I need to switch to an energy efficient bulb. Lumen’s dividend cut will be a budget buster. JackF/iStock via Getty Images

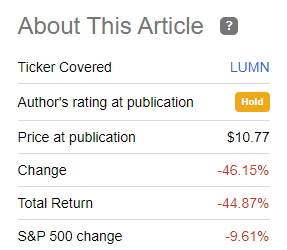

When we last covered Lumen Technologies Inc. (NYSE:LUMN) we had a neutral outlook for the stock and deferred our bullish tendencies to the bonds.

With a debt to EBITDA of close to 3.2X, when all the smoke has cleared, you have to only believe that the entire company is worth more than 3.2X EBITDA to consider these bonds. We think that is an extraordinarily low hurdle to clear. Interest coverage should be close to 5X and if you like the 2X dividend coverage, you should love the 5X interest coverage. We rate the bonds a buy (yes, the 2042 bonds with a 10% YTM was what the title was referencing) and have a hold rating on the stock.

Source: A 10% Yield We Can Get Behind

Most of Lumen bonds are down about 10-14% net of interest accrued so one can hardly declare that a victory. But it did avoid this.

Seeking Alpha

So, we have that going for us, which is nice. We look at the Q3-2022 results and see how that changes our thesis.

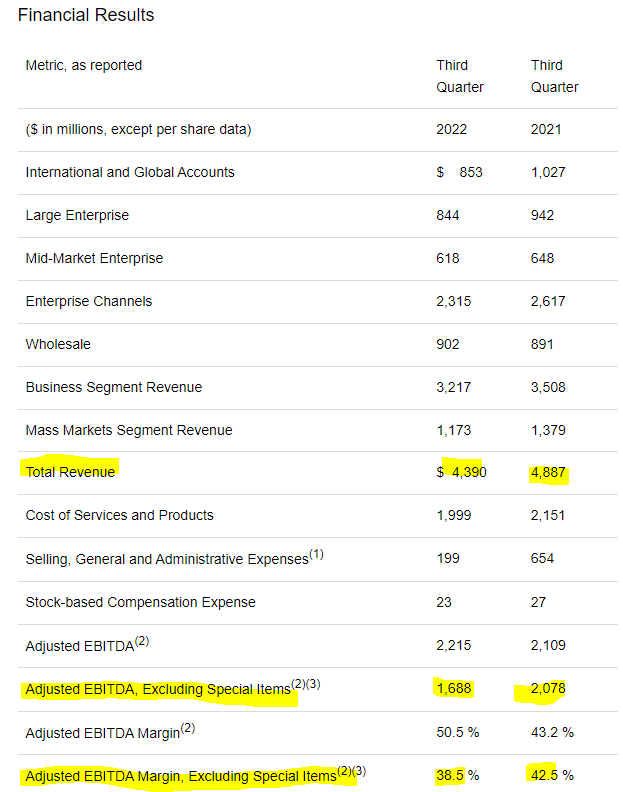

Q3-2022

Market conditions were rough in Q3-2022. Keep in mind that official real GDP metrics fell in Q1 and Q2 of this year. So it is not surprising to see capex pullback from businesses. That said, LUMN’s Q3-2022 numbers were really weak. We have highlighted the key numbers to focus on below.

LUM Q3-2022 Press Release

There were quite a few components to this and it is hard to gauge this relative to analyst expectations as the Latin America divestiture was completed in the middle of the quarter. Other factors that weighed heavily were the end of the Connect America Fund II (CAF-II) program and extreme currency headwinds. We should generally not be forgiving if management blames currency strength or weakness for weak results. If you go overseas, that is part of the game. But this quarter was definitely unusual from that standpoint, and we sympathize with the problems the company had. Adjusted for extraordinary events and currency headwinds, total revenue was down 4.3% year over year and 2% quarter over quarter. Many had hoped that adjusted revenues would flatten out year over year, or even rise. After all, inflation is a huge tailwind for at least nominal metrics like revenues. That obviously did not happen and the results were worse than Q2-2022 where LUMN had noted the mild improvement over Q1-2022.

On an adjusted basis, revenue declined 3.4% in the second quarter, an improvement from the 5.5% adjusted year-over-year decline in the first quarter of this year.

