Leestat/iStock via Getty Images

Investment Thesis

Vermilion (NYSE:VET) is an oil gas company. The main distinguishing feature facing this company is that it’s undergone 2 big acquisitions, Corrib and Leucrotta, that have slightly muddled its results temporarily.

At a time when investors only wanted capital returns to shareholders, Vermilion made meaningful acquisitions. Investors didn’t look too favorably towards this.

However, now the market is starting to look through this. Before there was a doubt over the value of these acquisitions and a lack of interest in the stock.

But now, investors are starting to reconsider this stock. Here’s why I believe that investors should get onboard this stock, while it’s still priced at less than 2x its 2023 free cash flows.

Vermilion Near-Term Prospects

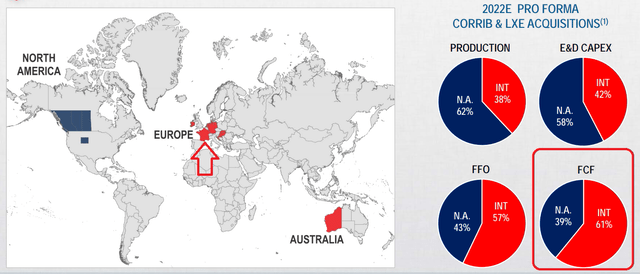

Vermilion has a European gas portfolio. This means that its international production now represents approximately 60% of its free cash flow.

VET June presentation

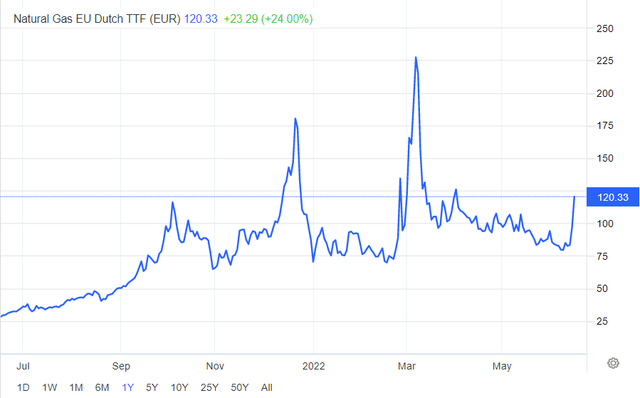

As you know, with the price of natural gas in Europe being notably high, this puts Vermilion in a very favorable position to benefit from high natural gas prices.

Trading Economics, Europe natural gas

What’s more, as you know, the recent Freeport LNG outage has only intensified these prices.

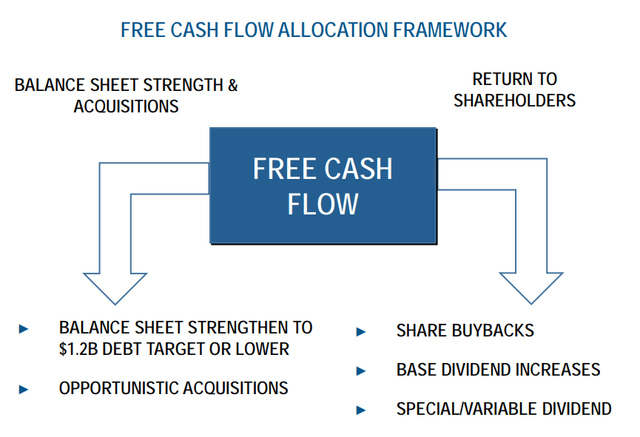

For their part, Vermilion declares that it plans to get its net debt profile to CAD$1.2 billion, which will increase its capital returns to shareholders.

As a reminder, Vermilion carried CAD$1.4 billion of net debt in Q1 2022.

Meanwhile, Vermilion contends that when its net debt falls to CAD$1.2 billion, at some point in H2 2022, it will increase its return of capital to shareholders through one or a combination of base dividend increases, special dividends, or share buybacks.

VET June presentation

We are now a few weeks away from entering H2 2022. When Vermilion reports in August, we should expect to see the company substantially increasing its capital return program, as it will have reached its near-term debt target.

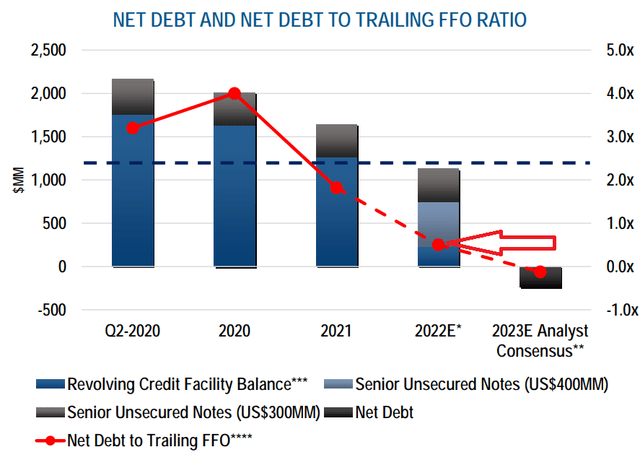

VET June presentation

As you can see in the graphic above, Vermilion’s net debt to cash flows from operations is already around 0.5x and is likely to drop lower in the coming weeks.

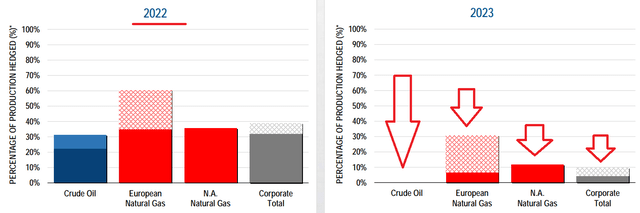

Hedges Booked, Less than 10% for 2023

VET June presentation

Vermilion has some hedges in 2022. But as it gets further into 2023, nearly all those hedges roll off.

VET June presentation

Vermilion’s two acquisitions brought with them meaningful hedges. But those hedges will roll in 2023, leaving the company very attractively positioned for a strong 2023.

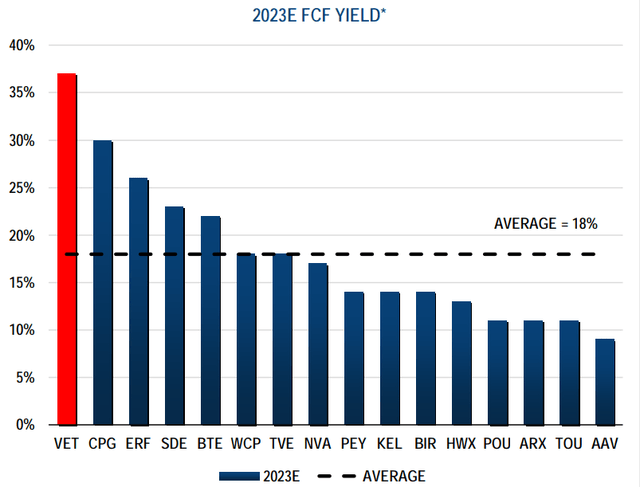

VET Stock Valuation – Priced at 3x Free Cash Flow

VET June acquisition

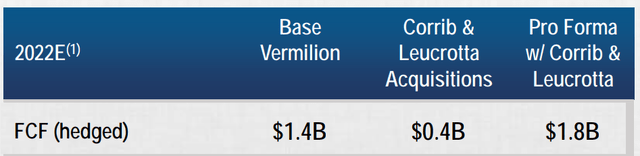

As I’ve noted above, Vermilion holds substantial hedges in 2022. That will mean that its free cash flows will be partially suppressed in 2022.

Now, let’s make some assumptions.

VET June presentation

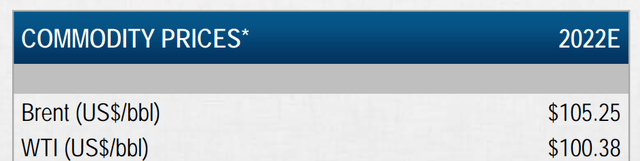

When Vermilion estimates around CAD$1.8 billion of hedged free cash flow, it did so at $100 WTI. But WTI is now close to $115 to $120.

What’s more, in 2023, Vermilion will only have around 10% of its book hedged.

Hence, I believe that Vermilion will make around CAD$2.5 billion of free cash flow next year.

VET June presentation

This means that rather than Vermilion being priced at 3x as the graphic above entails, Vermilion’s free cash flow yield is now closer to 45%, when looking out to 2023.

The Bottom Line

I believe that with high WTI prices here to stay for a while, it makes sense to buy the cheapest companies, with the most beta.

If you are going to take on the risk of volatile oil prices, you might as well position yourself into the highest beta opportunities, provided that the balance sheet is clean. As discussed throughout, Vermilion’s balance sheet will be very strong in a matter of weeks.

If you want to participate in high natural gas prices in Europe, Vermilion is well-positioned to do so.

With those considerations in mind, I believe that paying 2x free cash flow for Vermilion makes a lot of sense.

Be the first to comment