Eoneren

Just before pondering the prospects of a 50% plunge, the S&P 500 (NYSEARCA:NYSEARCA:SPY) rallied. The index peaked in mid-August. Federal Chair Jerome Powell warned that the central bank would act on inflation. Last month, it repeated the same message by mentioning inflation and housing prices dozens of times.

After markets continued to feed on bearish sentiment in the third quarter, readers want to know when the everything bubble will pop. Investors cannot time the market with any precision. If economists cannot forecast, neither can investors.

Investors may look for the proverbial canary in the coal mine. There are five things to look for.

1/ Tesla Stock Decline

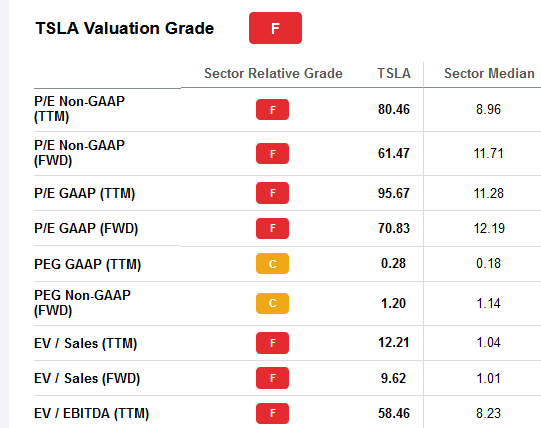

Investors might argue that Apple’s (AAPL) stock decline signals a pop in the technology bubble. The smartphone and services giant has a 7.03% weighting on the S&P 500. However, Tesla scores an ‘F’ on nearly every valuation metric:

SA Premium

The electric vehicle firm, which bulls argue is just an advanced software developer in automotive, scores a C on price-to-earnings to growth. Although Tesla is not a stock to short-sell, its missed delivery estimate triggered a drop of 8.67% at the time of writing. Below, TSLA stock fell while the broader market rebounded on Oct. 3, 2022.

Last Friday, CEO Elon Musk debuted Optimus at Tesla’s AI Day. Unfortunately, the machine had more hype than substance. Investors might buy Hyundai Motor (OTCPK:HYMLF) instead. The South Korean conglomerate bought Boston Dynamics for only around $1 billion in 2020. HYMLF stock would give investors exposure to the robotics sector.

Bearish investors might consider avoiding the automotive sector altogether. During a recession, consumers are less likely to buy big-ticket items. They might avoid Ford’s F-150 Lightning, for example. Contractors who buy a truck to work must pay more than the $55,000 base price to get a longer driving range.

The market’s fascination with Tesla stock needs to end before the market bubble pop ends. Shares would first need to re-test the May 2022 low of $206.86.

2/ 30-Year Treasury Yields Fall

Investors who bet that U.S. long-term bonds would not fall with stocks lost money. The 30-year Treasury (TLT) tried to break out above $120 in August 2022. Once speculators started pricing the Federal Reserve rate hikes, TLT stock fell to near $100.

The 3-month, 6-month, 2-year bond yields need to fall along with the 30-year. The 2-year bond yield is around 4.2%. This return competes with dividend income stocks and would explain the sector’s decline in Q3. The bond yields might not fall until the Fed hints that it will stop raising interest rates.

3/ Ark Invest Inflows Decline

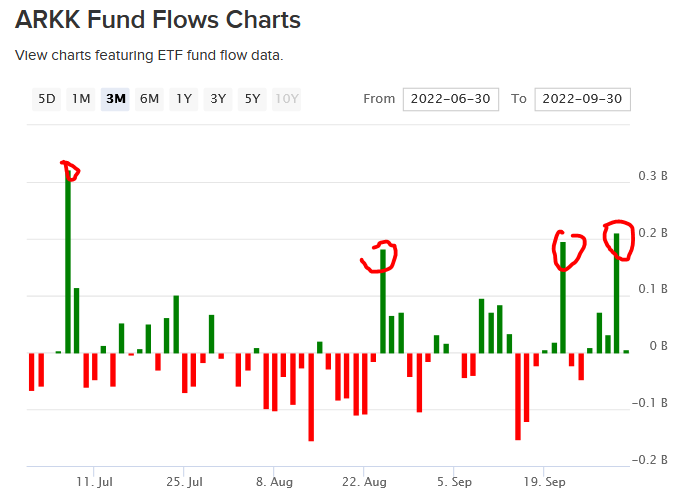

In the third quarter, investors withdrew only$75.73 million from ARK Innovation (ARKK), Cathie Wood’s flagship fund. The exchange-traded fund still manages $7.59 billion in assets. Speculators keep buying the ETF whenever the technology sector dips. Tesla, Zoom (ZM), and Roku (ROKU) are among the top holdings.

ETFdb

Zoom faces bearish headwinds. The video conferencing service thrived during the pandemic. In a post-pandemic world, office workers may just as easily use Microsoft (MSFT) teams. As for Roku (ROKU), the$605 per share target by 2026 is not playing out. ROKU stock lost around 33% of its value in the last quarter. Still, Roku might recover when it updates investors with its active user figures on Nov. 2, 2022.

The ETF depends on a buying frenzy to lift the underlying purchases. More recently, the fund manager built a 3.44% allocation in Ginkgo Bioworks (DNA). The provider of cell programming doubled its total revenue to $145 million in the second quarter.

Although it ended with $1.4 billion in cash, Ginkgo lost $647 million from operations. This is due mostly to the $600 million in stock-based compensation.

Other Considerations

4/ Mid-term Elections

Increased government spending on advertising during the mid-terms might end the drop in tech firms. Meta Platforms (META) would welcome increased ad spending. The stock is near its 52-week lows on worries that its revenue will sink further. To rebound, the company needs to post strong daily active users in its third-quarter report.

5/ Cryptocurrency Prices

Luna’s crash started a panic in the spring. It sent Bitcoin (BTC-USD) lower. However, BTC prices are holding the $20,000 level. The crypto market would need BTC prices to fall in the high teens again. Confidence improved after the Ethereum (ETH-USD) merge. However, volatility in the sector is hurting crypto trading volumes.

Weak activity did not hurt Coinbase (COIN), which rose by 31% in the quarter. Robinhood (HOOD) returned ~ 23% in that time.

The crypto trading platforms need to issue a weak outlook before the bubble in the sector deflates.

Your Takeaway

Investors will have their “go-to” proverbial canaries in the coal mine. This includes watching gold, commodities, and currency. Market fears are still rising after the disastrous third-quarter stock performance. Investors could stay out of the market by holding cash. Still, the market will not likely offer the perfect time to re-enter the market.

The everything bubble pop ends when stock prices adequately reflect future risks. The market is not there yet. The Federal Reserve’s interest rate hikes raised mortgage rates and are hurting home prices first. It has yet to slow the rest of the economy down enough to lower inflation rates.

Investors may average down steadily into the market over the next 12 months. You will not time the lowest price but adding regularly will keep you invested.

Be the first to comment