AsiaVision

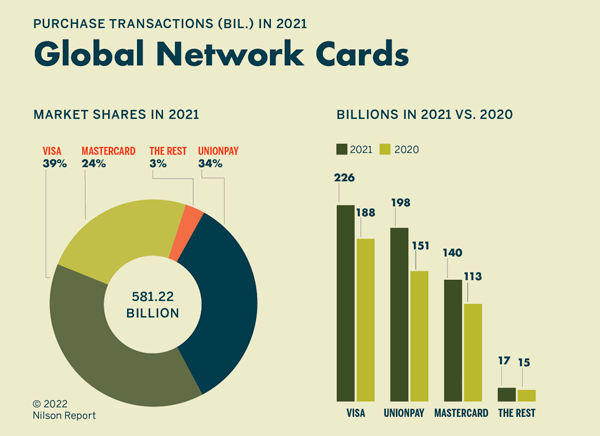

Visa (NYSE:V) and Mastercard (NYSE:MA) are the definition of high margin duopolies. The two companies have dominant positions in global cashless payments, with Visa commanding a 39% market share of transaction volumes and Mastercard having a 24% (Figure 1). Although UnionPay is listed as having 34% market share, most of that are transactions within China.

Figure 1 – Global Network Cards Market Share (Nilson Report)

Recently, I came across an article in the Economist discussing the duopoly:

America is home to the heftiest interchange fees of any major economy – costs are an order of magnitude greater than in Europe and China. That largely benefits two firms: Visa and Mastercard, which facilitate more than three-quarters of the country’s credit-card transactions. Doing so has made them two of the most profitable companies in the world, with net margins last year of 51% and 46% respectively.

The shift to a cashless society has benefited the two firms greatly, particularly in the last few years due to rise of online shopping and the COVID-19 pandemic. According to the Economist article, the use of credit and debit cards in transactions reached 57% in 2021, up 12 pts from 45% in 2016.

The Economist article also goes on to broadly define two major threats to Visa and Mastercard: regulation and competition.

This purpose of this article is to discuss these two threats and the potential downside to Visa and Mastercard’s valuation from these threats.

Increasing Regulatory Scrutiny

First, on the regulatory front, Senator Richard Durbin has recently introduced the Credit Card Competition Act (“CCCA”), which attempts to increase competition by stipulating that banks must offer merchants at least two card networks to process each transaction, and the two networks must not be Visa and Mastercard together. In theory, this allows smaller competitors such as American Express (AXP) or Discover (DFS) to compete, and potentially offer lower network and interchange fees.

Reaction to the proposed law has so far been mixed. Merchants support the proposal, as it will mean potentially lower transaction fees, which is often one of the largest costs of doing business. The Food Industry Association (“FMI”) notes that interchange fees cost the average American family $900 per year, as merchants have to pass on the cost to customers. On the other hand, consumer banking groups are against the law, citing a potential reduction in credit card rewards and network security, as presumably, the companies will have less incentive and funding to maintain these rewards and upkeep.

Taking a step back, we should ask the basic question – how credible is this threat?

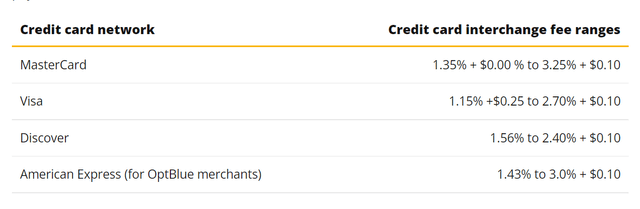

According to valuepenguin (a consumer finance website sponsored by Lendingtree), interchange fees are broadly comparable between the 4 networks (Figure 2). Of course, interchange fees are highly complex, and depending on the merchant category and customer rewards level, one network can be more expensive than another. However, it’s not a given that mandating two network processing will lower interchange and network fees.

Figure 2 – Comparison of interchange fees (valuepenguin.com)

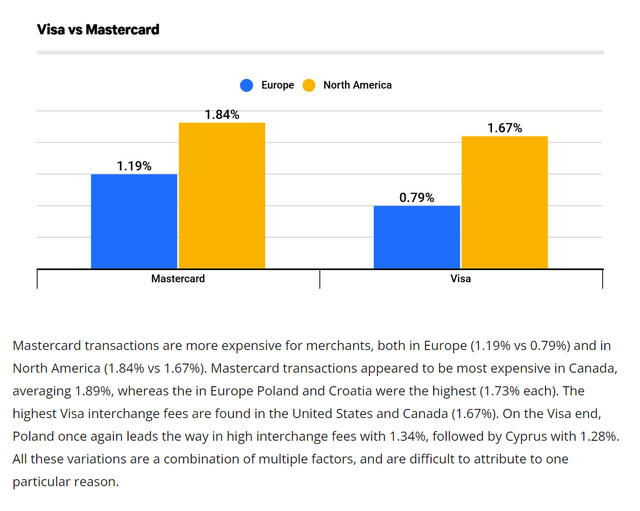

What investors should focus on is the fact that North America has some of the highest interbank fees in the world. The average American interchange fee is 1.73%, while Canada is worse at 1.74%. The compares to the global average interchange fee of 0.99%. Even within the same network, North Americans pay much higher interchange fees (Figure 3).

Figure 3 – Europe vs. North American interchange fees (valuepenguin.com)

While the CCCA by itself may not increase competition and decrease interchange fee rate, it could just be the opening salvo to increased regulatory scrutiny and regulations. Senator Durbin, the chief sponsor of CCCA, was also the main sponsor of the Durbin Amendment that capped American debit card fees. I’m sure if the CCCA is not able to lower interchange fees, Senator Durbin will likely look at other measures to reduce them. For context, France has the lowest average interchange fee rate of 0.22% due to government regulation from the European Commission.

