BrianAJackson/iStock via Getty Images

Investment Thesis

The ink was barely dry on my last post for Seeking Alpha about Viatris Inc. (NASDAQ:VTRS) – in which I suggested the company makes for an excellent “buy” opportunity, given its exceptionally low price to sales ratio of 0.75x, free cash flow per share of ~$2.1, which translates to a price-to-FCF ratio of ~5x, and dividend of $0.11 per share paid for the final 3 quarters of 2021 – when Viatris elected to sell its biosimilars division to India-based Biocon in a $3.3bn deal. This caused its share price to fall by 35%, from $15 down to $9.80.

In my last post, I had highlighted Biosimilars as one of the key strengths of Viatris’ business model, commenting that:

A biosimilar is very similar to a generic, but its biological profile is not identical to the drug it is trying to imitate – so long as the efficacy and safety match the drug, however, the biosimilar can get around some of the restrictions that apply to generic drugs.

Viatris believes there is ~$161bn of current revenues up for grabs, if biosimilars can be brought to market that exactly match the performance of the drugs whose mechanism of action (“MoA”) they are designed to mimic.

Some of the targets already lined up by Viatris are compelling. In July, the FDA approved Viatris’ Semglee – an insulin glargine biosimilar of Sanofi’s (SNY) Lantus, a drug that once earned peak sales of $7bn per annum, albeit less than $1bn in 2021.

Hulio – a biosimilar of Humira, AbbVie’s (ABBV) >$20bn per annum selling anti-inflammatory therapy – has been launched in Canada, whilst biosimilars in development include versions of Regeneron’s (REGN) $8bn per annum selling Eylea, Botox and a range of cancer drugs.

In fairness, Viatris is not cutting its ties completely with its biosimilars division. Biocon has been a long-term partner of Mylan, the Netherlands-based specialist generic drug developer whose merger with Pfizer’s spin off of its Upjohn legacy brands division created Viatris in November 2020. As part of the sale, Viatris will take a 12.9% equity stake in Biocon via $1bn of convertible preferred shares.

Viatris will also have a seat on Biocon’s board, and assist in a planned 2023 IPO. However, it is clear that Viatris’ management divested the Biosimilars division at the first available opportunity. This gives investors some much-needed insight into what type of company Viatris is, and as importantly, what type of company it isn’t.

Short Term Profits and Asset Sales, Not Biosimilar R&D

Those hoping that Viatris would prioritize forward-thinking biosimilar drug development, and invest heavily in R&D to try to change the prescription drug landscape, will obviously be disappointed.

Anybody who is buying Viatris stock for more pragmatic reasons – to benefit from high margin sales of legacy drug brands before they are replaced by newer brands, or swallowed up by generics, for a generous dividend, and at an exceptionally cheap share price – will probably have taken the news – and the share price dip – far better.

Biosimilars were not a core part of Viatris’ business. Complex generics and biosimilars accounted for only $1.34bn of $17.8bn of revenues in 2021, or 7.5%. Viatris will hold onto its complex generics after the deal, which is scheduled to complete in the 2nd half of this year.

Management argues that completing the deal for $3.3bn total consideration – which is 16.5x projected 2022 EBITDA, and 3.8x projected revenues, makes good business sense. It argues this is a positive action in light of the company’s 3 point “immediate execution” plan to reshape the business, corresponding to point 1 – “unlock value and simplify out business” – the others being to “accelerate financial flexibility” and “build a durable, higher margin portfolio.”

It is a pragmatists’ wish list, and a strategy that will almost certainly involve further asset sales – up to $9bn by 2023, including the Biocon deal, Viatris management hopes. The company already has earmarked another $4-$6bn of products it would be happy to part with. Management also speaks optimistically about creating global, vertically integrated businesses through these sales, beginning with biosimilars.

Debt Too Pressing A Concern Not To Make Further Sales

Given that Viatris has set itself the goal of paying down $6.5bn of debt by 2023, having paid off $2.1bn in 2021, perhaps the Biocon deal was the only way of keeping pace with its deleveraging goals. Given its Q421 earnings presentation, which suggests the company has $23bn of debt, or 3.5x EBITDA, it is easier to see why management is not gambling on biosimilars becoming the next big thing, but conducting an asset sale instead.

That is in keeping with the current biotech bear market conditions, and it also makes it clear what kind of company Viatris is. As mentioned above, it is a company focused on shrinking in size and becoming more profitable. It is not focused on speculative R&D and challenging for share in new markets.

Does that make Viatris a good or a bad investment? As mentioned, news of the Biocon deal sent Viatris’ share price down by ~35%. However, the stock has gained slightly since, rising to a price of $10.7 at the time of writing, with a market cap valuation of $12.94bn. I suspect the share price will continue to rise.

There is a fear around Viatris that it is valued so low relative to sales and free cash flow because it has been set up to wind down or dispose of Pfizer’s failing UpJohn legacy assets, whilst attempting to revive the fortunes of generic drug manufacturer Mylan. In many ways this is true, and the Biocon deal underlines it.

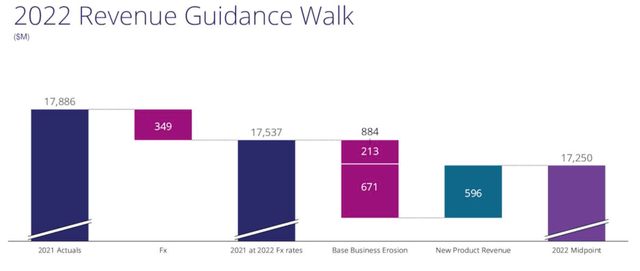

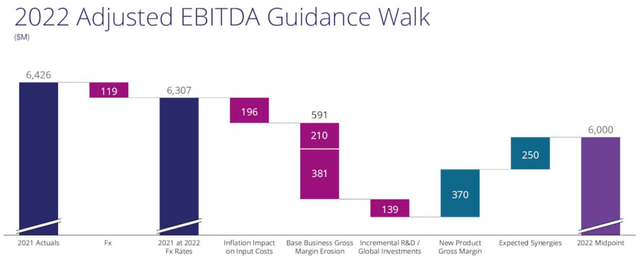

Although this business model may not offer much of a pipeline, or much long-term sustainability, it’s difficult to argue that it is not attractive in the short term. There is a massive debt pile to contend with, but Viatris generated EBITDA >$6bn last year, on revenues of $17.9bn, and expects to do similar again in 2022, as shown below.

Viatris FY22 Revenue Guidance Walk. (earnings presentation)

Viatris FY22 adjusted EBITDA guidance walk. (earnings presentation)

Paying off $2bn of debt using EBITDA / deal cost synergies, and, let’s say, $2bn using asset sales each year for the next 3 years would halve Viatris debt position. It would also bring net debt to EBITDA down to close to 1.5x, all whilst the company pays a dividend that offers a current yield of 4.5%. This is not a bad proposition for a prospective shareholder.

It’s Not All Doom and Gloom on The R&D Front – Although Everything Is Likely On Sale

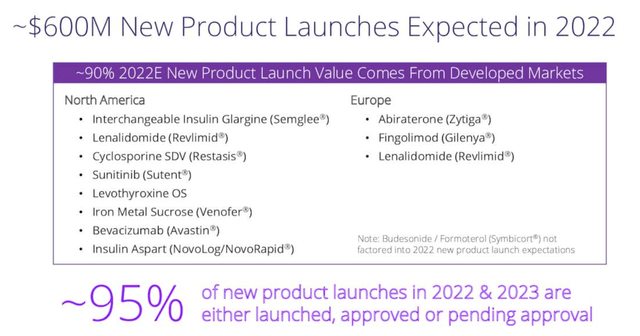

Although I have been critical of Viatris’ ability / desire to develop new revenue streams, there will be ~$600m anticipated contribution from new products next year, from a relatively healthy Generics pipeline, as shown below.

New Product Launches slated for 2022. (earnings presentation)

There is more to come besides, with 5 more products expected to launch in 2023, including a generic version of blood thinners Xarelto and Eliquis. The latter is one of the top 5 best selling drugs in the world, 6 in 2024, most from the complex generics pipeline, and 8 in 2025 and 2026.

There’s no telling if Viatris may sell its complex generics business in 2022 or 2023, however. But, again, even if management does do that, complex generics does not presently pull in much revenue – between them, core generics – $5.6bn. Established brands – $10.84bn – brought in the vast majority of Viatris’ $17.8bn of revenues last year.

Brands Are Viatris’ Bread & Butter & Sales Are Holding Up

Viatris makes 61% of its sales in developed markets, and 60% of all of its sales are from its established brands. So, there is nothing revolutionary about the company’s business model.

Although, in time, some established brands may lose market share in, e.g., the US and Europe, as new medicines arrive with a superior efficacy / safety profile, their sales may still increase in emerging markets that cannot afford to pay top dollar for their medicines.

Having long since gone off patent, the likes of Lipitor, Lyrica, Norvasc and Viagra are still generating >$500m revenues per annum. This is $1.7bn per annum in the case of cholesterol lowering Lipitor, so investors should not be overly concerned about sudden declines in Viatris’ top line revenues – at least for the rest of this decade.

Of more concern is the sheer volume of medicines Viatris must be dealing with. Ten of its most successful brands account for only ~$6bn of revenues, the earnings presentation suggests, which leaves $10bn more revenue generated from assets likely earning ~$100m or less.

That must be a challenge operationally, although Viatris does benefit from a global infrastructure built by Pfizer and Mylan. This will help it to scrap effectively for market share for new launches, and fiercely protect existing share around the world, whilst also waiting for markets such as China to open up.

Conclusion – Viatris Will Keep Rewarding the Pragmatist, Disappointing the Biotech Enthusiast

When I last covered Viatris I was comparing the company’s stock with another spin-off company, Organon & Co. (OGN). This was formed after Merck divested its biosimilars, Women’s Health, and Established Brands divisions into a new entity.

In an earlier note on Organon, I wrote:

Considering its current valuation relative to its sales, you could almost forgive Organon’s management team for taking a hands-off approach, and focusing on keeping sales of its 49 different Established Brands profitable as revenues slowly shrink in the face of generic competition, returning a nice profit to shareholders by maintaining gross sales margins, currently 65%.

To summarize most of the above discussion, I feel similarly about Viatris – that you could hardly blame management for selling off what it can of its lesser revenue generating assets, whilst ensuring sales of established brands are optimized. In the process, this generates revenues and profits that make a mockery of its $12.5bn valuation – less than 0.8x projected FY22 sales.

After the sale of its most dynamic, promising division to Biocon to raise funds to pay back debt, I think investors now have a much clearer picture of the direction Viatris is headed in. It is likely going to get smaller in size, operationally streamlined, and less indebted. It is not going to invest heavily in new market opportunities, new drugs, or extensive R&D.

I can understand investors’ concerns on that front – how can you buy a company that is not going to grow, where is the value? But the corollary to that argument is the old Benjamin Graham investing mantra:

In the short run, the market is a voting machine but in the long run, it is a weighing machine.

What I mean by this is that, when Viatris first began trading in November 2020, and through its first investor day, it was judged by investors in terms of what they expected the company might be, or what they hoped it could be. Viatris may well prove to be a disappointment on that front.

But as the voting machine gives way to the weighing machine, it is very hard to look past $17bn of projected revenues in FY22, and a market cap valuation of $12.5bn. That kind of value is simply not on offer elsewhere in the biotech or pharmaceutical sectors, or indeed in any other sectors.

That’s why, in my view, investors in Viatris can continue to collect the dividend, and more likely than not, benefit from steady growth in the share price, punctuated by the occasional sharp fall whenever a new asset sale is arranged. The value proposition is sufficiently good at the present time to outweigh concerns about how much Viatris will shrink in the next 5-10 years.

It would take a lot for Viatris to perform badly enough as a company to justify its current low market cap valuation. Although I think investors might need to time their exits right in the long term, I plan to continue to hold my Viatris stock for a 3-5 year period. I will not panic when the company sells of chunks of the business, and look elsewhere to find progressive biotech companies.

Viatris isn’t one of those – its shares are simply very good value at current price, I believe.

Be the first to comment