David Ramos

Market volatility is here to stay, at least in the near term. What used to be wild swings in a week are now happening in a single day, like the 800-point swing in the Dow Jones Industrial Average earlier this past week. As such, some investors may just want to, as the saying goes, watch Netflix (NFLX) and chill to sit out the wild market swings.

For those investors, I would advocate for buying beaten down companies that have “steady eddy” income streams. This brings me to Verizon (NYSE:VZ), which, at a 7% yield, may be an ideal choice. This article highlights why VZ may be an optimal choice for great income, so let’s get started.

Why VZ?

Verizon is the nation’s largest wireless carrier, serving 93 million postpaid and 23 million prepaid phone customers following its acquisition of Tracfone. It has a deep asset base that includes extensive fiber build in major metro areas of the U.S. Together with rivals AT&T (T) and T-Mobile (TMUS), the big three carriers control the vast majority of the market, making it difficult for new entrants to gain foothold.

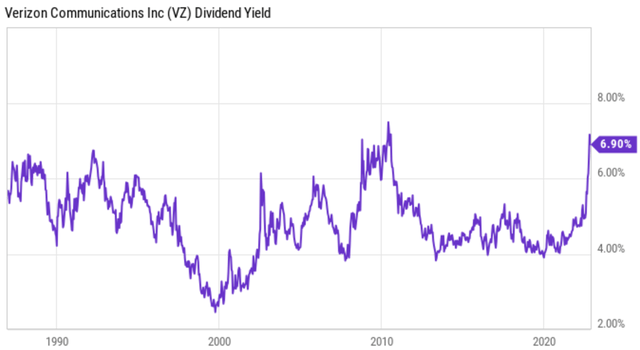

One of the major attractions in buying Verizon is not for huge growth but rather for the dividend. VZ currently excels at that with a 7% dividend yield, which, as seen below, is currently at the second highest level in history. Importantly, the dividend is well-covered by a 48.6% payout ratio.

(Note: The following shows the TTM dividend yield. Forward yield is 7%.)

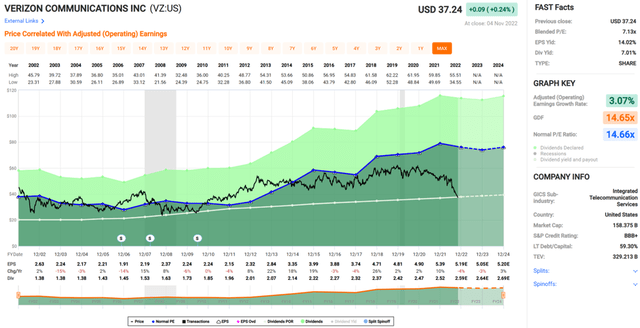

Verizon has also gotten very cheap. At the current price of $37.24, it trades at a forward P/E of just 7.2, sitting very much below its normal P/E of 14.7, as shown below.

Of course, a stock doesn’t get this cheap without some concerns. This includes losing nearly 300,000 net consumers year to date, or about 1% of its customer base. In the most recent quarter, Verizon lost 189,000 postpaid consumers, but this was offset by a gain in business accounts, resulting in 8,000 net postpaid customer adds.

Some of this lackluster performance can be attributed to Verizon behaving rationally by introducing higher prices in an inflationary environment, while competitors AT&T and T-Mobile are behaving irrationally by either holding prices flat or introducing aggressive promotions. Longer term, I believe the industry will come to its senses and realize that a price war is not in the best interest for any of the players.

Plus, management recently announced the first of its kind Apple (AAPL) 1 Unlimited bundle, in which Verizon customers now have access to Apple services all under one subscription. Apple likely chose Verizon due to its higher quality customer base that are in general less likely to delay bill payments as AT&T has shown in recent quarters.

Moreover, fixed wireless is a strong greenfield opportunity, as Verizon is in position to capture home broadband customers away from cable incumbents Comcast (CMCSA) and Charter Communications (CHTR). Verizon’s strong progress in this arena was noted by management during the recent conference call:

In broadband, our fixed wireless access and fire service continued to see strong demand. Total broadband net adds were 377,000, a sequential growth of over 40%. All of these services are built to deliver on top of our world-class network. We have a premium network and experience that our customers value and that demands premium pricing.

We are currently covering over 160 million POPs with C-band and on track to deliver 200 million within the first quarter of 2023. C-band usage is up 170% quarter-over-quarter and fixed wireless access now covers more than 40 million households. Right now, more than 48% of our cell sites are connected by Verizon’s own fiber. We are expecting to be about 50% by year-end with the majority of our 5G sites already on our own fiber. This not only improves network performance, but also improves our owners’ economics.

While Verizon’s debt load has increased in recent years, new business expansion into areas such as fixed wireless and edge computing for business customers provide a good counterweight. Management also appears to be addressing leverage, as long-term debt has declined by $8 billion since the end of last year, and plans to deliver company-wide cost savings that is expected to save $2 to $3 billion annually by 2025. Verizon also maintains a BBB+ credit rating, so cost of debt should relatively favorable as debt matures.

Investor Takeaway

Verizon at the current price is giving one of its highest dividend yields in its history. While the telecom industry may not be the most exciting, it is a critical part of our economy and offers investors a unique combination of stability and income. S&P Capital IQ has an average price target of $46, translating to potential double-digit annual returns. With a 7% dividend yield, Verizon is an attractive option for income-seeking investors want to ride out market volatility.

Be the first to comment