Devonyu

The stock market surged in value last week.

The S&P 500 (SPY)… Tech stocks (QQQ)… Utilities (XLU)… they all rose significantly.

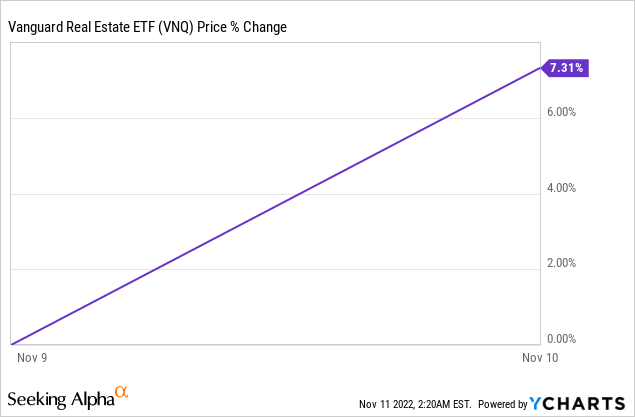

But the best performing sector was REITs (VNQ).

They had one of their best weeks in years, rising by 7.3% on average in a single day last Thursday:

That’s just the average performance of an ETF that’s market cap weighted and mainly invested in large-cap REITs.

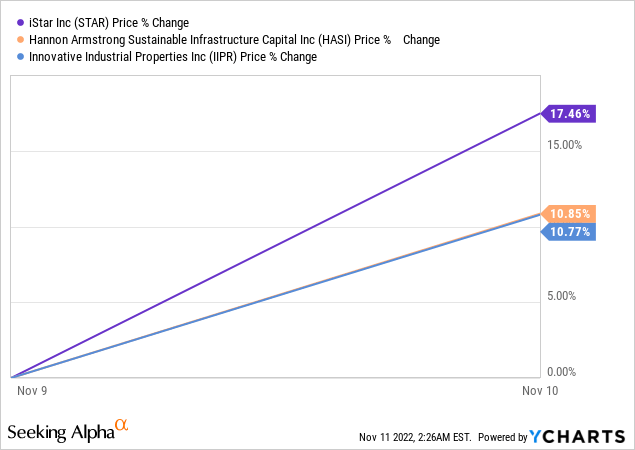

Most REITs are actually much smaller and lots of them rose by over 10% in a single day. Some examples include iStar (STAR), Innovative Industrial (IIPR), and Hannon Armstrong (HASI):

It just goes to show that prices can recover just as fast as they drop, and this is particularly true when the drop occurred for reasons that weren’t justified in the first place.

REITs dropped heavily in 2022 due to concerns over rising interest rates.

But as we have pointed out in previous articles, REITs are actually quite resilient to rising rates. Their balance sheets are the strongest ever with low leverage and long debt maturities. Moreover, rates are only rising because inflation is hot, which leads to higher rents. And finally, interest rates will inevitably drop back to lower as inflation begins to cool down. Therefore, worrying about debt maturities that are often years away is very premature, especially since the debt is low, maturities are long, and rents are growing rapidly.

Now, the market appears to be finally coming to this realization.

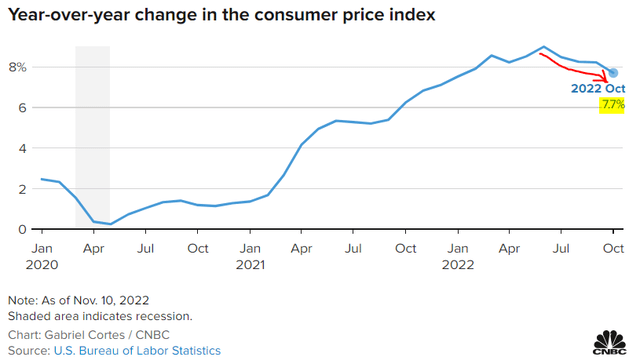

For the first time, the inflation rate cooled a lot more than expected in October, and it caused interest rates to tumble and the market to soar. The year-to-year change in consumer prices was 7.7% in October, which is a clear improvement from the previous months, and we now have a clear trend to lower levels:

US Bureau of Labor Statistics via CNBC

Mark Zandi, chief economist at Moody’s Analytics, noted: “It’s pretty clear that inflation has definitely peaked and is rolling over. All the trend lines suggest that it will continue to moderate going forward, assuming that nothing goes off the rails.”

And this is very good news for REITs!

I can’t overstate how positive this could be for REITs because it removes the primary concern that caused them to drop so much in the first place.

REITs dropped because the high inflation caused interest rates to rise, but with inflation now cooling down, we can also expect interest rates to decline, and we are also getting closer to an eventual pivot of the Fed. Already now, the market is beginning to price in smaller rate hikes, and before you know it, the rate hikes will again turn into rate cuts as we get inflation under control.

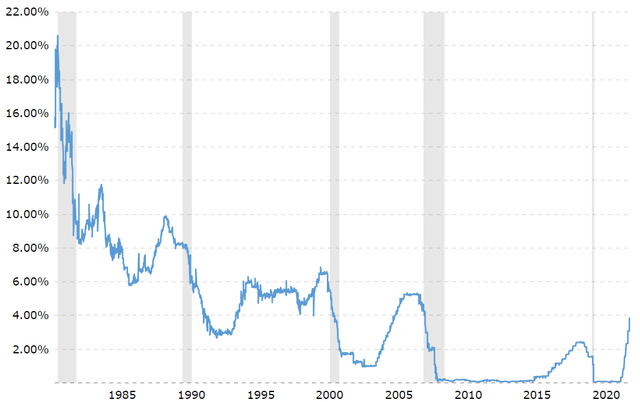

If you look back at the last 40 years, we have actually had many such periods of rapidly rising interest rates, and yet, the overall trend has still always been lower:

Federal reserve via macrotrends

Each and every time, people claimed that this was the end of “low rates”, but they were always proven wrong in the end. This is because there are strong deflationary forces that are pushing rates lower. These include the aging demographics, the high debt loads, income inequality, and technological innovation. That hasn’t gone anywhere and therefore, this time probably won’t be any different.

The market is now slowly coming to this realization and we believe that this will lead to a recovery in REIT share prices, unlocking significant upside for investors who buy today.

Even following the recent surge, REITs are still down 25% year-to-date on average, and there are many REITs that are down closer to 50%, without any good reason. They trade at large discounts relative to the fair value of their assets and offer significant upside potential going forward.

Below we highlight just a few opportunities that we are currently buying:

BSR REIT (OTCPK:BSRTF / HOM.U) is an apartment REIT that owns mainly affordable Class B communities in Texas. Its rents are growing by 10% at the moment and yet, it is still priced at a 35% discount to its net asset value. The company is buying back shares to create value for shareholders. We expect 50% upside, and while we wait, we expect to earn double-digit total returns from near 4% dividend yield and its growth.

BSR REIT

Another example would be STAG Industrial (STAG). It owns a portfolio of industrial properties, many of which focus on e-commerce activities. Its rents are currently growing the fastest in years with 20%+ rent hikes becoming the norm at the time of lease expiration. This is because not enough has been built in its markets and there is rapidly growing demand for space from companies that are bringing back larger portions of their supply chains onshore. Despite this rapid growth, the company is currently priced at a 25% discount to net asset value and offers 40% upside just to get back to its NAV. While you wait, you earn a near 5% dividend yield, and the NAV keeps growing as well.

STAG Industrial

These are two examples that we own in our Core Portfolio at High Yield Landlord, along with 21 other undervalued real estate investment opportunities. All in all, our REITs trade at an average 30% discount to net asset value right now, despite rapidly growing rents. The market overreacted and prices have now begun to recover.

Be the first to comment