FG Trade

Viatris (NASDAQ:VTRS) is a global pharmaceutical company with a portfolio of over 1,400 approved molecules, most of which are active ingredients in generic medicines that improve the quality of life for millions of people around the world. However, the sale of Viatris’ only growing segment, the decline in net income, and sales of the company’s branded medicines increase doubts about the effectiveness of business management and reduce Wall Street’s investment interest. This article will provide an analysis of the past, present, and prospects of a company with more than a 5% dividend yield and one of the lowest financial indicators in the industry.

Viatris’s financial position in the past

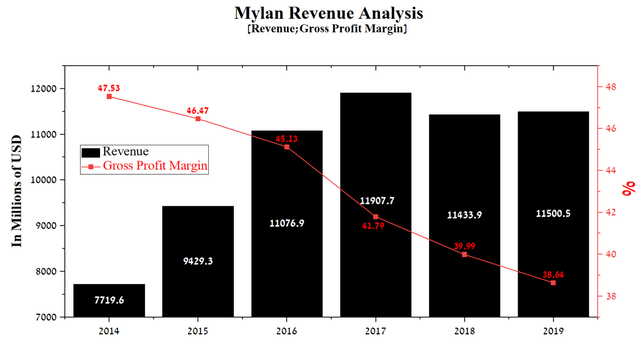

To understand the prospects of the company, it is necessary first of all to evaluate its achievements and the forecasts made by management in the past, which will give an idea of the ability of the CEO to achieve their goals over time. On November 16, 2020, Viatris was formed as a result of the merger of Mylan and Upjohn, a former division of Pfizer (NYSE:PFE). Mylan’s revenue in the pre-merger years remained stable at $11,500.5 million in 2019, up 0.6% year-over-year.

Source: Author’s elaboration, based on Seeking Alpha

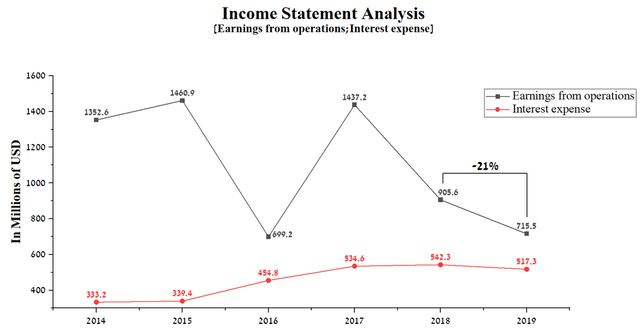

At the same time, the gross margin was declining from year to year, which ultimately had a negative impact on the company’s free cash flow, which is necessary for servicing and subsequent repayment of the multibillion-dollar debt. Interest expense continued to rise year on year, thus limiting the company’s ability to expand its business through acquisitions of promising companies and slowing down R&D activities, which are critical in the pharmaceutical industry. Moreover, operating income also showed a negative trend and the main reasons for this are increased competition and lower prices for generic medicines, which currently make up a significant share of Mylan’s revenue.

Source: Author’s elaboration, based on Seeking Alpha

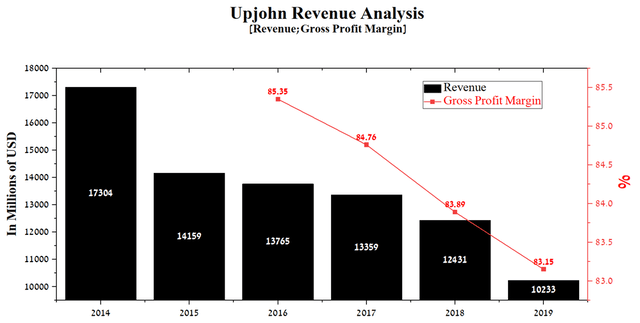

As a result of financial difficulties, Mylan did not pay dividends from 2012 until the merger with Upjohn. Unlike Mylan, Upjohn’s revenue in the years before the merger showed a serious decline and amounted to $10,233 million in 2019, down 17.7% year-on-year. At the same time, the gross margin decreased slightly, remaining one of the highest in the healthcare industry due to the presence of only branded medicines in the portfolio.

