sorts of numbers are likely to attract increasing regulatory scrutiny and suggest some uncertainty about the long-term sustainability of growth in the sector.

Conclusions

Visa posted outstanding quarterly results with strong growth numbers. Increasing cash digitization and new payment methods are likely to drive growth going forward. The company combines outstanding profitability, decent 15% growth prospects, and a near pre-pandemic valuation. Investors looking to exit riskier growth securities may well be drawn to Visa. However, I believe much of the growth upside has already been priced into the stock. I expect market performance, which could be substantial given the sell-off in the past couple of months.

Be the first to comment