Disruption From New Entrants

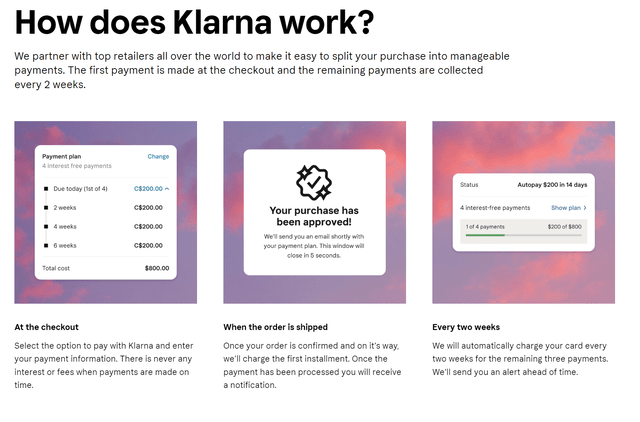

In addition to increased regulatory scrutiny, Visa and Mastercard are facing increased competition from fintech Buy Now Pay Later (“BNPL”) startups such as Klarna and Affirm that are disrupting the payments industry. Klarna works by allowing consumers to make purchases upfront and pay for the purchase directly from their bank accounts (Figure 4). This sidesteps the crucial card networks operated by Visa and Mastercard.

Figure 4 – Klarna Business Model (Klarna website)

BNPL startups have grown like wildfire in the past few years. Klarna was started in 2005, and today boasts over 2 million daily transactions and 147 million active customers. These fintech startups are funded by deep pocketed venture capitalists that don’t care about near-term profitability. Even Mastercard and Visa have begun experimenting with BNPL. How long before the BNPL movement will begin impacting the duopoly’s interchange fees?

Reduction In Margin Could Have Double Impact To Valuation

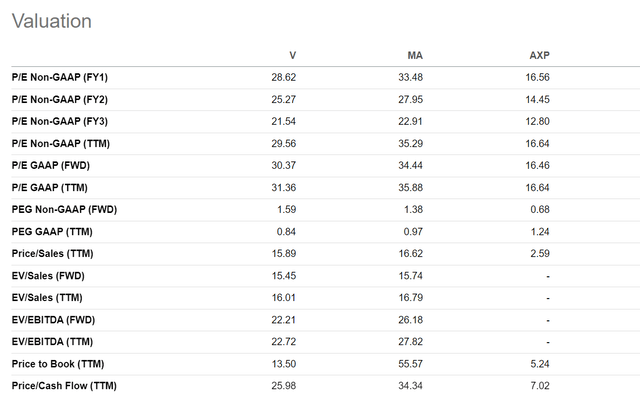

Currently, investors value V and MA at 28.6x and 33.5x forward P/E respectively (Figure 5). It appears MA has a higher multiple because it has a higher 3-yr revenue and EPS growth rate than V.

Figure 5 – V, MA, and AXP valuations (Seeking Alpha)

If interchange fees and net margins do compress for Visa and Mastercard, we can also expect a serious compression in the two companies’ valuation multiple as well.

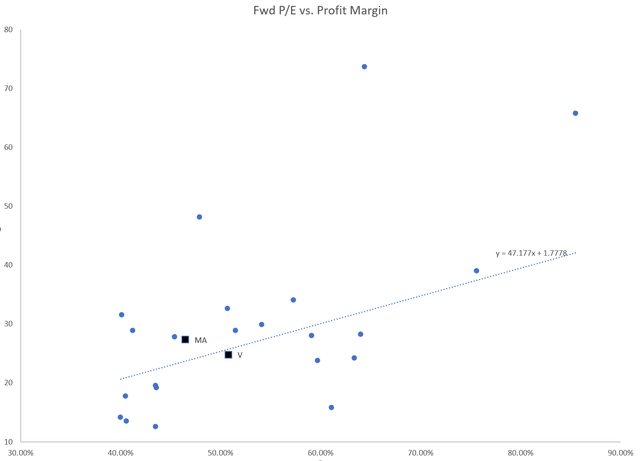

Figure 6 plots Forward P/E multiple vs. net profit margin for some of the largest non-cyclical companies (excluding banks and oil and gas companies) in the U.S. As we can see, there is a clear correlation between higher margins and higher P/Es.

Figure 6 – Fwd P/E vs. Profit Margins (Author created with data form finviz.com)

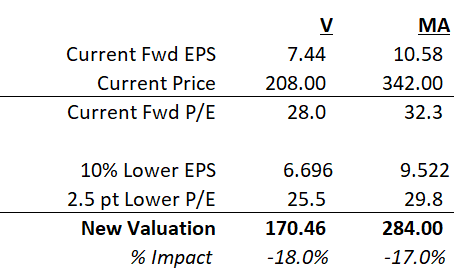

From a regression analysis on the dataset, every 2% change in net margin is worth about 1 P/E multiple point. Assuming profitability decreases by 10% for Visa and Mastercard from increased competition and regulation (from 51% and 47% to 46% and 42% respectively), we should expect a 2.5 pt compression in the valuation multiple for V and MA. Based on current 2022 expected EPS of $7.44 and 10.58 respectively, the valuation downside could be up to 18%.

Figure 7 – Stock downside from 10% lower profit margins (Author created)

Ofcourse, this downside scenario will take time to play out, but investors should be mindful that high valuation multiples can compress in a very short period of time.

Conclusion

Although Visa and Mastercard still have fantastic moats around their core card network businesses, there are potential storm clouds on the horizon. The extraordinary profit margins of the two firms may come under attack from regulations and fintech startups. Investors of V and MA are highly encouraged to monitor developments on the CCCA bill, as well as progress of the BNPL startups.

Be the first to comment