piranka

Many Americans here have been struggling with the persistently high inflation that has been plaguing our economy for the past year or two. This situation has forced many people to take on a second job or find other ways to obtain extra money in order to keep the bills paid and food on the table. Fortunately, as investors, we have other methods that we can use in order to obtain the money that we need to support our daily requirements. One of the best of these methods is to invest in a closed-end fund that focuses on income. These funds provide easy access to a diversified portfolio run by professionals that are able to use a variety of strategies in order to produce a higher yield than pretty much anything else in the market. In this article, we will discuss the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (NYSE:ETW), which is one fund that can be used for this purpose. The fact that the fund can be a good source of income is evidenced by its distribution yield, which is 8.48% as of the time of writing. I have discussed this fund before, but more than a year has passed since that time so obviously, a great many things have changed. This article will focus specifically on these changes as well as provide an updated analysis of the fund’s finances in an effort to determine if it could be a good addition to your portfolio today.

About The Fund

According to the fund’s webpage, the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund has the stated objective of providing its investors with current income and gains. This is the sort of thing that we expect out of an income fund as it tends to result in the fund paying out a lot of money in distributions, which we will discuss later in this article. The strategy that the fund uses to achieve this objective is a bit more unusual, however. In short, the fund invests its assets into various common stocks and then writes call options against one or more domestic or foreign indices. The objective is to have the option expire worthless so that the fund can keep the premium that was paid for the option and then repeat the process. Admittedly, it is quite difficult to see how this strategy varies from Eaton Vance’s other option income funds. It is also important to note that these are not covered calls as the fund does not actually own any of the indices that it is writing options against. This is something that could expose the fund to a significant amount of risk.

The biggest risk with option strategies arises when a call option writer does not own the asset that the call is written against. That is because, should the option be exercised, the call writer will have to go out into the market and purchase the assets that the option is written against. As stocks, indices, and similar things can theoretically have unlimited upside, the option writer could conceivably have unlimited losses when the asset is forced to be sold to whoever purchased the option. That is unfortunately the strategy that this fund is using since as already mentioned, it does not actually own an index. In order to avoid this, management has constructed a portfolio that they hope will perform similarly to the index against which the fund is written. There is no guarantee that this will be the case, however. In addition, the fund will attempt to buy back the option if the potential losses get too large but again there is no way to guarantee that this will be possible. This is something that will likely be concerning to risk-averse investors and rightly so. Admittedly, the fund has yet to have this strategy result in enormous losses but the risk is still there.

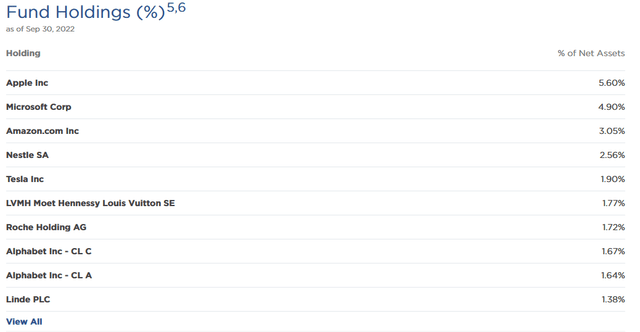

The largest positions in this fund are certainly not what we would expect to see in an income fund. Here they are:

This is a very unusual portfolio for a fund like this because of the high concentration of assets in companies that pay no dividends. We see here positions in Amazon (AMZN), Tesla (TSLA), and Alphabet (GOOGL) (GOOG) all have no dividends. In addition, Apple (AAPL) and Microsoft (MSFT) have such a low yield that they may as well be non-dividend stocks. The fund is sacrificing a substantial amount of income by having these companies in the portfolio as opposed to something with a dividend. With that said though, the fund also stated that it has an objective of earning capital gains, and all of these stocks were reasonably reliable sources of capital gains over the past decade. However, all of that has changed now. In fact, all of these stocks have significantly underperformed the S&P 500 year-to-date:

|

Company |

Year-to-Date Performance |

|

Apple |

-18.25% |

|

Microsoft |

-27.79% |

|

Amazon |

-43.01% |

|

Tesla |

-53.26% |

|

Alphabet |

-31.46% |

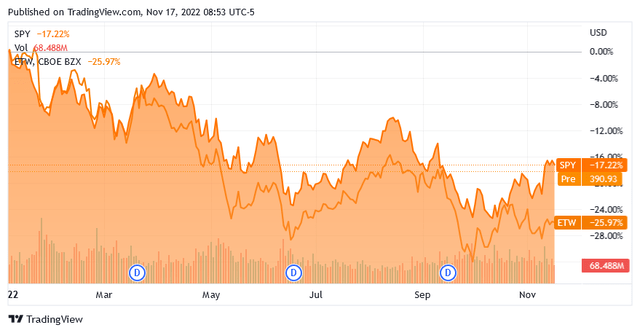

For reference purposes, the S&P 500 index (SPY) is only down 17.22% year-to-date so Apple is the only one of these stocks that came anywhere close to beating the market. Unfortunately, it does not seem likely that any of these stocks will see an improvement in performance in the near future. One of the reasons that have been cited for the disappointing performance of the stock market this year is the Federal Reserve’s interest rate hikes. Basically, the “free money” economy that has been going on for the past fourteen years has come to an end. It does not seem particularly likely that the Federal Reserve will change its policy anytime soon as inflation is still well above its target level. In fact, the current consensus among economists and analysts is that the federal funds rate will be above 5% by the end of 2023. This does not bode well for any of these companies, which is clearly indicated by the layoffs that we have been seeing across the sector.

