ti-ja/E+ via Getty Images

Chewy (NYSE:CHWY) is one of those companies that consumers just love. One proof of that is the incredibly high rating its apps have, with 4.8 stars in the Google Play Store and 4.9 stars in the Apple App Store. These are some of the highest ratings we have even encountered for a widely used app. To us, this signals strong product-market fit. Another sign that the customer has an excellent product-market fit is the increasing percentage of customers that are opting for the “auto-ship” feature, trusting the company with the delivery without having to manually place the order every time.

Financials

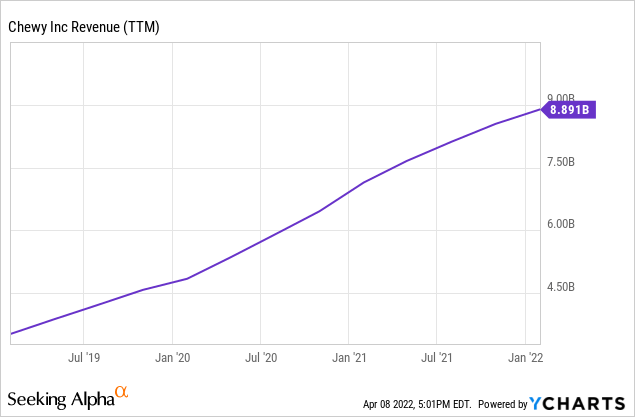

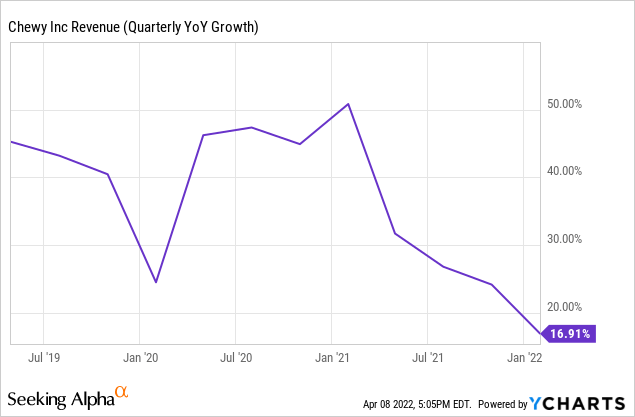

Chewy has been growing its revenue at breath-taking speed, almost doubling it in the last two years. It was helped by the pandemic and the corresponding surge in pet adoption, but even before that, it was already growing revenue at a very quick pace.

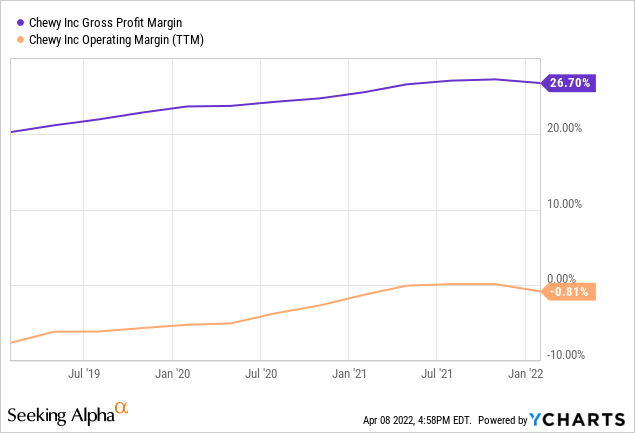

One common criticism of Chewy relates to its relatively low gross margins, which have tended to average ~25%, even if they have generally increased in the last three years. At least something we see is that the company is displaying operating leverage, with improving operating margins as sales increase. There are many fast growing technology companies that do not display operating leverage, and that is a red flag to us. If Chewy can make modest improvements to its gross margin, and continue delivering operating leverage as revenue increases, then we believe the company is not that far from being sustainably profitable.

Near term gross margin pressures likely peaked in Q4 of 2021. Fourth-quarter 2021 gross margin declined 170 basis points to 25.4 percent. The main drivers of this were fourth-quarter pricing lagging cost inflation and higher inbound freight costs.

The company reports in its Q4 FY21 shareholder letter that in February 2022, the first month of its first quarter, they saw a sequential improvement in gross margin. We therefore believe that one of the main investor concerns regarding lower margins seems to be resolving itself. The other main concern is decelerating growth, which we will show further in the article.

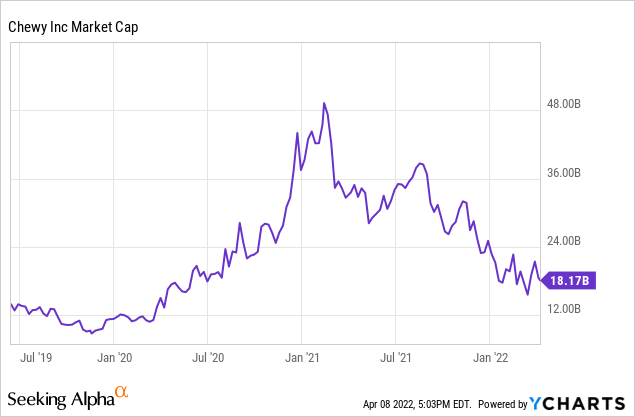

Below we show the market cap of Chewy, to keep in mind when we discuss the valuation. The current market cap at ~$18 billion is about 2x TTM revenues, which might sound cheap in many industries, but we think Chewy is more similar to a low-margin retailer and should therefore trade closer to 1x revenue.

