Foxys_forest_manufacture/iStock via Getty Images

When the topic of alcohol comes up, many investors might think of the major players in the market or the small, privately held, craft brewers that have dotted the country. But one company that sits in between those two groups that investors can participate in is Vintage Wine Estates (NASDAQ:VWE). Recently, financial performance achieved by the company has been rather impressive. Although the company has quite a bit of debt on hand, shares do look affordable from a cash flow perspective relative to other alcohol-oriented businesses. Obviously, investing in a small player in the wine market carries its own unique risks, such as the potential inability to deal with competitive pressures and a heavy reliance on a small number of properties or suppliers to provide all of their core ingredients. But for investors who don’t mind this kind of risk, Vintage Wine Estates might make for a good prospect to consider.

A small wine play

According to the management team at Vintage Wine Estates, the company operates as a leading vintner in the U.S. market. The company provides its customers with a variety of brand-name wines, packaging concepts, and craft spirits. Examples include Layer Cake, Cameron Hughes, Clos Pegase, B.R. Cohn, Firesteed, Bar Dog, Kunde, Cherry Pie, and more. All of its brands combined are responsible for 2 million cases of product shipped annually, making the company the 15th largest wine producer in California.

While this is undoubtedly a crowded market, management does believe that it has a special differentiator that sets it apart from the competition. They refer to this as the firm’s ‘three-legged stool’ business model. The first leg involves the fact that the company has a diverse collection of brands, with over 50 different brands across the spectrum and with prices ranging from $10 per bottle to $150 per bottle. The company does, however, focus largely in the $10 to $20 per bottle range. The second leg involves the company’s sales strategy. Management refers to the company as an omnichannel provider with sales split between direct-to-consumer activities, traditional wholesale activities, and business-to-business direct sales. 30% of its revenue comes from direct to consumer, with 33% attributable to traditional wholesale and 35% due to its business-to-business direct sales. On the direct-to-consumer side of things, the company’s revenue stream also includes sales from tasting rooms, wine clubs, and more. It also generates revenue from custom label design and engraving.

To get to the point where the company is today, management has overseen over 20 acquisitions over the past decade through the end of its latest completed fiscal year. This has allowed the company to grow into a sizable player that sources its products from 2,800 owned and leased vineyard acres across the country, and from 10 winery estates that it currently owns. Other interesting moves have been made since the end of the year. In January of this year, for instance, management announced the acquisition of Meier’s Wine Cellars For an undisclosed sum that should bring $18 million in annual revenue to the company. Although the company only produces around 2 million cases per year, management claims that the winery facilities the company owns are capable of producing up to 7 million annually. This extra capacity has not stopped the company from investing more in additional growth initiatives. In March, the company launched a new partnership with Travel + Leisure Group to open two wine clubs featuring selections from over 25 wineries across key parts of the nation. In March, the company announced a $30 million plan to buy back stock and/or warrants (up to the $30 million amount) that are currently outstanding. Though no official announcement was made regarding its completion, the company supposedly made a $45 million investment into its Ray’s Station production facility that included a high-speed bottling facility with the capacity to bottle over 13.5 million cases per year and a 364,000 square-foot warehouse and distribution center. The last update on that was that it was due to be complete at the end of the first quarter of 2022.

Analyzing Vintage Wine Estates is a bit complicated because of the company’s history. Although the firm has been around for over 20 years, the current entity as we know it today was formed in 2019 as Bespoke Capital Acquisition Corp. This special purpose acquisition corporation, or SPAC for short, ended up acquiring, in June of 2021, the privately held Vintage Wine Estates in a move that ultimately brought that company public. Because of how the financial statements were done, we end up with some comparability issues for the time prior to 2020. So because of that, I’ve decided to work with just the 2020 fiscal year and beyond.

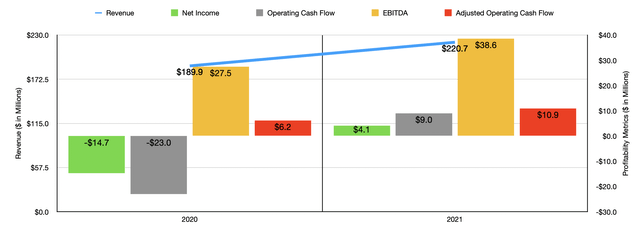

Author – SEC EDGAR Data

What limited data we do have on that is promising. In 2020, the company generated revenue of $189.9 million. This increased to $220.7 million in 2021. A big driver to this 16.2% increase in sales year over year was an increase in the number of equivalent cases the company sold. That number grew by 8.9% from 1.72 million to 1.88 million. That came even as wholesale cases sold decreased by 6.6% from 1.04 million to 969,000. This, management said, was because of the discontinuation of certain brands. Meanwhile, the business-to-business side of things took off, with sales volumes skyrocketing by 35.8% thanks to expanded relationships involving private label dealings. Meanwhile, the direct consumer side reported volume growth of 27%, driven by increased tasting room activity and special programming through a large e-commerce company the business worked with. Most of the company’s growth came from organic means, with acquisitions pushing sales up by just 1%.

On the bottom line, things have also looked up. The company went from generating a net loss of $14.7 million in 2020 to generating a profit of $4.1 million last year. Operating cash flow followed a similar trajectory, going from negative $23 million to positive $9 million. If we adjust for changes in working capital, it would have risen more modestly from $6.2 million to $10.9 million. And over that same window of time, we would have also seen EBITDA for the company increase, rising from $27.5 million to $38.6 million.

