Igor Kutyaev/iStock via Getty Images

Overview

Virtu Financial (NASDAQ:VIRT) is an electronic market maker. The company uses algorithms to quote spreads (standing, fluctuating, bid and ask orders) across a variety of financial instruments. It is regarded as a leader in the market, executing roughly 25% of all retail equity flow in the United States.

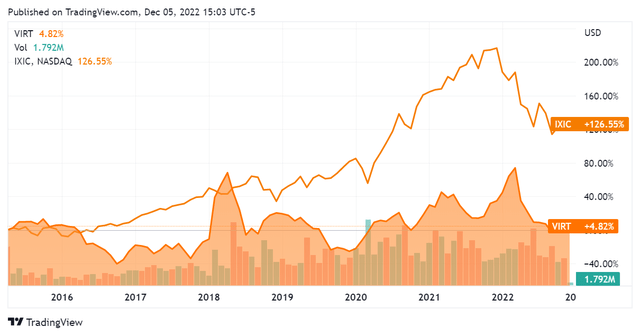

Virtu first conducted an initial public offering in Q2 2015 at $19 a share. While initially performing roughly in line with the NASDAQ Composite, Virtu has underperformed since then and continues to trail the index. It is a mature technology entity that is paying a dividend yield of 4.38% at its current valuation of $22.56 a share. This article will review its financial picture and present a forward-looking view as to its stock.

Financials

As many investors are aware, market makers profit from increased volatility in the securities that they trade in. The market context of 2020-2021 was a banner year for entities of this nature and can be considered exceptional. Additionally, market making is a capital-intensive business that requires significant outlays of cash across an ever-shifting duration. Nonetheless, once someone has ‘cracked the code’ for electronic market making, the significant technology costs create a natural moat for the ongoing operations of a business of this nature. These broader elements are worth keeping in mind as we look through Virtu’s financial picture.

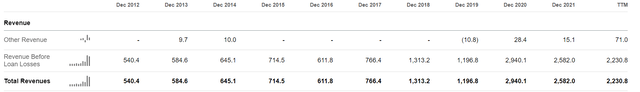

The company has posted a consistently increasing body of revenues as well as the performance that is to be expected during the recent high-volatility market regime: revenues for fiscal year 2020 were 246% that of 2019. For fiscal year 2021, the business appears to have returned to normalcy and saw revenues dip 12% from 2020. The TTM figure shows a continued decline in revenues, with the trailing twelve months figure 86% that of fiscal year 2021. Nonetheless, the TTM figure is still 186% that of Virtu’s 2019 revenues. This figure is difficult to predict at present, but as an investor, I am inclined to look at these ongoing numbers as positive; the drop-off could have been significantly more severe.

This trendline is reinforced in the firm’s operating income, correlating tightly with revenues. Worth noting is that the company’s overall operating expenses have increased less than its revenues throughout this time, appearing to also decrease somewhat as revenues have dipped.

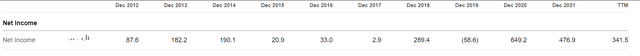

This looks like a profitable entity, and it certainly is: Virtu has only lost money one year out of the last decade. This can be attributed to the vagaries of the market-making business referenced above, and I don’t consider the loss for fiscal year 2019 to be particularly indicative. Net income has continued to drop off with revenues but has remained – and is expected to remain – positive.

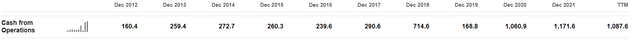

Since this is a mature entity, its cash flow statement will be most informative as to the health of its business. This is a company that is generating significant positive cash flow from operations, with an almost 10x increase during the pandemic banner year. The company’s cash flow generation has appeared to be steadier than its revenue picture, with the decline materially less severe – that is a good sign in my book.

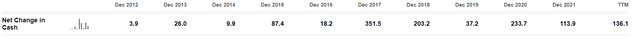

Virtu continues to positively add to its cash balance year over year.

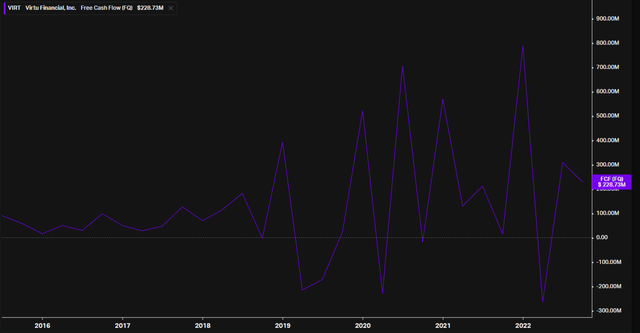

As to free cash flow, things look volatile but certainly good overall. The nature of its business creates significant volatility in its quarter-to-quarter cash flow, but it is immediately clear that this nets out to something quite positive: the peaks are that much higher than the troughs.

Worth noting is that the company has continued to display cash flow strength on a per-share basis. Continuing its then-record-breaking cash flow per share performance in 2020, Virtu has actually increased this number even further in 2021 and appears to still be adding to it on a TTM basis.

At its current price of $22.56, this means that the company is generating 42.4% of its entire valuation in cash every quarter. It really doesn’t get better than that in the technology sector.

The balance sheet for this entity is complex and is again a byproduct of its business, which requires an ongoing rebalancing of cash borrowed and cash allocated. Since we have a lengthy operating history to work with, we can establish that Virtu’s proven capacity to generate cash flow indicates that it can manage this quite well.

The counterpoint here would be the firm’s exposure to interest rates. Since a market maker must constantly borrow and pay back capital in the course of conducting its business, Virtu is definitely staring down a materially higher cost structure. The early stages of this are reflected in its cash interest paid figure on a trailing twelve-month basis. If this occurs in conjunction with a decrease in volatility, then Virtu will very likely see decreased profits and lower cash flow generation. However, this business appears more than robust enough to weather a 5% increase in its overall cost structure. I do not expect the Federal Reserve to increase rates into the double digits, but that will represent a much more significant burden on market makers and would require a reevaluation of this instrument. At present, I believe these headwinds will be weathered quite well by this company.

Conclusion

Virtu has a lot going for it. Notably, it is a uniquely large market maker in that it turns over 25% of the US equities market daily. The only comparison for this level of scale would be Citadel Securities, which does about 40% – and is not a publicly traded entity. As such, these companies together account for 65% + of the equities market-making market here in the United States. While competition between the two of them will continue to act as its own cost pressure, this doesn’t seem to have had much bearing on profits and cash flow to date. Additionally, the moat created by this combined level of technology and scale is very difficult to replicate and quite likely will not be.

While notably exposed to system-wide increasing costs of capital, the numbers that Virtu is generating should continue to see it do very well. I do not foresee this company entering a loss-making period or losing its ability to generate free cash flow, although those numbers could be crimped somewhat in the coming quarters. The stock looks particularly cheap from a cash flow valuation and is paying a steady dividend; I am calling this one a buy.

Be the first to comment