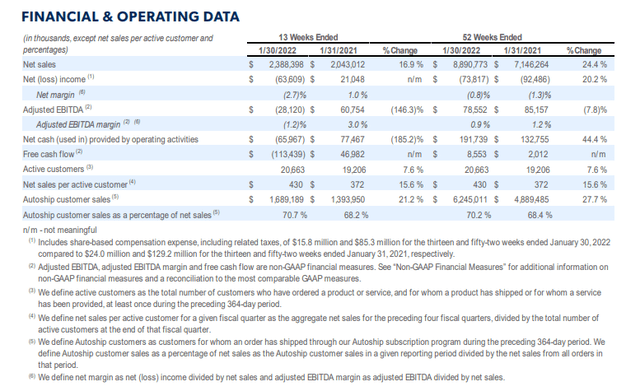

Below we share the key financial and operating statistics for Chewy, taken from the Q4 FY21 shareholder’s letter. As can be seen, the company is operating very close to break-even profitability. Even the more optimistic adjusted EBITDA margin is not very high at all.

There are however some positive operating statistic that we would like to highlight, such as the increasing sales per active customer. This went from $372 in 2021 to $430 in 2022. Another positive statistic is the increase in the percentage of customer sales from “autoship”, which increased from 68.2% in 2021 to 70.2% in 2022.

Target Addressable Market

The company believes its addressable market today is ~$120 billion, which should give it a nice growth runway. This is probably one of the best arguments in favor of expecting growth rates to re-accelerate moving forward. This is what the company has to say about its TAM and its growth in its most recent shareholder letter:

In many ways, we are just getting started. We compete in a $120 billion total addressable market (TAM) today that is expected to grow rapidly over the next five years, and within that broader pet TAM, e-commerce sales are expected to grow even faster. We believe that Chewy will continue to be a strong beneficiary of these secular tailwinds, as we continue to deliver a superior customer experience as the most trusted and convenient destination for pet parents and partners everywhere.

Valuation

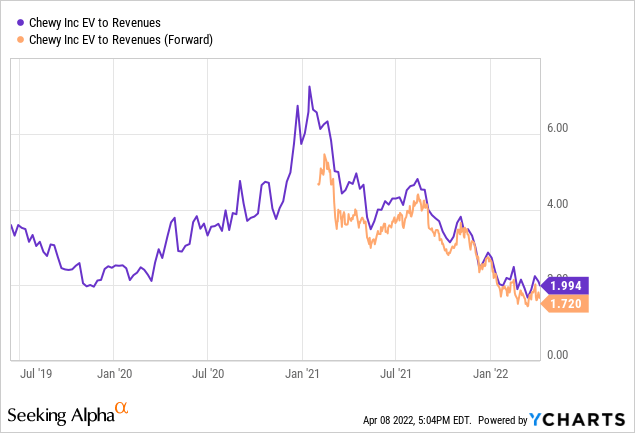

Measured by EV/Revenues multiple, shares are close to the cheapest they’ve ever been. However, as we previously mentioned, we believe that Chewy is really a retailer even if it makes use of a lot of technology and apps. And as a retailer, almost 2x revenue is still expensive, unless the company can re-accelerate revenue growth to impressive levels again.

As seen in the graph below, revenue growth has significantly decelerated. At one point, it was exceeding 50%, but now it is below 20%. Together with the margin deterioration, these are the two issues that we believe have made investors push shares down.

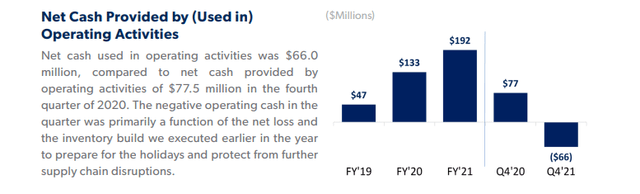

The combination of decreasing margins and reduced growth made net cash provided by operating activities come out negative in Q4 FY21. However, even in an excellent year like FY21, it was only $192 million. At the current market cap of ~$18 billion, the multiple to this level of operating cash flow is ~90x. We believe this is extremely expensive, especially now that the hyper-growth phase appears to be over.

Conclusion

Chewy is an interesting company that appears to be delighting its customers and has reached an excellent product-market fit. In addition, some operational statistics like average sales per customer and the percentage of customers on autoship are trending in the right direction. We also like that the company has displayed operating leverage, which makes us think that sustainable profitability is not too far away in the future.

That said, we believe that the company is still valued more like a technology company than a retailer, and we are not ready to pay 2x sales for it, unless revenue growth significantly re-accelerates.

Be the first to comment