grandriver

On Monday, November 7, 2022, energy royalty company Viper Energy Partners LP (NASDAQ:VNOM) announced its third quarter 2022 earnings results. At first glance, these results were quite positive, as the company beat the expectations of its analysts in terms of both revenues and earnings. As might be expected, the company posted substantial year-over-year growth as the price of crude oil was significantly higher than a year ago.

This has certainly had a beneficial effect on the company’s unit price as it is up 47.44% over the past twelve months. Unfortunately, these results appeared to have disappointed the market, most likely because the company’s declared distribution is lower than the company was paying earlier this year. I must admit that I found this quite disappointing too, particularly given that the partnership’s cash flow was fairly robust. There is still a good case to be made for holding the company, though.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Viper Energy Partners’ third-quarter 2022 earnings results:

- Viper Energy Partners reported total revenue of $221.617 million in the third quarter of 2022. This represents a 73.13% increase over the $128.004 million that the company reported in the prior-year quarter.

- The company reported an operating income of $173.380 million during the reporting period. This compares quite favorably to the $92.278 million that the company reported during the year-ago quarter.

- Viper Energy Partners received an average of 34,489 barrels of oil equivalent per day during the most recent quarter. This represents a 24.87% increase over the 27,620 barrels of oil equivalent per day that the company received in the equivalent quarter of last year.

- The company reported a distributable cash flow of $79.216 million during the current quarter. This works out to $1.07 per common unit. The company declared a $0.49 per share distribution for the quarter.

- Viper Energy Partners reported a net income of $210.102 million in the third quarter of 2022. This represents a 186.07% increase over the $73.445 million that the company reported in the third quarter of 2021.

It seems essentially certain that the first thing anyone reviewing the highlights will notice is that Viper Energy Partners delivered significantly better results than the company had during the equivalent quarter of last year. This is unlikely to be a surprise to anyone as it was caused by crude oil prices being significantly higher than in the prior-year quarter. This is evident simply by looking at the realized prices that Viper Energy Partners received for each unit of natural resources sold:

|

Q3 2022 |

Q3 2021 |

|

|

Oil ($/bbl) |

$91.87 |

$67.67 |

|

Natural Gas ($/Mcf) |

$7.01 |

$3.61 |

|

Natural Gas Liquids ($/bbl) |

$35.15 |

$30.66 |

|

Combined ($/BOE) |

$69.31 |

$50.24 |

It should be fairly obvious why these higher prices would result in improved financial performance. After all, if the company received more money for each unit of resources sold then all else being equal the company would have more money coming in as revenue. This means that more money is then able to make its way down to profit and cash flow. Unfortunately, the company may not be able to maintain this momentum in the fourth quarter.

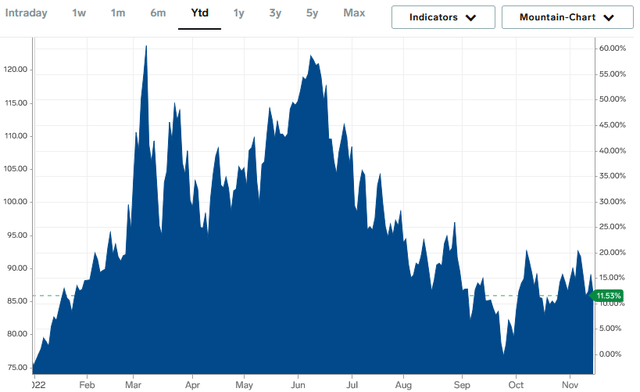

This is because energy prices were generally declining over the third quarter and have not yet regained the levels that they once had. We can clearly see this by looking at the price of crude oil. As of the time of writing, West Texas Intermediate crude oil trades for $85.15 per barrel, which is well below the price that the company received on average during the third quarter:

Thus, the fourth quarter may come in a bit weaker than the third. However, there are other factors at play besides energy prices that affect the company’s results. The most important of these is production. As we can see in the highlights, the company received more barrels of oil equivalent via its royalty agreements during the most recent quarter than in the prior year. This also has a positive impact on the company’s revenue because it means that it will have more products available that it can sell and generate money from. Thus, if Viper Energy Partners sees higher production in the fourth quarter than it did in the third, this could offset some of the impacts of the lower energy prices.

However, the company is not expecting any near-term production growth. In its earnings press release, Viper Energy Partners stated that it expected to receive royalties of 33,250 to 35,000 barrels of oil equivalent per day during the fourth quarter of 2022 and the first quarter of 2023. This is relatively in line with the 34,489 barrels of oil equivalent per day that the company received on average during the reporting quarter. Thus, the company probably will not benefit from higher royalties in the near term and may even see a slight decline in royalties since its third-quarter level was at the high side of its guidance over the next half-year.

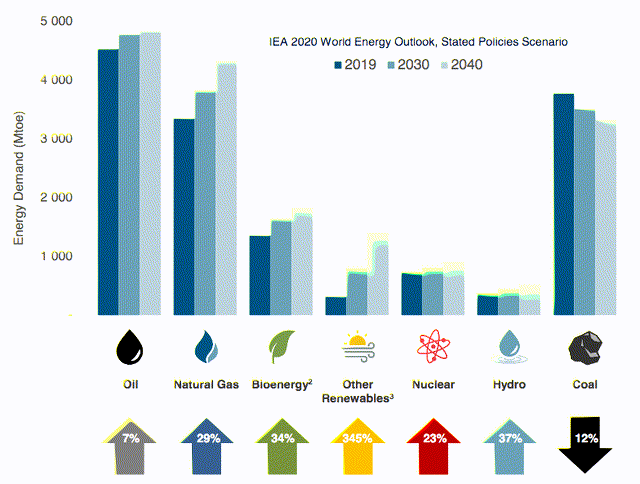

Fortunately, the long-term outlook looks significantly brighter. This is because the fundamentals for energy prices are quite strong as demand is expected to rise much more than supply. This is something that may be surprising for some readers as we have been hearing from politicians and the media that fossil fuels will soon be rendered obsolete. However, the International Energy Agency actually projects that the demand for global demand crude oil will increase by 7% over the next twenty years:

Pembina Pipeline/Data from IEA 2020 World Energy Outlook

This growth is primarily driven by the various emerging markets around the world. As many readers are likely aware, these markets are projected to see enormous economic growth over the projection period, which will have the effect of lifting the citizens of these nations out of poverty and putting them securely into the middle class. These newly middle-class people will begin to desire a lifestyle that is much closer to what their counterparts in the developed nations enjoy than what they have now.

This will result in the growing consumption of energy, including energy derived from crude oil. The populations of these rapidly growing nations are much larger than the populations of the world’s developed nations. Thus, the growing demand for crude oil from these areas will more than offset the stagnant to declining demand among the world’s developed nations.

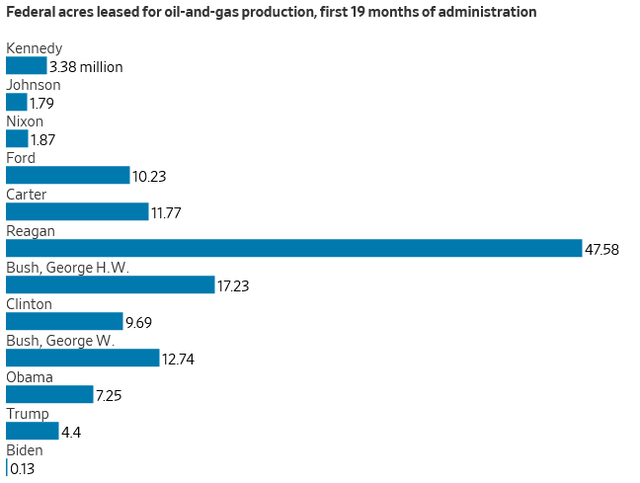

It is unlikely that we will see the production of crude oil increase by the degree that is necessary to satisfy this new demand. One of the biggest reasons for this is that the energy industry has been critically underinvesting in production capacity since the 2015 crude oil bear market. This is one of the reasons why the offshore drilling industry never recovered from the events of that time. In addition to that, we have various politicians and other officials actively working to curtail the production of crude oil. During the first nineteen months of his administration, President Biden leased 126,228 acres for drilling activity. That is less than any president since Harry Truman:

