magicmine/iStock via Getty Images

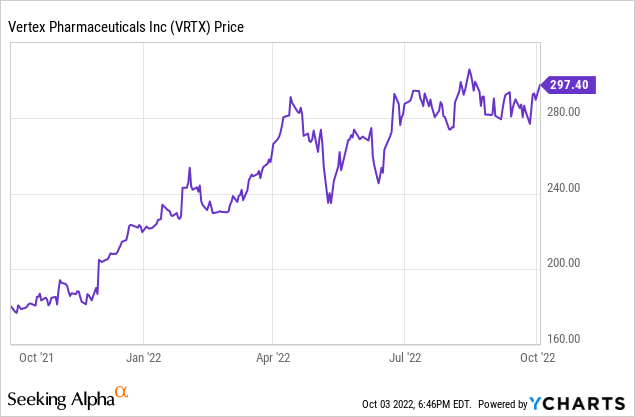

Vertex Pharmaceuticals (NASDAQ:NASDAQ:VRTX) is a large cap company best known for its CF (cystic fibrosis) therapies. However, it is also working at the cutting edge of biotechnology with gene therapies. Although the company’s stock is near its 52-week high or $305.92, bucking the generally downward trend in pharmaceutical stocks, I believe its long-term potential makes it an attractive for longer-term investors. In this article I will focus on recent news and potential pipeline developments that could eventually push the stock price higher. I will first ground the reader with a quick review of Q2 results.

Vertex Pharmaceuticals Q2 2022 Results and Conference

Vertex Q2 2022 results were reported on August 4. Revenue is growing at a fast pace, hitting $2.2 billion for the quarter, up 5% sequentially from $2.10 billion and up 22% from $1.79 billion in Q2 2021. Resulting GAAP net income was $811 million or $3.13 per diluted share. Vertex also reported non-GAAP net income of $930 million and EPS of $3.60.

All of Vertex’s product revenue came from its cystic fibrosis franchise. Its older CF drugs Orkambi, Kalydeco, and Symdeko lost ground. 86% of revenue, or $1.89 billion came from sales of Trikafta. That is good for long-term investors since it means it will be years before patent protection expires.

In addition, Vertex ended the quarter with $9.3 billion in cash and equivalents but no debt. Vertex is in a position to pay substantial dividends to stockholders, though I do not expect that anytime soon. It could use cash to license therapies from other companies or swallow whole companies. Note too that R&D expense in the quarter was $600 million, which can be seen as a form of investment in future products. For more details about Vertex in Q2 see the analyst call transcript or audio recording.

MaxCyte Licensing and other recent developments

The most recent Vertex development is the agreement to license an electroporation platform from MaxCyte (MXCT). It will be used to develop exa-cel. Few details were released, but MaxCyte sells three versions of its benchtop systems, so I would guess this agreement is about scaling up production rather than being research-oriented.

In July 2022, Vertex entered into a definitive agreement to acquire ViaCyte, a privately held company focused on delivering novel stem cell-derived cell replacement therapies as a functional cure for Type 1 diabetes, for $320 million in cash. Vertex anticipates the acquisition will close later this year. Also in July, Vertex entered a research collaboration with Verve Therapeutics, focused on discovering and developing an in vivo gene editing program for a liver disease. In May, Vertex acquired Catalyst Biosciences’ complement portfolio and related intellectual property for $60 million in cash.

Exa-cel Gene Editing Progress

Exa-cel (exagamglogene autotemcel) is intended to treat sickle cell disease and transfusion-dependent beta thalassemia. On September 27, with partner CRISPR Therapeutics (CRSP), Vertex announced the FDA had granted exa-cel a rolling review for both sickle cell disease and transfusion dependent beta thalassemia. The submission will begin in November and should be completed by the end of March 2023. Vertex also plans to make a European application before the end of this year. Exa-cel already has Fast Track and Orphan Drug designations from the FDA. The primary trials for the diseases, CLIMB-111 and CLIMB-121, have completed enrollment. Complete trial results are not yet available, but some results were shared in June 2022. A follow-up open-label trial will be required for all trial participants. Two Phase 3 trials for children with the diseases are now open for enrollment.

Cystic Fibrosis Franchise

Vertex had its first cystic fibrosis drug, Kalydeco, approved by the FDA in 2012. It was the first CF drug to treat the underlying condition rather than the disease symptoms. Cystic fibrosis is caused by gene mutations, but not all patients have the same mutation. Vertex continued to bring out new medicines, including combinations. Trikafta was approved in 2019 and can work with about 90% of the CF population, so it has been both helping new patients and gradually replacing the older therapies. Vertex dominates the CF market. I do not see that changing anytime soon. Revenue growth should continue as patients are added around the globe. At some point patient numbers might level off, so growth would only come through price increases, but that should be at least several years down the road.

Vertex is not resting in its CF therapy efforts. Its pipeline for CF includes VX-121 and VX-561, which are in the same small molecule class as its current therapies. It also has a CRISPR gene therapy and an mRNA therapy in preclinical development.

Rest of Pipeline

After succeeding with CF, Vertex began building its pipeline of therapies for other diseases. VX-548 is for acute pain. In March 2022, Vertex reported positive data from two Phase 2 dose-ranging acute pain studies, one following bunionectomy surgery and the other following abdominoplasty surgery. Both studies met their primary endpoint. Vertex also intends to initiate a Phase 2 dose-ranging study of VX-548 in neuropathic pain by the end of 2022. If this is a non-addictive, effective therapy for pain, it could be very valuable.

VX-147 is being developed for APOL1 proteinuric kidney disease and is in a Phase 2/3 trial. The study was initiated in March 2022, with no timeline for results yet. The Phase 2 study had reported positive results in Q4 2021. Vertex believes this is a multi-billion-dollar opportunity.

VX-880 is in Phase 1/2 for Type 1 diabetes. 150-day data was very positive. This could be a transformative therapy given the nature of Type 1 diabetes. However, the FDA placed a clinical hold on the study in April 2022. The trial has since resumed enrollment.

Vertex has three drugs licensed to MERCK KGaA (OTCPK:MKGAF) for unspecified indications. Furthest from commercial approval are several preclinical programs. They include encapsulated islet cells for Type 1 diabetes; a therapy for Duchenne muscular dystrophy; and a potential Alpha-1 antitrypsin deficiency therapy. Other acquired therapies described above in the recent developments section are not yet shown on the pipeline page.

Problems With Genetic Engineering for Investors

I made the same analysis for the CRISPR gene therapies of bluebird bio (BLUE) in bluebird bio: Hold, Wait to See if Revenue Ramps. It is a bit early to get excited about this part of the pipeline. There are relatively few patients with the diseases treatable by gene therapies in development so far. To recover development costs the price of therapy must be set high. While it is arguable that money is saved in the long run over treatment with conventional therapies, in the short run payers may balk. Then there is competition: bluebird also has a potential sickle cell disease gene therapy, Lovo-cel, in its pipeline. Longer run, if these therapies work without major side effects, and if some are developed for more common diseases, this could be a fruitful field for investors. However, I do not see it as a significant income source for Vertex in the next 2 to 3 years.

Evaluation and Conclusion

I generally do not like to buy stocks near their 52-week highs. In the short run, the most likely trend is reversion to a lower level. In the longer run I expect Vertex Pharmaceuticals to continue to ramp revenue from its CF franchise. Add to that a big pile of cash, and I think the long run looks great. I expect Vertex to keep expanding its therapy pipeline, which will reinforce revenue in the second half of this decade. Despite my caveat about gene therapy, that should work out reasonably well in the long run if costs can be brought down to levels attractive to payers. While there are risks, for longer term investors I believe the potential upside is strong. At the current price I may continue to accumulate the stock, but I would also be looking to buy on dips, unless they are caused by substantial problems being revealed. I would like to see a dividend initiated, but do not expect one.

Be the first to comment