alberto clemares expósito/iStock via Getty Images

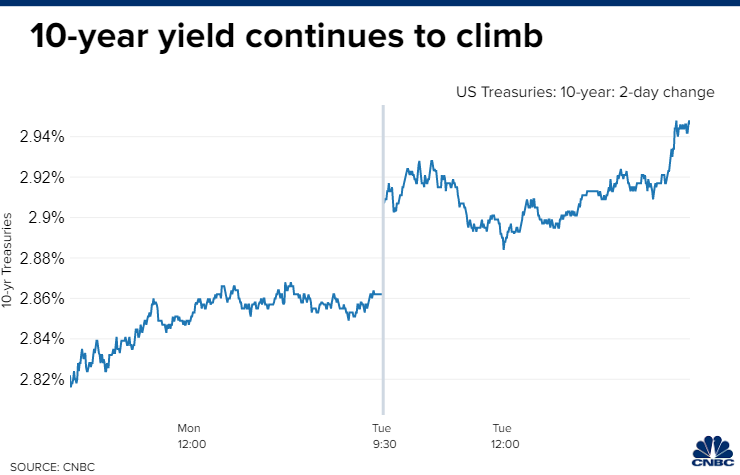

Yesterday was extraordinary from the standpoint that stocks soared across the board, led by the technology sector and small caps, despite a new cycle high in the 10-year Treasury yield at 2.94%. Even more profound was that it came after St. Louis Fed President James Bullard asserted a 75-basis-point rate increase in May was a distinct possibility. That resulted in Fed funds futures placing the probability of a 2.75% short-term rate at near equal odds with 2.5%. Regardless, investors focused on better-than-expected earnings reports and took advantage of the pullback in the major market averages following the March rebound.

Finviz

I don’t expect to see too many repeat performances of yesterday. Higher long-term interest rates should weigh heavily on both technology and small-cap stocks, and if rates climb above 3%, we are bound to see more selling. Perhaps the consensus sees long-term rates peaking at 3% for the short to intermediate term, which would explain the allure of growth stocks that are reporting better-than-expected earnings. Higher long-term rates also suggest that we will see an above-trend rate of economic growth, which is my forecast, and in that scenario, stocks remain the only viable hedge against the current inflation rate.

CNBC

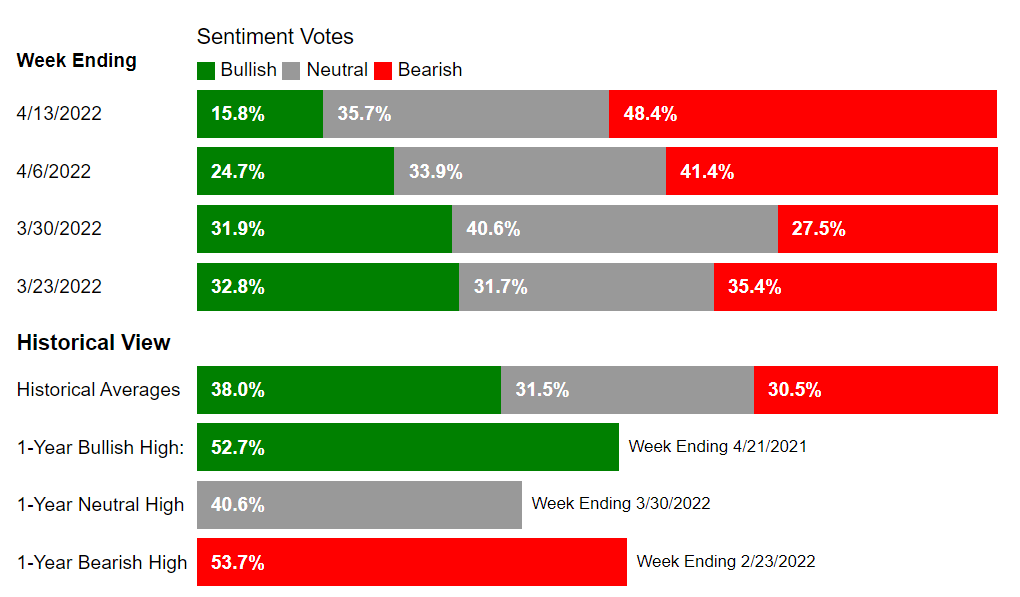

Another more quantitative rationale for yesterday’s rally is that the percentage of bulls in the latest poll by the American Association of Individual Investors has fallen to a 3-decade low of 15.8%. That has been a phenomenal contrarian indicator over time, which I pointed out in my weekend write up.