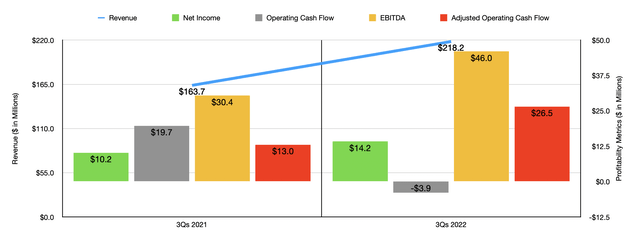

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year, results have been somewhat mixed but mostly positive. Driven by increased volumes associated with wholesale and direct-to-consumer activities, the company saw total case volume skyrocket by 25.5% in the first nine months of the 2022 fiscal year. That took the number of cases from 1.46 million to 1.83 million. By comparison, the business-to-business side of things was a bit slower with case volumes rising a more modest 3.4%. In all, this took revenue for the company up from $163.7 million in the first nine months of 2021 to $218.2 million the same time this year for a year-over-year increase of 33.3%. The company has benefited to some degree from acquisitions during this time. Between all three segments, acquisition activities contributed $11.4 million in revenue. Without these acquisitions, sales growth would have still been impressive at 26.3% year over year. What did not come from increased volume came, instead, from higher costs as management pushed inflationary pressures onto customers.

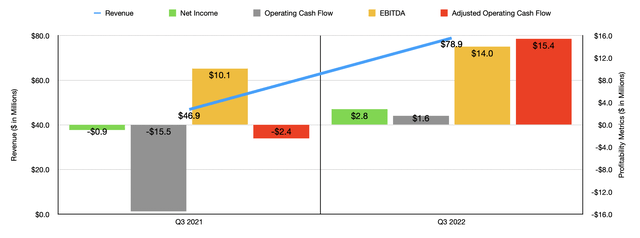

Author – SEC EDGAR Data

When it comes to bottom line results, the company also fared quite well. Net income rose from $10.2 million to $14.2 million. Over that same window of time, operating cash flow did suffer, dropping from $19.7 million to negative $3.9 million. But if we adjust for changes in working capital, it would have actually risen from $13 million to $26.5 million. Meanwhile, EBITDA for the company was also higher, climbing from $30.4 million last year to $46 million this year.

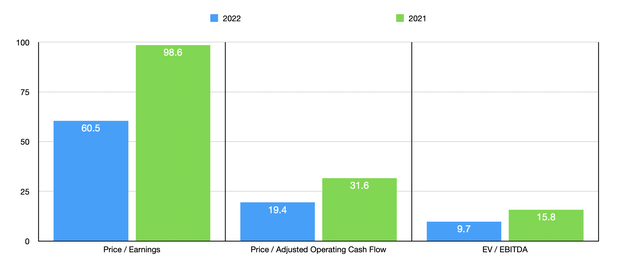

When it comes to the 2022 fiscal year as a whole, management expects revenue of between $290 million and $295 million. At the midpoint, that would translate to a year-over-year increase of 32.5%. The current guidance for EBITDA is between $62 million and $64 million. No guidance was given when it came to other profitability metrics. But if we assume that they would increase at the same rate that EBITDA is forecasted to, we should anticipate net income of $5.7 million and operating cash flow of $17.8 million. Given these numbers, we can easily value the firm. On a price-to-earnings basis, the company is trading at a forward multiple of 60.5. Although this is astronomical, it is lower than the 98.6 reading we get using 2021’s results. The price to adjusted operating cash flow multiples dropped from 31.6 to 19.4, while the EV to EBITDA multiples should decline from 15.8 to 9.7.

Author – SEC EDGAR Data

As part of my analysis, I also compared the company to five similar firms. Admittedly, three of these companies are significantly larger by comparison, making them not exactly perfect comparables. On a price-to-earnings basis, these companies range between a low of 23.4 and a high of 38.1. In this case, Vintage Wine Estates was the most expensive of the group. Using the price to operating cash flow approach, the range was between 15.6 and 33.4. In this case, three of the five companies were cheaper than our prospect. And finally, using the EV to EBITDA approach, the range was between 16 and 25.9. In this scenario, our prospect was, by far, the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Vintage Wine Estates | 60.5 | 19.4 | 9.7 |

| The Duckhorn Portfolio (NAPA) | 30.2 | 30.4 | 18.4 |

| MGP Ingredients (MGPI) | 23.4 | 18.5 | 16.0 |

| Brown-Forman (BF.A) (BF.B) | 36.6 | 33.4 | 25.9 |

| The Boston Beer Company (SAM) | 38.1 | 15.6 | 16.8 |

| Constellation Brands (STZ) | 24.3 | 16.5 | 16.6 |

Takeaway

For investors who like the alcohol space, and who don’t mind the downsides that come from a rapidly growing small player in the space, Vintage Wine Estates might make for a great prospect to consider. Although shares are expensive from an earnings perspective and could be cheaper from a cash flow perspective, they are incredibly cheap relative to their enterprise value. Add on top of that the recent growth achieved by the business and continued growth initiatives, and I would argue that it should make for a good soft ‘buy’ prospect at this time.

Be the first to comment