Source: Author’s elaboration, based on Form S-4

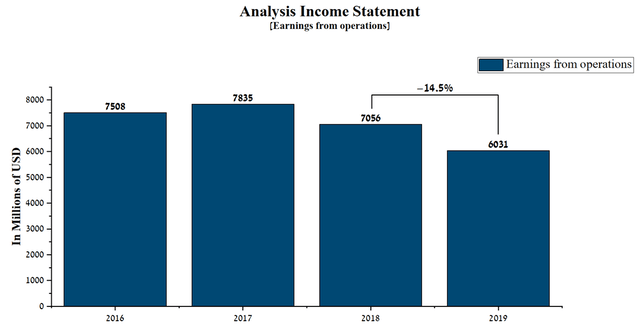

Between 2016 and 2018, operating income showed a stable trend, but in 2019 this indicator began to decline and amounted to $6,031 million, which is 14.5% less than in 2018.

Source: Author’s elaboration, based on Form S-4

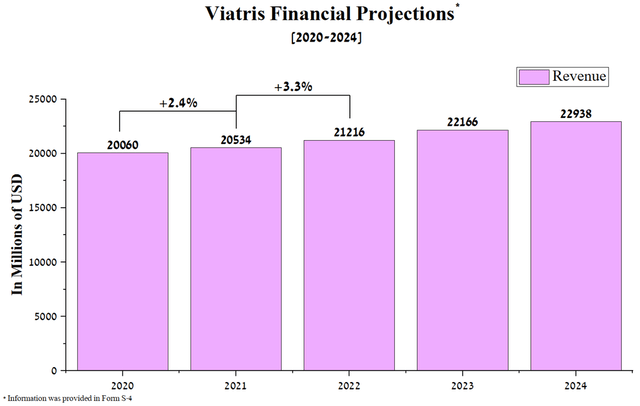

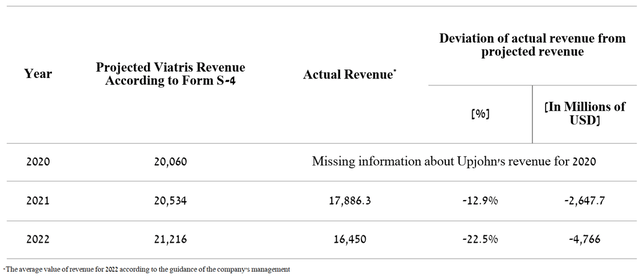

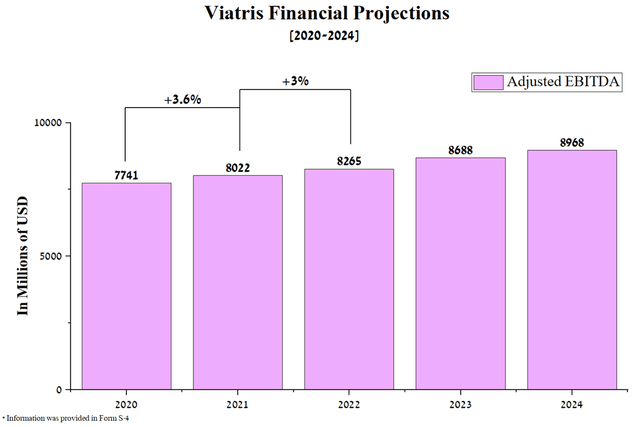

Thus, Upjohn, which was supposed to become a cash cow in the new business and generate billions of dollars, began to show a decline in revenue already before the formation of Viatris, which at least should have alerted investors in 2020. Doubts about an objective assessment of business prospects were manifested in the management’s forecasting of Viatris’s financial indicators in the period from 2020 to 2024. Contrary to the well-formed trend towards the deterioration of the financial position of Mylan and Upjohn, the decrease in sales of the company’s patent medicines and the growth of competition among generic manufacturers, in Form S-4, Viatris’s management predicted an increase in revenue and adjusted EBITDA. According to the financial forecast, the company’s revenue was to be $20,060 million in 2020 and increase by 2.4% by 2021.

Source: Author’s elaboration, based on Form S-4

However, the company’s actual revenue was $17,886.3 million in 2021. Thus, the deviation of the projected revenue from the actual one was about $2.65 billion or 12.9%.

Source: Author’s elaboration, based on Form S-4

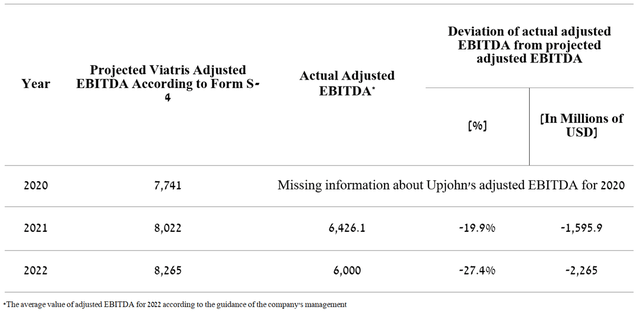

Moreover, Viatris’s adjusted EBITDA was expected to be $7,741 million in 2020 and increase by 3.3% by 2021. At the same time, the growth of this indicator should have continued at least until 2024.

Author’s elaboration, based on Form S-4

The company’s actual adjusted EBITDA was $6,426.1 million in 2021, and thus the deviation of the projected adjusted EBITDA from the actual one was about $1.6 billion, or 19.9%.

Source: Author’s elaboration, based on Form S-4

I believe that the most successful businesses are built in an environment where the company’s management, aware of the negative trends in product sales, does not overestimate expectations but instead puts a little pessimism into the company’s strategic development plans. In the case of optimal business development, this will allow using excess profits to launch a more aggressive R&D and M&A policy that can increase investor interest. In the case when the company’s budget includes over-optimism, as happened with Viatris, this can negatively affect the correct operation of the business, with the subsequent need to sell certain divisions of the company, which most often have the greatest potential in the future. As a result, this could undermine the investment interest of Wall Street, which is most dangerous in the current period of high volatility.

Viatris’s current financial position

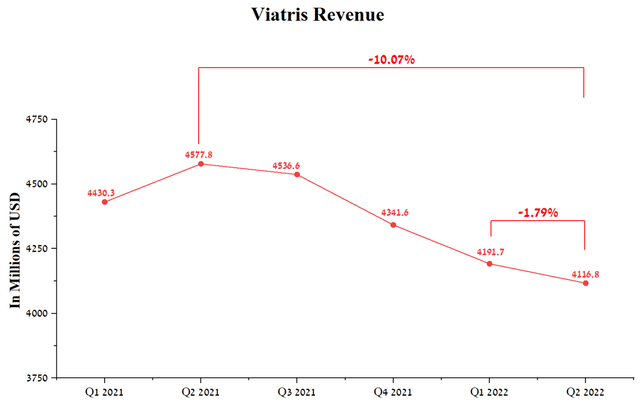

This part of the article will provide an analysis of the company’s financial position over the past six quarters, which can provide information about the current state of Viatris in the pharmaceutical industry. Viatris’ revenue was $4116.8 million in Q2 2022, down 10.07% year-on-year. At the same time, the company continues to show a drop in sales of medicines on a quarterly basis.

Source: Author’s elaboration, based on Seeking Alpha

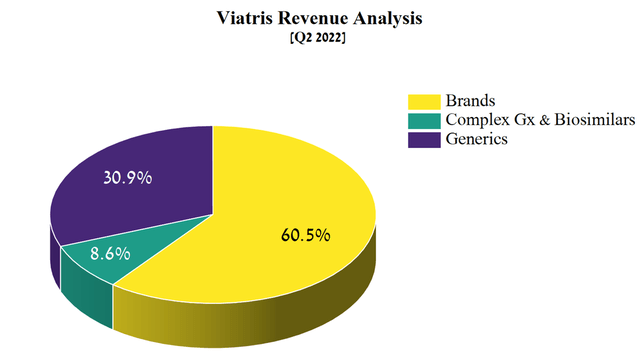

Viatris’s branded medicine portfolio is feeling pressure from generics and major pharmaceutical companies, including Pfizer, to bring to market more effective drugs that can capture a larger share of the multi-billion-dollar market. As a result, the company’s key segment, which has the highest margin in the Viatris structure and which generates 60.5% of total revenue, continues to stagnate.

Source: Author’s elaboration, based on 8-K

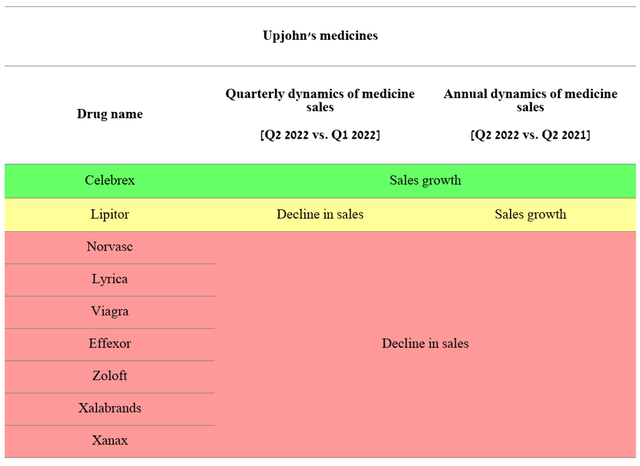

7 out of 9 Upjohn medicines have struggled to demonstrate both quarterly and yearly positive sales trends, continuing their sales decline in recent years.

Source: Author’s elaboration, based on quarterly securities reports

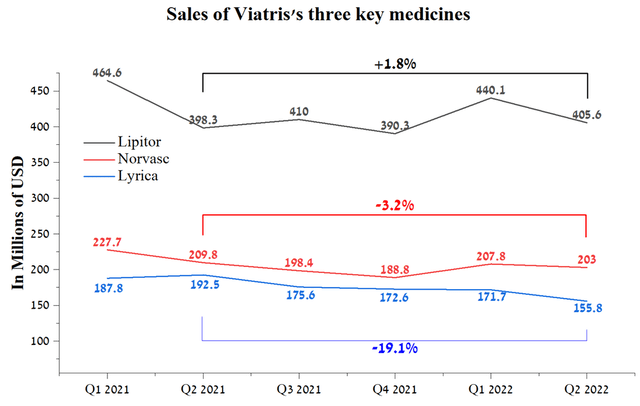

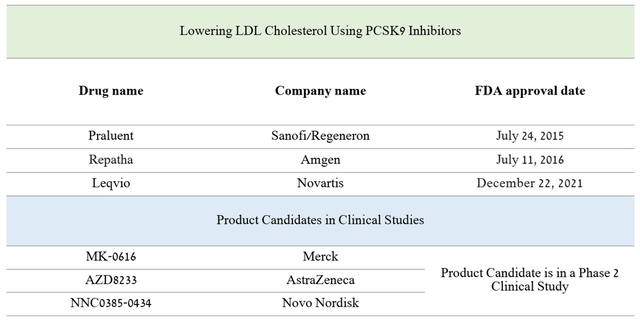

Viatris’s three key drugs, namely Lipitor, Norvasc, and Lyrica, whose combined sales account for 18.6% of the company’s total revenue, showed mixed dynamics. Lipitor (atorvastatin) is a statin drug that made a huge breakthrough in the late 20th century in treating high LDL cholesterol and reducing the risk of developing cardiovascular disease and brought Pfizer tens of billions in profits before losing exclusivity in 2011. Over the past six quarters, this drug is one of the few in the Viatris branded medicines segment that has been trying to maintain stable sales despite competition from generics. According to my estimates, the situation with the sales of this medicine may worsen due to the spread of PCSK9 inhibitors on the market, namely Sanofi and Regeneron’s (REGN) Praluent, Amgen’s (AMGN) Repatha, and Novartis’s (NVS) Leqvio. Moreover, the product candidates of Merck (NYSE:MRK), AstraZeneca (NASDAQ:AZN), and Novo Nordisk (NVO) are in phase 2/3 clinical trials. All of these drugs are more effective at lowering LDL cholesterol than statins, which is Lipitor.

The worst performer of the company’s top three selling drugs was Lyrica (pregabalin), which has been Pfizer’s flagship blockbuster brand for years thanks to multiple approvals that include treatment for shingles infection, pain caused by fibromyalgia, or nerve damage due to diabetes.

Author’s elaboration, based on quarterly securities reports

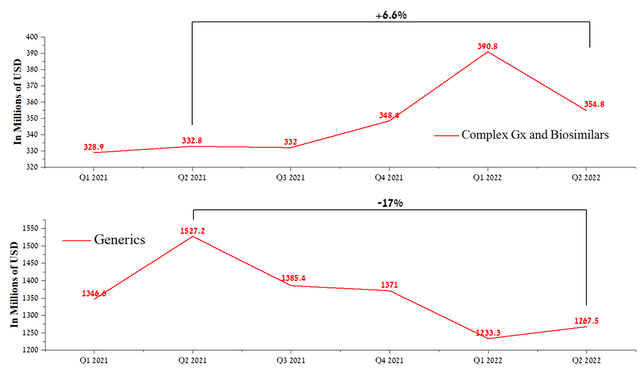

Viatris’s generics business, unlike Teva Pharmaceutical (NYSE:TEVA), continues to stagnate, which, combined with the $3.385 billion sale of the fast-growing biosimilars segment to Biocon Biologics, casts doubt on the ability of the company’s management to develop the business in the right direction. Generic sales were $1,267.5 million in Q2 2022, down 17% year-over-year, while Complex Gx and Biosimilars segment revenue was $354.8 million, representing year-on-year growth of 6.6%.

Source: Author’s elaboration, based on quarterly securities reports

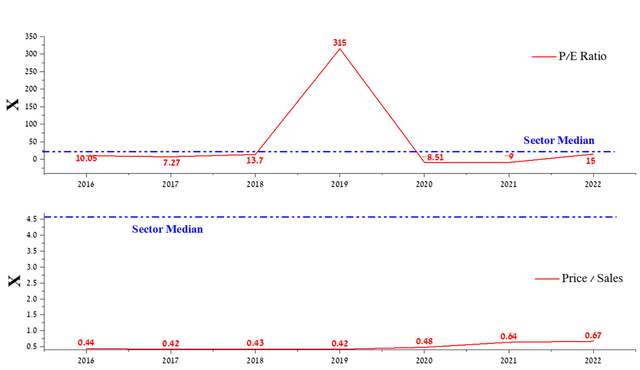

But despite the current situation, the price/sales ratio of the company is significantly lower than the average value for the healthcare sector, which at first glance indicates that Viatris is undervalued by Wall Street in this indicator. On the other hand, if you look at the situation from the other side, then even before the formation of Viatris, the predecessor company, namely Mylan, had lower financial ratios, but at the same time, Mr. Market was not encouraged by these values, which affected the decrease in the company’s shares.

Source: Author’s elaboration, based on Seeking Alpha

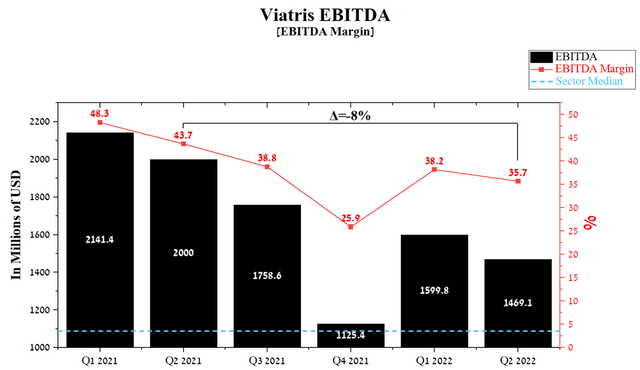

Viatris’s EBITDA was $1,469.1 million in Q2 2022, down 26.5% year-on-year. This indicator continues to decline on a quarterly basis due to lower sales of branded drugs, and a sharp increase in raw materials and transport costs in the European Union due to the negative impact of inflation and the war in Eastern Europe. As a result, the EBITDA margin decreased by 8% year-on-year to 35.7% in Q2 2022.

Source: Author’s elaboration, based on Seeking Alpha

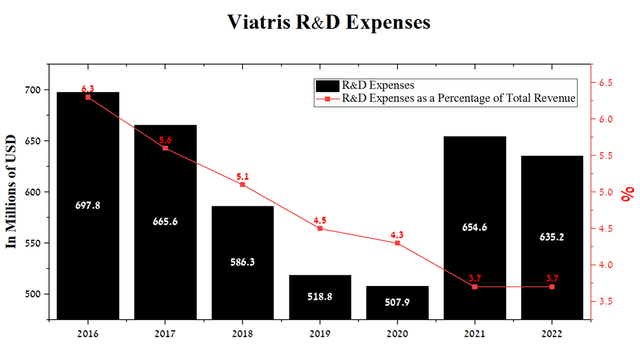

The financial success of large pharmaceutical companies depends almost entirely on the discovery and development of drugs that have a more favorable safety profile and competitive advantage in efficacy relative to the standard of care and competitors. Like any innovation, the discovery of a new generation of drugs requires multibillion-dollar investments, and therefore the average expenditure on R&D in the pharmaceutical industry is more than 25% of revenue. In contrast, Viatris’s R&D spending continues to decline year on year, totaling $635.2 million over the past 12 months. The cost share of the company’s revenue is staggeringly low at only 3.7%, which, given the desire of Viatris’s management to buy back the company’s shares at such low R&D spending, casts doubt on the effectiveness of such a business model in the long term.

Source: Author’s elaboration, based on Seeking Alpha

Decreased R&D spending reduces the company’s likelihood of bringing to market a drug that could dramatically improve the company’s financial position and win Mr. Market’s favor.

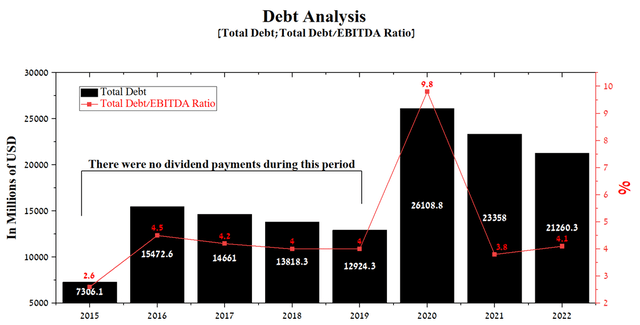

Improving Viatris’s debt burden

The company’s total debt was $21,260.3 million in Q2 2022, down 9.8% from the end of 2021. However, the decline in EBITDA led to an increase in the total debt/EBITDA ratio to 4.1x in 2022, which indicates the presence of insignificant risks associated with the company’s debt servicing. As a consequence, I believe that the deal to sell the company’s biosimilars segment, which if closed in the third quarter, will net Viatris about $2 billion in cash and another $335 million in 2024, was driven by two factors. These factors are the urgent need to repay the company’s debt and the desire of Viatris’s management to delay the decision to reduce dividend payments in the future as long as possible. Even if the company’s CEO decides to use all of the cash from the deal to redeem the senior bonds, Viatris’ total debt would still be substantially larger than Mylan’s total debt, which didn’t pay dividends. As a result, the reduction in the company’s debt burden will not be sufficient to guarantee dividend payments for the coming years.

Author’s elaboration, based on Seeking Alpha

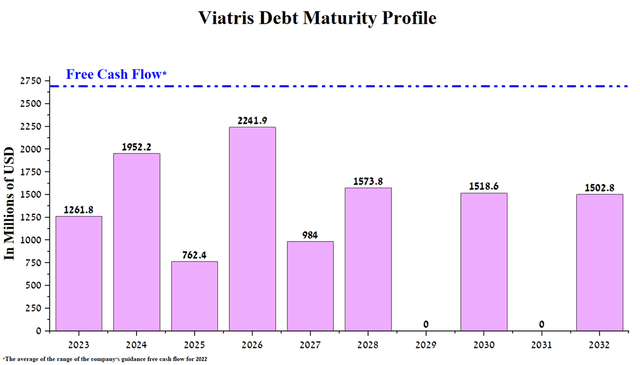

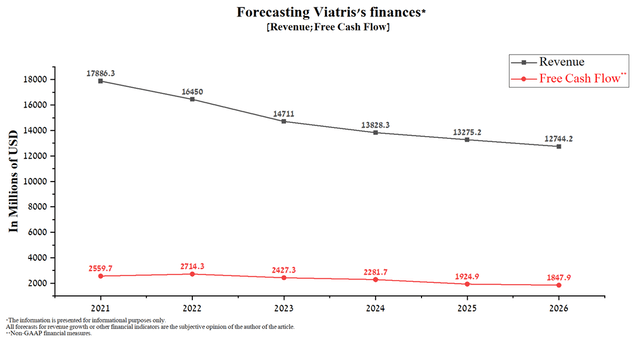

Viatris has a free cash flow of around $2,559.7 million in 2021, slightly more than the payments on senior notes maturing in 2024 and 2026.

Author’s elaboration, based on 8-K

Viatris’s dividend yield of 5.08% is one of the largest in the pharmaceutical industry, which attracts investors with a long-term investment strategy. Moreover, despite the decline in revenue and business margins, Viatris’s management has continued to increase dividends since the formation of the company. In 2022, investors should receive $0.48 per share, up 4 cents from the previous year.

Viatris’s financial position in the future

Despite the deplorable past and current financial situation, the prospects for Viatris’s business must also be considered.

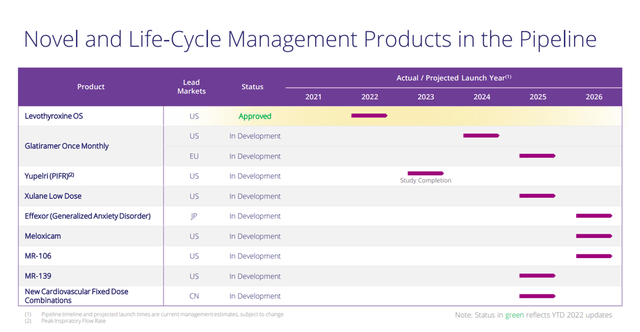

Company pipeline

Low levels of R&D spending are reflected in the small number of product candidates in the company’s pipeline, most of which may not be commercially available until 2025.

Thus, in the medium term, the company does not have assets that can significantly improve the company’s financial position and increase investment interest from large investment funds.

Viatris share repurchase program

On February 28, 2022, the company announced it had authorized a $1 billion Viatris share repurchase program. However, after 4 months, the company’s management has not yet begun to spend money for these purposes, which gives hope that this will not happen in the future. Otherwise, I believe that the CEO of the company will make the same mistake as the management of GE did, who decided to buy back the shares of a stagnant business, and not engage in its active development, which in subsequent years led to a sharp drop in General Electric shares by tens of percent.

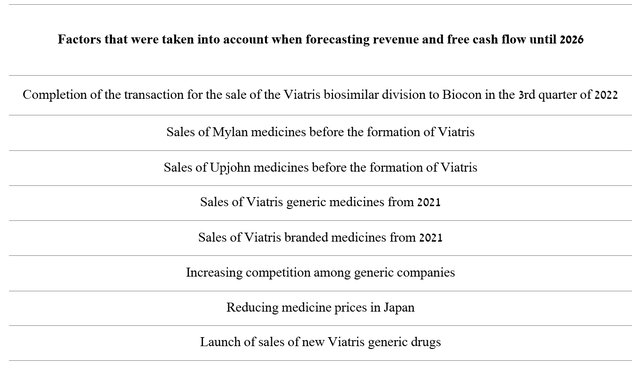

Assessment of the company’s ability to pay dividends

When forecasting the company’s revenue in the period from 2023 to 2026, I took both historical trends in the sale of medicines and events that have not yet affected the company’s financial performance, for example, the launch of new generics and the results of the revision of drug prices by the National Health Insurance (NHI) in Japan.

When assessing the company’s ability to pay dividends in the future, I took into account that the share of the company’s free cash flow from Viatris’s revenue will be 16.5% in the period from 2023 to 2024 and decrease to 14.5% from 2025 to 2026.

In my estimation, the total amount of the company’s bond redemptions combined with interest expense will exceed the company’s free cash flow starting in 2024, forcing the Viatris’s management to cancel the increase in dividend payments from 2023 and completely suspend them from 2026.

Conclusion

Before the deal to combine Mylan with Upjohn, there were many amazing presentations, and the management of both companies touted the business, but, as is often the case on Wall Street for beautiful slides, investors receive an asset that is far from ideal. The decline in revenue, margins, and EBITDA from year to year and the lack of product candidates capable of putting the company on a sustainable growth path undermine confidence in the future of Viatris, including the ability to pay dividends from 2026. Low financial ratios are not a prerequisite for considering Viatris as a long-term investment, but only continue the multi-year trend of Mylan, whose shares were in a bearish trend before the formation of Viatris. In the medium term, I expect the company’s stock to correct to $12.5/share, followed by a decline to my target price of $8/share.

Be the first to comment