AAI

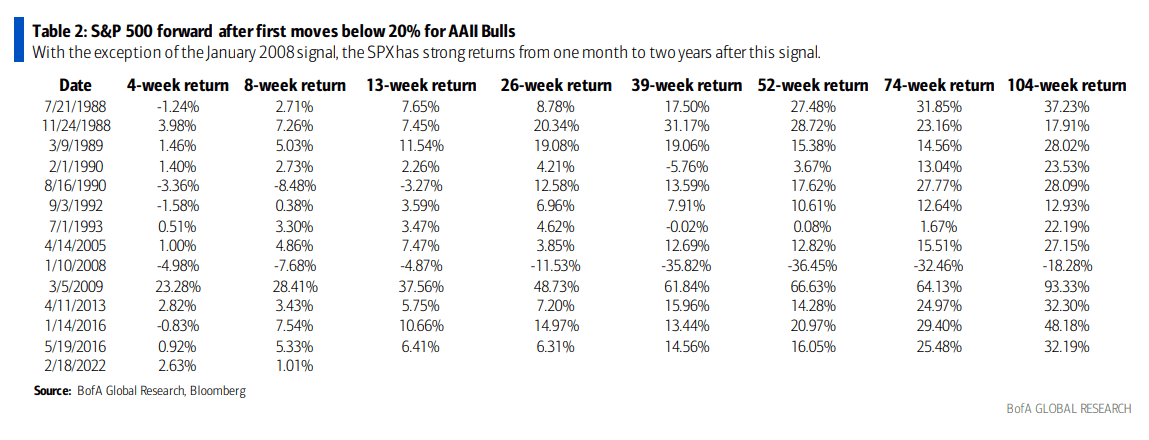

Bank of America followed up yesterday on the same finding with the historical returns after bulls in this poll fall below 20%, and with the exception of the 2008 financial crisis, the returns bode well for the market. This report may have triggered some meaningful institutional buying yesterday. Regardless, it tells me that the next six months are not likely to be as poor and either consumer or investor sentiment suggests. Markets have largely priced in this year’s Fed tightening and a 40-year high in inflation.

Seeking Alpha

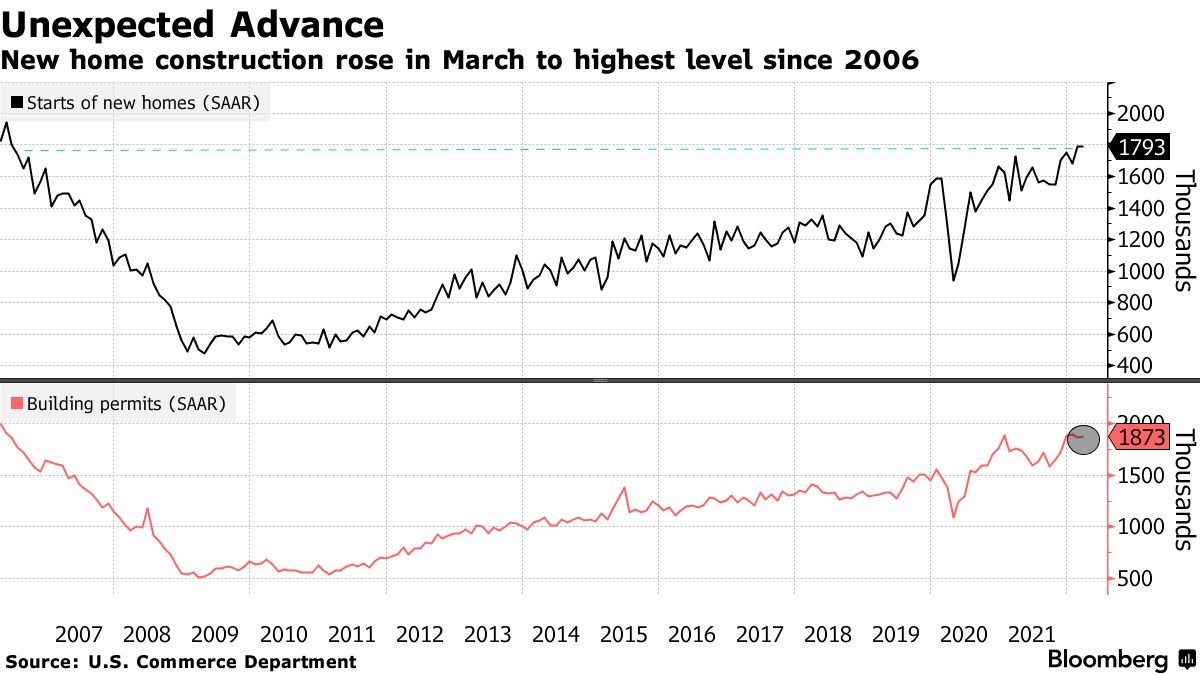

In another sign that the economy is outperforming expectations, along with corporate earnings, housing starts unexpectedly rose in March to the highest level since 2006. This comes despite higher labor and material costs, supply chain bottlenecks, and mortgage rate that have risen above 5%. Homebuilders have huge backlogs, which bodes well for future activity and employment. There is still a tremendous shortage of housing in this country.

Bloomberg

I continue to lean bullish as we move into the thick of first quarter earnings season with expectations that we will recover this year’s losses in the S&P 500.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment