RoschetzkyIstockPhoto/iStock via Getty Images

One interesting but young and risky air transportation business that investors should be aware of is Vertical Aerospace (NYSE:EVTL). For the most part, the company is still in the development phase of its technology, but it has started to take orders from customers. With an emphasis on making air travel personal and on-demand, the company provides a compelling value proposition conceptually. But at the end of the day, it’s the vision that investors are ultimately buying into should they purchase shares of the firm. This is because, fundamentally speaking, the company is still immature and severely lacking in discernible value.

A special note on EVTL’s financials

Vertical Aerospace reports its financial condition in pounds sterling instead of US dollars. Where this does apply, I have converted all pounds into dollars at the current exchange rate.

Vertical Aerospace – A different take on air travel

Usually, when someone mentions to me the concept of air travel, I imagine standing in an airport waiting to board a flight for somewhere hundreds, if not thousands, of miles away. But this is not the only application for air travel. Today, Vertical Aerospace is striving to create a new niche in this market, with a special focus on making air travel personal, on-demand, and carbon-free. Based out of Britain, with the company has, over the past few years, worked to develop an electric vertical takeoff and landing, or what management calls an eVTOL, aircraft that will be capable of transporting a pilot and four passengers across distances of over 100 miles at speeds of over 200 mph. The goal is to also create a product that has only minimal noise and produces no greenhouse gas emissions.

The company’s VX4 aircraft has been designed with already existing and certifiable technology by the company’s experienced team. Management has worked on developing this aircraft with the help of companies like Rolls-Royce (OTCPK:RYCEY) (OTCPK:RYCEF) and Honeywell International (HON), with the emphasis of those companies being on the firm’s powertrain and flight control systems, respectively. The firm has also partnered up with a number of other businesses to get where it is today. While the carbon-free initiative targeted by management is a differentiator, the real value proposition has to do with the use for the aircrafts the company plans to sell.

Instead of focusing on long-haul trips with dozens or hundreds of people per vehicle, the company’s objective is to provide additional mobility in heavily populated areas like cities. According to management, an estimated 32 billion hours of time is lost every year in the US because of transportation network congestion. Given that 55% of the world’s population lives in cities, a figure that is expected to climb to 68% for an increase of 2.5 billion people by 2050, this picture will only worsen. Not only is transportation a time issue. It’s also an issue of pollution and cost. By providing its aircraft for the purpose of serving the same role that taxis, trains, and helicopters can, the company hopes to alleviate many of these concerns.

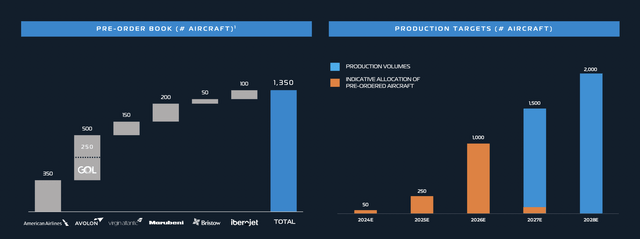

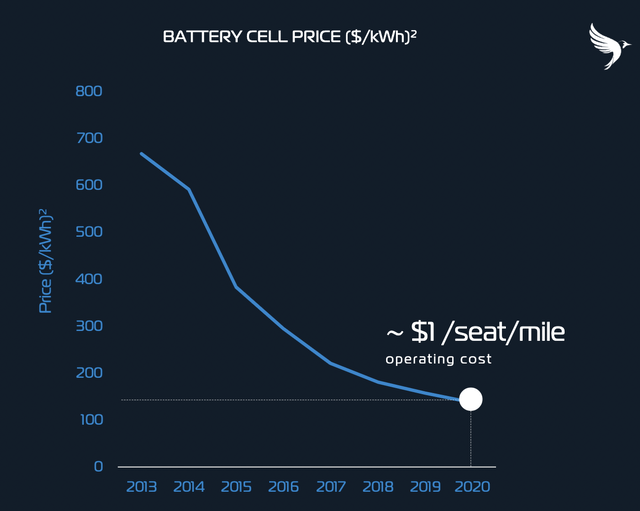

Naturally, investors might be wondering about what kind of cost this will bring. Management currently estimates, however, that the average cost of transportation could be as little as $1 per seat mile, which could make the technology ideal for ridesharing operators. Due to the allure that this technology provides, management has done well to attract some major customers. These can be seen in the image above. In short, the company currently has a pre-order book amounting to 1,350 aircraft. The largest customer, Avolon, could be interested in acquiring up to 500 of these over the next few years.

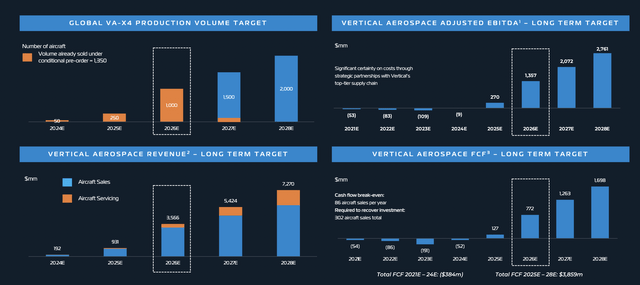

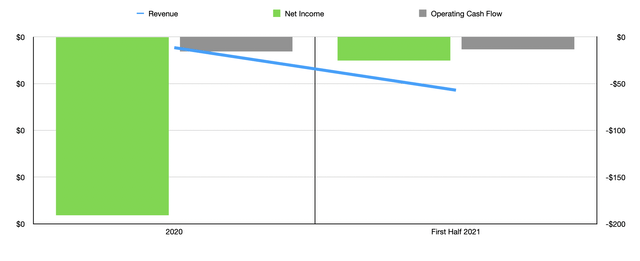

This is important for investors because, fundamentally, there really is no value proposition for Vertical Aerospace. During the first half of its 2021 fiscal year, which covers the most recent data publicly available for the business, it generated revenue of about $85,810. It saw a net loss of $25.46 million and had operating cash flow of negative $13.42 million. What’s more, it will still be a little while before the company can generate any substantive revenue. After all, they anticipate not delivering any units commercially until at least 2024. During that year, they anticipate selling 50 units and generating revenue from aircraft sales of about $192 million. The company should deliver a further 250 units in 2025, generating sales of $931 million before reaching 1,000 and $3.57 billion in revenue, in 2026. Management’s hope is to hit 2,000 units per year by 2028, ultimately generating $7.27 billion in sales that year. It is worth noting that while the bulk of the company’s revenue will likely always come from the production and sale of these aircraft, a growing portion of revenue should be attributable to aircraft servicing activities as well.

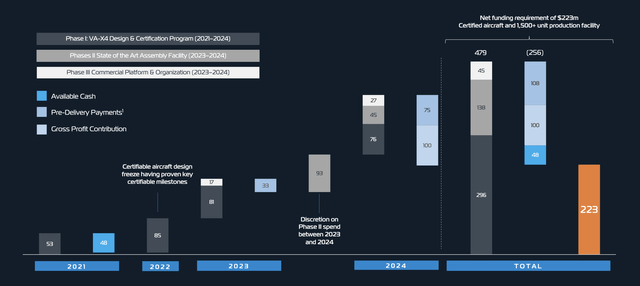

This means a long wait for investors who are trying to buy an undervalued company. Instead, those who like the business and ultimately pulled the trigger are doing so based on management’s target for the future. It will still be years before the company can break even. For instance, EBITDA and free cash flow are not forecasted to be positive until 2025. During those years, management hopes for EBITDA of $270 million and free cash flow of $127 million. The company will also likely require additional funds to get up to the point that it needs to be at. At present, the business does have cash in excess of debt of $134.39 million. However, the company still believes that it will need a further $223 million in net funding to produce its certified aircraft and 1,500+ unit per year production facility by the end of 2024. That figure is net of $48 million in available cash the company expects to have at that time, as well as net of $100 million in gross profit contribution and $108 million associated with pre-delivery payments. One other note that is important is that, while the company does have a significant number of pre-orders, any and all of these can be canceled prior to sometime in 2023, with some even being canceled in 2025, with no recourse to be had. So although the company may be doing well by growing its order book, there is no guarantee that customers will follow through.

Vertical Aerospace Vertical Aerospace

Takeaway

Based on the data provided, Vertical Aerospace is an interesting company that hopes to solve a significant real-world problem. More likely than not, this technology will eventually come into play across the globe. But at the end of the day, there’s no guarantee that this firm will be the one to achieve that goal. There is substantial risk for investors today. But if the company can pull off its objectives, the rewards might ultimately be worth it.

Be the first to comment