jaanalisette

Thesis

Twilio (NYSE:TWLO) shares crashed as much as 40% on a weaker than expected Q4 2022 guidance. I must admit that I did not expect Twilio to issue such a soft outlook. But I am even more surprised by the aggressive negative market reaction – as Twilio’s communication was not all bad. In fact, Twilio reiterated the 2023 non-GAAP profitability goals and the 15%-25% growth target is without a doubt attractive still.

I remain bullish on TWLO stock, as I strongly believe the company’s low valuation more than offsets any business growth uncertainty and profitability risk.

For reference, Twilio stock is now down by more than 90% from ATH – and down approximately 84% YTD, versus a loss of 21% for the S&P 500 (SPX).

Twilio’s Q3 Results

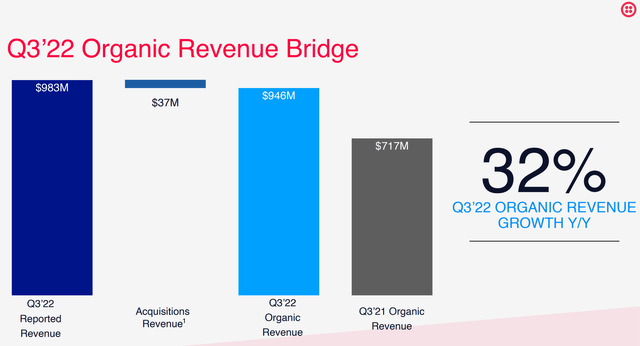

Paradoxically, Twilio’s Q3 results were actually pretty strong (the problem was in the guidance). From July to end of September, the cloud communications software provider generated total revenues of $983.03 million, which compares to $740.18 million for the same period one year earlier (32% year-over-year growth) and analyst consensus expectations of $972.2 million ($10 million beat). Notably, Twilio’s strong topline performance was almost exclusively driven by organic growth.

Active customer accounts increased to 280,000, from 275,000 one quarter prior (Q2 2022).

Similar to revenues, also profitability surprised to the upside: gross profit reached $499 million in Q3 (25% year-over-year growth) and net loss narrowed to 27 cents per share, versus a loss of 36 cents per share as expected by analysts.

Softer Than Expected Guidance

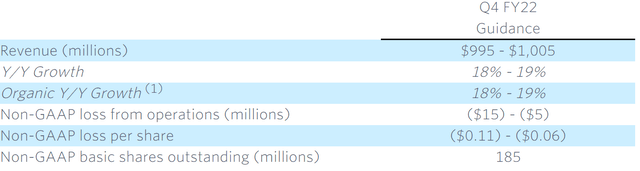

Twilio said that ‘our Q4 guide is below where I’d like it to be’. The company now estimates that revenues for the December quarter will likely fall between $995 million to $1,005 million – which is below analyst consensus expectations by about $70 million – and would indicate a year-over-year growth of 18%-19% versus Q4 2022.

Arguably, analysts had believed that Twilio would be a 30% CAGR growth company through 2025. But expectations are now cut by almost half, between 15% – 20%.

Jeff Lawson, Twilio’s co-founder and CEO, said that the company was ‘facing some short-term headwinds‘ and: (emphasis added)

Like many software companies, we are seeing a more pronounced impact from the macro environment on our business than in prior quarters. As we noted on the Q2 call, certain verticals, such as crypto, consumer-on-demand, and social have been more heavily impacted in day-to-day usage. This trend persisted in Q3, and has also extended to the retail and eCommerce verticals …

But Jeff also reiterated that the company’s …

… long-term opportunity remains strong as companies continue building their customer engagement strategies, become more efficient, and aim to build better and more personalized relationships with their customers

On a more positive note, investors should consider that Twilio reiterated prior expectations that the company will achieve non-GAAP profitability by 2023, and also promised to ‘deliver improvements four each year thereafter as we balance growth and profitability’.

It’s A Dip-Buying Opportunity

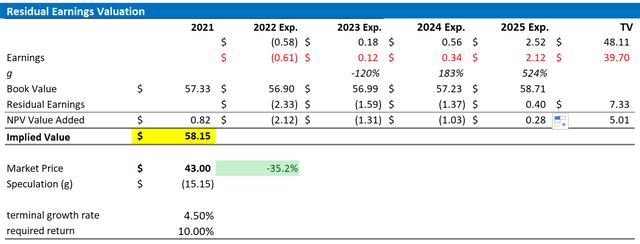

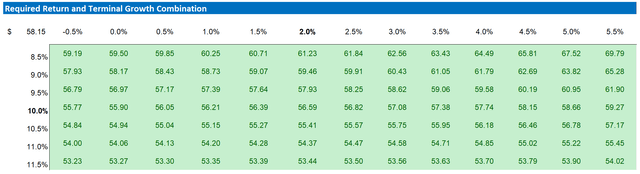

Following Twilio’s Q3 results and guidance update, I adjust my residual earnings model for TWLO to account for preliminary consensus EPS downward revisions. Moreover, I raise the cost of capital from 9% to 10%, to account for generally higher risk premia for stocks, and software/tech companies in particular. However, I continue to anchor on a strong 4.5% terminal growth rate.

Given these updated assumptions, I now calculate a base-case target price for TWLO stock of $58.15/share versus $71.46 prior.

Analyst Consensus Estimates; Author’s Calculations

Here is the updated sensitivity table.

Analyst Consensus Estimates; Author’s Calculations

Risks

I continue to see investor sentiment towards growth assets (and stocks in general) as the major risk for Twilio shareholders. Thus, investors should expect price volatility even though Twilio’s business outlook remains unchanged.

Moreover, rising real yields could add significant headwinds to Twilio’s stock price, as the higher discount rates affect the net-present value of long-dated cash-flows.

With regard to Twilio’s fundamentals, I continue to believe that non-GAAP 2023 profitability will be a major reference point for investors. Should management fail to deliver on this ‘promise’, then Twilio stock will likely fall to the all-time lows around $30/share.

Conclusion

Although Twilio’s lower growth outlook is a disappointment, the earnings announcement was not all bad – certainly not bad enough to justify a 38% sell-off, in my opinion. Investors should consider that with 15-20% CAGR expectations until 2025 Twilio remains an attractive growth company. Moreover, I believe more (positive) weight should be given to Twilio’s affirmed profitability target for 2023.

Twilio stock is now trading at a discount to book value and a one-year forward EV/sales multiple of approximately 2.4. Such a valuation set-up is simply too attractive to be bearish (as every investment opportunity remains a function of price. And Twilio’s price is cheap). On the backdrop of EPS revisions, I now calculate a fair implied share price of $58.15.

Be the first to comment