loops7

“Where there is no hope, it is incumbent on us to invent it.” – Albert Camus

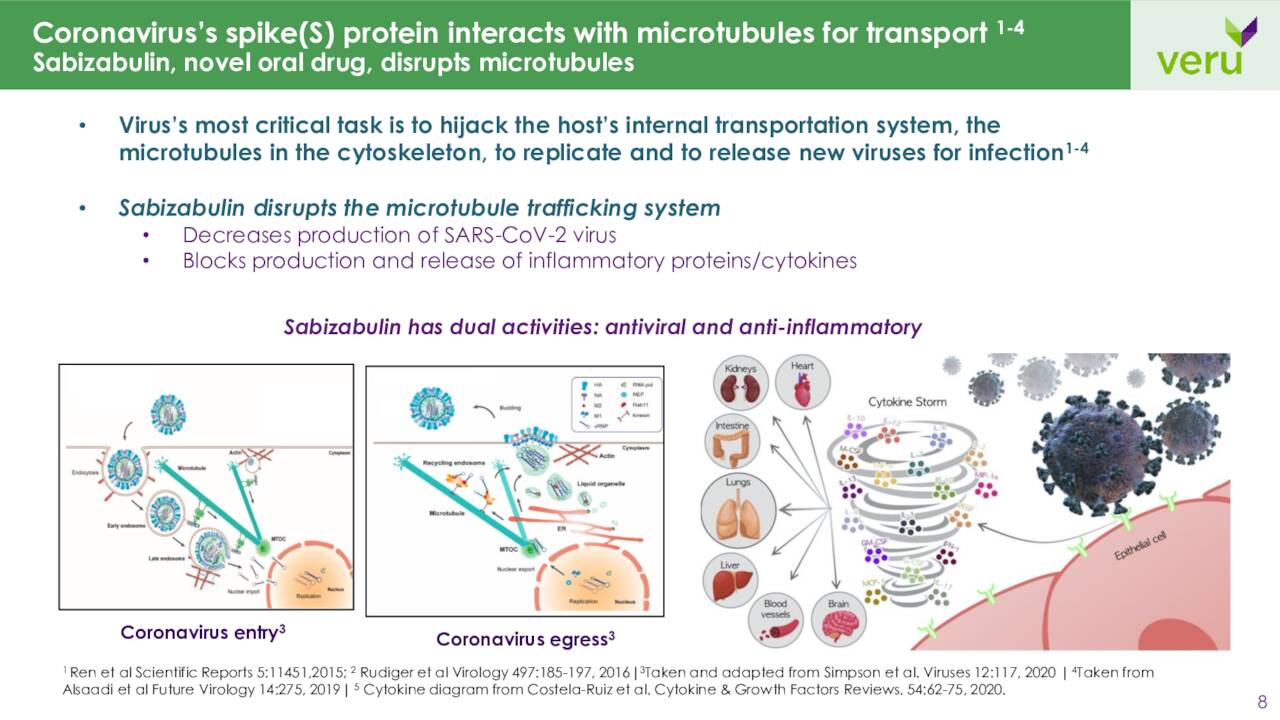

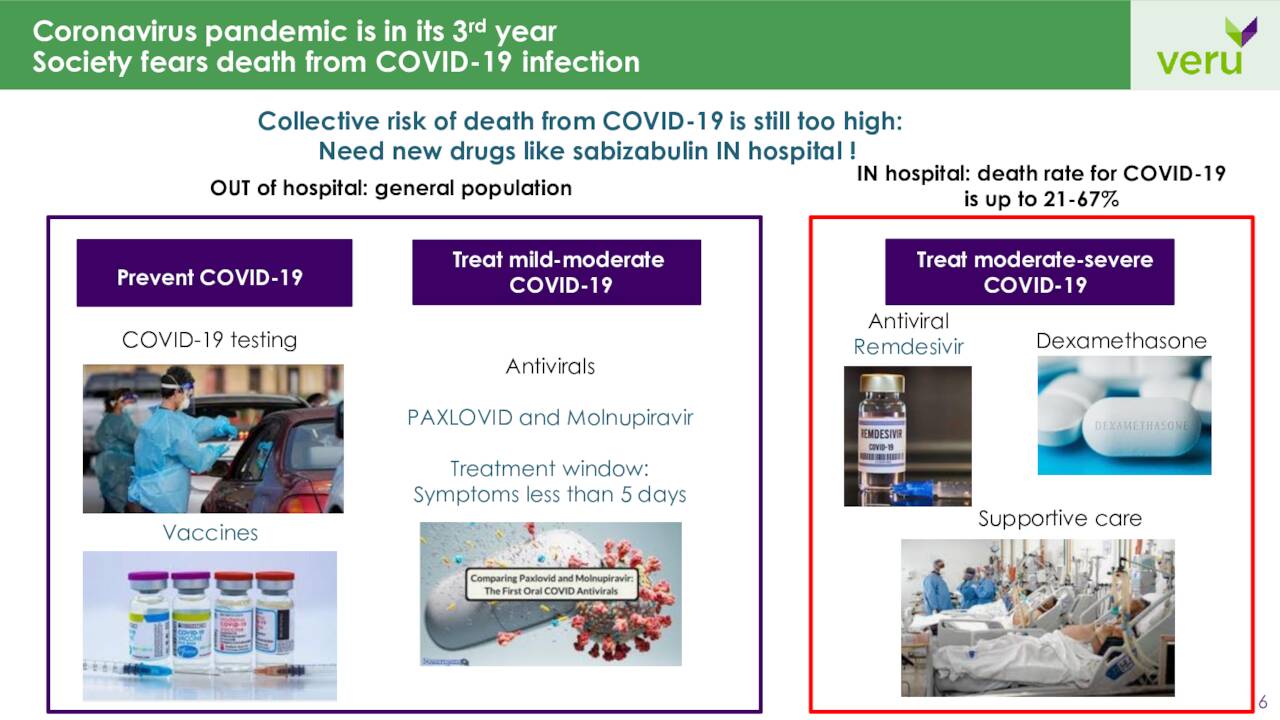

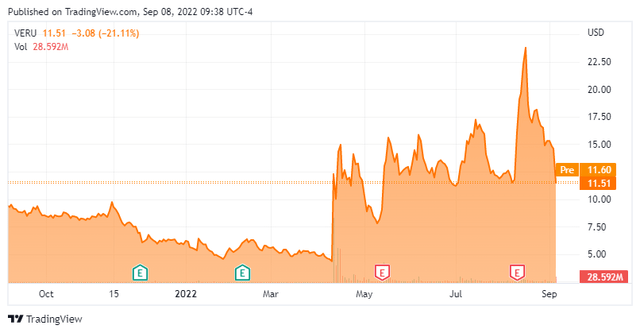

We are going to take our first look at Veru Inc. (NASDAQ:VERU) today. The company is one of many biotech concerns developing new Covid-19 vaccines. Its marketing application for its Covid-19 therapy sabizabulin hit a bit of a snag yesterday when it was learned the Emergency Use Application process would require an AdComm Panel. Can the shares recover? We attempt to answer that question via the analysis below.

Company Overview:

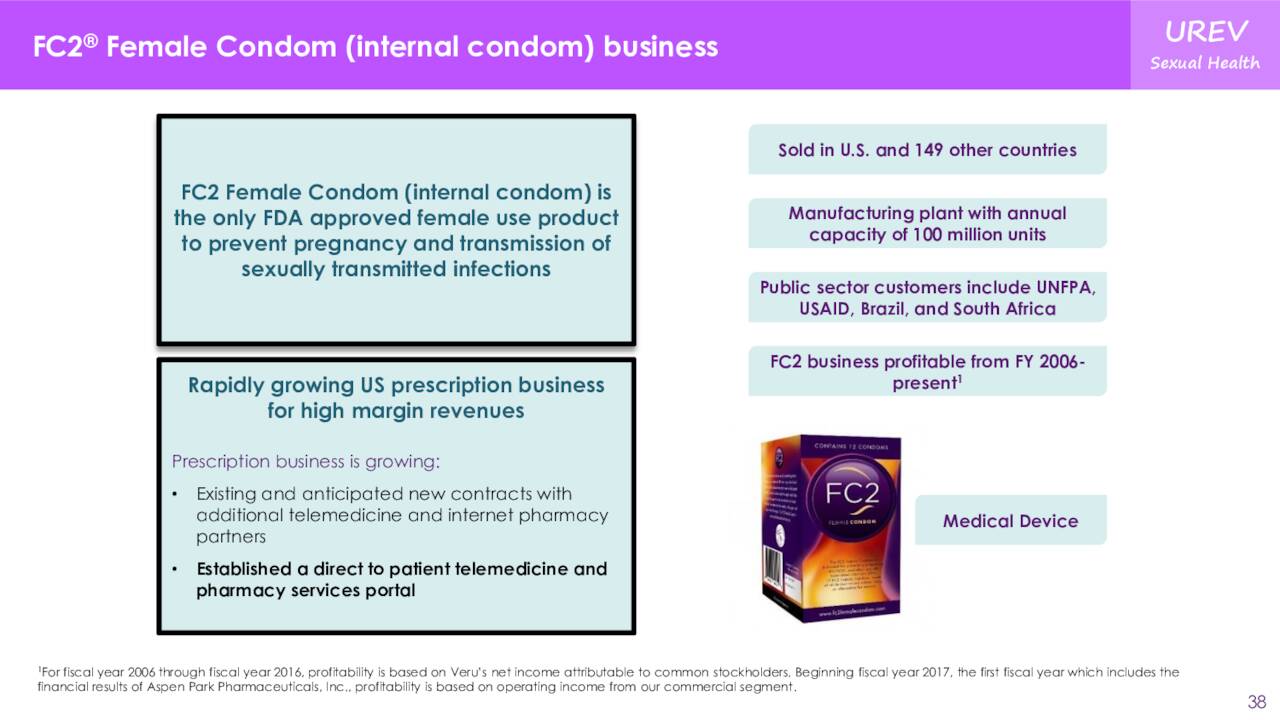

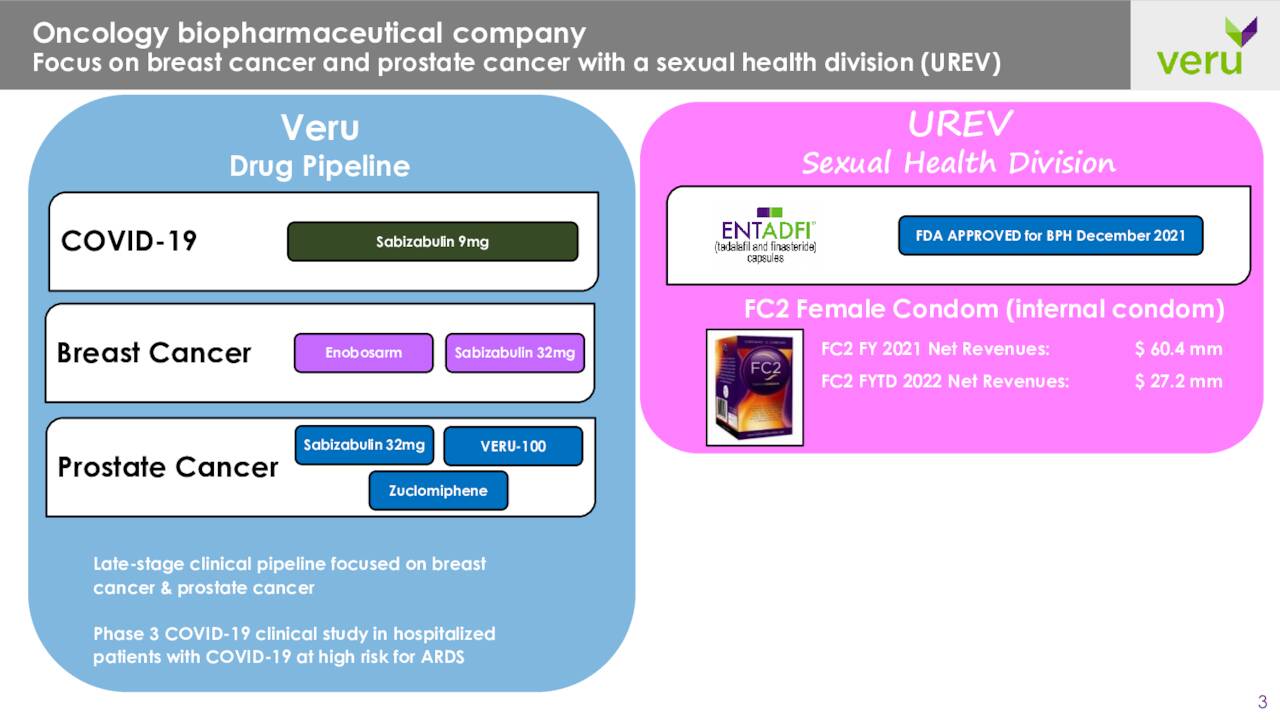

Veru Inc. is based out of Miami, FL and is primarily focused in developing medicines for the management of cancers. However, it has an FC2 female condom/internal condom on the market for the dual protection against unintended pregnancy and the transmission of sexually transmitted infections.

June Company Presentation

In addition, its compound sabizabulin is being developed as a Covid-19 therapy in addition to targeting various oncology indications in ongoing trials. The stock currently trades around $11.50 a share and sports a market capitalization just south of $1.2 billion.

June Company Presentation

Recent Developments For Veru:

On August 11th, the company announced second quarter results. The company has a GAAP loss for the quarter of 28 cents a share as revenues fell just over 45% on a year-over-year basis to $9.6 million. Both top and bottom line numbers missed the consensus badly. It was an ugly quarter from many different angles

U.S. FC2 prescription net revenues decreased 50% to $6.7 million from $13.5 million. The company’s operating loss increased to $21.8 million versus a loss of $2.9 million in the year-ago period. Part of this was due to falling sales, but research and development expenses also increased to $18.1 million from $11.2 million in 2Q2021.

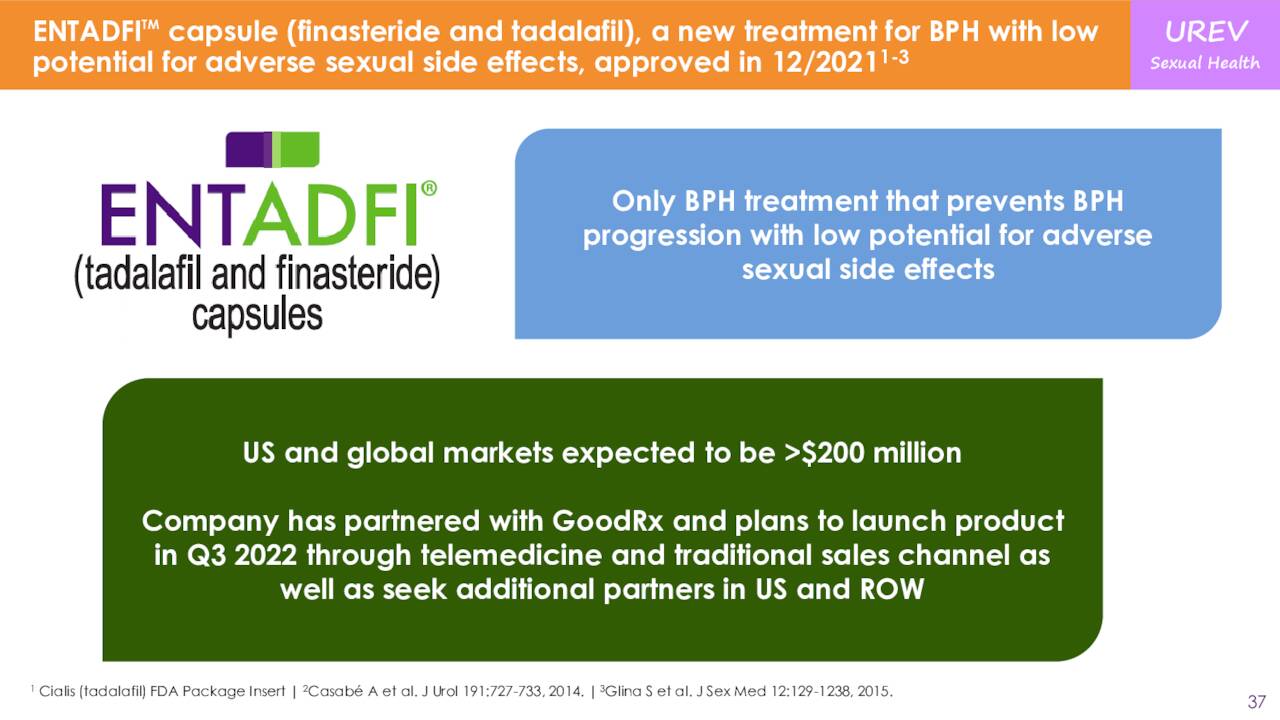

The company did launch ENTADFI™ in August, a capsule with once daily usage. This product is a new oral treatment for benign prostatic hyperplasia or BPH. This product is intended to effectively treat urinary tract symptoms caused by BPH, with less potential for adverse sexual side effects compared to finasteride monotherapy. Management believes this product has over $200 million in eventual peak sales potential.

June Company Presentation

On the Covid-19 vaccine front, in late July, the company received notice that sabizabulin is eligible for expected review to receive authorization in the U.K. as a Covid-19 treatment for hospitalized COVID-19 patients who are at risk of Acute respiratory distress syndrome or ARDS. It was granted the same status in Australia on August 22nd.

June Company Presentation

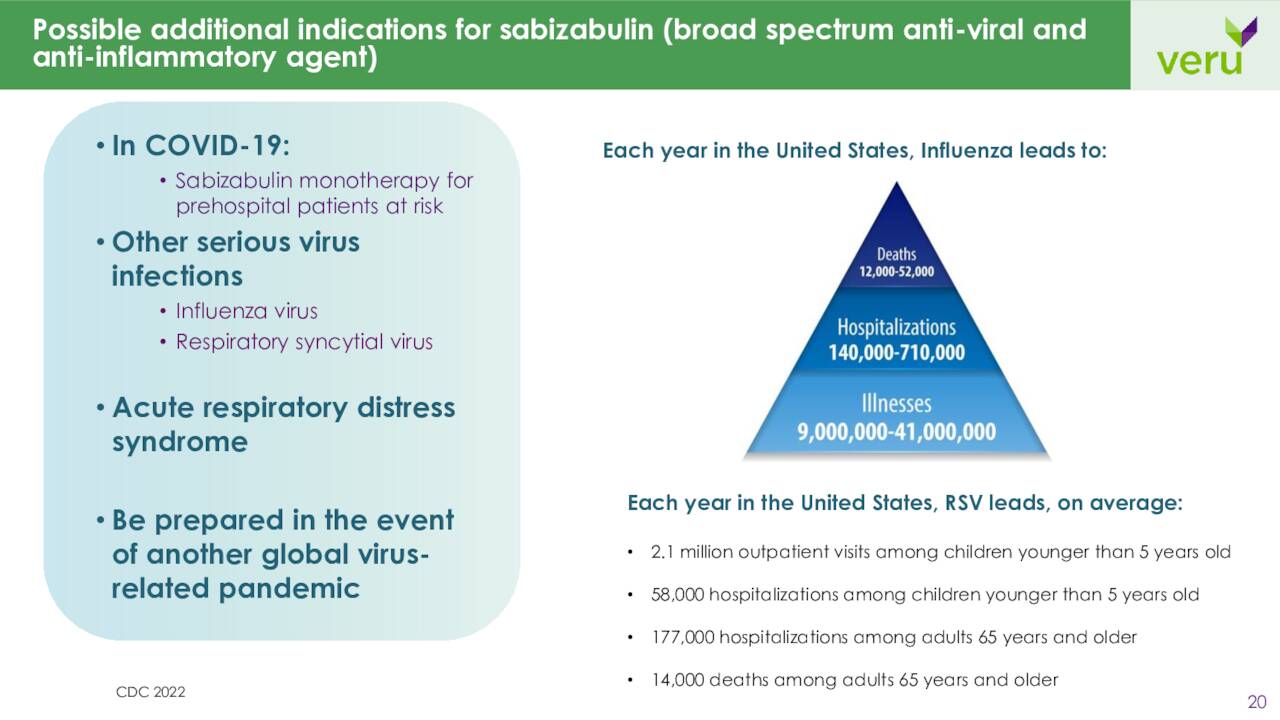

However, in the U.S. approval process, the drug candidate hit a bit of a snag yesterday when it was disclosed that the application process for sabizabulin would have to undergo an AdComm Panel on October 6th. Some of the key issues the panel will focus on will be the therapeutic effect in terms of the high placebo mortality rate and the limited size of the safety database. This could potentially delay the application process further if additional data is deemed to be needed. A panel recommendation would make approval more likely and could open the way for other potential indications such as similar subsets of influenza for instance.

June Company Presentation

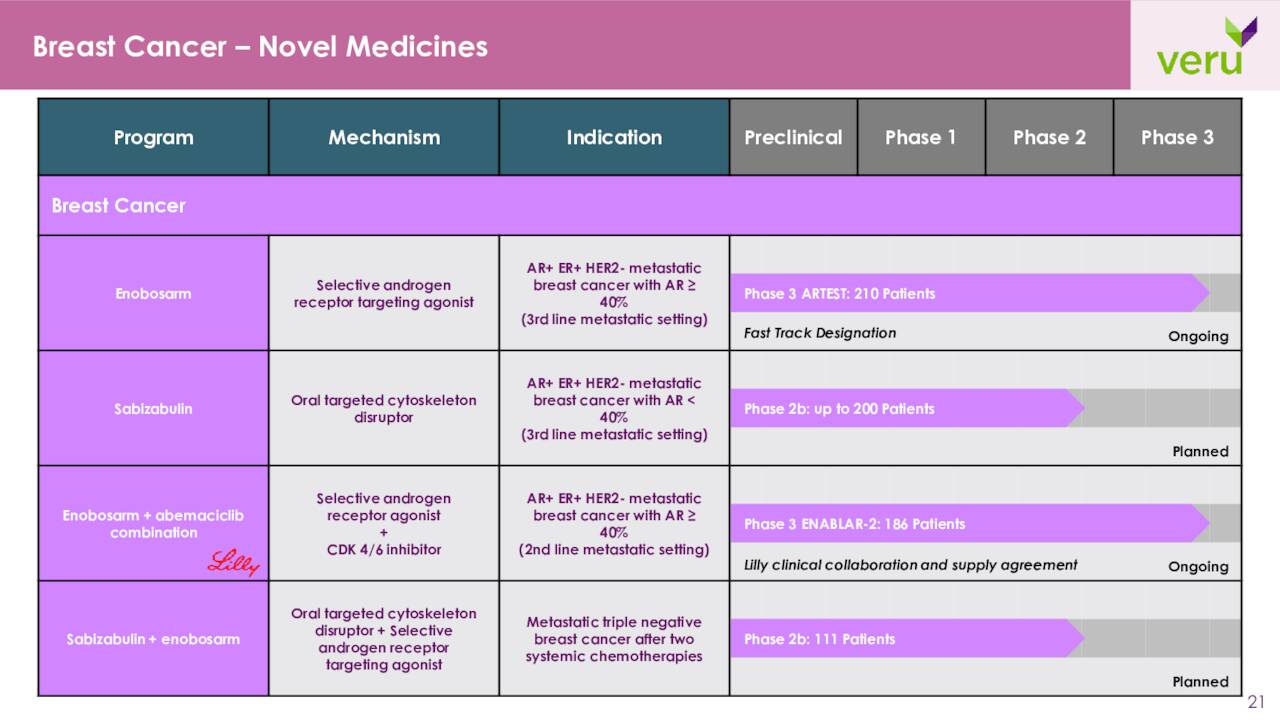

Adding to the complication of trying to put a value on VERU, is that sabizabulin as well as other compounds in the company’s pipeline are also being developed to treat various cancers.

June Company Presentation

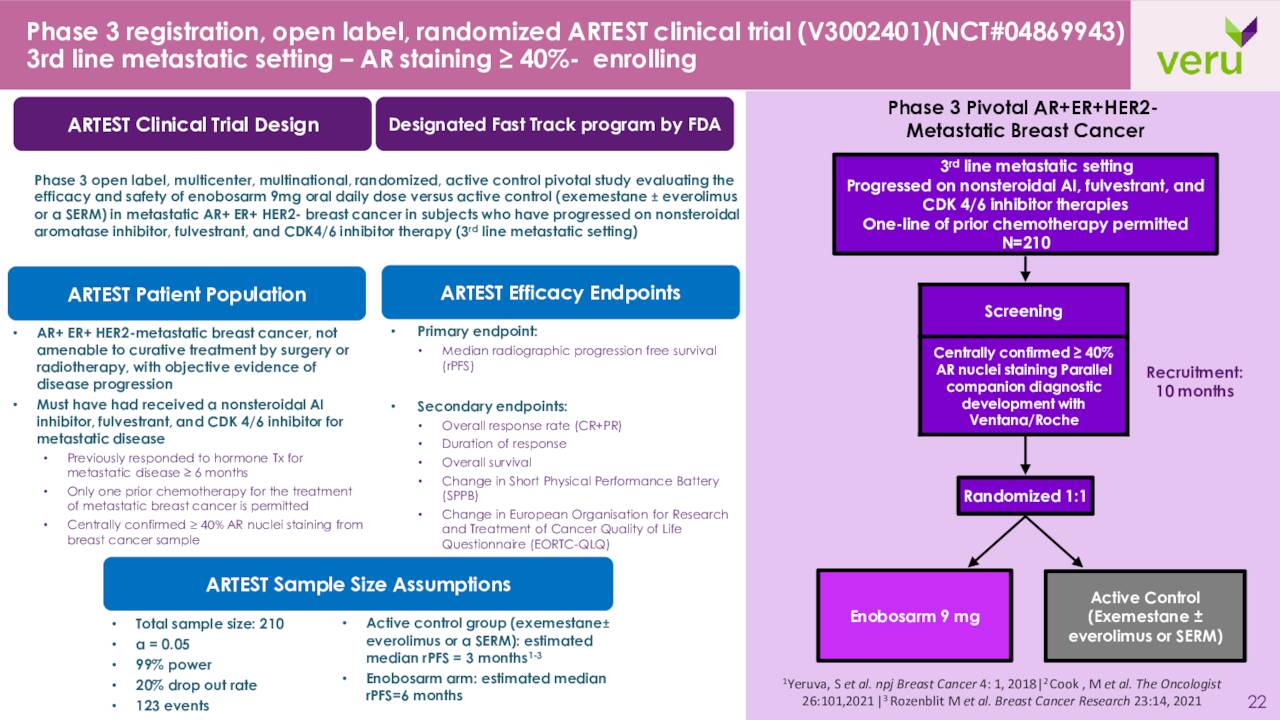

The company is also developing Enobosarm. This is an oral selective androgen receptor targeting agonist that activates the androgen receptor [AR], a tumor suppressor, in AR+ER+HER2- metastatic breast cancer without causing unwanted masculinizing side effects. VERU is currently enrolling a Phase 3 study called ARTEST. This will be:

A registration clinical trial design to evaluate enobosarm monotherapy versus physician’s choice of either exemestane ± everolimus or a selective estrogen receptor modulator (SERM) as the active comparator for the treatment of AR+ER+HER2- metastatic breast cancer in approximately 210 patients with AR expression ≥40% in their breast cancer tissue who had previously received a nonsteroidal aromatase inhibitor, fulvestrant, and a CDK4/6 inhibitor.“

June Company Presentation

Earlier this year, the FDA granted Fast Track designation to the ARTEST Phase 3 registration program.

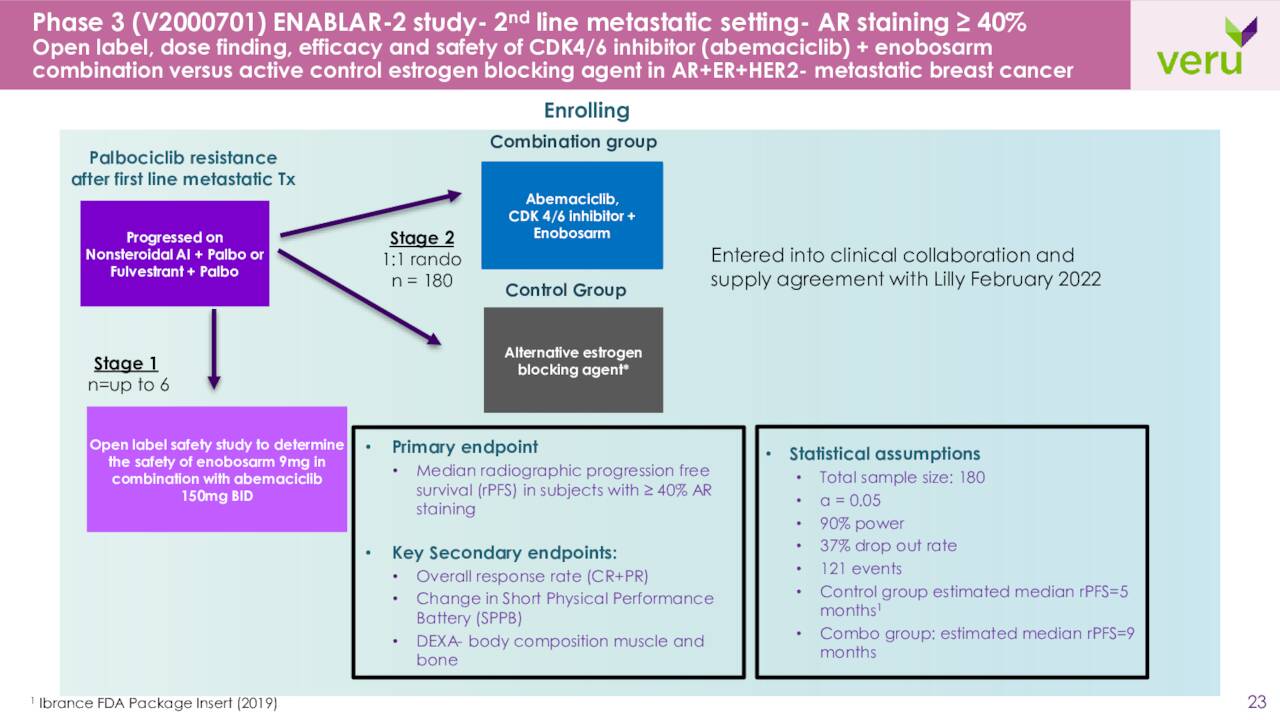

The company also is enrolling patients in a Phase 3 study called ENABLER-2 which is described as:

June Company Presentation

A study to evaluate the treatment of the enobosarm and abemaciclib combination versus an alternative estrogen blocking agent (fulvestrant or an aromatase inhibitor) in subjects with AR+ER+HER2- metastatic breast cancer who have failed first line palbociclib (a CDK 4/6 inhibitor) plus an estrogen blocking agent (non-steroidal aromatase inhibitor or fulvestrant) and who have an AR ≥ 40% expression in their breast cancer tissue in approximately 186 subjects“

Eli Lilly (LLY) is a partner in this trial and will supply the abemaciclib, better known by its brand name Verzenio. Sabizabulin is also in some much earlier stage development in this area that is not germane to this analysis.

June Company Presentation

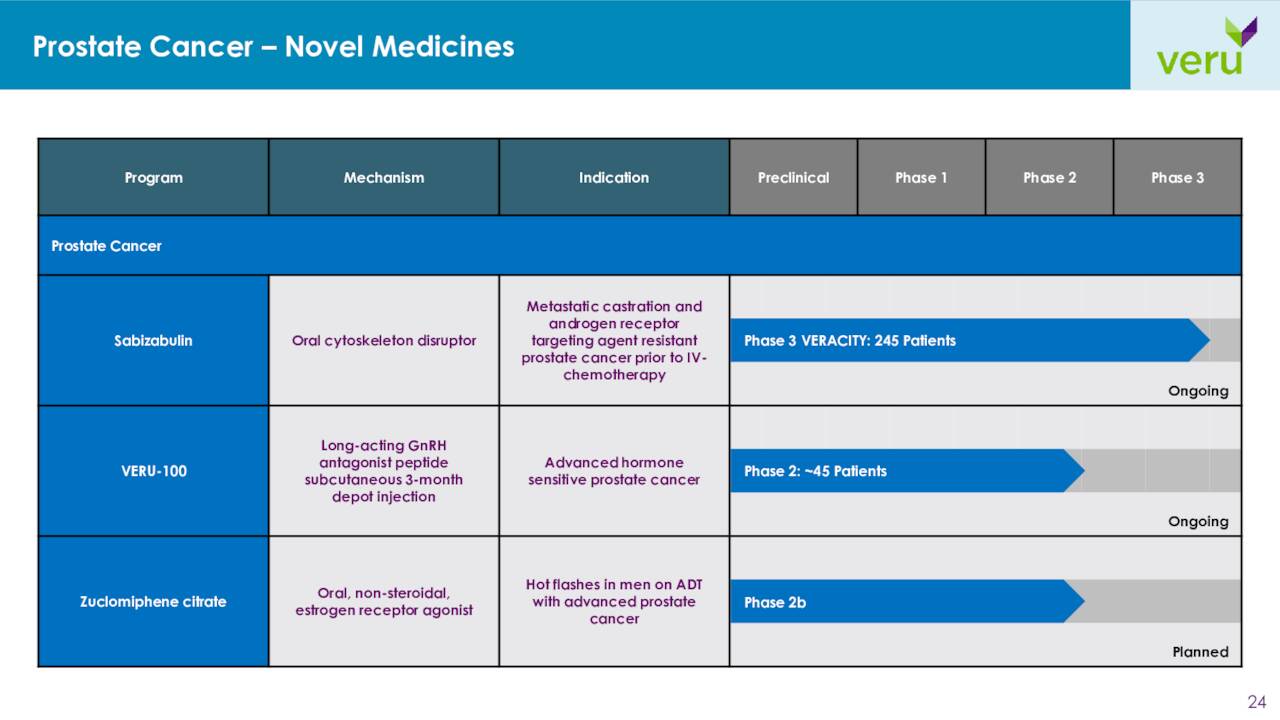

Turning to the company’s efforts in prostate cancer, the company is in the middle of enrolling another Phase 3 trial called VERACITY. This 245-person study will evaluate a 32 mg dose of sabizabulin versus an alternative androgen receptor targeting agent for the treatment of chemotherapy-naïve men with metastatic castration resistant prostate cancer who have tumor progression after previously receiving at least one androgen receptor targeting agent.

