Leonid Ikan/iStock via Getty Images

Vermilion Energy (NYSE:VET) may be able to generate US$1.5 billion in positive cash flow in 2023 and US$1.2 billion in 2024 at current strip prices, with sky-high European natural gas prices having a major effect on its results. Vermilion deal (in late 2021) to acquire a larger stake in Corrib will basically pay off by early 2023 due to the strength in natural gas prices. There is the potential for European windfall taxes to reduce Vermilion’s projected cash flow though.

European natural gas prices are around US$57 for 2023 and in the mid-$30s (US dollars) for 2024, making it worth over four times the price of oil for 2023 and around three times the price of oil for 2024 on a per BOE basis.

I now estimate Vermilion’s value at US$27 per share in a scenario where long-term (after 2023) prices average $70 WTI oil, US$3.25 AECO and US$13 for European natural gas. This includes a reduction in Vermilion’s value for the potential European windfall tax.

There is uncertainty about how long super high European natural gas prices will last. Current strip for 2024 and 2025 is still well above my long-term prices. Thus in a scenario where commodity prices follow current strip until the end of 2024 instead, I’d estimate Vermilion’s value at US$30 to US$31 per share.

Free Cash Flow Projections

Vermilion’s Corrib acquisition (expected to close in Q4 2022) should pay off quickly due to high NBP natural gas prices. The free cash flow from the acquired assets (since the January 1, 2022 effective date) gets netted out of the purchase price, so Vermilion now expects to only pay approximately US$100 million (including contingent payments) assuming a year-end 2022 closing date.

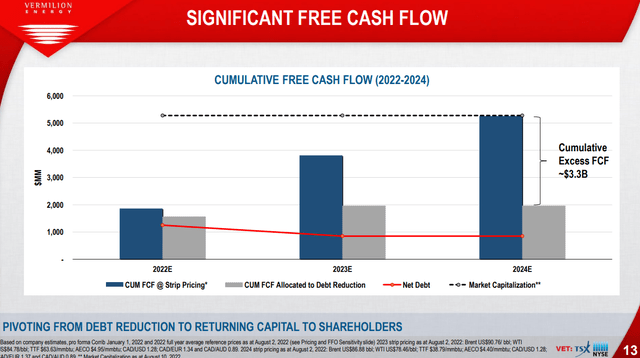

Vermilion also previously projected around US$1.5 billion in free cash flow in 2023 and US$1.1 billion in free cash flow in 2024 at early August strip prices. Since then, oil strip prices have gone, but the effect of that has generally been more than made up by the increases in natural gas strip prices.

Vermilion’s Cash Flow (vermilionenergy.com)

At current strip, I estimate that Vermilion could generate US$1.5 billion in free cash flow in 2023 and US$1.2 billion in free cash flow in 2024 (before new taxes).

European Windfall Tax

The European Union has proposed a 33% windfall tax on the “surplus” profits of various energy producers. The exact details are still to be worked out, but the preliminary design appears to be an attempt to extract maximum tax revenue that the baseline profits are based on 2019 to 2021 results. Commodity prices for 2020 (particularly for oil) were abnormally depressed due to the pandemic.

While the final tax implementation isn’t certain yet, I’ve taken around US$2 per share off of Vermilion’s estimated value to account for the potential impact of that tax.

Updated Results With Year-End 2022 Production

I’ve updated my assumptions for long-term prices to average US$70 WTI oil, US$3.25 AECO and US$13 European gas. The outlook for long-term natural gas prices has been boosted by 30% since my earlier look at Vermilion.

For comparison, 2026 strip is currently around US$65 for WTI oil, US$3.80 for AECO and US$16 for European natural gas.

At 2022 exit rate production of 97,500 BOEPD, Vermillion could generate US$1.912 billion in revenues now.

|

Barrels/Mcf |

$ Per Barrel/Mcf (Realized) |

$ Million |

|

|

Crude Oil & Condensate (Barrels) |

14,946,750 |

$68.50 |

$1,026 |

|

NGLs (Barrels) |

3,202,875 |

$28.50 |

$91 |

|

Natural Gas [MCF] |

104,627,250 |

$7.60 |

$795 |

|

Total Revenue |

$1,912 |

This results in a projection of over US$1.2 billion EBITDA and US$0.61 billion in positive cash flow in this scenario based on long-term prices. This also factors in higher costs and taxes than before.

|

Expenses |

$ Million |

|

Royalties |

$171 |

|

Transportation |

$75 |

|

Operating Expense |

$395 |

|

G&A |

$50 |

|

PRRT |

$10 |

|

Corporate Income Tax |

$100 |

|

Interest |

$50 |

|

Capex |

$450 |

|

Total Expenditures |

$1,301 |

Notes On Valuation

I’ve modified my view on long-term prices to $70 WTI oil, US$3.25 AECO and US$13 European natural gas. If commodity prices follow current strip until the end of 2023 and then follow those long-term prices after that, I’d estimate Vermilion’s value at approximately US$27 per share. This includes the deduction in value for the potential European windfall tax.

This increases to approximately US$30 to US$31 per share if commodity prices follow current strip until the end of 2024. The main difference between current strip and long-term prices is with European natural gas. Vermilion’s value gets boosted the longer European natural gas prices remain particularly elevated.

Conclusion

Vermilion Energy may be able to generate around US$2.7 billion in free cash flow in 2023 and 2024 combined at current strip prices, before any impact from new taxes. While oil prices have weakened somewhat, European natural gas prices remain several times that of oil on a per BOE basis.

Vermilion’s Corrib acquisition will thus be paid off via cash flow by early 2023 at current strip. Vermilion’s upside is largely tied to how long elevated European natural gas prices last.

If European natural gas prices follow current strip until the end of 2023, then I’d estimate Vermilion’s value at around US$27 per share (in a long-term $70 WTI oil scenario). If they follow current strip until the end of 2024, Vermilion’s value is boosted to around US$30 to US$31 per share, and this rises to around US$32 to US$33 per share if it follows current strip until the end of 2025.

Be the first to comment