FroggyFrogg/iStock Editorial via Getty Images

“A person does not grow from the ground like a vine or a tree, one is not part of a plot of land. Mankind has legs so it can wander.“― Roman Payne

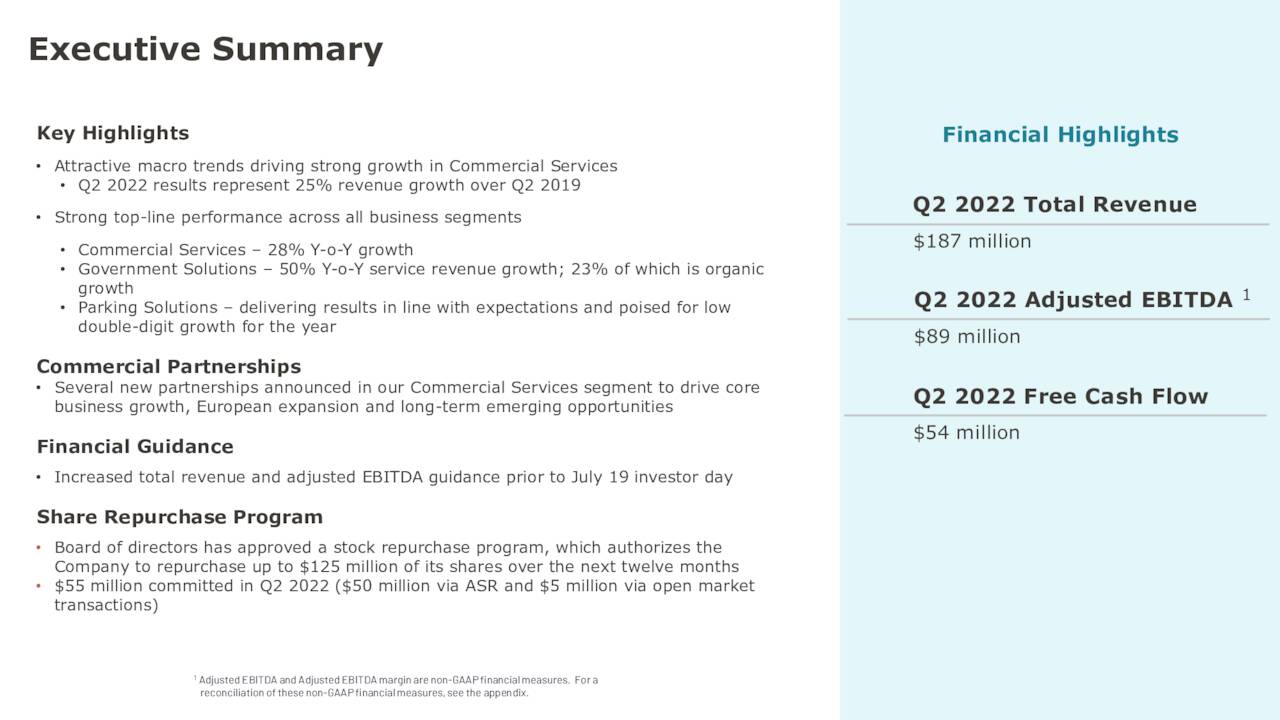

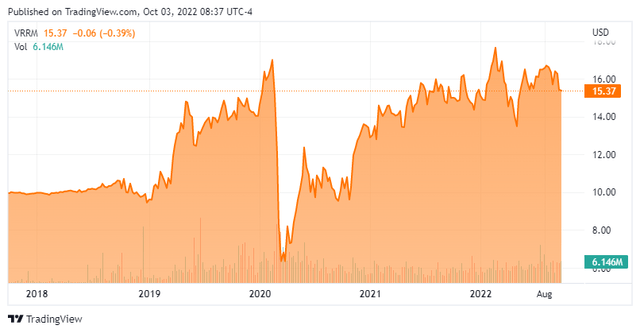

Today, we put Verra Mobility Corporation (NASDAQ:NASDAQ:VRRM) in the spotlight for the first time. The company has recovered nicely from the pandemic and has recently made a couple of small acquisitions to help bolster growth. The shares do seem to be topping out in recent months even as the company has drawn the interest of an activist investor. An analysis follows below.

Company Overview:

Verra Mobility Corporation is located in Mesa, AZ, a city I spent my grade school years in. The company provides smart mobility technology solutions and services in the United States, Australia, Canada, and Europe both to government and private entities. Its Parking division provides an integrated suite of parking software and hardware solutions to universities, municipalities, parking operators, healthcare facilities, and transportation hubs. The company services municipalities by enabling photo enforcement through road safety camera programs, which detects and process traffic violations. Finally, its Commercial division provides automated toll and violations management as well as title and registration services to rental car companies, fleet management companies, and other large fleet owners. The stock currently trades just above $15.00 a share and sports an approximate market capitalization of $2.35 billion.

Second Quarter Results:

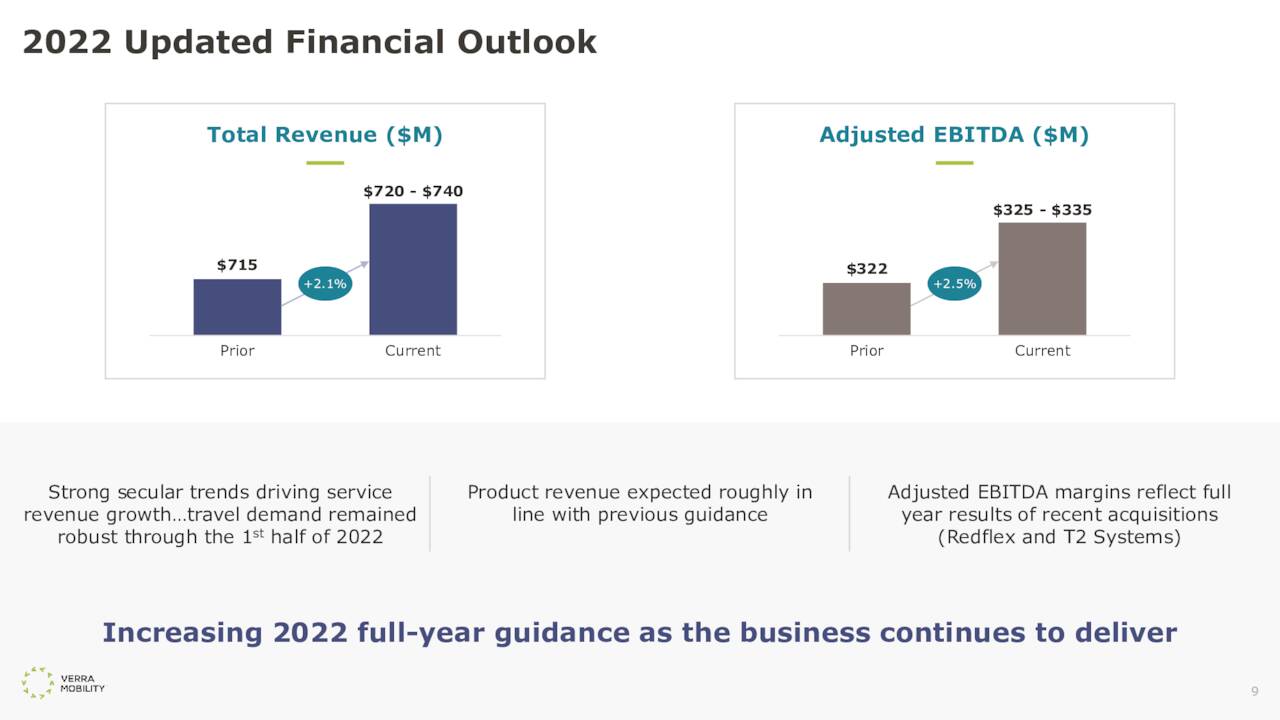

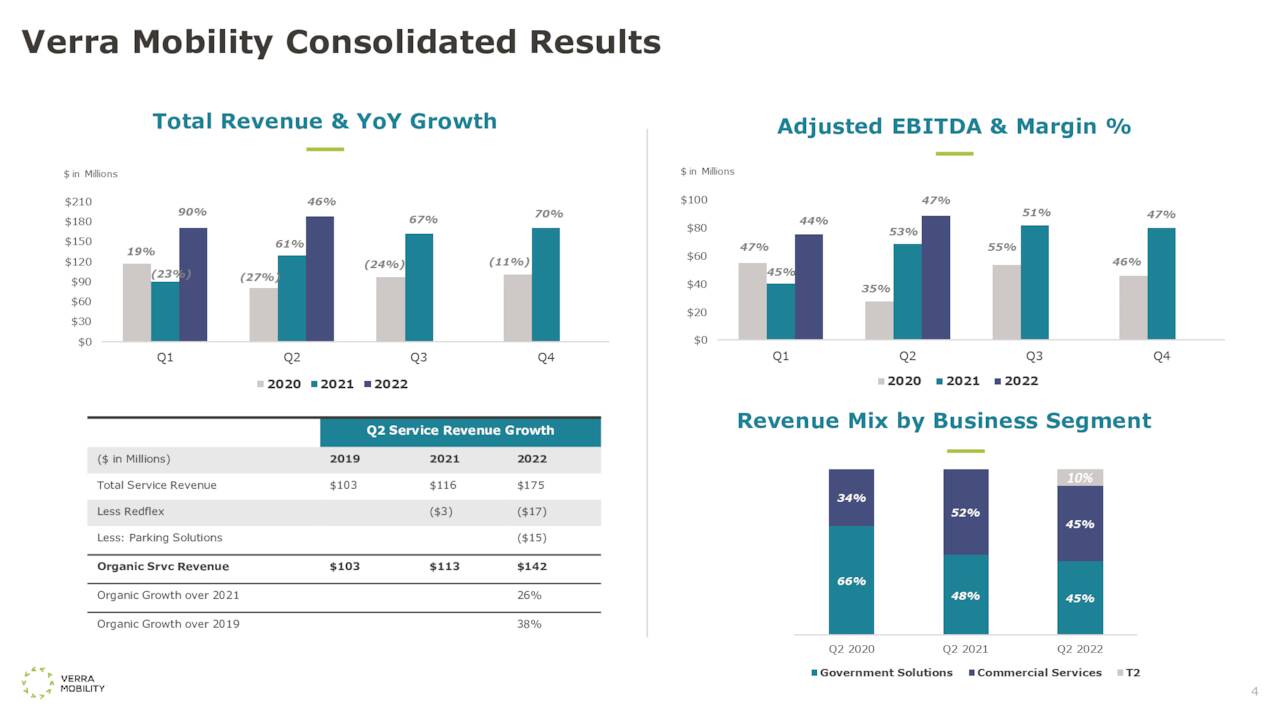

On August 3rd, the company reported second quarter numbers. The company had non-GAAP earnings of 29 cents a share. This was up substantially from the 10 cents a share of profit it made in 2Q2021 and four cents a share above expectations. Revenues rose just over 45% on a year-over-year basis to $187.5 million, which also was nicely above the consensus. Management provided full year 2022 sales guidance of $720 million to $740 million, a slight rise from previous guidance.

August Company Presentation

It is important to note that organic revenue growth for the quarter was 26%. Verra Mobility got $29 million to service revenue in the quarter from recently acquired Redflex and T2 Systems.

August Company Presentation

Here is breakdown of revenue growth from the company’s three divisions:

- The Commercial Services segment generated total revenue of $84.9 million, a 28% increase compared to $66.5 million in 2Q201.

- The Government Solutions segment garnered total revenue of $83.5 million, a 34% increase compared to $62.2 million in the same period a year ago.

- The Parking Solutions segment generated total revenue of $19.1 million with no comparable amounts in the prior year. The was the result of the recent purchase of T2 Systems.

Analyst Commentary & Balance Sheet:

The analyst community is mixed on its view around the company at the moment. Since mid-July, William Blair, Credit Suisse ($20 price target) and BTIG ($21 price target) have reissued Buy ratings while Deutsche Bank ($19 price target), Morgan Stanley ($17 price target) and Robert W. Baird ($18 price target) have all maintained Hold ratings on the equity.

August Company Presentation

Approximately seven percent of the outstanding float is currently held short. Two insiders sold $670,000 worth of the shares in January and February but there has been no insider activity in the stock since then. The company ended the second quarter with just over $90 million in cash and marketable securities on its balance sheet versus just over $1.2 billion in long term debt. The company repurchased $50 million worth of shares in the second quarter, part of a new $125 million stock buyback program. The company produced $54 million of free cash flow during the quarter as well.

Verdict:

The current analyst firm consensus has Verra Mobility earning a buck a share in FY2022 as revenues rise by a third to $735 million. Sales growth is expected to slow in FY2023 to the mid-single digits while earnings are projected to come in just under $1.15 a share.

It should be noted that activist investor Scopia Capital took a just over five percent stake in the company in July. It is pushing for changes at the company as the stock trades near the same levels of three years and its fair value for Verra Mobility is $25.00 a share.

The stock has doubled off pandemic lows but seems to be topping out in recent months. The shares trade for just over 15-time forward earnings and just over three times this year’s projected sales. Reasonable valuation for a company likely to grow earnings in the low teens next year on a mid-single-digit rise in sales. Based on the second quarter results, the stock has free cash flow yield in the high single digits.

Personally, I do wish the company would use that cash flow to pay down debt versus buying back stock. I am going to pass on any investment recommendation on VRRM at this time, as the shares seem fairly valued. If the stock dropped to the $12 to $13 range in the next market pullback, however, I would be tempted to pick up a small ‘watch item‘ position in VRRM.

“The freedom I treasure most is the freedom to get up and leave.”― Marty Rubin

Be the first to comment