June Company Presentation

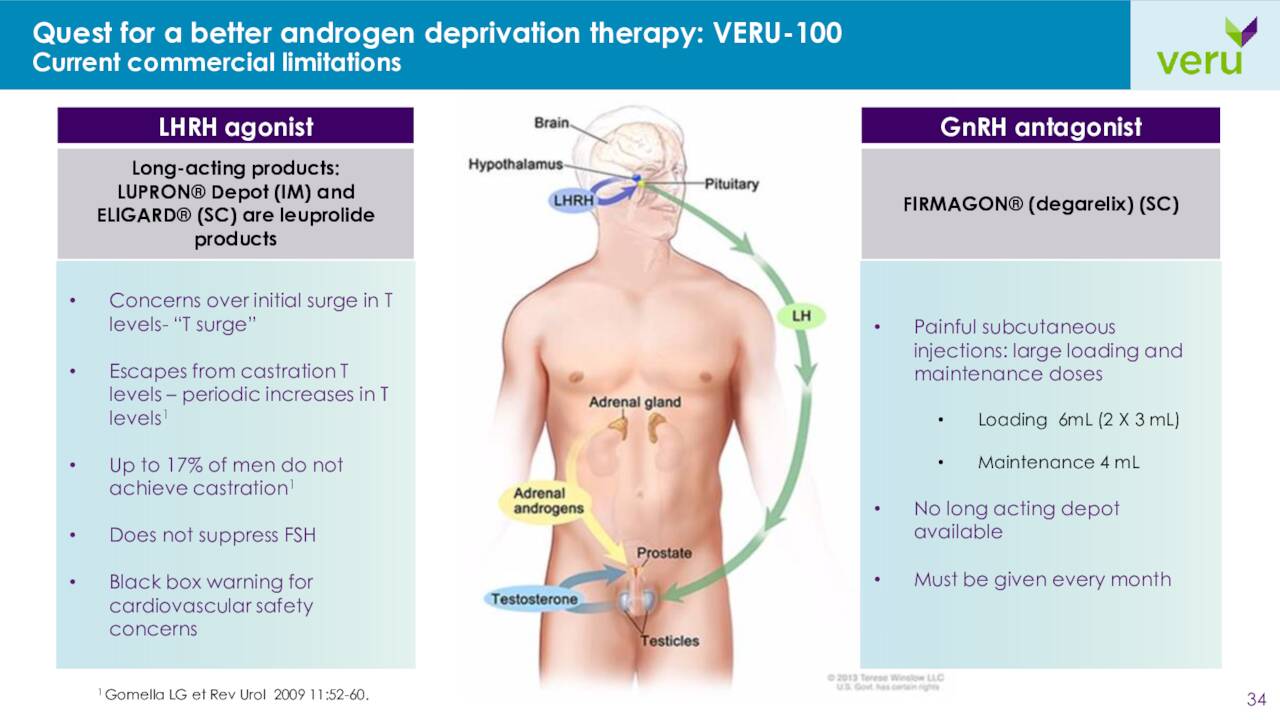

The company is also developing VERU-100, which is a chronic, long-acting GnRH antagonist peptide administered as a small volume, three-month depot subcutaneous injection without a loading dose. A Phase 2 study targeting advance prostate cancer is currently enrolling.

Analyst Commentary & Balance Sheet:

Over the past two months, five analyst firms have reissued Buy ratings on VERU. This includes both Oppenheimer and H.C. Wainwright after the news of the AdComm Panel broke. Price targets proffered range from $24 to $55 a share.

Bears have targeted the stock with over one in every three shares currently held short. A director sold just over $2 million worth of shares on August 15th. This is the only insider activity in this equity so far in 2022. After posting a net loss of $22.2 million in the second quarter, the company ended the first half of 2022 with approximately $100 million in cash and marketable securities on its balance sheet against just over $10 million in long-term debt.

Verdict:

The analyst consensus has revenues dropping just under 20% this year to just over $49 million. They project revenues will soar over 120% in FY2023 to $110 million, but there is a wide range of estimates ($43.2 million to $230.4 million).

June Company Presentation

Veru Inc. is a very complicated “sum of the parts” story. The company is targeting Covid-19 where it might have a nice niche. Veru is also enrolling numerous late stage trials targeting both breast and prostate cancer that look promising.

There are numerous worries for me around this name at the moment. The AdComm Panel is a potential obstacle that could extend the approval timeline for sabizabulin as a Covid therapy. The company also would appear to need to raise additional capital based on its current cash burn in the near future. Then there is the very large short position in the stock, that is a bit concerning.

In an ideal scenario, the company would sell its Sexual Health division with two approved products on the market to fund its other potentially more lucrative focus area (cancer and Covid-19). Barring that, until sabizabulin is approved as a Covid-19 therapy and funding needs are addressed, VERU seems at best a small “watch item” position at the present time.

“May your choices reflect your hopes, not your fears.” – Nelson Mandela

Be the first to comment