This is critical because the United States is one of the only nations in the world that actually has the ability to increase its production of crude oil due to the rich deposits found in the various shale plays. It seems obvious though that this will not happen barring a reversal in Federal government policy. This has led some to expect that we will soon have a shortage of crude oil. In fact, according to Moody’s, global upstream spending needs to increase by $542 billion in order to avoid a supply shock. That is a 54% increase over the industry’s current capital expenditures. It seems highly unlikely that the energy industry will actually increase spending to that degree given the pressures that it is under from politicians and activists to improve sustainability.

Thus, we are almost certainly looking at a situation in which the supply of crude oil will increase slower than the demand and that will lead to higher prices. This will obviously benefit Viper Energy Partners due to the higher value of the royalties that it receives even if the actual production on the company’s acreage remains the same. The fact that the company will probably have weaker results in the next few quarters compared to its third-quarter numbers will thus be a relatively short-term problem.

One of the biggest reasons why many people purchase units of master limited partnerships like Viper Energy Partners is because of the high distribution yields that these companies tend to pay out. Viper Energy Partners, unfortunately, disappointed somewhat here during the third quarter. The company only declared a distribution of $0.49 per unit, which was a marked decrease over the $0.81 that it paid for the second quarter of the year.

The reason was not a lack of cash flow, either, as we will see in a few moments. The company still has a 5.87% distribution yield with this lower yield though, which is still substantially better than the 1.56% yield of the S&P 500 index (SP500). As this is what anyone buying today will receive, let us investigate and see how sustainable this distribution is likely to be.

The usual way that we examine the sustainability of a master limited partnership to maintain its distribution is by looking at its distributable cash flow. Distributable cash flow is a non-GAAP measure that theoretically tells us the amount of cash that was generated by a company’s ordinary operations and is available for distribution to limited partners. As stated in the highlights, Viper Energy Partners reported a distributable cash flow of $79.216 million in the third quarter of 2022.

This works out to $1.07 per common unit and thus is sufficient to cover the declared distribution 2.18 times over. Analysts generally consider anything over 1.20x to be reasonable and sustainable. As we can clearly see, Viper Energy Partners is more than capable of covering its distribution and, in fact, it could pay out a much higher one.

This brings us to the major complaint about the distribution that I hinted at in the introduction to this article. Viper Energy Partners has a stated policy of paying out 75% of its distributable cash flow to investors. That works out to $0.80 per common unit in the third quarter. Clearly, the distribution is nowhere near this level. The reason for the discrepancy is that the company has begun aggressively buying back its own partnership units. During the third quarter, the company repurchased 1.8 million common units at a total price of $57.0 million. The company is considering this to be a method of distributing money to its investors. As I have explained in previous articles though, I strongly favor cash distributions over share buybacks as a method to return money to investors.

This is because quite often buybacks do not actually result in the capital appreciation that we would expect and thus the buyback is basically wasted money. Although Viper Energy Partners did see some unit price appreciation over the third quarter, it is hard to determine whether that was actually caused by the buyback or by changes in energy prices or other factors. In most cases, it would be better to just forego the buyback and give the money directly to investors, who could then opt to use the distributions to purchase more shares if they wish to increase their ownership of the company. That would have the same effect as a buyback and still give investors the option to use the cash for other purposes if they choose to.

In conclusion, these were reasonable results from Viper Energy Partners, although it does look like the next quarter or two will be a bit weaker. The long-term future of Viper Energy is still quite solid though, which is why I continue to hold its partnership units. I am admittedly a bit perturbed by the company opting to do buybacks as opposed to paying out a higher distribution even if it may have had a positive effect on the unit price during the period. Overall though, Viper Energy Partners LP does have enough going for it to consider it a hold if not a moderate buy.

Be the first to comment