Source: Q2-2022 Transcript

The side effect of falling revenues in an inflationary environment is that your margins tend to fall even faster, and we saw that with the company’s adjusted EBITDA margin drop.

Outlook

LUMN surprisingly maintained its full year adjusted EBITDA expectation of approximately $7 billion. It also increased free cash flow outlook to $2.3 billion (midpoint). That increase comes from a decreased capital expenditure outlook. Alongside the elimination of the dividend, LUMN has plenty of room to continue deleveraging. Moving ahead to 2023, we expect a $5.4 billion EBITDA (adjusting for the sale to COLT announced with the Q3-2022 results) and that when combined with the firm’s likely spending plans (over $3.0 billion), creates solid free cash flow. That basic math suggests that LUMN possibly could have sustained the $1 billion in annual dividends, but that could put things at risk down the line. It is also likely free cash flow might undershoot based on cash tax payments in 2023.

Also be aware that these transactions caused a taxable event and we expect to pay approximately $900 million to $1 billion of tax during the first half of 2023 related to these transactions. This tax impact will be included in the overall cash tax guidance for 2023, which we expect to share with you when we report our fourth quarter results.

Source: Q3-2022 Transcript

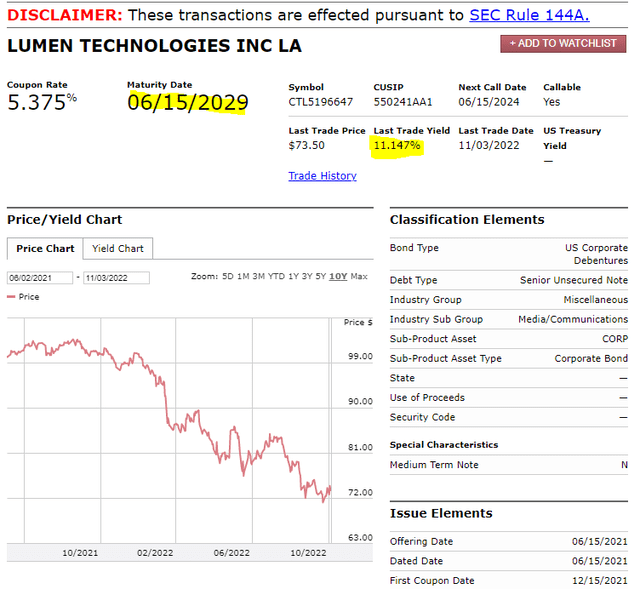

The risks are also high when revenues are declining quarter after quarter. This is truer with the 7-year out bonds having a yield to maturity of over 11%.

Any CFO who does a buyback with that bond yield should be fired.

We would hence expect minimal buybacks under any reasonable timeframe.

So, no dividends and no buyback for you. What can you look forward to?

Verdict

LUMN is a liquidation sale and in a liquidation sale, you really want to be part of the debt. If you apply a blended valuation based on recent asset sales, you could make an argument that the equity is undervalued to extremely undervalued.

As Jeff mentioned, since the Level three merger in 2017, we have reduced debt by approximately $16 billion, sold our LatAm business for about nine times EBITDA, sold our ILEC business for approximately 5.5 times EBITDA and announced today that we have entered into an exclusive arrangement for the proposed sale of our EMEA business to Colt for $1.8 billion.

This represents a very attractive multiple of approximately 11 times EBITDA, and most importantly, Jeff has positioned our company well as we drive to profitable revenue growth.

Source: Q3-2022 Transcript

Indeed, it is not hard to fathom a residual equity value of $12-$18 per share in such a scenario. But these deals will become harder to execute as market conditions for junk debt tighten. The new CEO, Kate Johnson, also comes from a “growth mindset” and is unlikely to liquidate the entire company to end the suffering of the shareholders. On the other hand, the debt is looking fairly attractive with yields to maturity in the double digits for medium term bonds. Another large asset sale at 10-11X EBITDA multiples could send the bonds 20-30% higher, especially if that coincided with the end of the Fed’s hiking cycle. That 30% is also what we would see as the upside in the common equity over the next year, albeit with far more risk. Hence we maintain a buy rating on the bonds and are keeping the common stock on a hold.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment