MF3d

The Virtus Artificial Intelligence & Technology Opportunities Fund (NYSE:AIO) is a closed-end fund that uses leverage in a highly-speculative niche of the global stock and bond markets. Rising interest rates not only cause issues with steeper borrowing costs for the AIO management team, but the fund’s high-duration assets suffer likewise. Finally, the CEF’s hybrid and fixed-income positions are also hurt by higher yields. But is enough bearish news now priced in? Let’s dive into AIO.

According to Virtus Investment Partners, AIO seeks to generate a stable income stream and growth of capital by focusing on one of the most significant long-term secular growth opportunities in markets today. The fund invests in a combination of securities issued by artificial intelligence companies and in other companies that stand to benefit from artificial intelligence and other technology opportunities.

As of October 31, 2022, AIO had net assets under management of $662.4 million with $130 million debt for a total managed assets figure of $792.4 million. The CEF pays a monthly dividend with a current market price distribution rate of 10.94% while its NAV distribution rate is 9.33%. It has a steady $0.15 per month dividend this year. Importantly, the fund has a very high 1.74% net expense ratio, so I would rather go for cheaper thematic ETFs.

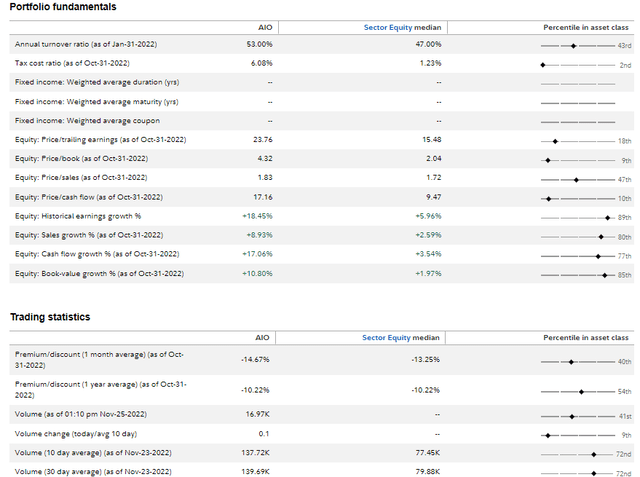

Its equity trailing 12-month price-to-earnings ratio is high at 23.4, though its earnings growth is solid. From a trading point of view, the average volume is low at under 140,000 shares, on average.

AIO: Portfolio Fundamentals & Trading Statistics

The reason AIO has such a high annual expense figure is that it actively buys and sells several types of securities on leverage. Convertible bonds and high-yield debt are often illiquid at times, particularly during market turmoil and volatility.

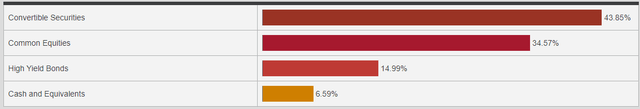

AIO: A Hybrid CEF

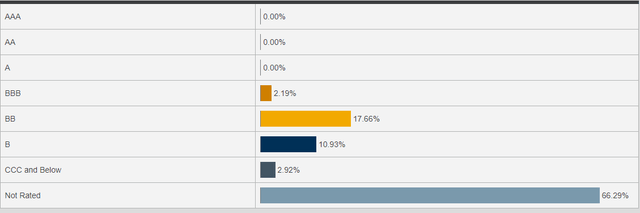

Prospective investors should also recognize that the debt piece of AIO’s portfolio appears quite speculative, so there is little ballast from the bond part of the fund.

Bond Allocation: Low-Grade Debt

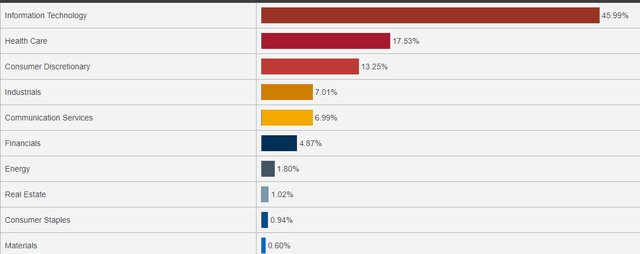

AIO’s top holdings are household blue-chip names such as UnitedHealth Group (UNH), Deere & Co (DE), McDonald’s (MCD), and Microsoft (MSFT). But the top 10 positions also include other aggressive tech wagers. In all, rate-sensitive Information Technology sector equity and credit make up a high 46% of AIO. Overall, this area should do well if we see a drop in interest rates, but global growth risks could further hurt tech.

A Tech-Heavy Portfolio

The Technical Take

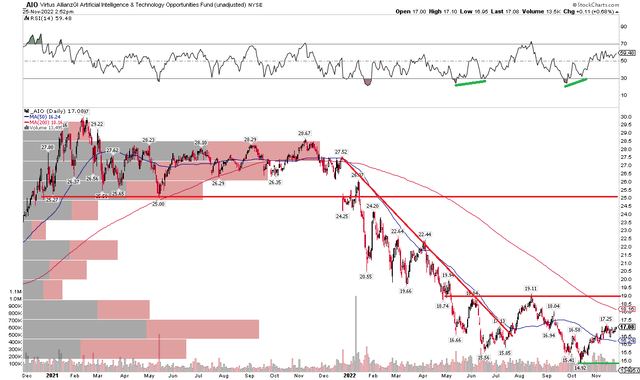

AIO began to turn lower a year ago when so many speculative and high-duration assets petered out. By the time the S&P 500 notched its lone 2022 all-time high, the CEF was already in its drawdown. Key support near $25 was broken, and the downtrend did not let up until the broad market’s low in June (when the bond market also hit a short-term bottom). The June nadir came on bullish RSI divergence, though, and the fund staged an impressive summer rally. Those near-term gains evaporated, however, and AIO notched a new year-to-date low in October, but that, too, hit with bullish RSI divergence.

Now here we are at $17 – between the 50-day moving average and the falling 200-day moving average. I see near-term resistance at $19 – the August peak and near the early June rebound high. If the fund can climb above that, there actually isn’t a whole lot stopping it in terms of overhead supply to get back to the $25 price point. I would get long shares on a close above $19. It is a hold until then, though. For those who are currently long, I’d have a sell-stop order under the $14.92 October low.

AIO: Shares Putting In A Bottom, Eyeing Upside Targets

The Bottom Line

This AI fund, which invests in convertibles, common equity, and high-yield debt, is an aggressive way to go for yield. The fund’s high expense ratio, like many closed-end funds that employ leverage, is a key concern in my eye. I like how the downtrend appears to have broken, but the chart still has work to do technically, and I remain skeptical from a fundamental/cost perspective.

Be the first to comment