The fund’s large allocation to underperforming technology stocks is likely why it has underperformed the S&P 500 year-to-date:

The Eaton Vance fund’s distribution does admittedly help even things out somewhat, though. However, the fund would certainly do better with a portfolio that is not so heavily weighted to a handful of stocks that were darlings of the free-money era that are now likely to underperform for quite some time.

There have been remarkably few changes to the fund since the last time that we looked at it. In fact, other than some weightings changing significantly, the only changes to the top ten holdings list are that Facebook (META) and ASML Holding (ASML) were replaced by Tesla and Linde PLC (LIN). This may lead some readers to believe that the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund has a very low turnover. This is indeed the case as the fund’s annual turnover is only 3.00%. This is the lowest turnover that I have ever seen in an actively-managed closed-end fund and in fact, it rivals some index funds. This is something that is somewhat nice to see because a high turnover is a drag on a fund’s performance. After all, trading stocks or other assets costs money, which is billed to the investors in a fund. Thus, management must work to both cover these expenses as well as still generate a sufficient return to keep the shareholders happy. This is why index funds have become so popular since their low expenses and minimal trading allow more of the assets’ return to make its way to the shareholders. However, management of the Eaton Vance fund does not appear to have much of a hurdle to overcome since the fund’s annual turnover is remarkably low as it is.

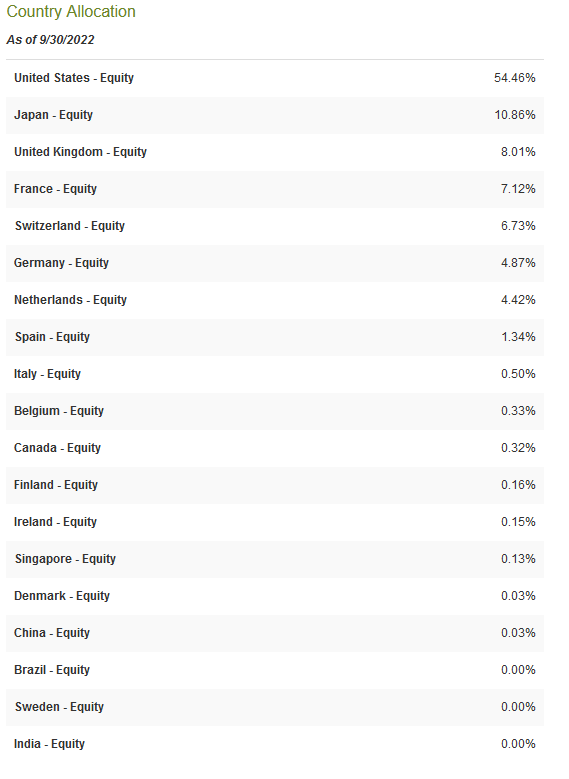

One other thing that we notice by looking at the largest positions list is that four of the ten positions are foreign companies. As already stated, this is a global fund but that will almost certainly lead a number of people to think that the fund’s American exposure is fairly low. However, 54.46% of the fund’s assets are invested in American companies:

CEF Connect

The United States only accounts for just under a quarter of the global gross domestic product so the fund is overweighted to this nation relative to its actual representation in the global economy. This is not uncommon for a global fund though and in fact, this one is not nearly as bad as some other global funds. We frequently see global funds possess a 60% to 70% exposure to the United States so this one is more balanced than most. However, it is still important to include a large non-American fund in a portfolio in order to achieve sufficient international diversification across your entire portfolio.

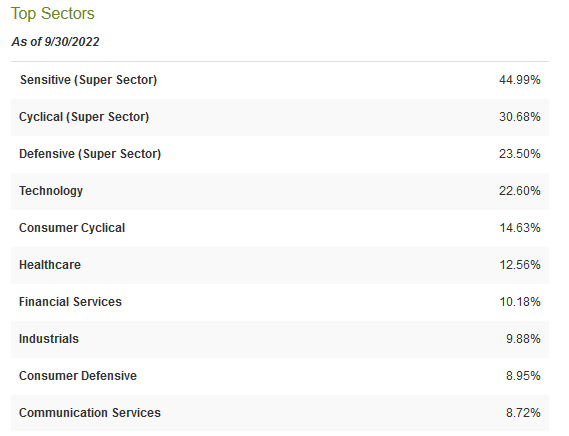

The fund’s diversification across sectors is not particularly good, however. As we can see, the fund’s weighting towards technology is 22.60%, which is much more than any other sector:

CEF Connect

Interestingly, we see no exposure to the energy sector here, which is another strike against the fund’s portfolio. Energy is the only sector that has delivered a positive return year-to-date and it also boasts some of the highest yields available in the market. The fact that an income-focused fund would exclude this is confusing, to say the least. This is especially true as energy is likely to outperform next year as well. The higher returns would help ensure that the call options that the fund is writing will not pose an outsized risk to the fund. Overall, it is very confusing why management is opting for the fund’s current portfolio as opposed to changing it to adapt to the new reality in the markets.

Distribution Analysis

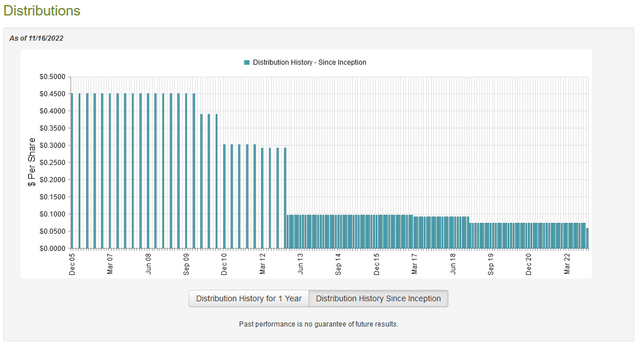

As stated in the introduction, the primary objective of the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund is to provide investors with a high level of current income and gains. As such, we might assume that the fund would boast a very high distribution yield. This is indeed the case as the fund pays out a monthly distribution of $0.0582 per share ($0.6984 per share annually), which gives it an 8.48% yield at the current price. Unfortunately, the fund has not been particularly consistent about this payout over the years. In fact, it has steadily cut the distribution including for the most recent month:

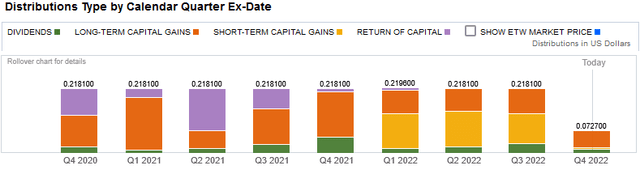

The fact that the fund has steadily decreased its distribution over time is unlikely to appeal to those investors that are seeking a stable and secure source of income with which to pay their bills and help support their lifestyles. The fact that the fund just recently had to cut its distribution again is quite likely because of the flawed portfolio that it has been running all year since that exposed the fund to significant losses. Fortunately, the fund’s recent distributions have been largely classified as capital gains and dividend income, although it did have quite a bit of return of capital last year:

The return of capital distributions may be concerning because that can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any sort of extended period. With that said, the fund apparently is not having this problem this year but it is possible that these distributions could be classified incorrectly. A return of capital distribution could also result from the distribution of unrealized capital gains or the distribution of money received from certain options strategies so this also does not mean that the fund is doing anything unsustainable. As such, it is important for us to look at exactly how the fund is financing its distributions in order to determine how sustainable they are likely to be.

Fortunately, we have a fairly recent report to consult for that purpose. The Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it will provide us with a great deal of insight into the fund’s performance during the somewhat choppy market that we saw in the first half of this year. This is also, naturally, a much more recent report than we had available the last time that we looked at the fund. During the six-month period, the fund received a total of $13,361,248 in dividends from the assets in its portfolio. It paid its expenses out of this amount, leaving it with $7,542,089 available for investors. This was nowhere close to enough to cover the $47,693,456 that the fund actually paid out during the period. This likely looks somewhat concerning at first glance.

However, the fund does have other methods that it can use to obtain the money that it needs to cover the distribution. The most prominent of these is capital gains but the fund failed miserably at this during the half-year period. It had net realized gains of $61,602,576 during the period but this was more than offset by $266,187,454 in net unrealized losses. Overall, the fund’s assets declined by $238,421,824 even after accounting for all inflows and outflows. Thus, it failed to overall cover its distributions. With that said, the fund did have sufficient income and net realized gains to cover the distribution but the declining asset base makes it harder for it to continue to generate that level of gains. This likely is the reason for the distribution cut.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on those assets. In the case of a closed-end fund like the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund, the usual way to value it is by looking at the fund’s net asset value. The net asset value of a fund is the total current market value of all the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to buy shares of a fund when we can acquire them for a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. This is indeed the case with this fund right now. As of November 16, 2022 (the most recent date for which data is currently available), the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund had a net asset value of $8.55 per share but the shares actually trade for $8.22 per share. This gives the fund a discount of 3.86% at the current price. This is certainly a more attractive valuation than the 1.10% premium that the shares have had on average over the past month so the price certainly looks quite attractive today.

Conclusion

In conclusion, the Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund has long been a fairly popular way for investors to generate a high level of income from their portfolios. Unfortunately, the fund’s own portfolio is not especially good for today’s market as it is loaded with companies that appear likely to underperform the market. This has resulted in the fund suffering heavy losses over the past year that ultimately resulted in it underperforming the market and cutting its distribution. The international diversification and price are certainly nice here but until the fund better aligns its portfolio with the current market, it is probably best to sit on the sidelines.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment